The Growing Convergence of Legal Studies and Social Impact Investment

- Berkeley Law's PISP offers full-tuition scholarships to JD students pursuing public interest careers, reducing debt barriers for social justice work. - Graduates earn median $72,000 salaries but maintain debt-free careers in criminal justice reform, reproductive rights, and corporate accountability. - The program creates long-term societal impact through sustained public service, aligning with social impact investing principles prioritizing systemic change over short-term profits. - By embedding scholars

Financial Returns: Purpose Over Profit

Berkeley Law’s PISP covers all tuition and fees for J.D. students who are dedicated to public interest law, removing the economic obstacles that often prevent graduates from accepting lower-paying jobs in advocacy and social justice. For the 2024 graduating class,

Recent graduate data shows a steady pattern:

Societal Impact: Valuing the Intangible

The broader community benefits of PISP are difficult to measure but are nonetheless profound. Graduates are active in essential sectors such as criminal justice reform, reproductive rights, and corporate oversight—fields where legal skills can drive meaningful change.

Although there is limited long-term data on outcomes five to ten years after graduation, the program’s structure is designed to cultivate a steady stream of lawyers committed to public service.

The Investment Perspective: Weighing Risks and Rewards

For those considering investment, PISP represents a blended model: it reduces personal financial risk for students while delivering value to society. Some may contend that public interest law lacks the growth potential of commercial enterprises, but

Additionally,

Conclusion: A Model for Tomorrow

Berkeley Law’s Public Interest Scholars Program questions the traditional ways of measuring educational return on investment. While its alumni may not reach the financial peaks of their counterparts in corporate law, their work addresses urgent societal needs. For investors, this marks a transition from seeking immediate financial returns to fostering lasting change—a model where the greatest value is found in the widespread effects of empowered legal professionals. As social impact investing continues to evolve, initiatives like PISP will become reference points for how education can drive progress toward fairness and justice.

[2] Employment Statistics [https://www.law.berkeley.edu/careers/employment-outcomes/employment-statistics/]

[3] Public Interest Scholars [https://www.law.berkeley.edu/spotlight/public-interest-scholars/]

[4] Updated study ranks Berkeley Law sixth in scholarly impact [https://www.law.berkeley.edu/article/scholarly-impact-rankings-2021-erwin-chemerinsky-faculty/]

[7] Long-run outcomes for UC Berkeley alumni [https://www.universityofcalifornia.edu/about-us/information-center/long-run-outcomes-uc-berkeley-alumni]

[10] Impressive Influx: Public Interest Scholars Program [https://www.law.berkeley.edu/article/public-interest-scholars-program-welcomes-11-new-standouts/]

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Switzerland Postpones Crypto Tax Data Exchange to Meet Technological and International Requirements

- Switzerland delays crypto tax data sharing until 2027, aligning with global regulatory reevaluations amid evolving tech and market dynamics. - SGS acquires Australia's Information Quality to boost digital revenue, reflecting Swiss firms' expansion into tech-driven compliance solutions. - Canada's Alberta oil sands policy shift highlights governments prioritizing economic growth over strict climate regulations, mirroring Switzerland's approach. - BridgeBio's precision medicine and Aires' EMF solutions dem

Switzerland's Focus on Privacy Conflicts with International Efforts for Crypto Taxation

- Switzerland delays crypto tax data sharing with international partners until 2027, contrasting with global regulatory efforts to close offshore loopholes. - The U.S. advances implementation of the OECD's CARF framework, aiming to automate reporting on foreign crypto accounts by 2029. - CARF requires foreign exchanges to report U.S. account details, mirroring traditional tax standards and targeting crypto tax evasion. - Switzerland's privacy-focused stance highlights tensions between financial confidentia

Zcash News Update: Reliance Shifts Entirely to Zcash, Citing Privacy and Regulatory Alignment

- Reliance Global Group, a Nasdaq-listed fintech firm, shifted its entire crypto portfolio to Zcash (ZEC), divesting Bitcoin , Ethereum , and other major coins. - The strategic pivot, announced November 25, prioritizes Zcash's privacy-focused zk-SNARKs technology for institutional compliance and selective data disclosure. - Zcash's 1,200% 90-day price surge and Grayscale's ETF filing highlight growing institutional interest in privacy-centric assets. - The move reflects broader crypto industry trends towar

