DASH Aster's DEX Listing: Ushering in a New Era for Decentralized Finance?

- DASH Aster's hybrid AMM-CEX DEX model bridges CEX speed with DeFi transparency, achieving $27.7B daily volume and $1.4B TVL by October 2025. - Zero-knowledge Aster Chain and cross-chain liquidity routing eliminate intermediaries, enabling 400% YoY TVL growth through multi-chain price discovery. - Strategic partnerships with Binance and RWA integrations (gold, equities) attract institutional capital, with 2M+ users and $4B ASTER market cap by 2025. - Tokenomics include 7% staking rewards, 5-7% annual burn

Redefining DeFi: The Rise of DASH Aster

The decentralized finance (DeFi) sector has consistently faced challenges in balancing scalability, security, and user experience. DASH Aster has emerged as a game-changer, pushing the boundaries of on-chain technology and market accessibility with its unique hybrid AMM-CEX DEX framework.

By October 2025, Aster’s ecosystem reported a remarkable daily trading volume of $27.7 billion and a Total Value Locked (TVL) of $1.399 billion. These milestones mark a significant transformation in how DeFi platforms attract both liquidity and institutional investment. This analysis explores Aster’s technological breakthroughs, token economics, and market approach to understand its influence on the future of DeFi adoption.

Innovative Architecture: Uniting CEX and DEX Strengths

Aster’s standout feature is its hybrid architecture, which fuses the efficiency and liquidity of centralized exchanges (CEXs) with the openness and decentralization of automated market makers (AMMs). The platform utilizes an on-chain order book that operates across major blockchains such as BNB Chain, Ethereum, and Solana. This design removes the need for off-chain matching engines, yet still delivers lightning-fast trade execution.

Supporting this is Aster Chain, a Layer 1 blockchain enhanced with zero-knowledge proof (ZKP) technology, enabling high transaction throughput and improved privacy. For institutional users, this means access to a scalable and transparent infrastructure that rivals conventional trading systems.

Another key differentiator is Aster’s cross-chain interoperability. By enabling liquidity routing across multiple blockchains, traders can secure optimal pricing without depending on third-party intermediaries. This is particularly valuable in a DeFi environment often fragmented by isolated liquidity pools. Data from October 2025 demonstrates the success of this model, with TVL increasing by 400% year-over-year as users transition from older DEX platforms.

Expanding Horizons: Integrating Real-World Assets

Aster’s vision extends beyond digital currencies. The platform is actively incorporating real-world assets (RWAs) like gold and stocks, aligning itself with traditional financial markets and appealing to institutional investors such as hedge funds and asset managers. Industry projections, including a 2025 Bloomberg report, anticipate that RWAs will comprise 30% of DeFi’s TVL by 2026, fueled by the search for yield-generating collateral.

Aster’s “Trade & Earn” initiative allows users to utilize yield-bearing tokens, such as asBNB and USDF, as collateral—enabling passive income opportunities alongside active trading. Strategic alliances with Binance and YZi Labs have further expanded Aster’s reach, providing access to extensive liquidity and advanced AI analytics. By October 2025, the platform had attracted 2 million registered users and saw 330,000 new wallets created in a single day following its token generation event, highlighting its rapid growth and scalability.

Tokenomics: Driving Value and Participation

The ASTER token is integral to the platform, functioning as collateral for perpetual contracts, a governance tool, and a means for transaction fee reductions. Staking ASTER can yield up to 7% annually, and users benefit from a 5% discount on transaction fees, encouraging active participation. To maintain scarcity and support value, Aster plans annual token burns of 5–7%, a strategy proven effective in other protocols like Uniswap and Compound.

For institutional investors, ASTER offers risk management capabilities by serving as collateral for leveraged trades, eliminating reliance on opaque centralized exchanges. Retail users, meanwhile, enjoy easy access and a streamlined interface that simplifies on-chain trading. This broad appeal has propelled ASTER to become one of the fastest-growing tokens of 2025, with its market capitalization surpassing $4 billion.

Investment Outlook: Potential Rewards and Considerations

Aster’s ascent presents attractive prospects for both institutional and retail participants. Institutions benefit from privacy features powered by ZKP and seamless integration of real-world assets, facilitating compliant entry into DeFi. Retail investors can take advantage of generous staking rewards and reduced fees, though they should remain mindful of the inherent volatility in the market.

