Date: Tue, Dec 02, 2025 | 03:45 AM GMT

The broader cryptocurrency market is off to a volatile start this week as the downturn has triggered over $518.83 million in liquidations across major exchanges, with long positions taking the biggest hit — more than $398.47 million wiped out.

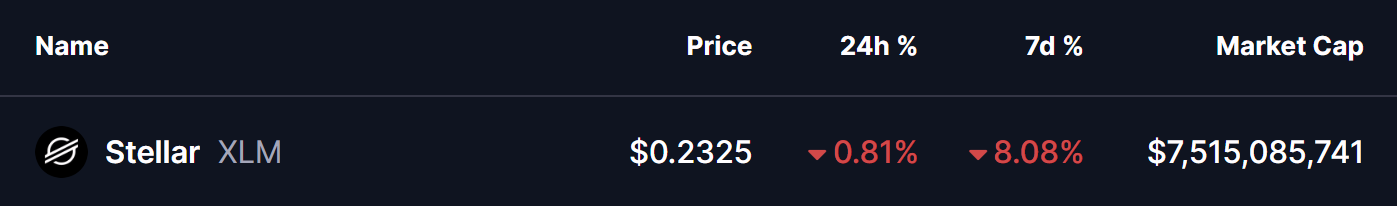

This wave of volatility has pressured major altcoins , and Stellar (XLM) is among those struggling, down more than 8% on the weekly chart. But despite the deep selloff, XLM’s larger technical structure hints that a potential rebound may be forming right at a crucial level.

Source: Coinmarketcap

Source: Coinmarketcap

Descending Triangle in Play

On the weekly timeframe, XLM continues to trade inside a descending triangle pattern. This structure builds when sellers consistently lower the highs while buyers repeatedly defend a key horizontal support zone. While descending triangles often act as bearish continuation patterns, they can also produce strong countertrend rallies — especially when support holds for an extended period.

The current drop has pulled XLM back into its major demand region between $0.20 and $0.24. This area has served as a solid support base for several months, with each test prompting strong pushbacks from buyers. The repeated defense of this zone shows clear signs of accumulation and weakening selling pressure.

Stellar (XLM) Weekly Chart/Coinsprobe (Source: Tradingview)

Stellar (XLM) Weekly Chart/Coinsprobe (Source: Tradingview)

XLM is also sitting below the 100-week moving average near $0.3276. Reclaiming this key moving average would be one of the earliest signals of a momentum shift in favor of the bulls.

What’s Next for XLM?

If buyers continue to defend the $0.20–$0.24 range and manage to push the price back above the 100-week MA, XLM could quickly regain strength. This would pave the way for a retest of the descending trendline resistance near $0.35 — a level that has capped upside movement for nearly a year.

A breakout above the trendline would be a major technical development and could signal the start of a broader reversal, especially if volume picks up on the breakout.

However, the risk remains on the downside. If XLM loses the $0.20 support with a firm close below the range, the descending triangle would break bearishly. In that scenario, the price could fall toward the next macro support around $0.13.

For now, the weekly close will be critical. As long as buyers continue to defend the foundation of the triangle, a rebound remains a realistic and technically supported possibility.