Bitcoin rebounds on Japan rate hike as Arthur Hayes sees dollar at 200 yen

Bitcoin aimed for $88,000 on Friday after Japan’s central bank raised interest rates to 30-year highs.

Key points:

- Bitcoin joins US stocks futures heading higher in a curiously bullish reaction to Japan’s interest-rate hike.

- Commentators argue that no further hikes will happen due to economic forces.

- Bitcoin continues to hammer out a bottom on longer timeframes.

Arthur Hayes eyes BTC price, yen surge

Data from and showed 2.5% BTC price gains versus the daily open.

BTC/USD one-hour chart. Source: Cointelegraph/TradingView

BTC/USD one-hour chart. Source: Cointelegraph/TradingView

In line with expectations, the Bank of Japan (BoJ) hiked rates to on the day, marking their highest levels in three decades and ending the country’s latest period of “cheap” money.

Against a backdrop of global central-bank policy easing, Japan’s move stood out. While the hike was notionally a headwind for crypto and risk assets, reactions were optimistic.

“Don’t fight the BOJ: -ve real rates is the explicit policy,” Arthur Hayes, former CEO of crypto exchange BitMEX, told X followers.

“$JPY to 200, and $BTC to a milly.”

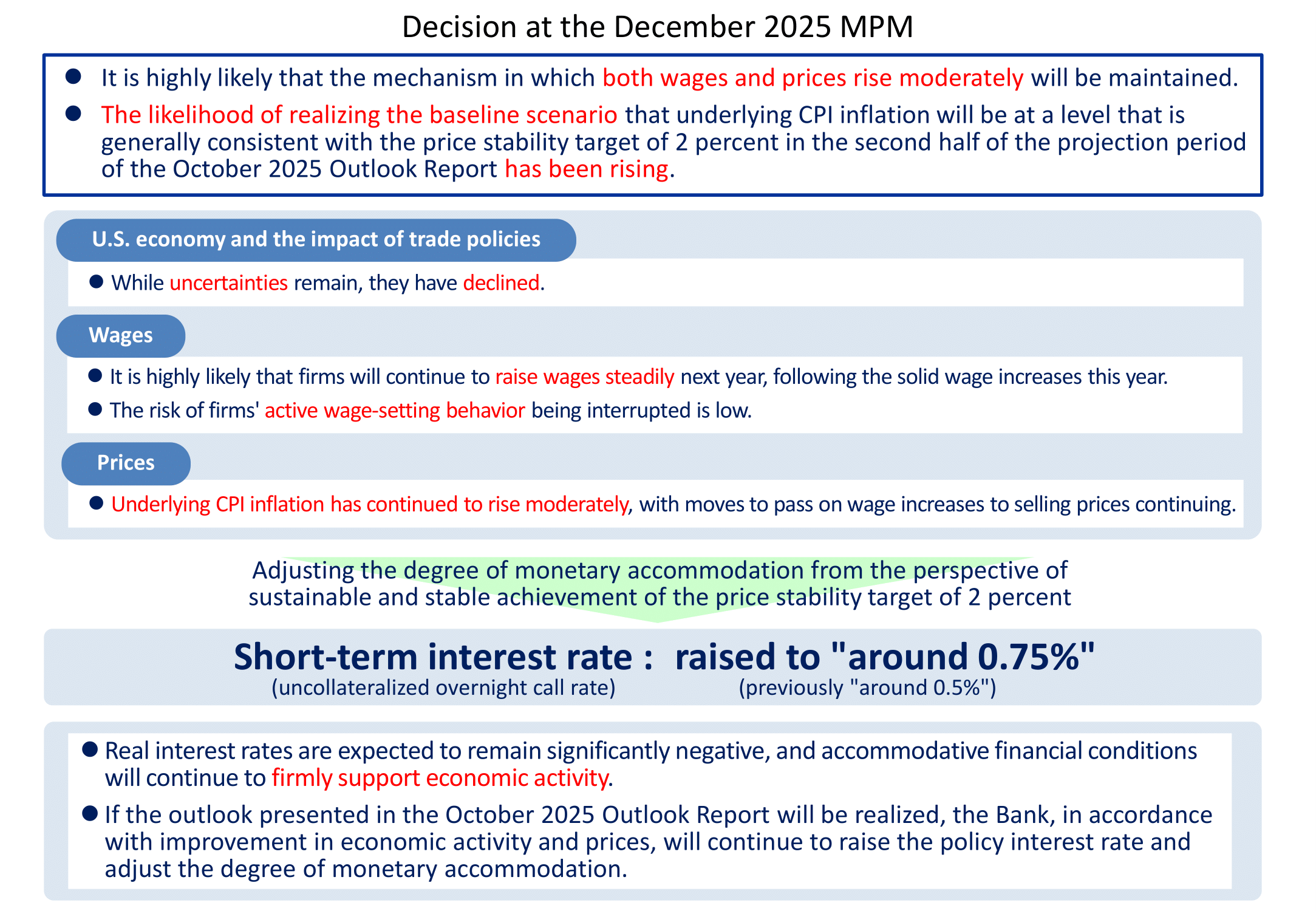

Source: Bank of Japan

Source: Bank of Japan

Hayes was one of several commentators who saw the hike as ultimately bullish for asset holders.

Continuing, the research project Temple 8 Research flagged an emerging standoff between market expectations and economic reality in Japan.

“The market sees a hawkish pivot. We see a political ceiling,” it summarized in a last week.

Temple 8 predicted that rates would not rise again before 2027 to protect the yen and avoid increased interest payments on Japan’s latest stimulus package.

“You cannot floor the gas (Fiscal Stimulus) while slamming the brakes (Rate Hikes),” the post added.

“If rates go to 1.5%, interest payments on this new debt explode.”

