SharpLink Gaming, the second-largest publicly disclosed Ethereum ETH $2 853 24h volatility: 2.6% Market cap: $343.79 B Vol. 24h: $24.58 B treasury holder, announced a leadership transition on Dec. 17 as it deepened its commitment to ETH. The corporate development unfolded as Ethereum price remained subdued below the $3,000 level, following a drop to 14-day lows near $2,890 in the previous session.

The SharpLink board appointed Joseph Chalom as sole Chief Executive Officer and elected him to the board, effective December 15. Rob Phythian stepped down from his roles as co-CEO and director, completing a planned leadership transition tied to the company’s evolution into an Ethereum treasury-focused business.

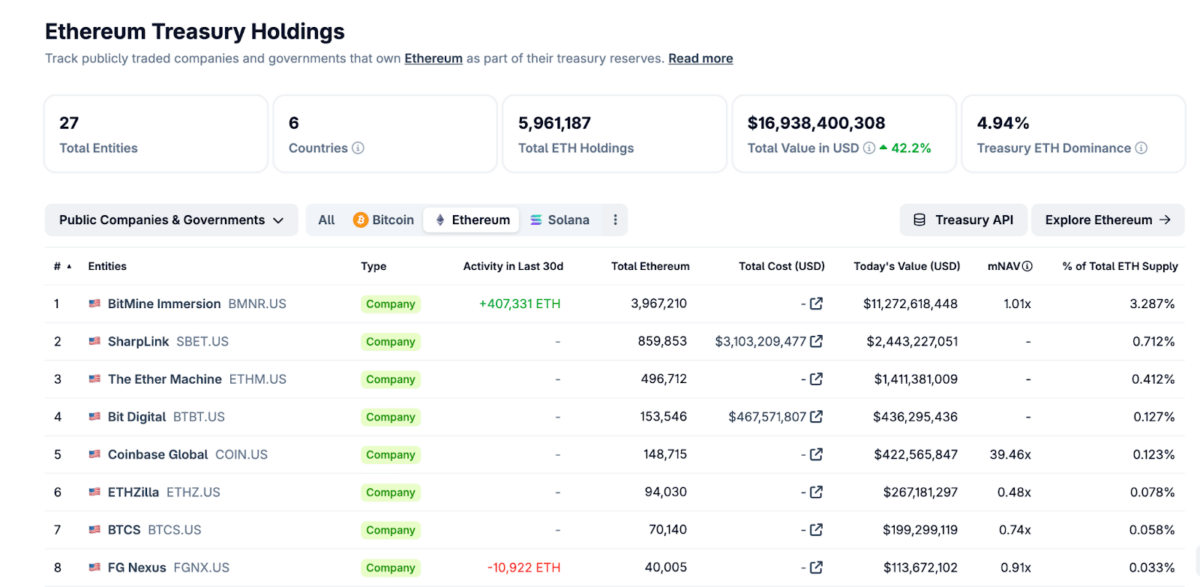

Ethereum treasury holder rankings as of Dec. 17, 2025 | Source: Coingecko

Since formally launching its ETH treasury strategy on June 2, 2025, SharpLink has acquired 863,424 ETH as of Dec. 14, split between 639,241 native ETH and 224,183 ETH in liquid staking instruments. With total reserves acquired for $3.1 billion, Sharplink Gaming ranks second largest ETH treasury holder, behind Bitmine.

SharpLink has staked nearly 100% of its ETH holdings, generating 9,241 ETH in cumulative staking rewards. The firm also reported a sharp increase in institutional ownership, rising from low single digits earlier in the year to over 30% by the third quarter, alongside the onboarding of an in-house team to manage treasury, investment, and risk functions.

Joseph Lubin, SharpLink chairman and Ethereum co-founder, said the transition positions the company to deepen ecosystem partnerships and expand staking operations.

