Reviewing Past Bitcoin Bull Markets: Why Does the Four-Year Cycle Occur, and Has It Disappeared?

Author: Arkham

Translation: Felix, PANews

Many market observers have described the multi-year "cycles" of bitcoin price, which coincide with bitcoin halving events. These patterns, collectively known as the "four-year cycle," have become significant psychological events influencing the mindset of crypto watchers and traders. This article will explore the various stages of the four-year cycle and review past bitcoin cycles. In addition, it will discuss whether the bitcoin cycle still exists.

The Typical Four-Year Cycle

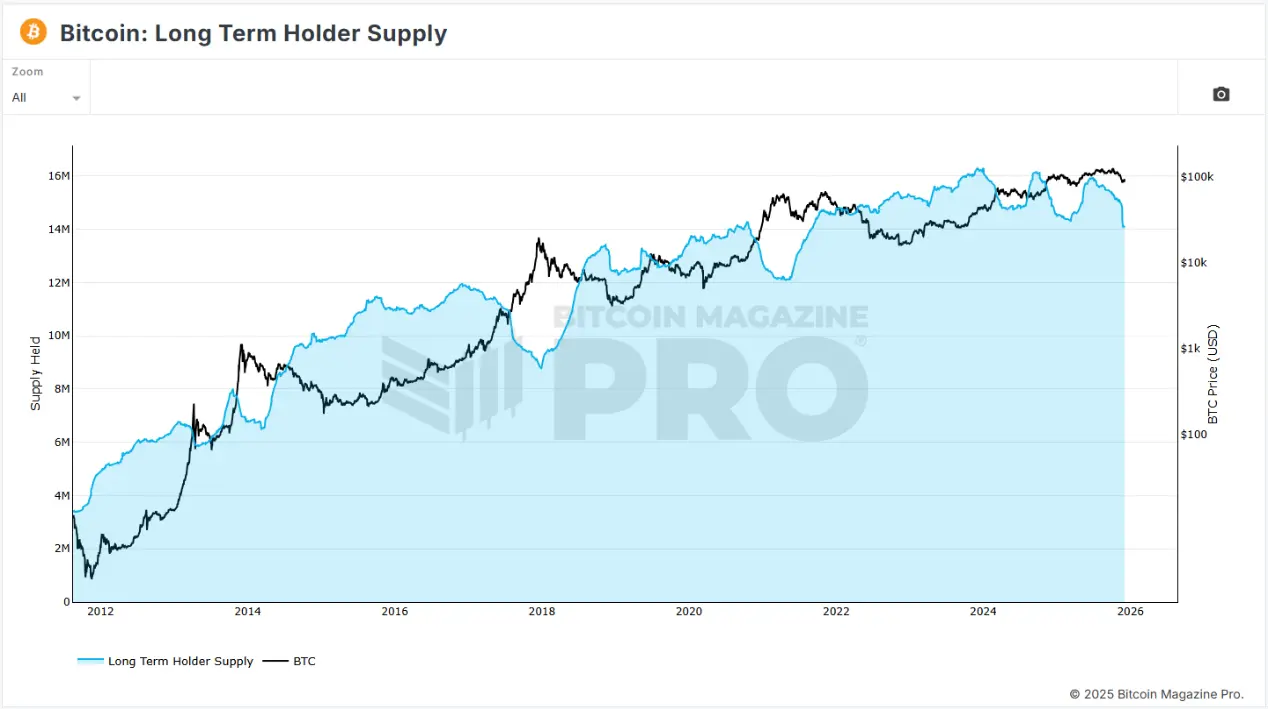

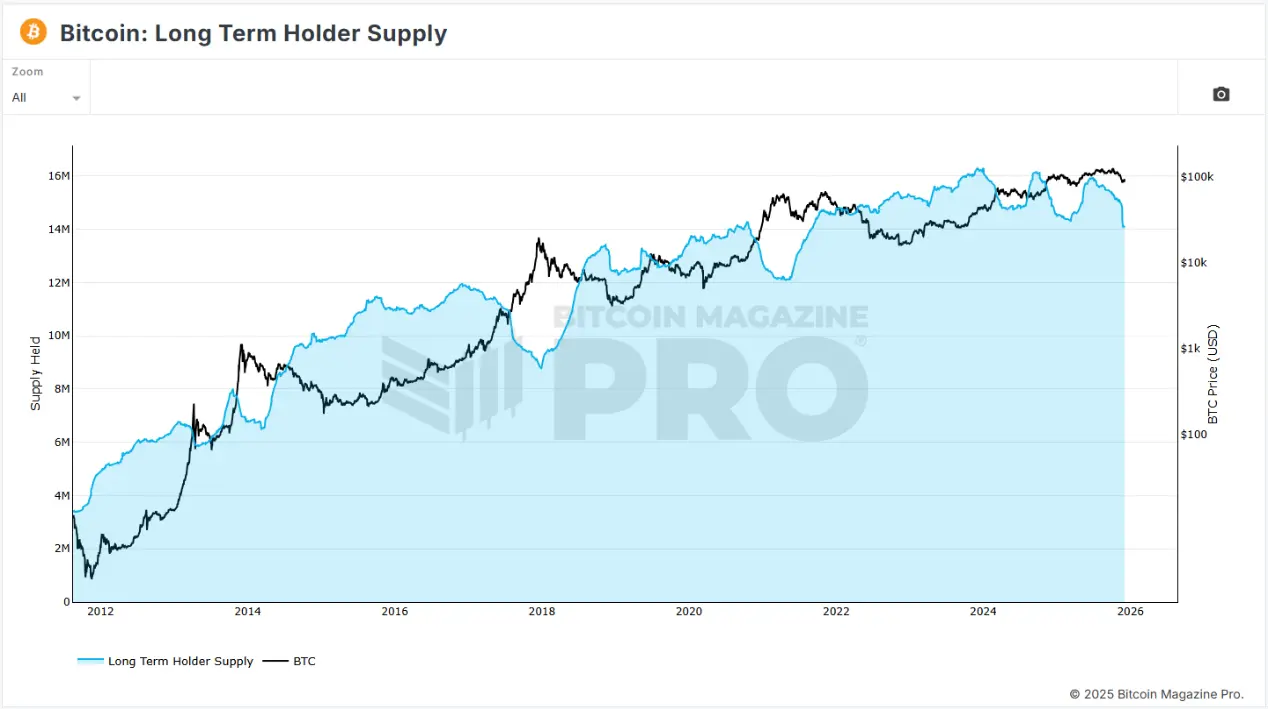

Market observers believe that the standard bitcoin cycle begins with what is commonly referred to as the "accumulation" phase. They speculate that this phase starts with the crash following the previous cycle's peak. During this period, price volatility and on-chain activity are relatively low, and market sentiment tends to be neutral or negative. It is called the accumulation phase because long-term bitcoin holders start buying in large quantities. As a result, the price characteristics during this period are a gradual recovery.

On-chain analysis shows that some investors are steadily accumulating, but most retail investors are still haunted by the previous crash and are not interested in buying bitcoin.

The accumulation phase usually lasts 12 to 15 months, after which the market cycle typically enters a new bull market. This usually occurs before the halving, as the prices of bitcoin and other crypto assets begin to rise in anticipation of the halving. The market starts to price in the bullish impact of future supply reduction, and sentiment shifts from neutral to optimistic. Liquidity begins to recover, and media attention increases accordingly.

Once the halving occurs, the bull market often rises parabolically, with prices starting to climb, sometimes slowly, sometimes explosively. Retail investors flood into the market, and traders begin to invest heavily. Historically, this is when all-time highs are often set, as a new wave of investors enters the market. Some investors increase leverage to chase the highs, resulting in even greater price volatility.

Previous bull markets have lasted about 12-18 months, typically ending with a sharp price drop. Leveraged traders are liquidated, altcoins fall even more, sentiment turns negative, and the bear market begins. At this stage of the cycle, many participants sell at a loss and cash out with whatever funds remain. Eventually, the dust settles and the market bottom slowly forms. Overall market activity and excitement have dropped significantly since the peak, but determined builders continue to move forward, quietly developing new products and innovations.

