Market Share Plummets by 60% - Can Hyperliquid Stage a Comeback with HIP-3 and Builder Codes?

What recent events has Hyperliquid experienced?

Original Article Title: Hyperliquid Growth Situation

Original Article Author: @esprisi0

Translation: Peggy, BlockBeats

Editor's Note: Hyperliquid once dominated the decentralized derivatives track, but in the second half of 2025, its market share plummeted rapidly, sparking industry attention: has it peaked, or is it positioning for the next stage? This article reviews Hyperliquid's three stages: from the ultimate dominance with a market share soaring to 80%, to strategic transformation and accelerated competition leading to a loss of momentum down to 20%, and then to a re-emergence centered around HIP-3 and Builder Codes.

The following is the original text:

Over the past few weeks, concerns about the future of Hyperliquid have escalated. The loss of market share, rapidly rising competitors, and increasingly crowded derivatives track have raised a key question: what exactly is happening beneath the surface? Has Hyperliquid already peaked, or is the current narrative overlooking deeper structural signals?

This article will dissect it one by one.

Stage One: Ultimate Dominance

From early 2023 to mid-2025, Hyperliquid consistently hit historical highs in key metrics and steadily increased its market share, thanks to several structural advantages:

A points-based incentive mechanism that attracted a large amount of liquidity; a first-mover advantage in launching new perpetual contracts (such as $TRUMP, $BERA), making Hyperliquid the most liquid venue for new trading pairs and the preferred platform for pre-listing trading (such as $PUMP, $WLFI, XPL). To not miss out on emerging trends, traders were compelled to flock to Hyperliquid, driving its competitive edge to its peak; best UI/UX experience among all perpetual contract DEXs; lower fees compared to centralized exchanges (CEXs); introduction of spot trading, unlocking new use cases; Builder Codes, HIP-2, and HyperEVM integration; achieving zero downtime even during major market crashes.

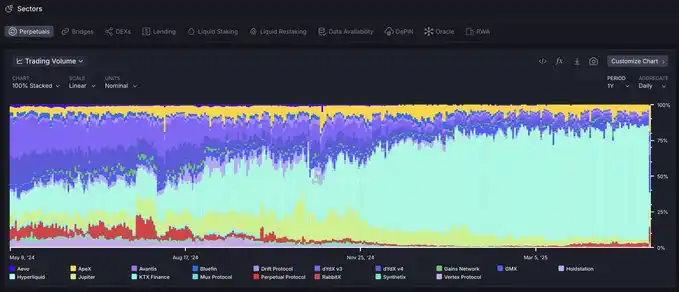

As a result, Hyperliquid's market share grew continuously for over a year, reaching a peak of 80% in May 2025.

Perpetual Contract Trading Volume Market Share data provided by @artemis

At that stage, the Hyperliquid team was significantly ahead of the entire market in innovation and execution speed, with no truly comparable products in the entire ecosystem.

The Rise of Liquidity-as-a-Service in the Second Stage and Accelerated Competition

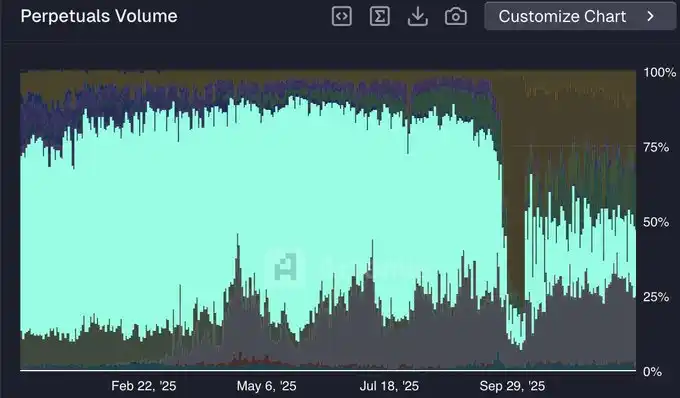

Since May 2025, Hyperliquid's market share has plummeted sharply, dropping from around 80% to close to 20% of the trading volume by early December.

@HyperliquidX Market Share (Data Source: @artemis)

This relative loss of momentum against competitors can be attributed to several factors:

Strategic Shift from B2C to B2B

Hyperliquid did not double down on a pure B2C model, such as launching a proprietary mobile app or continually rolling out new perpetual contract products, but chose to pivot to a B2B strategy, positioning itself as the "AWS of Liquidity."

