Nexton Connects Traditional Veterinary Clinics with Modern Technology Through $4M AI Investment

- Nexton Solutions secures $4M to launch PetVivo.ai, an AI platform slashing veterinary client acquisition costs by 50–90%. - Beta results show 47 new clients per practice in six months, with a $42.53 CAC—far below industry averages. - Targeting 30,000 U.S. practices, it projects $12M ARR in Year 1, scaling to $360M by Year 5 with SaaS margins of 80–90%. - Strategic AI alliances, like C3.ai-Microsoft and Salesforce’s AI CRM focus, highlight the sector’s growth potential.

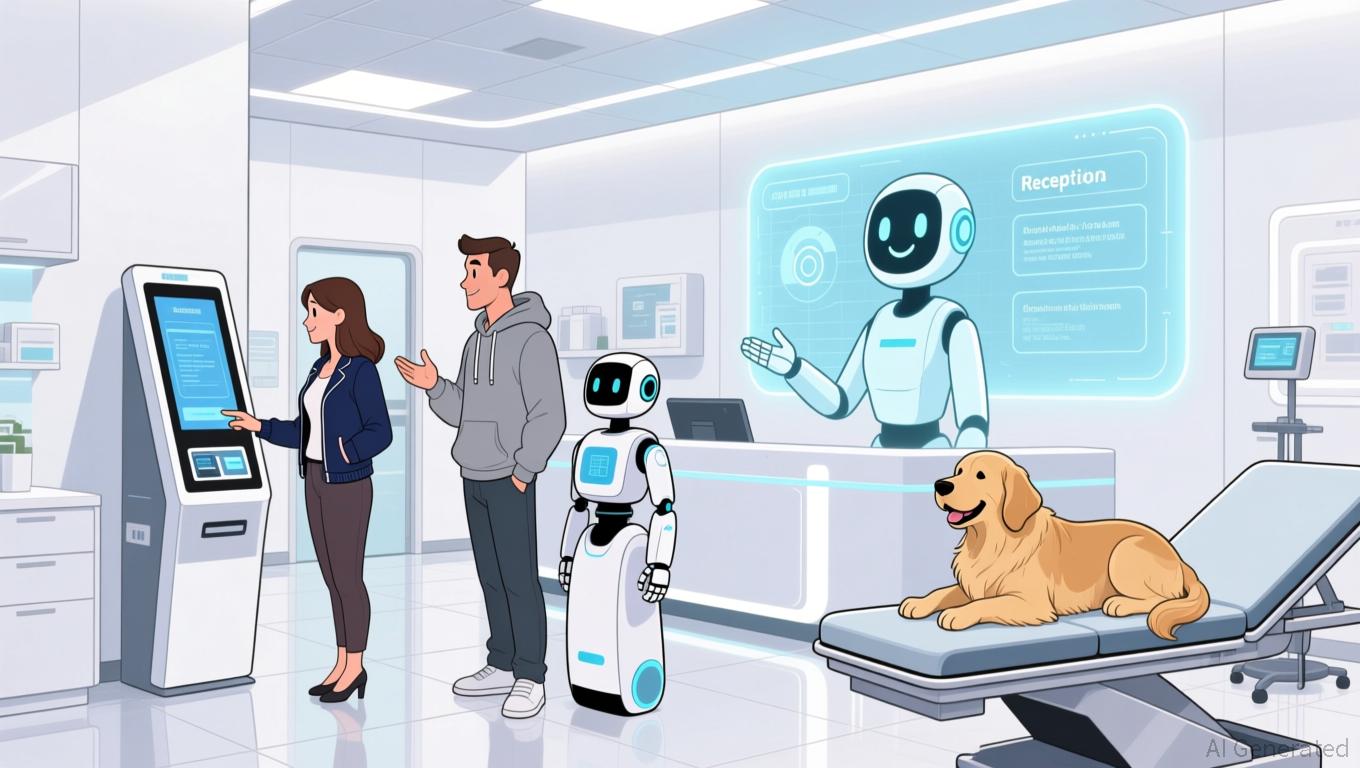

Nexton Solutions, an emerging name in veterinary technology, has raised $4 million in strategic funding, representing a significant milestone in its quest to transform how veterinary practices attract new clients. Its main offering, PetVivo.ai,

The veterinary sector’s dependence on outdated marketing channels—like television commercials and direct mail—has left a gap in addressing the needs of Gen Z and Millennial pet owners, who expect seamless digital interactions

The potential market is enormous: PetVivo.ai is targeting 30,000 veterinary clinics in the U.S. and over 100,000 worldwide.

At the same time, the broader AI landscape is seeing strategic collaborations that could further accelerate such advancements.

For Nexton Solutions, the $4 million investment signals strong investor belief in its capacity to connect traditional veterinary practices with modern digital solutions. With a 14-day complimentary trial and three subscription options, the platform’s official rollout is set to drive rapid uptake. As the company pivots from medical devices to SaaS, its valuation could follow the rapid growth trajectory seen in enterprise AI, where

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin News Today: Xapo's Enhanced Bitcoin Fund Signals Growing Institutional Confidence in Digital Assets

- Xapo Bank expanded its Byzantine BTC Credit Fund after $100M in institutional allocations, reflecting growing demand for Bitcoin-backed yield products. - The fund uses Hilbert Group's institutional-grade lending process to generate low-risk returns for Bitcoin holders through collateralized loans. - Xapo's expansion follows 2022 lending sector collapse, leveraging regulatory compliance in Gibraltar/Cayman to rebuild institutional trust in Bitcoin collateral. - The product differentiates from ETFs/stablec

Bitcoin News Update: Movements of Investors' USDT Indicate Bitcoin Highs and Periods of Profit Realization

- Bitcoin's price inversely correlates with USDT outflows, as investors shift liquidity between assets during market cycles. - S&P Global downgraded USDT's stability rating to "weak" due to 5.6% Bitcoin allocation and opaque reserves amid U.S. regulatory reforms. - The GENIUS Act and EU's MiCA framework are reshaping stablecoin markets, forcing Tether and Circle to launch jurisdiction-specific, cash-backed alternatives. - Institutional ETF activity, including Texas's Bitcoin purchases and fragmented inflow

The New Prospects for Economic Growth Infrastructure in Webster, NY

- Webster , NY, leverages $9.8M FAST NY grants and PPPs to transform Xerox campus into a high-tech industrial hub. - Infrastructure upgrades including roads, sewers, and electrical systems aim to attract advanced manufacturing and renewable energy firms. - Governor Hochul's strategy drives $51M in upstate investments, creating 250+ jobs via projects like the $650M fairlife® dairy plant. - Redevelopment boosts industrial land availability and residential property values by 10.1%, with mixed-use zoning enhan

The Impact of Artificial Intelligence on Contemporary Portfolio Management: Potential Benefits and Challenges

- AI redefines portfolio management with real-time analytics and dynamic asset allocation, shifting from static human-driven strategies to data-centric systems. - Generative AI tools like ChatGPT automate financial workflows, enabling hyper-personalized strategies and boosting business outcomes through optimized digital presence. - Risk modeling evolves via AI's pattern detection, but challenges persist in transparency and bias, requiring explainable AI frameworks and human oversight. - Institutions integr