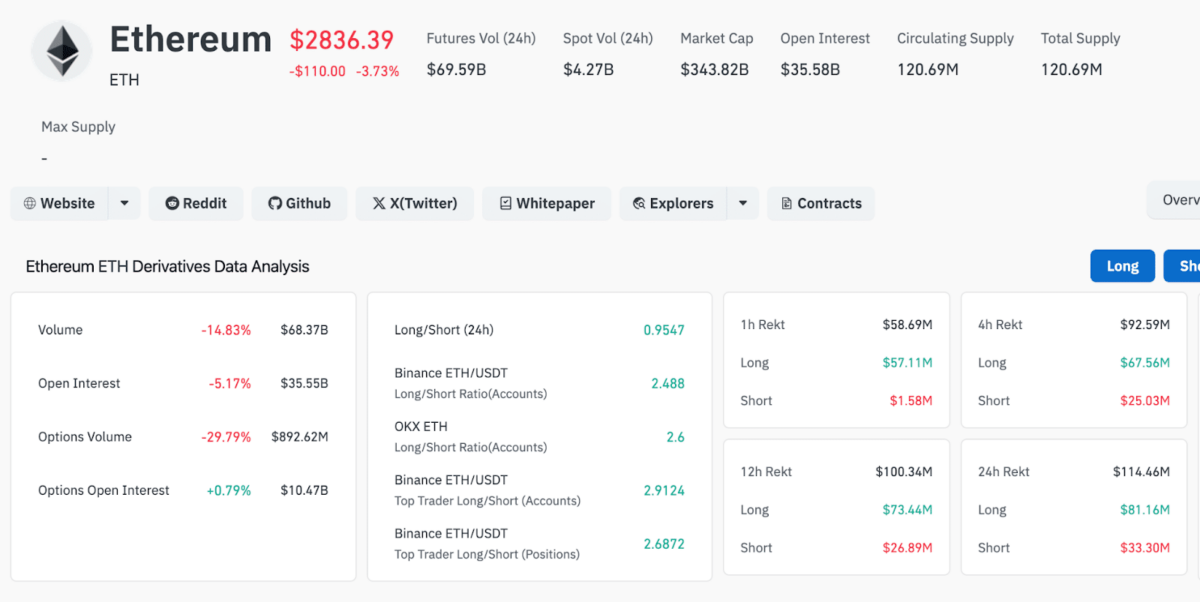

Ethereum Derivatives Market Analysis, Dec. 17, 2025 | Source: Coinglass

Data shows total ETH futures trading volume dropped 14.83% to $68.37 billion, while Ethereum open interest slipped 5.17% to $35.55 billion, reinforcing signs that recent selling pressure may be cooling after major sell-offs on Dec. 16.

Ethereum Price Forecast: Can ETH Defend $2,850 as Sellers Show Signs of Exhaustion?

Ethereum trades near $2,847 on the 12-hour chart, holding just above the lower Donchian Channel boundary at $2,843 after failing to reclaim the $3,000 handle. ETHUSD 12 hour chart posts a falling wedge that has compressed price action since early November, reflecting declining bearish momentum rather than acceleration.

Ethereum (ETH) Technical Analysis, Dec. 17, 2025 | TradingView

The RSI has slipped to 35, approaching oversold territory but no longer making lower lows. Historically, Ethereum has staged short-term recoveries when RSI stabilizes in the mid-30s after prolonged declines, particularly when volume fades.

That volume signal is now evident. Spot trading volume and derivatives activity have both contracted intraday, with open interest declining alongside ETH price. This combination signals that bears are reluctant to enter additional positions, increasing the probability of a near-term consolidation or relief bounce.

A break below $2,850 would expose the next support near $2,700, while a decisive move above $3,100 would reopen the path toward $3,300 and invalidate the current bearish structure.

For now, Ethereum remains compressed, but fading volume and stabilizing momentum suggest the market is closer to balance than continuation.

SUBBD项目最新进展以及市场动态

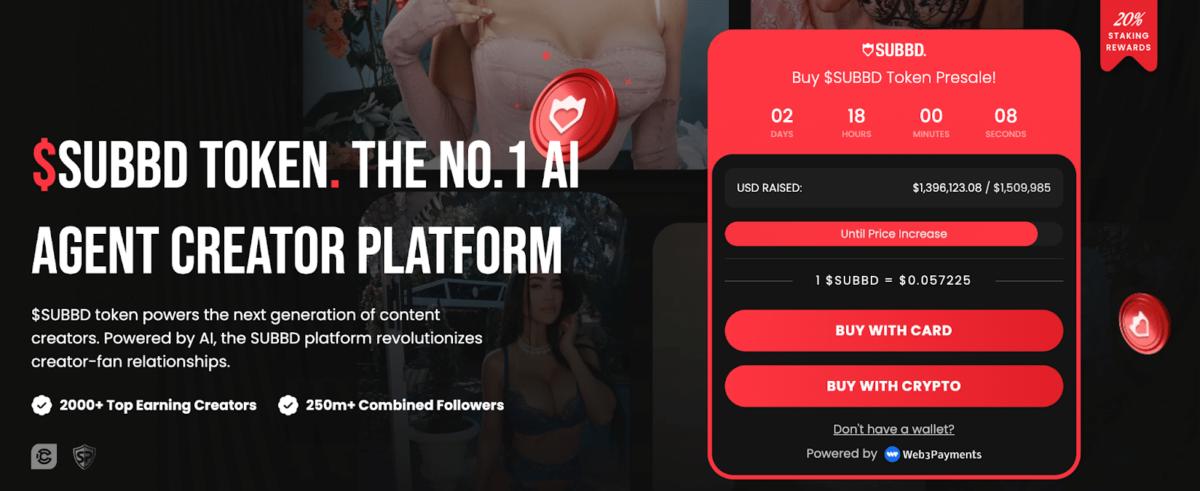

As Ethereum consolidates below key resistance levels and major treasury holders like SharpLink Gaming double down on their long-term ETH commitments, some traders are exploring opportunities in early-stage tokens.

SUBBD integrates AI-driven personalization with creator monetization, enabling influencers and brands to build fan communities.

SUBBD最新进展

I’m a research analyst with experience supporting Web3 startups and financial organizations through data-driven insights and strategic analysis. My goal is to help organizations make smarter decisions by bridging the gap between traditional finance and blockchain innovation.

With a background in Economics, I bring a solid understanding of market dynamics, financial systems, and the broader economic forces shaping the crypto industry. I’m currently pursuing a Master’s degree in Blockchain and Distributed Ledger Technologies at the University of Malta, where I’m expanding my expertise in decentralized systems, smart contracts, and real-world blockchain applications.

I’m especially interested in project evaluation, tokenomics, and ecosystem growth strategies, as these are areas where innovation can drive lasting impact. By combining my academic foundation with hands-on experience, I aim to provide meaningful insights that add value to both the financial and blockchain sectors.