XRP Price Still Holds Its Green, But One Group Is Slowly Turning Into a Red Flag

The XRP price trades near $2.20, flat on the day and up about 1.5% in the past week. On the surface, the trend still looks steady compared to the broader market. But when you dig deeper into holder behavior, one group is quietly shifting from supportive to risky. Short-Term Holders Stay Positive, But Long-Term Holders

The XRP price trades near $2.20, flat on the day and up about 1.5% in the past week. On the surface, the trend still looks steady compared to the broader market.

But when you dig deeper into holder behavior, one group is quietly shifting from supportive to risky.

Short-Term Holders Stay Positive, But Long-Term Holders Turn Risky

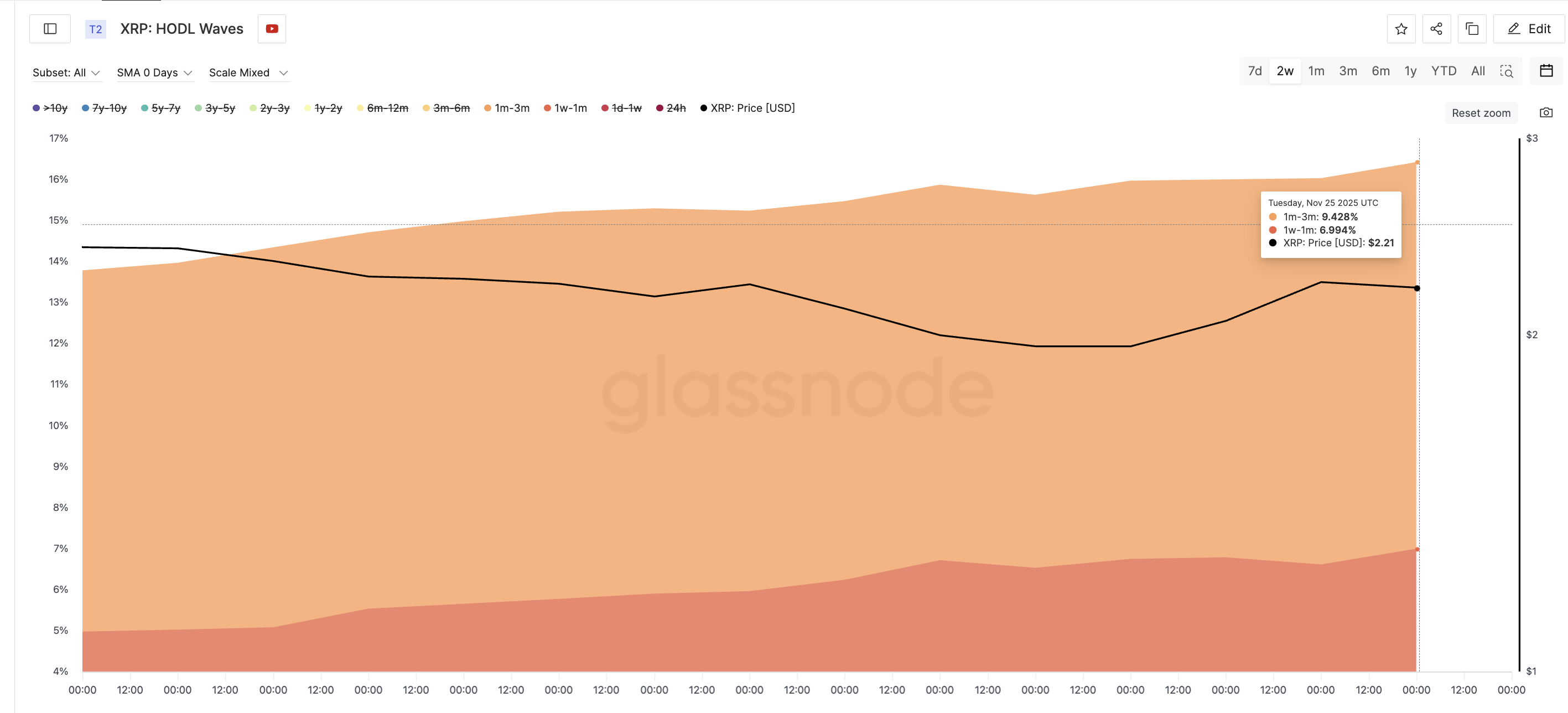

HODL Waves track how much supply sits in different holding-time bands. They show that short-term XRP holders are still steady. The one-to-three-month band has increased the stash from 8.80% to 9.48% since November 11. The one-week-to-one-month band also increased from 4.97% to 6.99%.

