Date: Tue, Dec 16, 2025 | 05:50 PM GMT

The cryptocurrency market continues to face heavy selling pressure, and this wave of downside volatility has spilled into major altcoins, including Near Protocol (NEAR). The token has declined by over 16% during the latest weekly correction, reflecting broader weakness across the market.

Despite the sharp drawdown, the higher-timeframe chart is beginning to reveal a technical structure that suggests downside momentum may be losing strength. Price action now hints that NEAR could be approaching a zone where a potential rebound may start to take shape.

Source: Coinmarketcap

Source: Coinmarketcap

Power of 3 Pattern in Play?

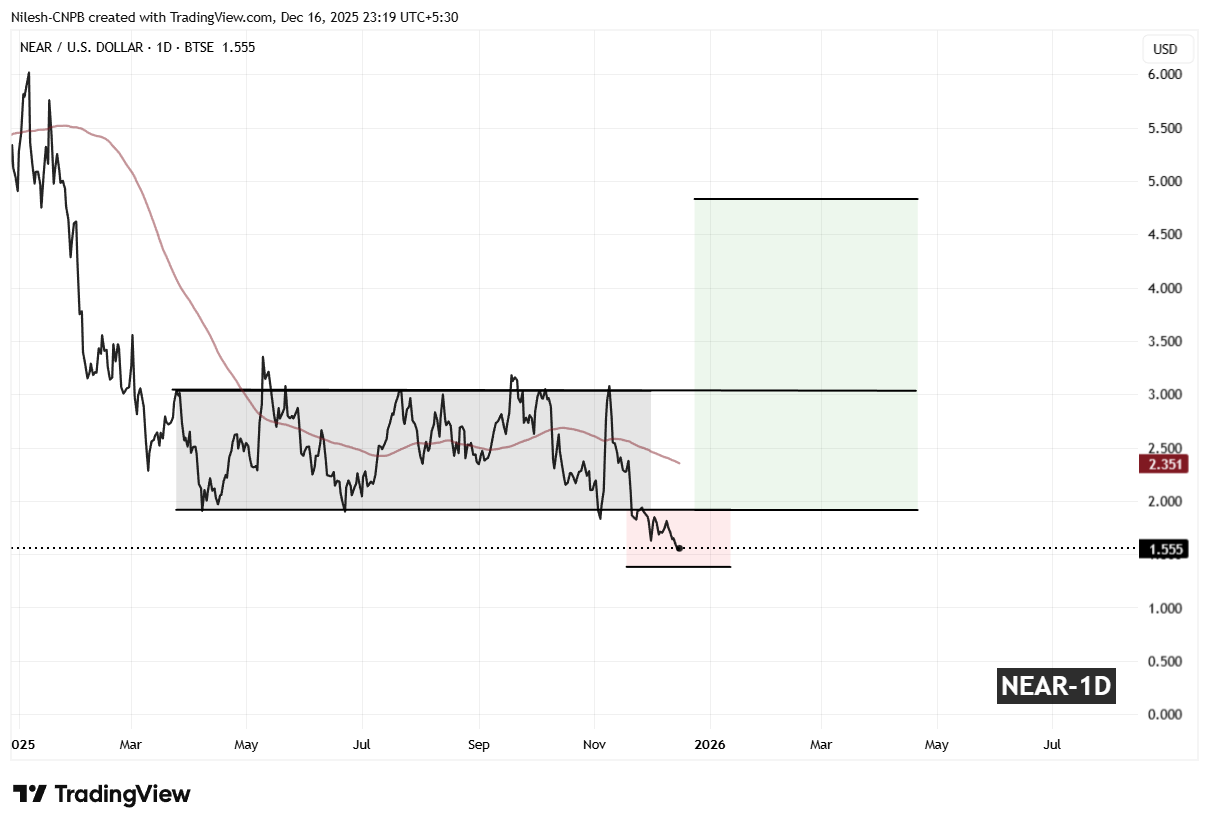

On the daily chart, NEAR appears to be tracing out the Power of 3 formation, a well-known market structure that unfolds in three distinct stages: accumulation, manipulation, and expansion. This pattern often emerges near major cycle lows and can precede strong directional moves once the final phase begins.

Accumulation Phase

NEAR spent several sessions consolidating within a defined range, capped by resistance near $3.04 and supported around $1.94. This extended sideways movement reflected an accumulation phase, where volatility compressed and price remained contained. Such behavior typically signals that larger participants are positioning quietly while retail interest fades.

Manipulation Phase

During the recent market-wide correction, NEAR broke decisively below the $1.94 accumulation support, sliding to a current low near $1.55. This sharp breakdown, marked by the red-shaded zone on the chart, aligns with the manipulation phase of the Power of 3 structure. These moves are designed to trigger stop losses, shake out weaker holders, and create pessimism before a potential reversal develops.

Near Protocol (NEAR) Daily Chart/Coinsprobe (Source: Tradingview)

Near Protocol (NEAR) Daily Chart/Coinsprobe (Source: Tradingview)

Notably, the sell-off has begun to lose momentum near this lower zone, suggesting that aggressive selling pressure may be exhausting.

What’s Next for NEAR?

At present, NEAR continues to trade within the manipulation zone, indicating that the market is still testing sentiment before committing to the next directional move. A period of consolidation around current levels remains possible as buyers and sellers battle for control.

If bulls manage to reclaim the $1.94 range support and push price back above the 100-day moving average near $2.35, the structure could transition into the expansion phase. This stage is typically the most explosive part of the pattern, often marked by rapid upside acceleration. Based on the chart projection, a confirmed expansion could open the door for a move toward the $4.80–$5.00 region over the coming months.

However, it is important to note that this remains a potential setup. As long as NEAR trades below the $1.94 level, downside risks cannot be ruled out, and the market remains vulnerable to further volatility. Reclaiming this level is crucial for bulls to regain control and validate the bullish reversal narrative.