Spot XRP ( XRP ) exchange-traded funds have continued to attract investor interest, drawing in almost $1 billion in inflows since their launch. Unfortunately, this didn’t help the bulls hold the price above the psychological $2 support level.

Key takeaways:

Spot XRP ETFs saw inflows for 20 consecutive days, totalling $1.2 billion.

XRP price extended its downtrend, slipping below a key moving support level.

Spot XRP ETFs add $1 billion in 3 weeks of inflows

US-based spot XRP ETFs have recorded inflows for twenty consecutive days, underscoring institutional demand for the network’s native asset.

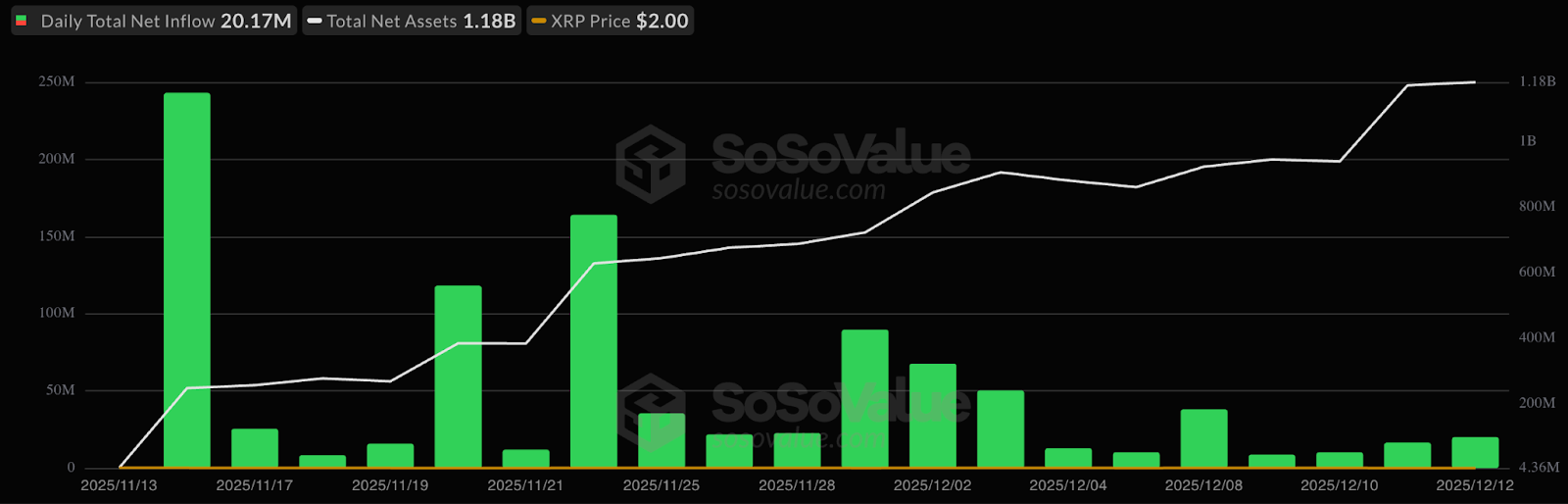

According to data from SoSoValue, XRP ETFs added $20.2 million on Friday, bringing cumulative inflows to $990.9 million and total assets to over $1.2 billion. The Franklin XRP ETF (XRPZ) led with $8.7 million in inflows on Friday, bringing its net assets to $175 million.

Related: XRP buy signal flashes as funding rate turns deeply negative: Will bulls step in?

Bitwise XRP ETF (XRP) and Canary XRP ETF (XRPC) were the only other products that recorded inflows on Dec. 12, while Grayscale XRP Trust ETF (GXRP) and 21shares XRP ETF (TOXR) did not see any flows.

XRP ETFs inflows. Source: SoSoValue

XRP ETFs inflows. Source: SoSoValue

Such a strong start for XRP ETFs reflected confidence among institutional investors. By comparison, spot Bitcoin ( BTC ) ETFs saw $49 million in inflows on the same day.

Spot Ether ( ETH ) ETFs posted $19.4 million in outflows, reducing their cumulative inflows to $13.1 billion. The funds also shed $42.3 million on Thursday.

“US spot $XRP ETFs have now recorded 20 straight days of inflows since launch, even as $BTC and $ETH ETFs continue to struggle with outflows,” said analyst Bitcoinsensus in a Monday post on X, adding:

“Institutional demand for XRP is heating up fast.”

As Cointelegraph reported , XRP ETF demand backs the bullish case for the altcoin with a rally to $10 still in the cards for 2026.

XRP price loses key support levels

The persistent demand for XRP ETFs has, however, failed to hold its price above $2, with the technical setup indicating a potential for a deeper correction.

XRP’s price extended its bearish trajectory on Monday, falling over 11% over the last 10 days and dropping below $2 for the second time since Nov. 21.

