The XRP price is currently in a decisive standoff, as its price is capped despite robust fundamentals, but a wavering market sentiment is preventing it from rising. Ripple’s recent regulatory breakthrough represents a historic shift for the crypto landscape, yet the XRP price has yet to show some response on the chart.

So far, it has been missing significant moves from many positive news stories, similar to other altcoins this quarter, but reflecting negative news immediately on the chart. However, unlike any other altcoin, the resilience in holding $2 is still commendable, and that was only possible for XRP due to its fundamentals, consistent demand, and the trust its investors have in it. Now, people are closely monitoring whether the $2 level will maintain its stability.

Ripple recently received conditional approval from the U.S. Office of the Comptroller of the Currency to charter Ripple National Trust Bank. This development places Ripple directly under federal banking oversight, aligning its operations with both OCC and NYDFS standards.

From a structural perspective, this approval elevates Ripple beyond a payments-focused crypto firm into regulated financial infrastructure. The move strengthens the foundation for RLUSD while positioning XRP as a compliant settlement asset connecting fiat rails, stablecoins, and tokenized assets.

Importantly, this milestone addresses long-standing criticism that crypto operates outside traditional financial rules. Instead, Ripple now operates within them under direct supervision.

Although this announcement did sparked intense discussion across crypto communities, but the XRP price chart seems to have digested this one too, showing little immediate reaction. This disconnect highlights the current environment where macro sentiment outweighs individual project advancements.

Under the new framework, XRP’s role is improving but markets often delay repricing until usage metrics and liquidity flows reflect these changes.

For now, XRP crypto fundamentals appear to be accelerating faster than price .

Despite positive developments, broader market sentiment remains cautious. Risk appetite across crypto has weakened, limiting follow-through even on major news. As a result, XRP price USD continues to trade defensively near the $2 psychological zone.

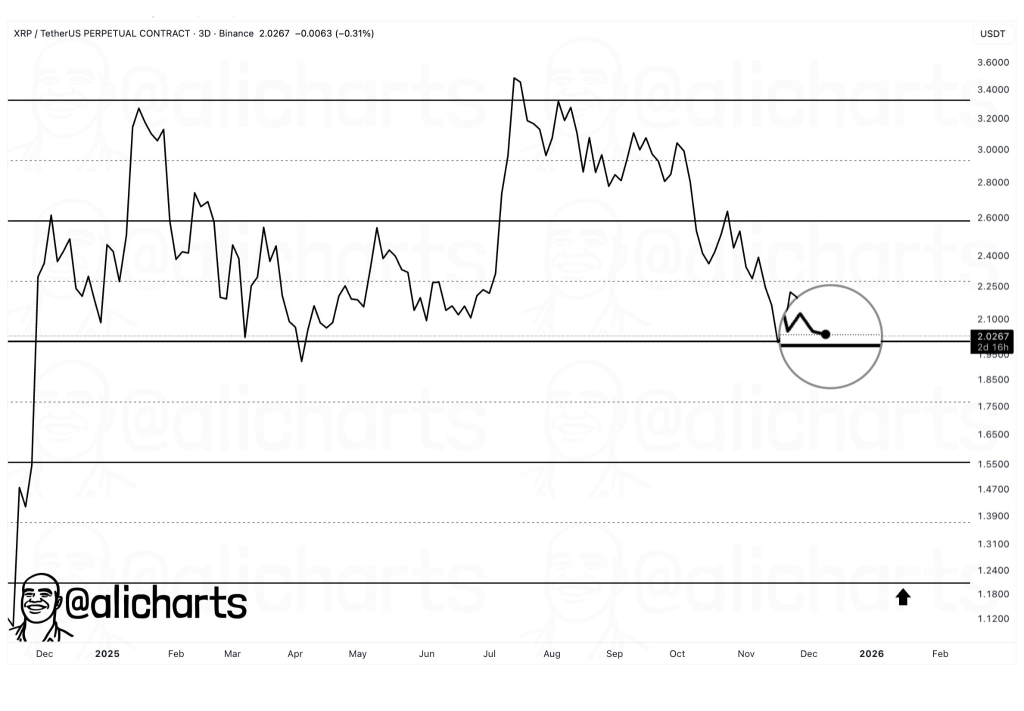

Technically, XRP is in a consolidation phase in 2025, where buyers consistently defend $2, while upside attempts fail to attract sustained momentum. This behavior suggests distribution rather than accumulation, reinforcing short-term uncertainty.

As long as sentiment remains subdued, XRP price prediction models remain restrained.

From a technical standpoint, the $2 level has become the most important reference point on the XRP price chart. Repeated defenses of this zone indicate longer-term holder confidence, yet each failed recovery adds pressure.

If sentiment does not improve, downside risk remains open. A loss of $2 could expose XRP /USD to deeper retracement levels near $1.20, according to prevailing technical projections.

Meanwhile, as Ripple’s regulatory positioning continues to mature, the divergence between price action and fundamentals leaves XRP price at a pivotal turning point, and what comes next depends purely on improving market sentiment in future weeks or months.