Nearly 100 billions Shiba Inu (SHIB) saved the world within 24 hours

Shiba Inu is showing one of the most interesting divergences in recent months. Despite the price continuing to decline and hovering near local lows, on-chain performance tells a completely different story. Nearly 100 billion Shiba Inu tokens are being moved. Exchanges have seen this outflow within 24 hours, which is crucial, especially during periods of price weakness.

Exchange Slimming

Exchange reserve data shows a significant reduction in funds. Cryptocurrency is flowing out of trading platforms rather than pouring in. This usually indicates that short-term selling pressure is easing, rather than a surge in sell-offs. At this stage of the cycle, sustained outflows suggest that holders are more inclined to choose custody over liquidity, which is typically how a bottom forms, rather than an acceleration of a crash.

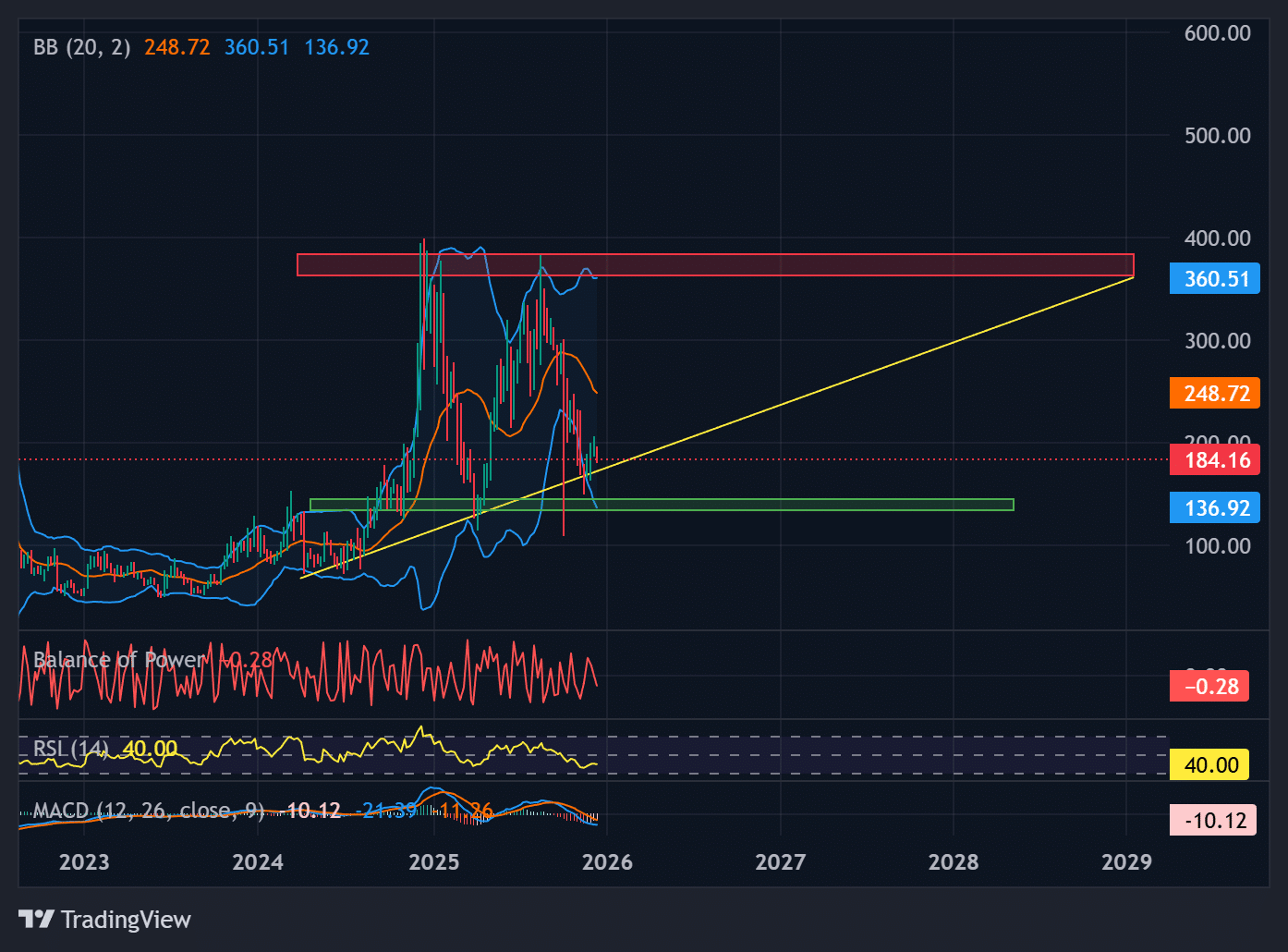

However, the price action remains far from optimistic. SHIB is still suppressed, trading below all major moving averages, with the overall structure showing a clear bearish trend. This is crucial. A reversal has not yet been confirmed, and anyone denying this is simply deceiving themselves.

Is Risk Shifting?

But the risk profile is changing. Compared to previous downward phases, selling pressure has eased, and the RSI indicator is in a contraction range, meaning that further declines would require a renewed surge in trading volume. Otherwise, the downward trend will be difficult to sustain.

The key point is: without new, active capital allocation, SHIB's price will not fall to zero. Whether it is a "meme coin" or not, the current supply dynamics do not support the "death spiral" narrative. For a true decline to occur, exchange inflows would need to surge again, offsetting the recent outflow trend. So far, this has not happened.

In the short term, it is more likely to see a stabilization and range-bound movement. Price volatility will be high, with false breakouts, slow digestion, and attempts to reclaim short-term moving averages. SHIB can build acceptance—instead of immediately dismissing every rebound, it may be worth taking a chance, as even a weak start to a rebound is becoming increasingly likely.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Aave to Enter 2026 With a Master Plan, SEC Ends 4-Year Investigation

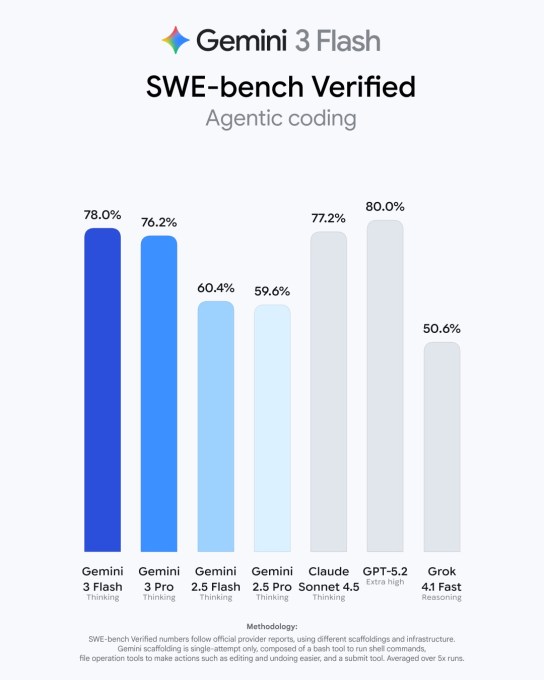

Google launches Gemini 3 Flash, makes it the default model in the Gemini app

Michael Saylor says quantum will “harden” Bitcoin, but he’s ignoring the 1.7 million coins already at risk

Buy or sell? What do technical indicators suggest for Shiba Inu (SHIB)?