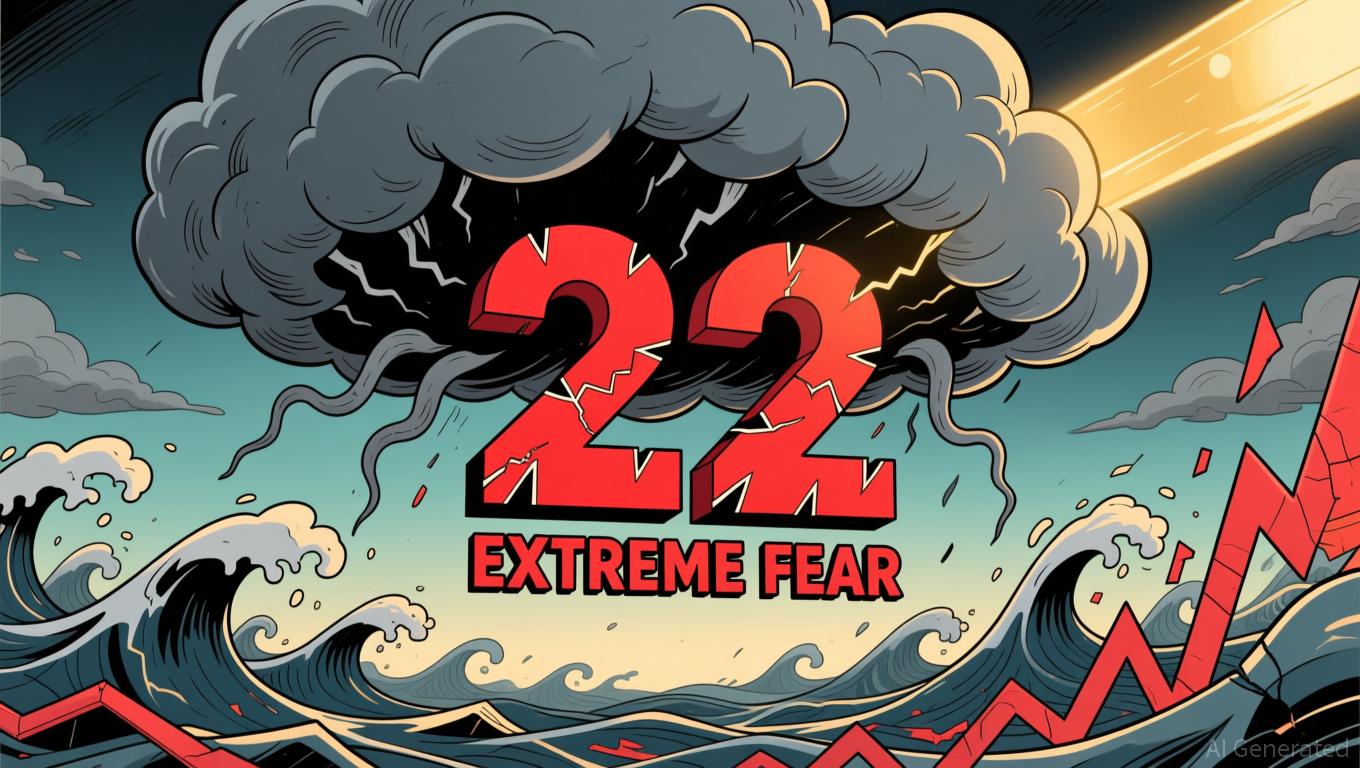

Bitcoin News Update: Bitcoin Fear Index Drops to 22 While Investors Look for Signs of Market Rebound

- Bitcoin Fear & Greed Index rose to 22 from 20, indicating slight easing of extreme fear but persistent bearish sentiment. - Bitcoin stabilized near $87,000 after hitting $80,553, yet remains below key resistance levels amid $3.5B ETF outflows. - Structural factors like leverage and liquidations drive selloffs, with ETF redemptions correlating to 3.4% price drops per $1B outflow. - Analysts note oversold technical indicators and waning retail capitulation as potential inflection points for near-term rebou