This strategy focused on building core infrastructure for external developers to use, such as Builder Codes for the front end and HIP-3 for launching new perpetual markets. However, this transformation essentially ceded the initiative for product deployment to third parties.

In the short term, this strategy did not perform ideally in attracting and retaining liquidity. The infrastructure was still in its early stages, adoption takes time, and external developers did not yet have the distribution capability and trust built up over the long term by the Hyperliquid core team.

Competitors Seizing the Opportunity of Hyperliquid's Transformation

Unlike Hyperliquid's new B2B model, competitors continued to maintain full vertical integration, allowing them to significantly accelerate their speed when launching new products.

Since they did not need to delegate execution, these platforms maintained full control over product releases while leveraging their established user trust to rapidly expand. As a result, they are more competitive than they were in the first stage.

This directly translates into market share growth. Competitors are now not only offering all products on Hyperliquid but also launching features on HL that have not yet gone live (such as Lighter launching spot markets, perpetual equities, and forex).

Incentives and "Hire-to-Liquidity"

Hyperliquid has gone over a year without running any official incentive programs, while its main competitors are still actively engaging. Lighter, currently leading in trading volume market share (about 25%), is still in its pre-TGE incentive season.

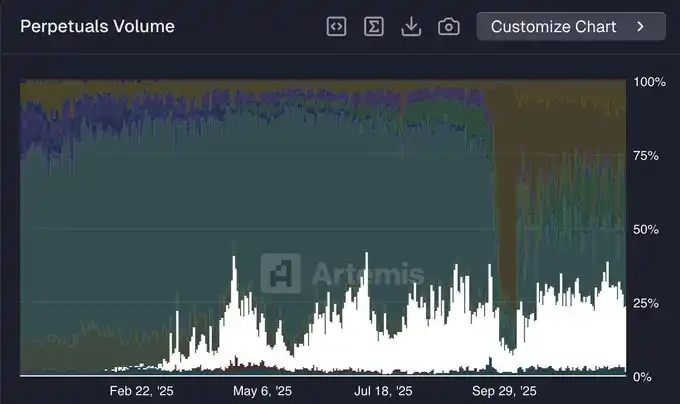

@Lighter_xyz Market Share (Source: @artemis)

In the DeFi space, liquidity is more “hire-to” than anywhere else. A significant portion of the volume flowing from Hyperliquid to Lighter (and other platforms) is likely incentive-driven, related to airdrop farming. Like most perpetual DEXs running incentive seasons, Lighter's market share is expected to decrease post-TGE.

Phase Three HIP-3 and the Rise of Builder Codes

As mentioned earlier, building the "AWS of liquidity" is not the short-term optimal strategy. However, in the long run, this model precisely positions Hyperliquid to potentially become the core hub of global finance.

While competitors have replicated most of Hyperliquid's current features, real innovation still stems from Hyperliquid. Developers building on Hyperliquid benefit from domain focus, allowing them to formulate more targeted product development strategies on an evolving infrastructure. On the other hand, protocols like Lighter that maintain complete vertical integration will face constraints when optimizing the development of multiple product lines simultaneously.

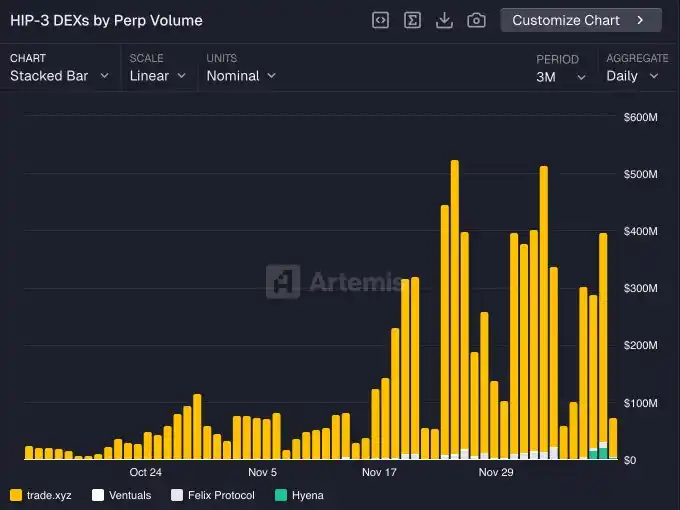

HIP-3 is still in its early stages, but its long-term impact has begun to materialize. Key participants include:

@tradexyz has launched perpetual equities

@hyenatrade recently deployed a trading terminal for USDe

More experimental markets are emerging, such as @ventuals offering pre-IPO exposure and @trovemarkets catering to niche speculative markets like Pokémon or CS:GO assets.