USD/JPY one-hour chart. Source: Cointelegraph/TradingView

USD/JPY one-hour chart. Source: Cointelegraph/TradingView

Bitcoin lacks “true capitulation event”

Bitcoin thus joined US stocks futures heading higher ahead of Friday’s Wall Street open.

At the time of writing, Nasdaq 100 futures were up 1.5%, while the S&P 500 sought a rebound after flat performance.

Nasdaq 100 futures one-hour chart. Source: Cointelegraph/TradingView

Nasdaq 100 futures one-hour chart. Source: Cointelegraph/TradingView

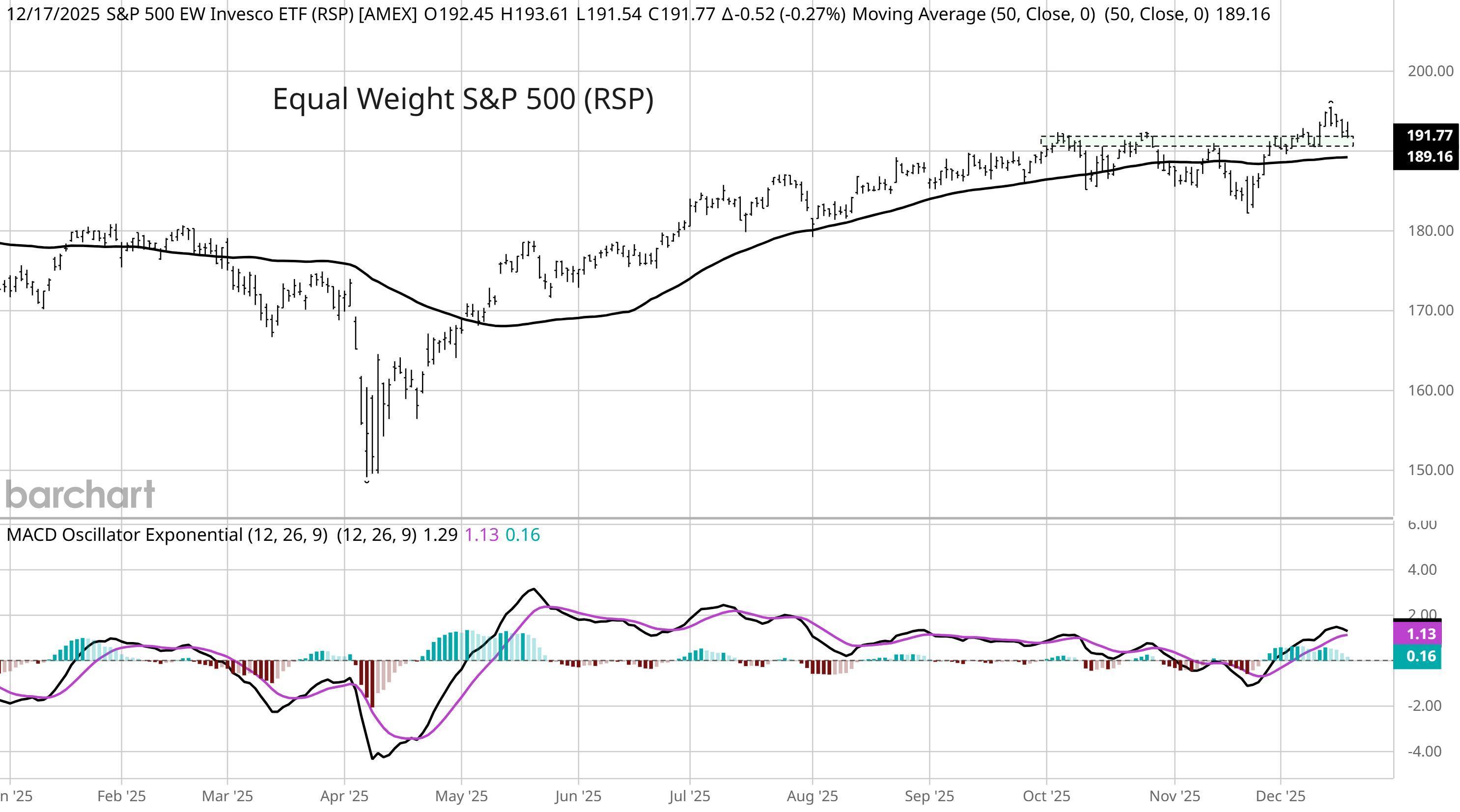

“With participation remaining strong some measures of investor sentiment shifting back to showing fear, that’s a positive backdrop to see a rally in the final weeks of the year,” trading resource Mosaic Asset Company forecast in a blog post Thursday.

“While the S&P 500 is trading weak recently, the second half of December tends to be positive from a historical seasonal standpoint.”

Equal weight S&P 500 chart. Source: Mosaic Asset Company

Equal weight S&P 500 chart. Source: Mosaic Asset Company

At the same time, BTC/USD hit a low of $84,390 amid volatility following the surprise US inflation data.

Traders remained highly cautious, with calls for further support retests commonplace on social media.

“Bitcoin is currently hammering out a bottom, but the process is far from over,” onchain analytics platform Checkonchain warned on the day.

Checkonchain singled out $81,000, the cost basis for the US spot Bitcoin exchange-traded funds (ETFs), as a key line in the sand.

It added that the market was yet to witness a “true capitulation event.”

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Taskon Partners with Euclid Protocol to Enable Users to Access DeFi Cross-Chain Liquidity, Unlock Advanced Web3 Opportunities

Hegota Upgrade: Ethereum’s Monumental 2026 Evolution for a Leaner, Faster Network

Pundit to XRP Investors: Jake Claver Calling It. Hold Tight

Bitcoin’s Post-CPI Whipsaw Liquidates Over $500M Again