Halving

To fully understand the four-year bitcoin cycle theory, one must thoroughly understand the concept of halving and its impact on bitcoin price.

Bitcoin halving is a significant event that halves the mining reward (paid in BTC) for adding new blocks to the bitcoin blockchain. This occurs every 210,000 blocks, approximately every four years. In 2009, the reward for adding a new block was 50 bitcoins per block. Since then, it has halved four times. The 2024 halving set the current new block mining reward at 3.125 bitcoins. Assuming the four-year rhythm continues, halvings will persist until the total supply reaches the cap of 21 million, around the year 2140.

Halving is Satoshi Nakamoto's way of ensuring bitcoin's scarcity. Bitcoin was born during the 2008 financial crisis, in part as a response to central bank bailouts and fiat currency inflation. Most governments and their associated fiat currencies constantly adjust monetary policy, making it difficult for holders to have long-term confidence in the value of their fiat currency.

Bitcoin's halving mechanism mimics gold, making it more scarce. As gold reserves are depleted, mining becomes increasingly difficult, while bitcoin achieves this mathematically. As the new supply of bitcoin decreases, its scarcity increases. Historically, bitcoin's price has generally risen with each halving, thanks to supply and demand dynamics. Therefore, some supporters believe that the transparency and consistency of halving make bitcoin a powerful store of value.

Review of Past Cycles

2013

Bitcoin was born in 2008, and 2013 was its first cycle. It was mainly driven by the tech community at the time, such as internet forums and cryptography meetups. This cycle also received some early media attention, with reports on topics such as the first real-world transaction using bitcoin (10,000 bitcoins for two pizzas) and "Is bitcoin digital gold?".

During this cycle, Mt. Gox was the largest bitcoin exchange. In 2014, Mt. Gox handled over 70% of global bitcoin transactions. However, in 2014, Mt. Gox suspended trading and shut down its website, later revealing that 850,000 bitcoins were lost. Since Mt. Gox was the main source of bitcoin liquidity, this event led to a significant loss of trust in bitcoin and an 85% price drop, marking the start of a bear market.

2017

2017 was the cycle in which bitcoin became popular among retail investors. With the launch of Ethereum in 2015, smart contracts and their revolutionary potential entered the public eye. Ethereum price soared from $10 to $1,400 during this cycle. This period was also known for the ICO frenzy, with thousands of ERC-20 tokens launched and investors pouring money into any token with a white paper. Bitcoin also surged in price due to the influx of new investors, rising from $200 to $20,000 in two and a half years. The industry was frequently covered by mainstream media (see image above).

Ultimately, the ICO boom that drove bitcoin's price up became the catalyst for its crash. In ICOs, investors exchanged their Ethereum or bitcoin for new project tokens. Many project teams, after accumulating large amounts of Ethereum, began selling these tokens for cash, creating selling pressure. The US SEC also began cracking down on ICOs, labeling them as "unregistered securities offerings" and suing many projects, many of which were Ponzi schemes and scams. In this environment, over-leveraged investors either panic sold or were forced to sell as prices began to plummet, causing bitcoin to drop 84% to $3,200.

2021

The 2021 bitcoin cycle coincided with the monetary expansion during the COVID-19 pandemic. Governments around the world sought to restart economies stalled by the pandemic, and fiscal stimulus became their solution. The surge in global liquidity pushed bitcoin to new highs in 2021. Another feature of this cycle was bitcoin's transition from an "internet currency" to a more significant "macro asset." Companies like Strategy and Tesla purchased billions of dollars worth of bitcoin, while payment apps like PayPal and CashApp began supporting bitcoin transactions. The DeFi boom in 2020 and the NFT craze in 2021 attracted a large number of retail participants to this cycle. Both retail and institutional investors drove up crypto prices, with bitcoin reaching a peak of $69,000.

The end of this bitcoin cycle was triggered by the collapse of several well-known protocols and companies in the industry. First, the Luna stablecoin UST lost its peg, evaporating $60 billions in a short time. Companies and institutions such as Voyager, Celsius, BlockFi, and Three Arrows Capital, which had direct or indirect exposure to Luna, made directional bets on the market and were interconnected, ultimately all declaring bankruptcy. BlockFi subsequently restructured and obtained a credit line from FTX. Eventually, with the collapse of FTX, BlockFi also declared bankruptcy.