By 2026, it is expected that the HIP-3 market will capture a significant share of Hyperliquid's total trading volume.

HIP-3 Trading Volume (by Builder)

The key driver behind the eventual restoration of Hyperliquid's dominance is the synergistic effect between HIP-3 and Builder Codes. Any frontend integrated with Hyperliquid can instantly access the full HIP-3 market, providing users with unique products.

Therefore, developers have a strong incentive to list on the HIP-3 market as these markets can be distributed on any compatible frontend (such as Phantom, MetaMask, etc.) and tap into entirely new sources of liquidity. It's a perfect virtuous cycle.

The ongoing development of Builder Codes makes me more optimistic about the future, whether in terms of revenue growth or active user expansion.

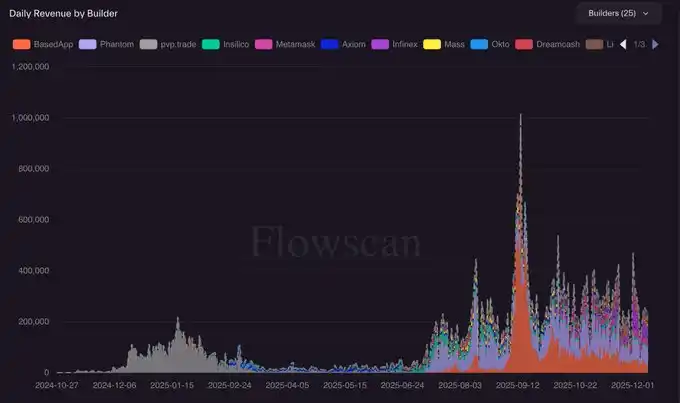

Builder Codes Revenue (data source: @hydromancerxyz)

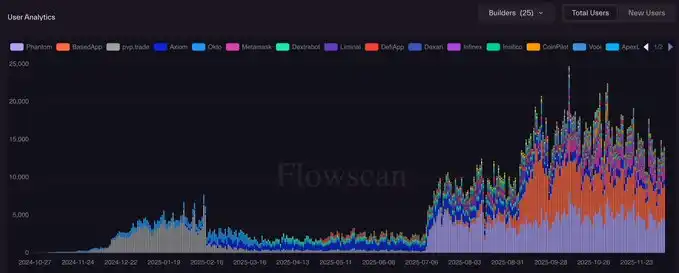

Builder Codes Daily Active Users (data source: @hydromancerxyz)

Currently, Builder Codes are primarily used by native crypto applications (such as Phantom, MetaMask, BasedApp, etc.). However, I anticipate a new class of super apps built on Hyperliquid to emerge in the future, aimed at attracting an entirely non-native crypto user base.

This is very likely to become the key path for Hyperliquid to enter the next stage of scaling, which will also be the focus of my next article.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Clean Energy Market Fluidity: Ushering in a New Age with CFTC-Sanctioned Platforms

- REsurety's CleanTrade, the first CFTC-approved SEF for clean energy , is transforming market liquidity and transparency by standardizing VPPAs, PPAs, and RECs. - The platform attracted $16B in notional value within two months, enabling institutional investors to hedge energy risks while aligning with ESG goals through verifiable decarbonization metrics. - Renewable developers benefit from streamlined financing and securitization tools, creating predictable revenue streams and expanding access to capital

Investing in Human Capital for a Greener Tomorrow: The Growth of Education and Career Training in Renewable Energy

- Global energy transition drives rapid growth in renewable workforce demand, with U.S. wind turbine technician roles projected to surge 60.1% by 2033. - Institutions like Farmingdale State College bridge skill gaps through industry-aligned programs, offering hands-on training and partnerships with firms like Orsted and GE . - Investors gain strategic opportunities by funding vocational training and microcredentials, addressing decarbonization needs while boosting social equity through inclusive initiative

Clean Energy Market Fluidity: The CFTC-Endorsed Transformation

- CFTC approved CleanTrade as the first SEF for clean energy , addressing market fragmentation and liquidity gaps. - The platform enables institutional-scale trading of VPPAs and RECs with automated compliance and $16B in early trading volume. - Integrated analytics and regulatory compliance enhance transparency, reducing risks for investors in renewable energy assets. - Early adoption by Cargill and Mercuria highlights CleanTrade's potential to reshape $1.2T clean energy investment landscape.

How iRobot Strayed from Its Original Path