These groups usually sell fast when pressure hits, yet they have been accumulating instead.

Short-Term Holders:

Glassnode

Short-Term Holders:

Glassnode

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

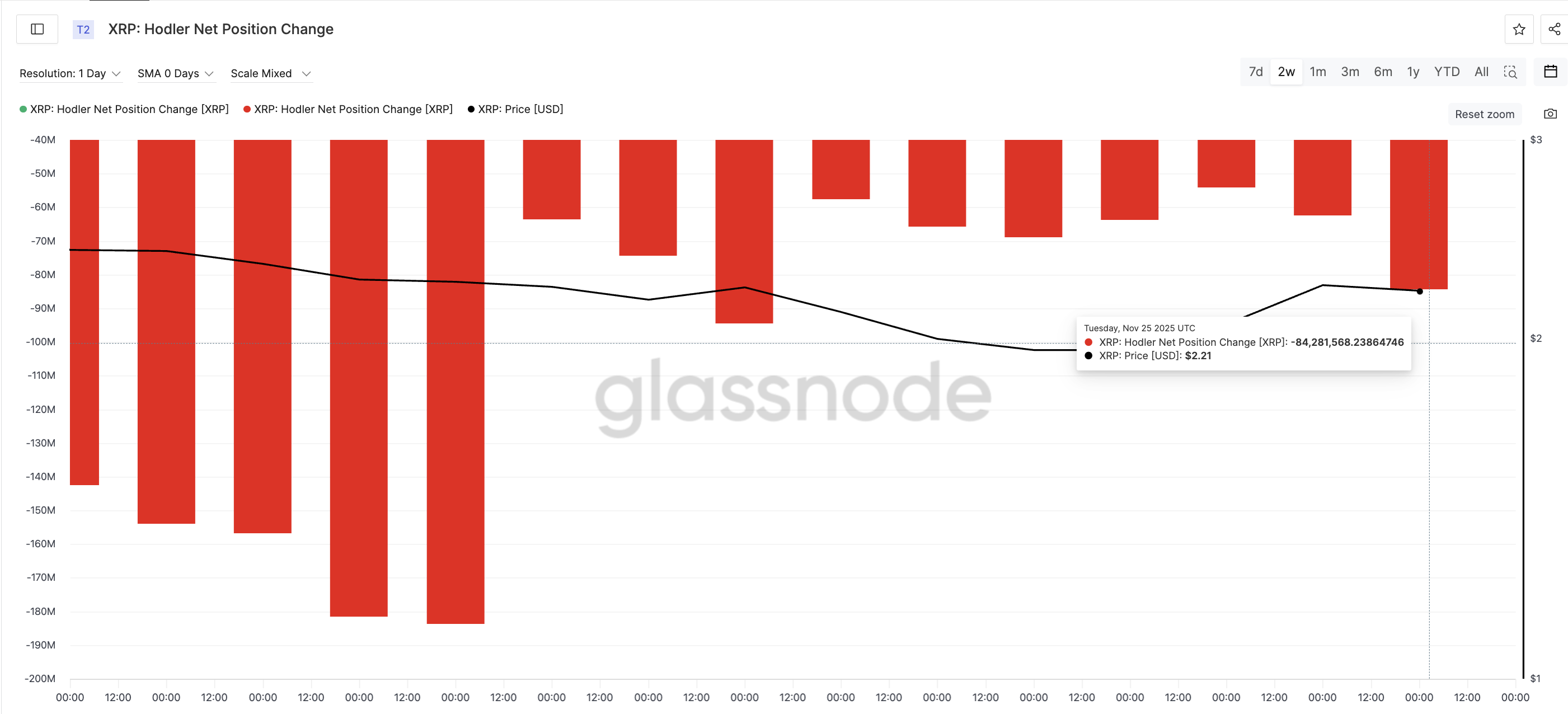

The pressure point sits with long-term holders. Hodler Net Position Change measures whether long-term holder wallets, on net, gain or lose coins.

