Ethereum Could Flip Resistance to Test $3,500, Here’s How

Ethereum has continued to rebound from a 4-month low as technical indicators hint at a potential bullish trend continuation.

Ethereum (ETH) is closing the week with a strong rebound, firmly back above the $3,000 mark, although it has already lost by about 1% in the last 24 hours.

The altcoin is up roughly 10.8% on the week, with today’s trading confined to a relatively tight daily range between $2,986 and $3,042. That consolidation near the top of the recent move hints at ongoing buying interest, even as short-term traders begin to lock in profits around psychological resistance.

Notably, the second largest crypto by market capitalization is down 5.9% in the last 14 days and down over 25% in the last 30 days. The latest price action shows buyers gradually regaining control after November’s volatility, but key resistance and support levels will determine whether this recovery can extend or fade into consolidation.

Where is Ethereum’s Momentum Skewed?

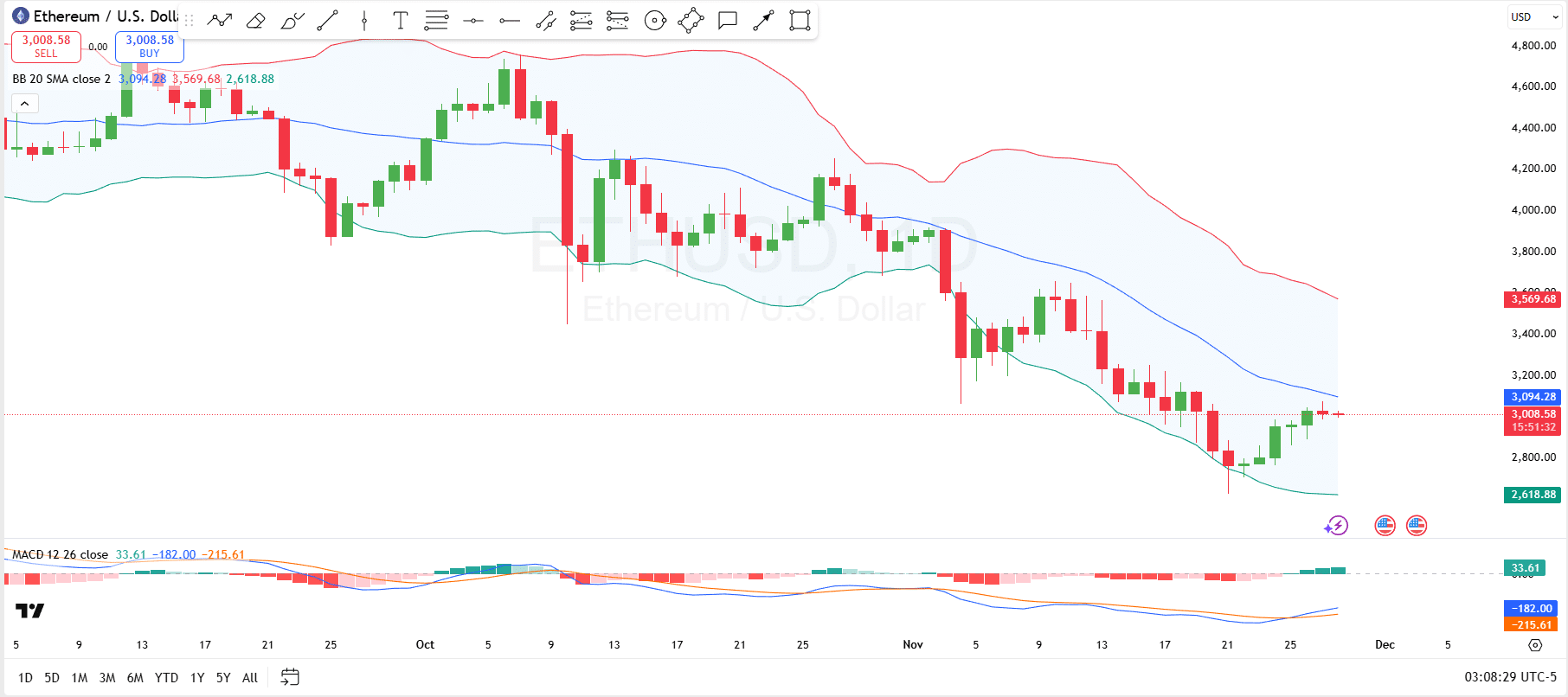

Looking at the technical end, Ethereum’s daily chart shows a market trying to stabilize after a prolonged downtrend. Price has bounced from the lower Bollinger Band at $2,619 and is now pressing against the mid-band, the 20-day simple moving average, at $3,094.

This mid-band currently acts as the first key resistance, capping the continuation of the trend. Meanwhile, the upper Bollinger Band near $3,569 forms the next resistance area if bulls manage a clean breakout above the 20-day SMA.

On the downside, initial support sits around the recent cluster of candles just above the lower band, with stronger backing at the band itself near $2,620. Also, a contraction in the volatility may be on the brink, as broader bands often precede a “squeeze” phase where price consolidates before the next major directional move.

Elsewhere, the MACD indicator has just printed a bullish crossover, and the histogram has moved into positive territory, signaling that bearish momentum is fading and short-term buyers are gaining some traction.

A sustained move above the mid-band would open the door for a continued grind toward the upper band, while a rejection here could see ETH slide back toward the lower support zone to retest the durability of this rebound.

