Latest cryptocurrency news: The stock market is about to usher in a Christmas rally, will bitcoin follow?

The Christmas Rally Matches Stock Market Historical Trends, Bitcoin, Ethereum, and XRP Prices Surge.

As Christmas approaches, global markets are entering one of the most closely watched seasonal windows: the Santa Claus rally phase in the stock market.

After experiencing panic, volatility, and sharp corrections, a seasonal rebound typically follows. Now, cryptocurrency investors are closely watching to see if digital assets will follow the same trajectory.

Christmas Rally Triggers Stock Market Rise: What Happens Next?

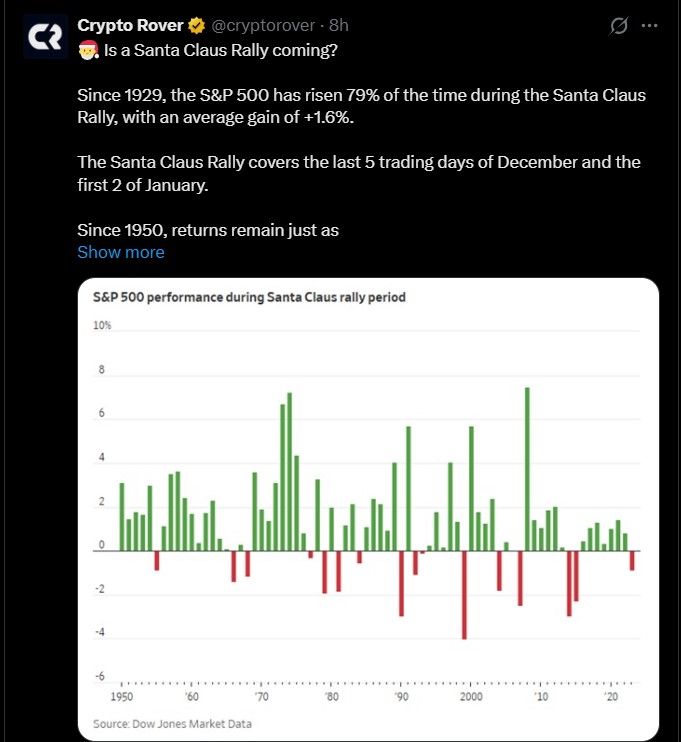

According to Crypto Rover a well-known analyst pointed out that data clearly shows that since 1929, the S&P 500 has risen 79% of the time during this period, with an average increase of 1.6%.

Even when counting only from 1950, the results remain strong, with a win rate as high as 79% and an average return of +1.3%. These data clearly show that the Santa Claus rally period has a solid historical record in the stock market.

For traders, more importantly, according to the S&P 500's December forecasts, the index has only declined once during this period in the past eight years, making this a historically strong period for financial markets.

In the past 75 years, the last two weeks of December have been the strongest two weeks for stock market performance.

This long-term historical data makes the breakthrough analysis for December 2025 ferment every year. The question now is: if a breakthrough in the financial industry really begins, will the cryptocurrency market also break out?

Santa Claus Rally: Cryptocurrency vs. S&P 500 Index—What Will Happen in December?

The movement of digital assets does not exist in isolation. When stock prices rise, risk appetite usually increases as well. Therefore, many traders closely watch the performance of cryptocurrencies and the S&P 500 during the Santa Claus rally.

Political news is also adding fuel to the fire. President Trump recently stated that he plans to sign a landmark Bitcoin and cryptocurrency regulatory bill this year. This statement is seen as a major shift.

Source:Official Cryptocurrency X Account

Clear rules can reduce uncertainty, encourage institutional participation, and enhance long-term industry trust. For many, this aligns with broader goals.Trump Cryptocurrency Bill Newsand strengthens the following argument:2025 Cryptocurrency Santa Claus Rally.

Liquidity Cycle: The Pattern Before Every Altcoin Surge

Many analysts point out that major altcoin surges often begin after a decline. The same structure frequently appears:

-

The Federal Reserve stops quantitative tightening (QT)

-

Liquidity slowly recovers

-

Altcoins move quickly

Before this, the industry retests support levels, triggers liquidations, and squeezes out weak investors. This happened in 2020. After the Federal Reserve ended quantitative tightening, the altcoin market cap tested support levels multiple times, liquidations scared investors, and then many altcoins surged by over 1000%.

Supporters of a December breakout believe that the situation in 2025-2026 is starting to resemble previous cycles. QT is about to end again, the altcoin market cap is near multi-year support, and liquidations have already begun.

Latest Cryptocurrency Market Dynamics: Panic Eases Slightly, Is a Reversal Coming?

After a sharp correction in digital asset prices yesterday, a preliminary rebound has now appeared:

-

Bitcoin price surged from $85 yesterday to $87,000 today, up 2% in the past 24 hours.

-

Ethereum price rose from $2,899 to $2,936.86 today, reflecting slight strength on the charts.

-

XRP price increased to $1.92, up about 3%, further boosting the altcoin rally momentum.

Market sentiment has also slightly improved. As shown in the chart above, the panic index rose from an extreme fear level of 11 to 16 today, indicating the market is still in a state of fear, but the degree of panic has eased.

From a market perspective and analysis, this price and sentiment pattern usually appears before a short-term rally, signaling a potential upcoming “Santa Claus rally.”Stock Market Window.

Conclusion: The Countdown Begins Now

History shows that the Christmas rally is one of the most reliable seasonal trends in finance. With strong historical data, improving liquidity conditions, favorable political signals, and early rebounds in cryptocurrency prices, the likelihood of a crypto Santa Claus rally is increasing.

Nevertheless, market volatility remains high and fear has not completely dissipated. Whether this rally will develop into a full-fledged “Christmas rebound” or just a brief bounce will become clearer in the final trading days of December.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Odaily Editorial Tea Talk (December 17)

Bitcoin Christmas Rally: By the end of 2025, will "Santa Claus" deliver gifts on time?

EtherFi Joins ETHGas Marketplace to Enable Gasless Ethereum Transactions and Boost Validator Economics