Date: Thu, Nov 27, 2025 | 06:12 PM GMT

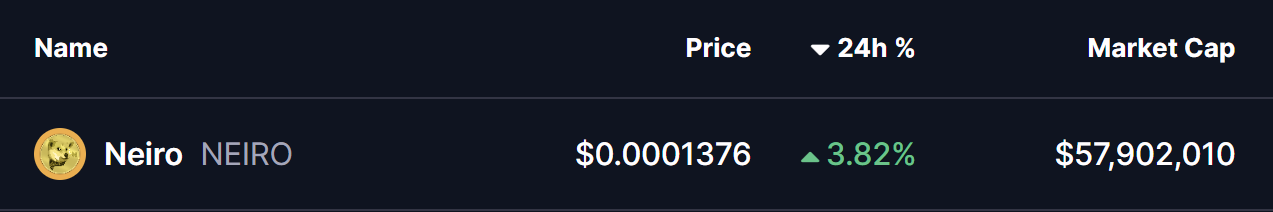

The broader cryptocurrency market continues its steady rebound after last week’s sharp volatility, which dragged Ethereum (ETH) to a low of $2,622 before recovering above the $3,000 mark. This improving sentiment is now helping several memecoins regain momentum — including Neiro (NEIRO).

NEIRO is showing modest gains today, but what stands out far more is the price structure developing on the chart. A well-defined harmonic pattern is emerging, and it suggests the possibility of a meaningful upside move in the coming sessions.

Source: Coinmarketcap

Source: Coinmarketcap

Bullish Butterfly Harmonic in Play?

On the daily timeframe, Neiro appears to be forming a Bullish Butterfly Harmonic Pattern — a structure known for signalling trend reversals or sharp corrective bounces after extended downtrends.

This pattern began with a strong impulse move from point X near $0.00019480 up to the swing high at point A. The retracement that followed found support at point B, aligning with the 0.785 Fibonacci level of the XA leg. From there, NEIRO pushed higher into point C, testing the 1.113 Fibonacci extension before entering a prolonged and steady decline.

Neiro (NEIRO) Daily Chart/Coinsprobe (Source: Tradingview)

Neiro (NEIRO) Daily Chart/Coinsprobe (Source: Tradingview)

This decline has now delivered price directly into point D at $0.00010854, positioned around the 1.617 extension of the XA move — a textbook measurement for a Bullish Butterfly’s completion. Price is currently bounced to near $0.0001377 and trading just below its 50-day moving average at $0.0001510. This entire region forms the Potential Reversal Zone (PRZ), a critical area where the pattern’s bullish reaction typically begins if buyers step in with conviction.

What’s Next for NEIRO?

The key near-term focus will be on how NEIRO reacts around this PRZ. If buyers manage to lift the price back above the 50-day moving average and sustain momentum, the harmonic structure suggests a potential upswing toward the higher Fibonacci targets.

The next major region of interest lies between $0.00039193 — the 0.382 Fibonacci retracement of the CD leg — and $0.00051373, which aligns with the 0.618 level. This zone represents the primary target region for the Butterfly pattern and has historically been where such setups complete their bullish follow-through before either consolidating or encountering pullbacks.

However, if NEIRO fails to hold above the current D support area, the pattern may delay its reversal, leaving the door open for further weakness before a more decisive bottom forms.