Nonetheless, certain risks remain. Regulatory uncertainties surrounding real-world assets and cross-chain operations could slow Aster’s expansion into traditional finance. Additionally, the platform’s reliance on token burns and staking incentives may lead to short-term inflation if user adoption wanes. Investors should also keep an eye on the sustainability of the 7% staking APY, which may decrease as TVL continues to rise.

Conclusion: Setting the Stage for the Next DeFi Era

The listing of DASH Aster’s DEX is more than a technical milestone—it marks a fundamental shift in how DeFi platforms balance decentralization with user accessibility. By blending on-chain innovation, cross-chain liquidity, and real-world asset integration, Aster is shaping a new blueprint for financial infrastructure. For investors, the crucial question is not whether Aster will succeed, but how swiftly it will establish dominance in its sector. Those who share its vision of a hybrid, institution-ready DeFi ecosystem may find ASTER to be a pivotal asset in their 2026 investment portfolios.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Hash Ribbon Flashes Signal That Often Marks Cyclical Bottoms for Bitcoin Price

Crypto for Advisors: Crypto’s Role in Portfolios

Bitcoin whale opens $56.7M Bitcoin long after 18 months on the sidelines

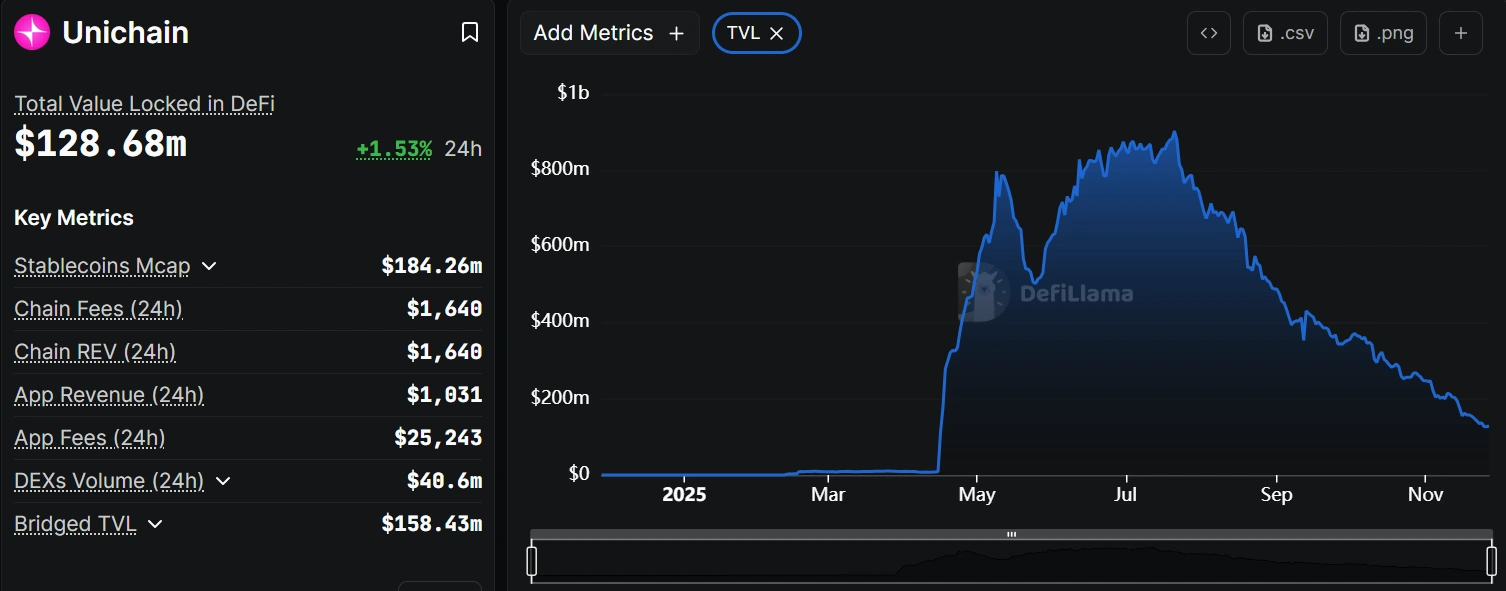

Unichain TVL collapses 86% as incentive program ends and liquidity exits