FTX and its affiliated trading platform Alameda were found to have engaged in large-scale fraud and were forced to liquidate assets to repay users. The US federal government also ended its stimulative monetary policy and began aggressively raising interest rates, draining market liquidity. All these events contributed to bitcoin's price plummeting to a bear market bottom of $15,500.

2025

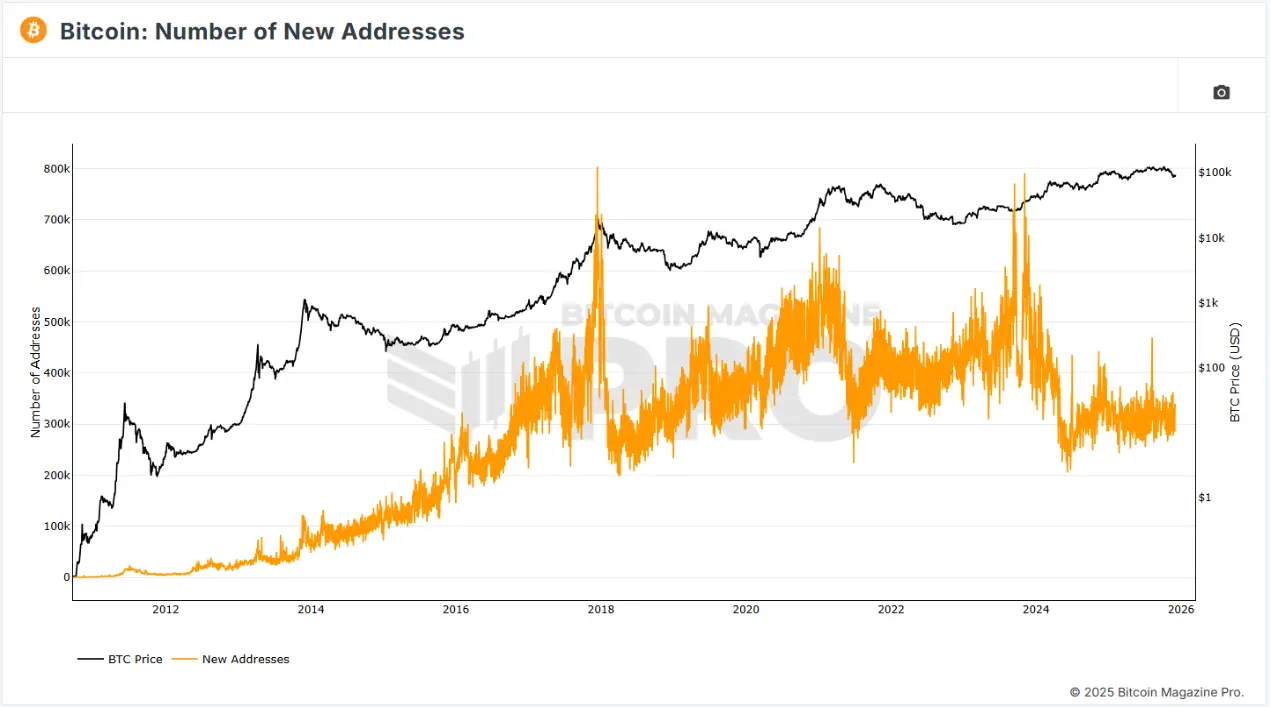

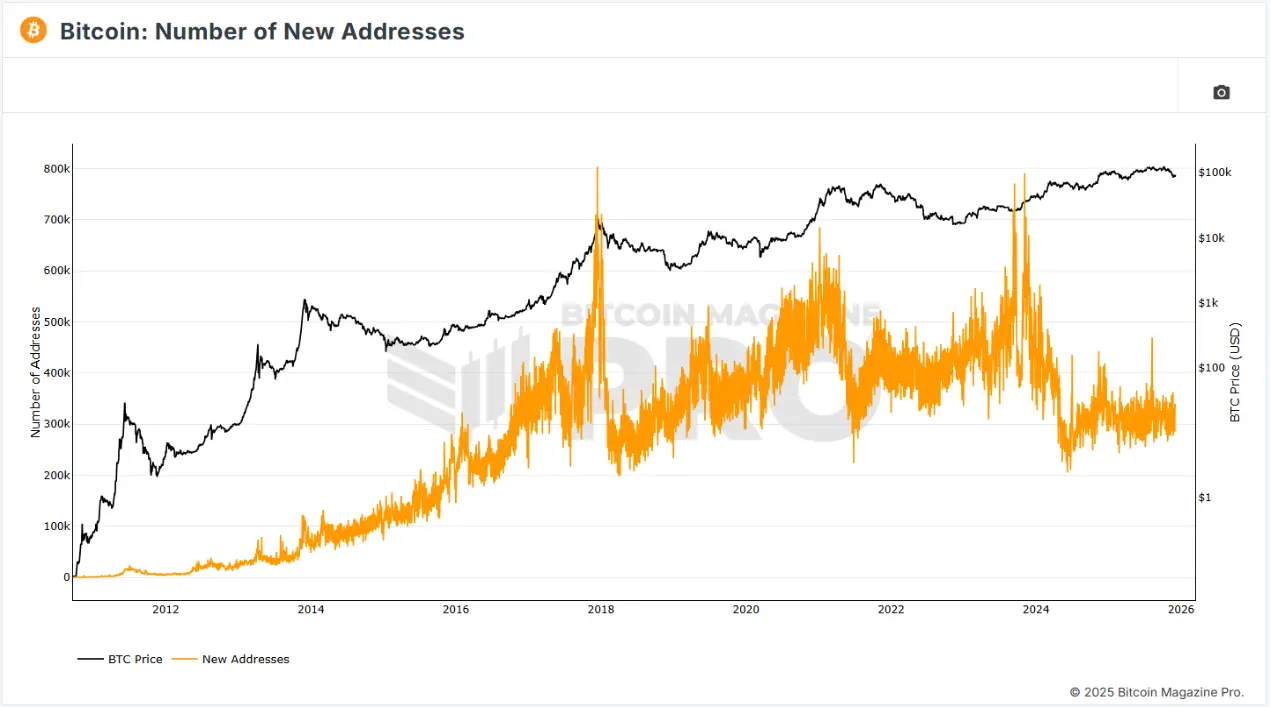

The current 2025 cycle has witnessed increased institutional adoption, with major traditional financial institutions entering the space. In January 2024, spot bitcoin ETFs were approved, and companies such as BlackRock, Fidelity, and VanEck began offering bitcoin as a standard investment product. Many companies have also adopted Strategy's Digital Asset Treasury (DAT) model, incorporating crypto into their balance sheets. Uniquely, bitcoin set a new high of $73,000 before the April 2024 halving. In addition, institutions have become the main price drivers, while retail participation has not yet reached previous cycle levels.

Why Do Cycles Occur?

Stock-to-Flow Ratio

There are several potential reasons for the occurrence of bitcoin's four-year cycles. A common explanation relates to the Stock-to-Flow (S2F) ratio, a model often used to measure the scarcity of commodities such as gold and silver.

This model compares stock (existing supply) to flow (annual new supply). The higher the ratio, the scarcer the commodity. Applying S2F to bitcoin makes sense because its total supply is fixed and mining rewards are issued on a fixed schedule. With each halving, bitcoin's stock-to-flow ratio doubles, as the new supply is halved. Currently, bitcoin's stock-to-flow ratio is about 110, while gold's is about 60, making bitcoin a scarcer asset under the S2F model.

Psychological Factors

Another simple explanation involves psychology and self-fulfilling prophecies. Bitcoin's price is heavily influenced by narratives, herd behavior, and expectations for the future. Because bitcoin, unlike traditional financial assets, does not have intrinsic value, its price mainly depends on people's expectations of its future value. As a result, bitcoin's price is highly reflexive and more sensitive to halving expectations, rumors, and narratives. Since the four-year bitcoin cycle has played out repeatedly, investors are more likely to trade bitcoin based on past cycles, creating a self-fulfilling prophecy.