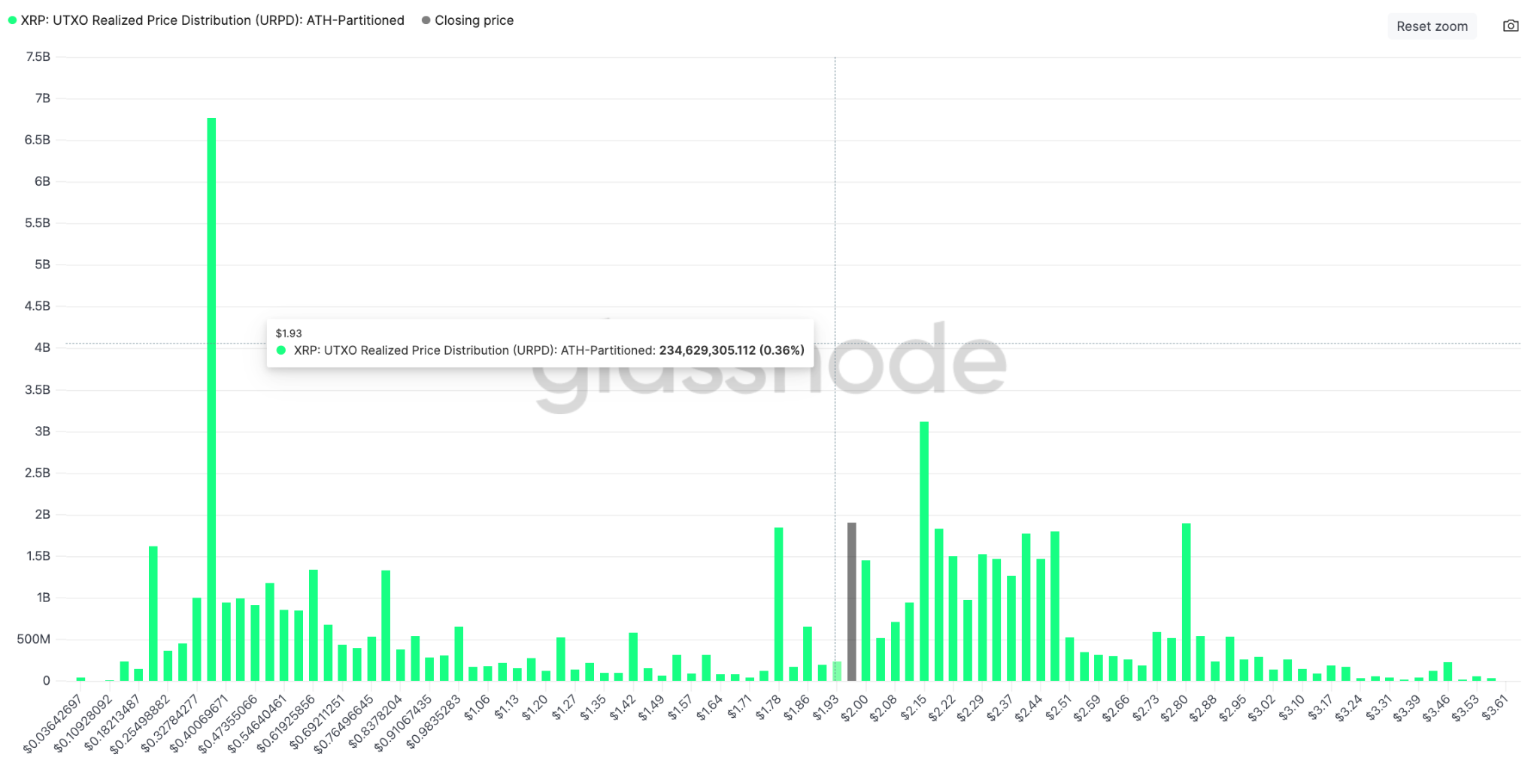

The XRP/USDT pair is currently testing a daily order block around $1.93, a level with limited support, according to data from Glassnode.

Glassnode's UTXO realized price distribution (URPD) — a metric that shows the average prices at which SOL holders bought their coins — reveals smaller clusters of these buy levels below $1.90. This means that fewer holders are likely to defend the price there.

The next significant support sits at $1.78, where approximately 1.85 billion XRP were previously acquired.

XRP: UTXO realized price distribution (URPD). Source: Glassnode

XRP: UTXO realized price distribution (URPD). Source: Glassnode

If the price breaks below this level, it could drop toward the green zone shown below, supported by the $1.61 local low and the 200-week EMA, which is around $1.40 and represents the last line of defense for the XRP price.

XRP/USDT weekly chart. Source: Cointelegraph/ TradingView

XRP/USDT weekly chart. Source: Cointelegraph/ TradingView

XRP’s downside momentum is also increasing based on the relative strength index , or RSI, which has hit its lowest level since July 2024.

As Cointelegraph reported , a break below $2 will see the XRP/USDT pair extend the decline to $1.75 and subsequently to the local low at $1.61.