Higher Ethereum Timeframes

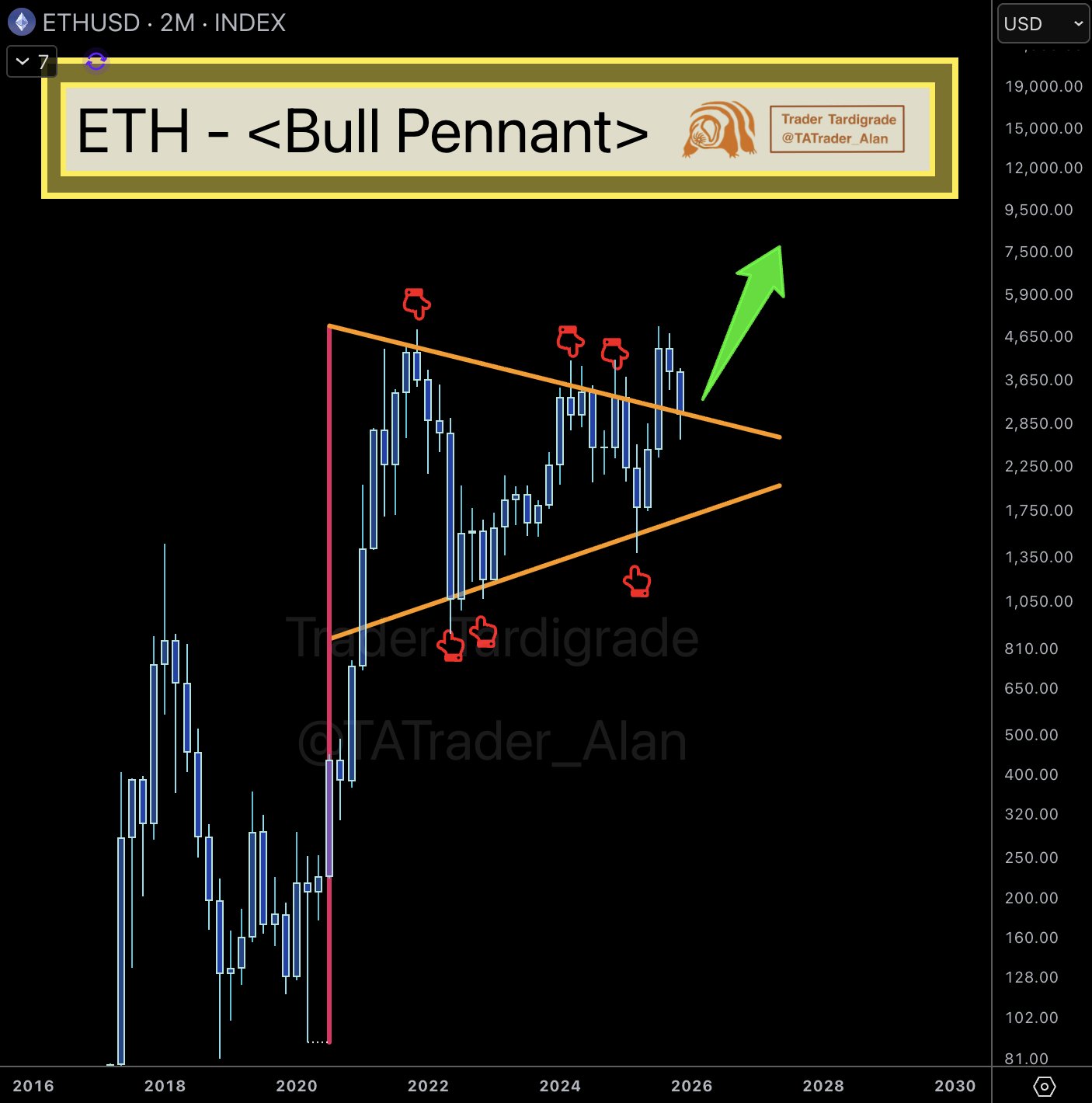

On the higher time frames, Ethereum’s structure looks much more constructive than the day-to-day volatility suggests. Trader Tardigrade’s 2-month chart frames ETH inside a large bull pennant that has been forming since the explosive rally off the 2020 lows.

The pattern is defined by fluctuations that compress price into converging trendlines, a classic consolidation after a strong “flagpole” advance.

According to the analyst, ETH has recently retested the upper boundary of this formation from above, turning former resistance into support. A sustained hold above the upper trendline would support Tardigrade’s view of an “upward trend only vibe,” that targets levels like $7,500. To reach $7,500 from the current $3,023, Ethereum must surge by about 148.1%.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Crypto Mining Faces Energy Cost Challenges as Tether Withdraws from Uruguay

- Tether halts Uruguay Bitcoin mining due to rising energy costs and unresolved tariff disputes, ending a $500M project with 30 layoffs. - Unpaid $5M electricity bills forced power cuts in July 2025, accelerating the project's collapse despite initial renewable energy ambitions. - The exit highlights Latin America's regulatory challenges for crypto mining, prompting Tether to shift operations to Paraguay and El Salvador. - Analysts note energy economics now dominate mining strategies, with firms prioritizi

DOGE Holds $0.1499 Support, Reviving Long-Term Bullish Structure and $1 Projection

Dogecoin Holds $0.144 Support as Price Climbs to $0.1484 in Tight Reversal Range

SOL Trades Near Resistance While Heatmap Highlights Major $145 Liquidation Band