On November 23, long-term holders were selling around 54 million XRP. By November 25, that number increased to 84 million XRP, a jump of about 56%.

Long-Term XRP Holders Selling:

Glassnode

Long-Term XRP Holders Selling:

Glassnode

This is not a random spike. A similar rise in selling happened between November 16 and 18, which was followed by a sharp drop in XRP from $2.22 to $1.96, almost 12%.

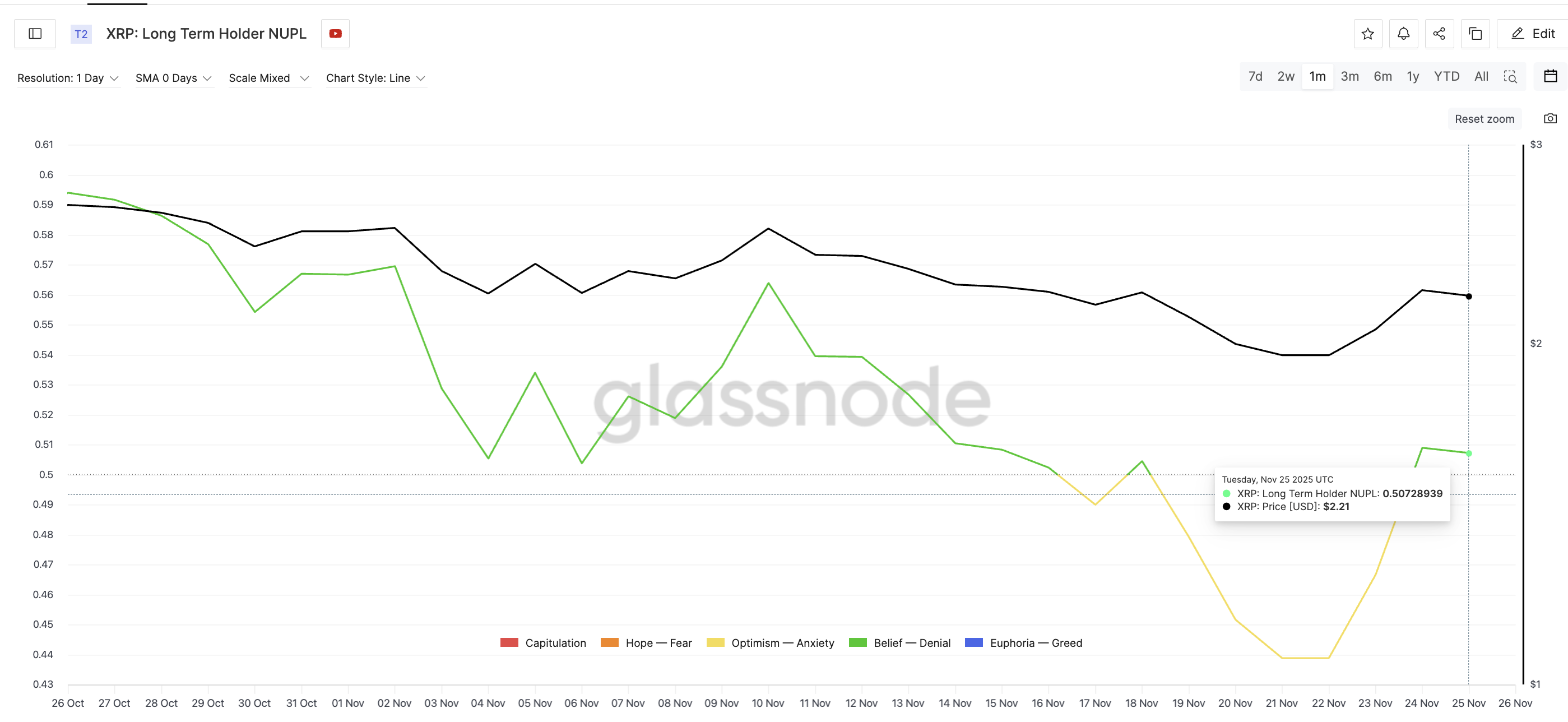

NUPL (Net Unrealized Profit/Loss) shows why. NUPL tracks how much profit or loss holders hold on paper. Long-term holder NUPL is near 0.50, which falls into the “belief–denial” region that often shows local tops. The last time NUPL hit this area on November 18, XRP corrected soon after.

High Profit-Taking Incentive:

Glassnode

High Profit-Taking Incentive:

Glassnode

So the incentive to take profit is real, and long-term holders are acting on it — this is the red flag. A sign that the XRP price is losing conviction among HODLers.

XRP Price Holds Key Levels For Now, But Breakout Confirmation Is Needed?

XRP trades between familiar levels. The first support sits at $2.06. If long-term holder selling increases and price loses this level, XRP could revisit $1.81, a recent local bottom.

To stay in its green zone, XRP needs a clean close above $2.24, flipping the short-term trend upward. That would open the path toward $2.58 and $2.69, but only if big money supports the breakout.

This is where CMF (Chaikin Money Flow) comes in. CMF measures money flowing in from large wallets. It has moved slightly above zero, indicating some inflow, but it still sits below a descending trendline. Until CMF breaks that trendline, inflows are not strong enough to fully offset long-term holder selling.

XRP Price Analysis:

TradingView

XRP Price Analysis:

TradingView

For now, XRP price still holds its green (week-on-week), but long-term holders — backed by high NUPL and rising outflows — remain the slow-forming red flag that traders should watch closely.

Read the article at BeInCryptoDisclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Australia's approach to cryptocurrency regulation promotes innovation and protects investors

