ICP Value Jumps 30% Following Significant Network Update and Changes in Adoption

- ICP's 30% price surge in late 2025 follows major upgrades like Caffeine (AI-powered dev tools) and Chain Fusion (cross-chain interoperability), enhancing scalability and enterprise appeal. - Institutional partnerships with Microsoft and Google Cloud validate ICP's hybrid cloud potential, while Flux/Magnetosphere upgrades aim to match centralized cloud performance through TEEs. - Despite 1.2M active wallets and $1.14B daily transactions, dApp engagement fell 22.4%, highlighting gaps between infrastructure

ICP’s 2025 Surge: What’s Fueling the Momentum?

In the latter part of 2025, Internet Computer Protocol (ICP) has emerged as a standout in the crypto space, posting a remarkable 30% price increase. This growth comes on the heels of major network enhancements and new institutional collaborations, even as the broader altcoin market faces turbulence. To assess ICP’s investment prospects, it’s essential to examine the technological progress, adoption patterns, and competitive landscape influencing its future.

Technological Advancements: Building for Scale and Innovation

ICP’s recent upswing is closely tied to its ambitious 2025 development agenda, which emphasizes scalability, seamless integration with other blockchains, and improved developer tools. A major highlight is the introduction of Caffeine, an AI-driven platform that allows developers to create blockchain applications using natural language commands. This breakthrough lowers the barrier for new developers, potentially accelerating the growth of decentralized applications and aligning with the DFINITY Foundation’s vision of an AI-assisted, self-evolving internet.

Another significant addition is Chain Fusion, a protocol that enables ICP to interact with leading blockchains such as Ethereum, Solana, and Dogecoin. With the upcoming Meridian milestone, ICP is positioning itself as a central hub for decentralized computing, facilitating smooth asset and data exchanges across different networks. These capabilities address a major challenge in the fragmented Web3 landscape and enhance ICP’s appeal as a robust, scalable platform for enterprise use.

Looking forward, the Flux and Magnetosphere upgrades are set to further boost computational power and security through trusted execution environments. Combined with a 50% increase in processing capacity from the Fission and Stellarator updates, these improvements indicate ICP’s ambition to rival traditional cloud services in performance. This strategic shift aims to attract enterprise clients seeking decentralized alternatives to conventional infrastructure.

Adoption Trends: Growth and Challenges

Data from the third quarter of 2025 presents a nuanced picture of ICP’s adoption. The network boasts 1.2 million active wallets and daily transaction volumes exceeding $1.14 billion, partly thanks to the adoption of Caffeine’s AI tools. However, there has been a 22.4% drop in dApp user engagement, revealing a gap between the platform’s technical expansion and actual user activity. This discrepancy raises questions about whether the recent price rally is driven by genuine usage or speculative trading.

Further complicating the outlook, reported Total Value Locked (TVL) figures vary widely. While the DFINITY Foundation claims a TVL of $237 billion, independent sources like DeFiLlama and CoinGecko report much lower numbers. Such inconsistencies highlight the importance of focusing on metrics like daily active addresses and dApp retention rates, which better reflect sustainable growth and real-world utility.

On a positive note, ICP’s partnerships with major players like Microsoft Azure and Google Cloud demonstrate its growing appeal to enterprises exploring hybrid cloud solutions. These collaborations not only validate ICP’s technical strengths but also pave the way for integration with industrial IoT and AI applications—sectors expected to drive the next wave of Web3 adoption.

Market Forces: Separating Hype from Reality

ICP’s 30–39% price jump in November 2025 stands out against a backdrop of declining altcoin prices, fueled by excitement over its new features and institutional support. Analysts forecast an average price of $18 for 2025, with optimistic projections reaching as high as $37.80. These predictions rest on three main pillars:

- Ecosystem Expansion: Continued growth in developer participation through platforms like Caffeine and Chain Fusion.

- Regulatory Navigation: Successfully addressing regulatory challenges, particularly those posed by the SEC.

- Competitive Edge: Outperforming rivals such as Solana and Ethereum in attracting enterprise adoption.

Nevertheless, risks remain. Regulatory scrutiny over token classifications could pose legal challenges, while competing platforms like Solana and Ethereum continue to innovate. Additionally, the mismatch between TVL and user engagement suggests that ICP’s valuation may not yet be fully underpinned by fundamental on-chain activity.

Investment Outlook: Key Considerations

For those considering an investment, ICP offers exposure to the intersection of AI, blockchain, and enterprise infrastructure. Its roadmap—anchored by Caffeine and Chain Fusion—positions it to benefit from the growing demand for AI-powered development and cross-chain connectivity. However, the ultimate outcome depends on effective execution.

Investors should monitor:

- Recovery in dApp Usage: A rebound in user engagement would confirm ICP’s value beyond just infrastructure metrics.

- Expansion of Institutional Partnerships: Deeper integration with AI and IoT sectors could unlock significant new opportunities.

- Regulatory Preparedness: Proactive compliance will be essential to avoid setbacks experienced by other Web3 projects.

While short-term price swings may be driven by speculation, ICP’s long-term prospects hinge on its ability to deliver on its ambitious plans and overcome adoption hurdles. For investors with a multi-year perspective, ICP’s focus on enterprise decentralization and AI integration presents significant potential rewards, albeit with considerable risk.

