US Indicts Chen Zhi Over $15B Bitcoin Scam

- Chen Zhi indicted by US for Bitcoin scam.

- Forced labor scam seized 127,000 BTC.

- Treasury imposed sanctions on Prince Group.

Chen Zhi, Chairman of Prince Holding Group, is accused of orchestrating a $15 billion Bitcoin scam using forced labor in Cambodia, leading to his indictment by U.S. authorities.

The incident highlights significant vulnerabilities within cross-border crypto activities and challenges global financial compliance frameworks, impacting market confidence and regulatory approaches.

Chen Zhi, a Cambodian national and CEO of Prince Holding Group, has been indicted by the U.S. Justice Department for orchestrating a Bitcoin scam. The operation, based out of Cambodia, seized 127,000 BTC worth $15 billion.

The U.S. Treasury has sanctioned Prince Holding Group, labeling it a Transnational Criminal Organization . Erin West, a U.S. fraud investigator, visited scam compounds where individuals were held captive, labeling the operation as modern-day slavery.

The indictment has sent ripples through global financial markets, reflecting on the use of cryptocurrency in fraud. Regulatory bodies worldwide are paying close attention to the implications of forced labor and ethical business practices. Erin West, Fraud Investigator, U.S. Department of Justice, stated, “They’re filled, these whole dormitories are filled with people… They’re being held captive. This is modern day slavery. These are people that are being held against their will and being forced to scam 16 hours a day.”

The forced labor allegations have significant political and social implications, with the U.S. vowing to combat human trafficking and cyber fraud. This case highlights the importance of maintaining strict compliance with anti-money laundering protocols.

The seizure of 127,000 BTC marks the largest crypto forfeiture in DOJ history. U.S. Treasury’s actions underline a robust response against financial crimes involving cryptocurrencies, adding pressure on platforms to enhance monitoring efforts.

This investigation may lead to increased scrutiny on offshore exchanges and their compliance with global regulations. Analysts suggest this could prompt updates to regulatory frameworks focusing on Bitcoin and other major cryptocurrencies.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Hash Ribbon Flashes Signal That Often Marks Cyclical Bottoms for Bitcoin Price

Crypto for Advisors: Crypto’s Role in Portfolios

Bitcoin whale opens $56.7M Bitcoin long after 18 months on the sidelines

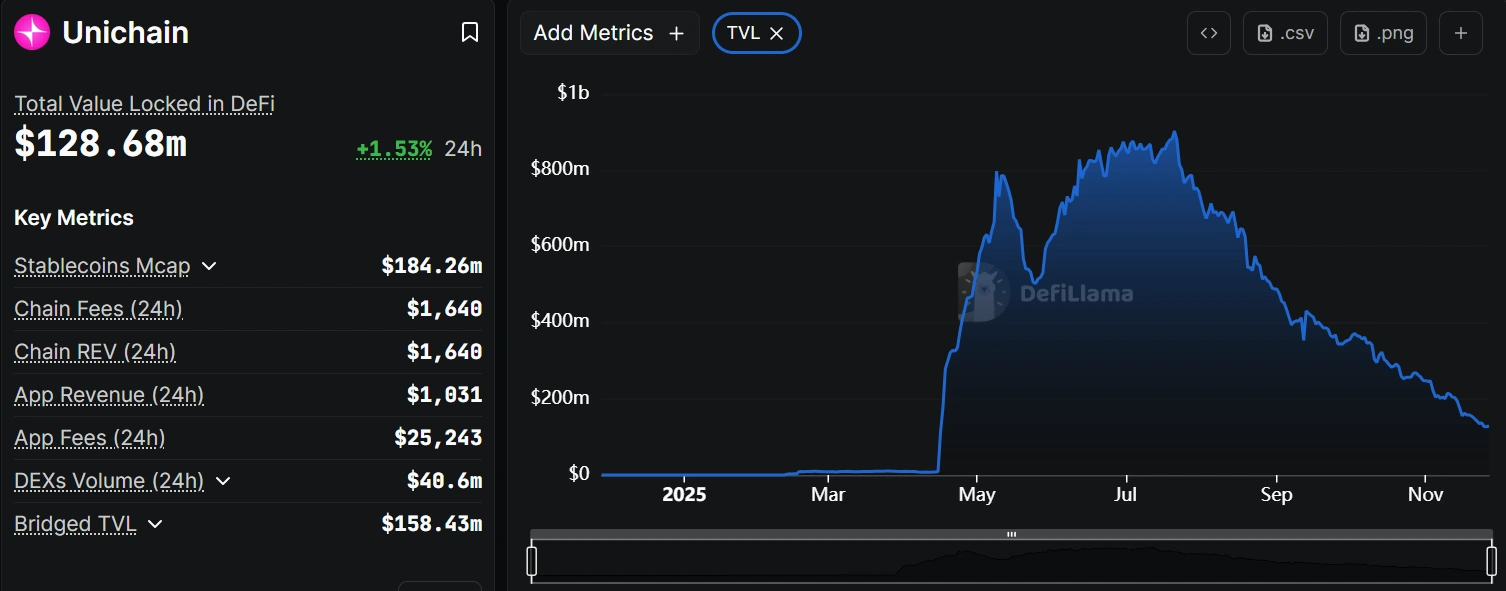

Unichain TVL collapses 86% as incentive program ends and liquidity exits