Bitcoin Tests Key Ichimoku Cloud Resistance as $220M in Shorts Get Liquidated

Bitcoin is testing resistance on the daily Ichimoku Cloud while liquidation data shows heavy pressure on short sellers during its latest rebound.

Bitcoin is maintaining a strong upward bias following a fresh intraday advance, trading near the upper end of its 24-hour range. Over the past session, BTC has moved between $87,186 and $93,928, holding firm after a series of higher lows that reinforced the rebound structure.

The latest run places the market leader up roughly 6.5% over the last 24 hours, adding to a broader 7-day gain of about 6.8%. On the 14-day window, performance remains modest but positive with an increase of roughly 1.8%, reflecting slow but persistent accumulation after recent volatility.

With price now consolidating near the daily highs, traders are watching to see whether bullish pressure can extend into a clearer breakout. Will Bitcoin break out?

Bitcoin Price Analysis

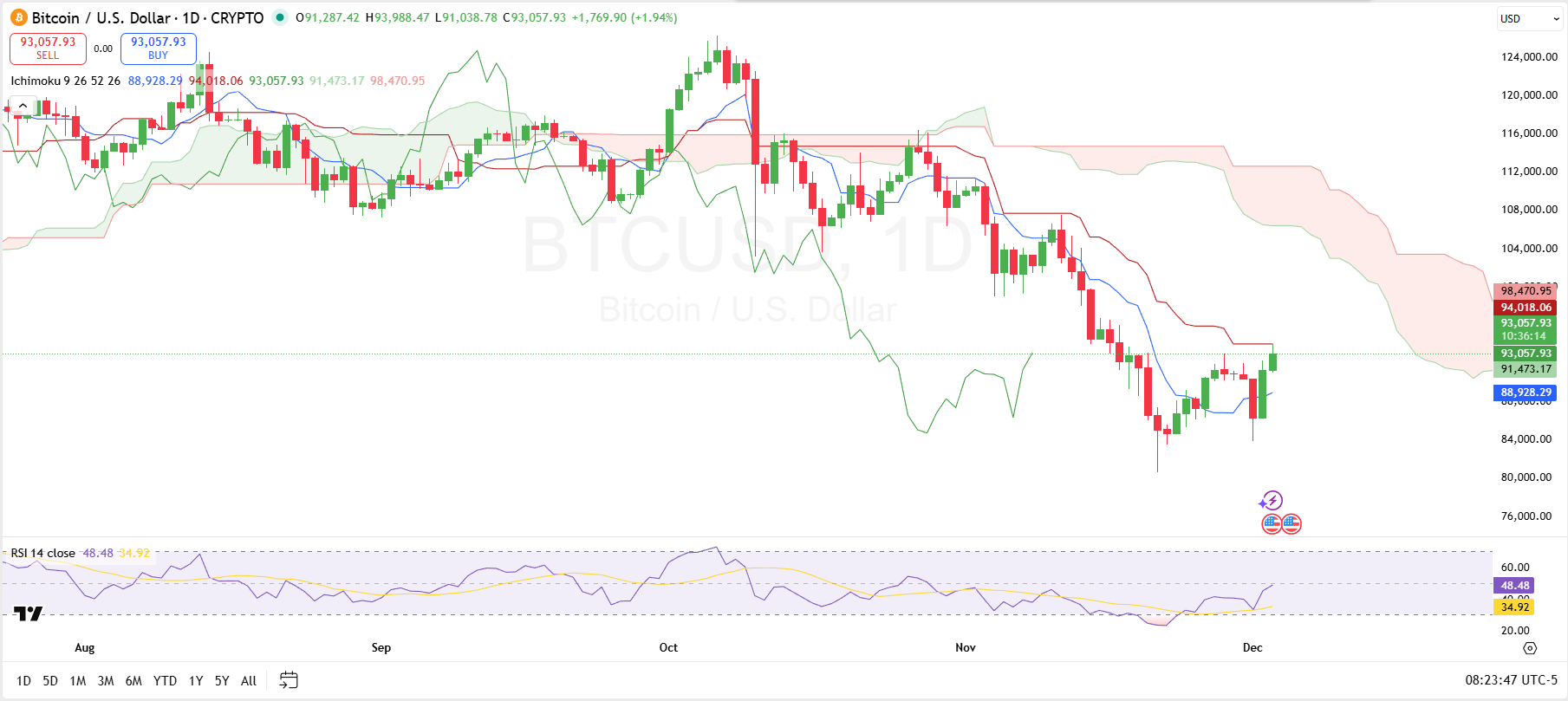

Bitcoin’s daily chart shows the price attempting to build a recovery structure after its November decline, with current action testing the Ichimoku cloud that had a lower boundary at $91,473. This cloud base had represented the first major resistance zone, acting as the point where bearish structure began to transition toward neutral conditions.