Final Thoughts

ICP’s impressive 30% rally in late 2025 highlights both its technical ambition and growing institutional interest. Despite ongoing challenges with user engagement and regulatory uncertainty, its emphasis on interoperability, AI-driven development, and strategic partnerships positions ICP as a major contender in the evolving Web3 landscape. For forward-thinking investors, the critical question is whether ICP’s ecosystem can maintain the momentum needed to transform innovation into enduring value.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Switzerland Postpones Crypto Tax Data Exchange to Meet Technological and International Requirements

- Switzerland delays crypto tax data sharing until 2027, aligning with global regulatory reevaluations amid evolving tech and market dynamics. - SGS acquires Australia's Information Quality to boost digital revenue, reflecting Swiss firms' expansion into tech-driven compliance solutions. - Canada's Alberta oil sands policy shift highlights governments prioritizing economic growth over strict climate regulations, mirroring Switzerland's approach. - BridgeBio's precision medicine and Aires' EMF solutions dem

Switzerland's Focus on Privacy Conflicts with International Efforts for Crypto Taxation

- Switzerland delays crypto tax data sharing with international partners until 2027, contrasting with global regulatory efforts to close offshore loopholes. - The U.S. advances implementation of the OECD's CARF framework, aiming to automate reporting on foreign crypto accounts by 2029. - CARF requires foreign exchanges to report U.S. account details, mirroring traditional tax standards and targeting crypto tax evasion. - Switzerland's privacy-focused stance highlights tensions between financial confidentia

Zcash News Update: Reliance Shifts Entirely to Zcash, Citing Privacy and Regulatory Alignment

- Reliance Global Group, a Nasdaq-listed fintech firm, shifted its entire crypto portfolio to Zcash (ZEC), divesting Bitcoin , Ethereum , and other major coins. - The strategic pivot, announced November 25, prioritizes Zcash's privacy-focused zk-SNARKs technology for institutional compliance and selective data disclosure. - Zcash's 1,200% 90-day price surge and Grayscale's ETF filing highlight growing institutional interest in privacy-centric assets. - The move reflects broader crypto industry trends towar

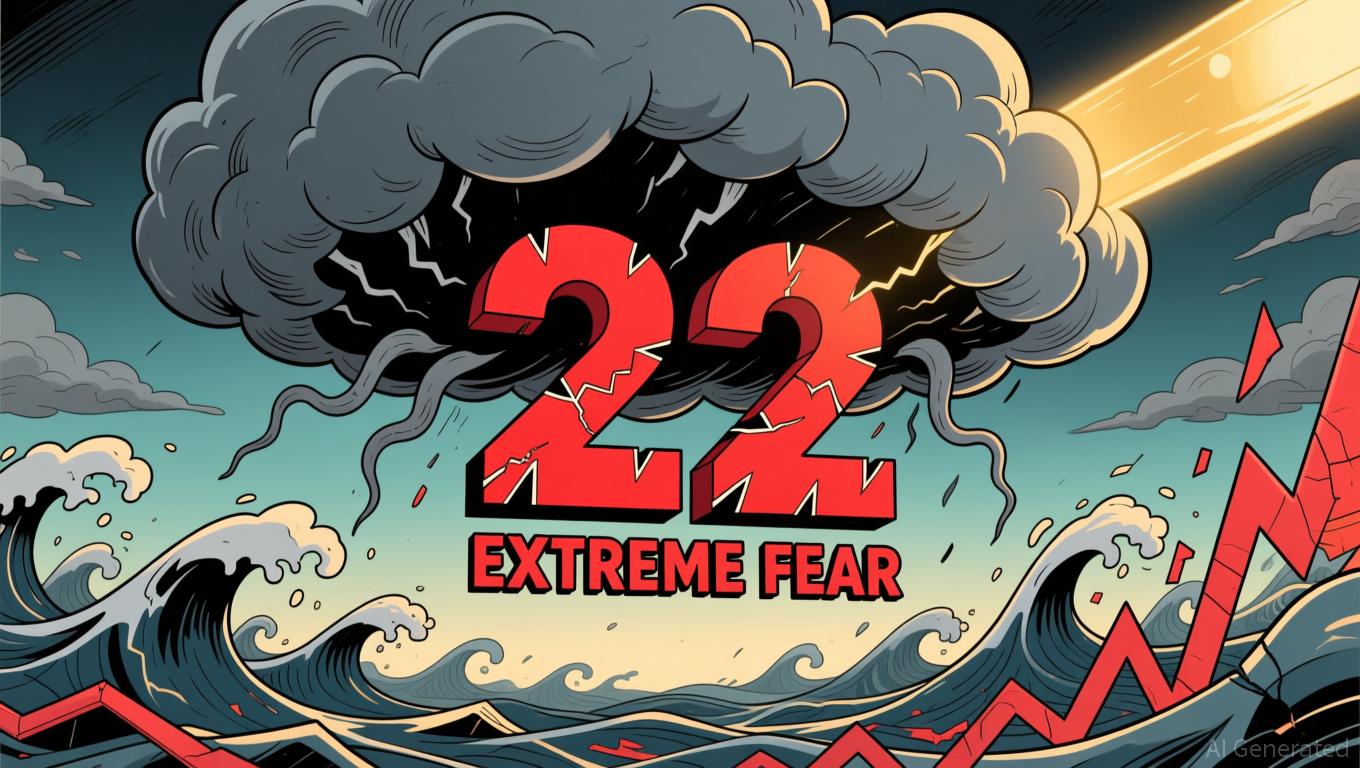

Bitcoin News Update: Bitcoin Fear Index Drops to 22 While Investors Look for Signs of Market Rebound

- Bitcoin Fear & Greed Index rose to 22 from 20, indicating slight easing of extreme fear but persistent bearish sentiment. - Bitcoin stabilized near $87,000 after hitting $80,553, yet remains below key resistance levels amid $3.5B ETF outflows. - Structural factors like leverage and liquidations drive selloffs, with ETF redemptions correlating to 3.4% price drops per $1B outflow. - Analysts note oversold technical indicators and waning retail capitulation as potential inflection points for near-term rebou