Liquidity

Others believe that bitcoin's cycles are mainly determined by global liquidity. BitMEX founder Arthur Hayes pointed out in his article "Long Live The King" that bitcoin's four-year cycle is directly related to global liquidity, emphasizing the influence of the US dollar and the Chinese yuan. Hayes explained that the 2013 peak was caused by monetary expansion after the 2008 financial crisis, the 2017 peak was caused by the depreciation of the yen against the dollar, and the 2021 peak was caused by monetary expansion after the COVID-19 pandemic.

Recently, with discussions around the end of quantitative tightening (QT, i.e., the Federal Reserve reducing assets on its balance sheet and thus lowering liquidity), the restart of quantitative easing, and falling interest rates, some claim that the 2025 bitcoin cycle will not follow previous patterns.

Retail vs. Institutions

The positions of retail and institutional investors also play an important role in driving bitcoin cycles. Institutional investors are generally more disciplined and have longer investment horizons, so they tend to buy during periods of panic, forming market bottoms. Retail investors are more emotional and more likely to buy due to FOMO. As a result, retail investors are more likely to chase price momentum and use leverage. Retail investors tend to cause greater volatility during the cycle, especially in the later stages.

Why Do Some Say the Cycle Is Over?

There are several reasons why people claim that the bitcoin cycle is outdated. A major reason is increased institutional participation through ETFs, corporate treasuries, hedge funds, and more. These financial entities behave differently from retail investors, buying on a fixed schedule, using reasonable leverage, and managing risk prudently. This behavior suppresses volatility, thereby dampening cyclical fluctuations.

Another potential reason is that crypto has grown significantly compared to earlier cycles. Bitcoin is increasingly tied to macroeconomic factors such as interest rates and Federal Reserve policy, weakening the impact of halving on bitcoin price. Halvings occur every four years, while Fed policy does not follow a similar fixed schedule. In addition, as the impact of halving on block rewards diminishes, the importance of halving itself is decreasing. The first halving reduced rewards from 50 BTC to 25 BTC, while the most recent halving only reduced rewards from 6.25 to 3.125 bitcoins.

How to Tell If the Cycle Is Over?

Closely monitoring the development of the current cycle can help better determine whether the four-year cycle has become a thing of the past. Some key signs that may indicate this:

- In previous cycles, prices typically surged after the halving, usually within 12-18 months after the halving.

- Previous cycles have all ended with large-scale leverage wipeouts and cascading liquidations, resulting in drops of over 70%.

- If bitcoin's price begins to perfectly match changes in global liquidity, then bitcoin becomes a macro asset rather than one based on the halving cycle.

- Previous cycles have seen a surge in retail participation in the later stages, with altcoins rising parabolically. Insufficient retail participation means the cycle is mainly driven by institutional buying, which may lead to reduced volatility and a smoother cycle.

Conclusion

Bitcoin has long followed the pattern of a four-year cycle. Bitcoin slowly recovers from a bear market, enters the halving phase, then sees a sustained price surge, followed by a rapid pullback as leveraged traders are wiped out. Historically, many factors have contributed to this phenomenon, ultimately forming the familiar four-year cycle. Nevertheless, bitcoin has continued to develop steadily, eventually becoming a giant with a market cap of $1.8 trillions. The emergence of institutional investors, ETFs, and sovereign wealth funds means that market participants have changed significantly compared to the first cycle. Bitcoin seems to be increasingly sensitive to macroeconomic factors, but its price trends are still influenced by some traditional factors, such as psychological elements and mining economics.

It is still unclear whether bitcoin's cycle has completely ended, but each cycle is unique, and future cycles could be entirely different from the past. Understanding the historical evolution of this asset and its participants is key to understanding future cycles, but ultimately, only time will tell whether this pattern will persist or become a relic of history.

Further reading: Has the Bitcoin Four-Year Cycle Failed?

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Polymarket predicts a 32% probability of "Bitcoin dropping below $80,000 in December"