Until Bitcoin secures a full candle close above that lower cloud line, the overall trend bias remains cautious. Immediate resistance exists at the red base line at $94,018, while further resistance stands at the upper boundary of the cloud at $98,470.

On the support side, the blue conversion line provides short-term structural backing for the recovery. This conversion line sits just under current price action and will act as the first downside level to defend if momentum turns soft.

Further, RSI momentum offers modest reinforcement for bulls, with the indicator lifting away from bearish territory and trending toward mid-range alignment.

Taken together, price now sits at a sensitive juncture: a sustained break into or above the cloud base would solidify the upward shift, while failure to hold above the conversion line would risk eroding the confidence behind Bitcoin’s current recovery attempt.

Bitcoin Liquidation Data

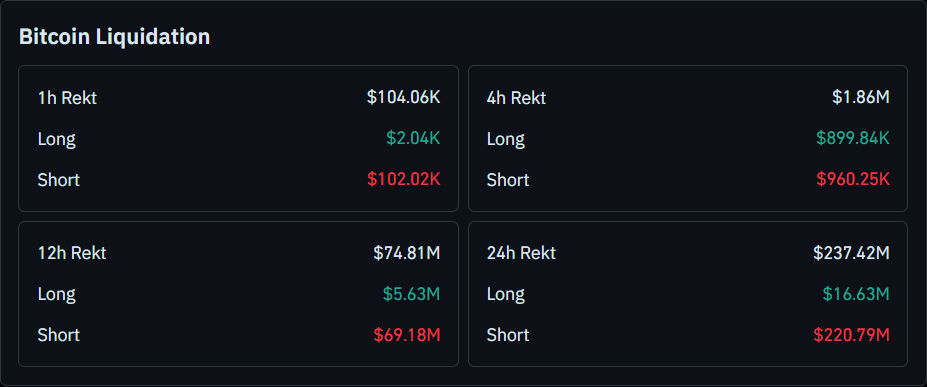

Bitcoin’s liquidation data confirms that the latest move higher has been due to pressure on short sellers. Over the past 24 hours, total liquidations reached about $237.4 million, with an overwhelming $220.8 million coming from short positions versus just $16.6 million from longs.

The pattern is similar on the 12-hour view, where roughly $74.8 million in positions faced liquidation, including $69.2 million in shorts and only $5.6 million in longs. This skew toward short liquidations suggests that traders betting against the rally have been forced to cover as price pushed higher.

Short-term readings echo the same dynamic, though at a smaller scale. In the last 4 hours, around $1.86 million in positions were liquidated, split between $899,800 in long and $960,000 in short exposure, while the 1-hour window shows approximately $104,000 in total liquidations, almost all of it ($102,000) from shorts.

Overall, the data indicates that Bitcoin’s upswing is being amplified by a series of short squeezes across multiple timeframes.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

The Increasing Economic Strain of Alzheimer’s Disease and Its Effects on Healthcare Systems and Long-Term Care Industries

- Alzheimer's disease's global economic burden is projected to surge from $1.6 trillion in 2023 to $14.5 trillion by 2050, straining healthcare systems and public infrastructure. - The Alzheimer's therapeutics market is growing at 23.4% CAGR, driven by disease-modifying therapies and tech innovations like AI-driven care platforms. - Strategic investments in dementia infrastructure include $3.9B U.S. NIH funding and startups like Isaac Health securing $10.5M for in-home memory clinics. - Public-private part

Building Robust Investment Portfolios: Insights Gained from Economic Crises and Policy Actions

Hyperliquid (HYPE) Price Rally: The Role of DeFi Advancements and Investor Sentiment in Driving Recent Market Fluctuations

- Hyperliquid (HYPE) surged to $59.39 in 2025 before retreating, driven by DeFi innovations and volatile market sentiment. - Technical advancements like HyperBFT consensus and USDH stablecoin attracted 73% of decentralized trading volume, while institutional partnerships stabilized the ecosystem. - Despite short-term volatility near $36, bullish RSI patterns and $3 trillion trading volume suggest potential for a $59 rebound, though sustained momentum above $43 is critical. - Analysts project HYPE could rea

The Driving Forces Behind Economic Growth in Webster, NY

- Webster , NY, transformed a 300-acre Xerox brownfield into a high-tech industrial hub via a $9.8M FAST NY grant, boosting industrial and real estate growth. - Public-private partnerships enabled infrastructure upgrades, attracting $650M fairlife® dairy projects and 250 high-paying jobs by 2025. - Industrial vacancy rates dropped to 2%, while residential values rose 10.1% annually, highlighting synergies between infrastructure and economic development. - The model underscores secondary markets' potential