- Australia introduces 2025 Digital Assets Framework Bill to regulate crypto exchanges and custody platforms under AFSL licensing and ASIC oversight. - The law creates two platform categories (transactional and custody) with exemptions for small operators and strict compliance penalties to prevent fraud. - Projected $24B annual economic gains aim to balance innovation with investor protection, aligning with global crypto regulatory trends like the U.S. GENIUS Act. - Industry welcomes safeguards but seeks s

Law Firms Take Action Against Corporations Amid Rising Investor Lawsuits

- U.S. law firms like Schall and Gross are leading class-action lawsuits against corporations for alleged investor misrepresentations across sectors. - Cases involve DexCom , MoonLake , Beyond Meat , and Stride , accusing them of concealing risks, overstating drug efficacy, and inflating enrollment figures. - Legal actions highlight SEC's intensified focus on biotech disclosures and edtech compliance, with deadlines set for investor claims by late 2025-2026. - These lawsuits emphasize corporate accountabil

Solana News Update: Solana ETFs Attract $476M While Death Cross and $120 Support Level Approach

- Solana ETFs attract $476M in 19 days, driven by Bitwise's 0.20% fee BSOL ETF with $424M inflows. - Technical indicators show a death cross and $120-$123 support test, with RSI at oversold 33 amid stagnant price action. - Institutional confidence grows via Franklin Templeton's fee-waiver strategy, contrasting Bitcoin/Ethereum ETF outflows of $5.34B. - Whale accumulation and on-chain growth hint at long-term buying, but $140 resistance remains unbroken despite ETF inflows.

XRP News Today: ADGM's Authorization of RLUSD Establishes International Standard for Institutional Stablecoin Compliance

- Ripple's RLUSD stablecoin gains FSRA approval for institutional use in Abu Dhabi's ADGM, effective November 27, 2025. - The $1.2B market-cap stablecoin features 1:1 USD reserves, third-party audits, and compliance with ADGM's transparency standards. - ADGM's approval aligns with its strategy to position Abu Dhabi as a global digital asset hub through regulated fiat-referenced tokens. - Ripple's Middle East expansion includes partnerships with UAE banks and regulatory licenses in Dubai, Bahrain, and Afric