BitMine Stock Pulls Back 7% as Recovery Doubts Grow; Charts Hint at Deeper Weakness

BitMine (BMNR) is trading near $29, down almost 7% after a sharp 15% jump that came around its large Ethereum purchase. The bounce helped stabilise sentiment for a moment, but the latest BitMine price pullback shows the recovery is still fragile. Both big-money flow and trend signals suggest the rally has not earned enough confirmation

BitMine (BMNR) is trading near $29, down almost 7% after a sharp 15% jump that came around its large Ethereum purchase. The bounce helped stabilise sentiment for a moment, but the latest BitMine price pullback shows the recovery is still fragile.

Both big-money flow and trend signals suggest the rally has not earned enough confirmation yet.

Weak Money Flow and Looming Crossovers Limit the Rebound

The Chaikin Money Flow (CMF), which tracks whether large buyers are supporting the price, still trades below zero and under a descending trendline. This means money flowing into BMNR is weak, even though the company continues to buy Ethereum in size.

This is key because every time CMF has approached this trendline and the zero line over the past two months, BMNR has staged a short bounce that later failed. The only time a rally held came in late September, when CMF broke above zero. That move pushed the stock 39% higher.

Big Money Flow Weakens:

TradingView

Big Money Flow Weakens:

TradingView

Right now, CMF is nowhere near repeating that signal. Until it breaks both the trendline and the zero line, recovery hopes remain weak.

Trend pressure is also building. Two bearish crossovers are forming:

- The 50-day EMA is closing in on the 100-day EMA, and

- The 20-day EMA is closing in on the 200-day EMA.

EMA crossovers track average price trends. Similar crossovers on November 3 and November 14 triggered declines of 17% and 29%.

Bearish Crossovers Loom on BMNR:

TradingView

Bearish Crossovers Loom on BMNR:

TradingView

With BMNR also exposed to Ethereum swings due to its heavy ETH holdings, this adds another layer of downside risk. If ETH weakens, it can amplify the impact of these crossovers when they form.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter

BitMine Price Levels Show Why the Bounce Remains Fragile

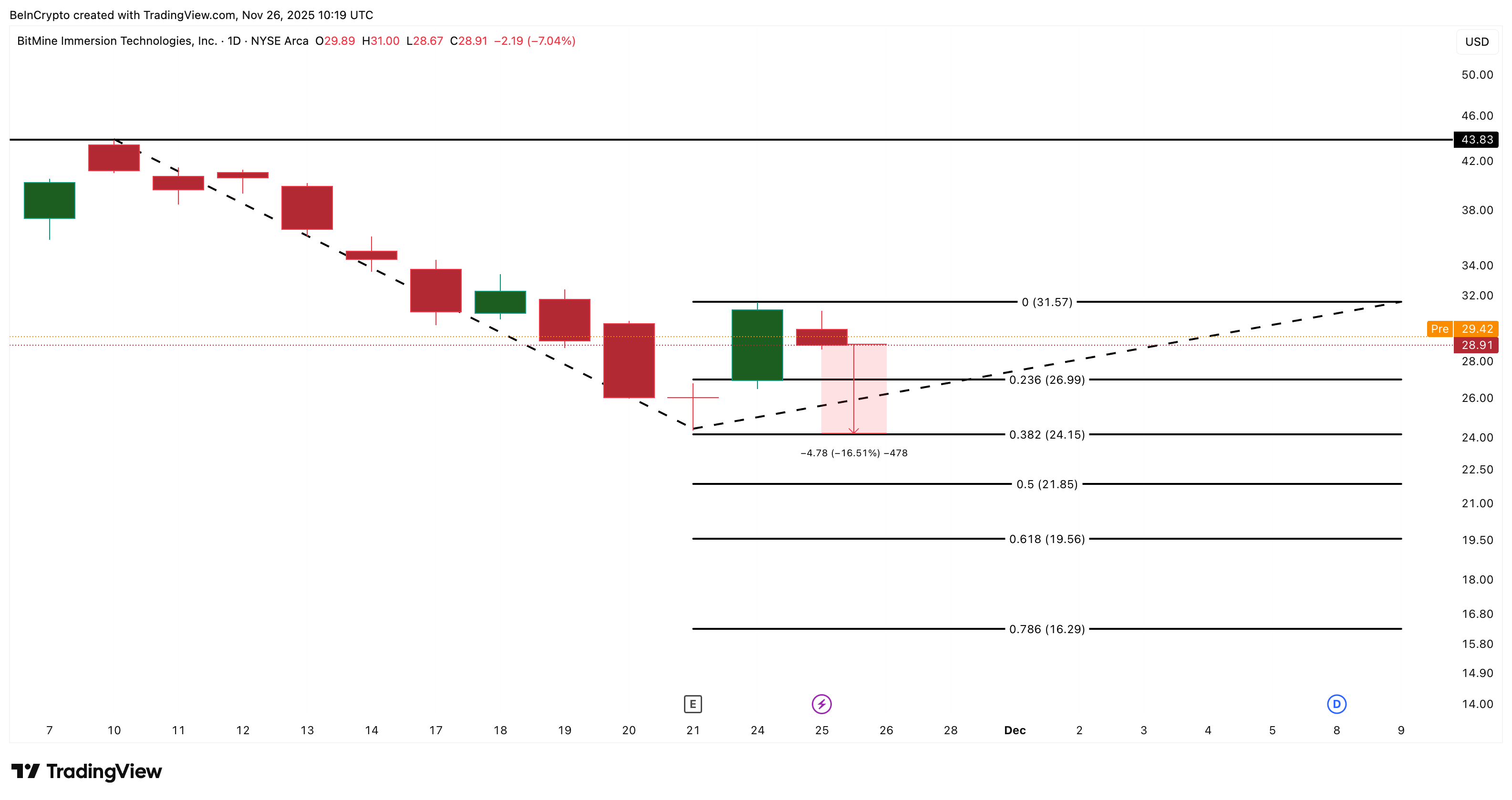

On the price chart, the BMNR price failed to reclaim $31.57, a similar level highlighted earlier as the first sign of real strength. The BitMine price moved close but could not close above it, reinforcing that buyers are not in control.

As long as BMNR stays below $31.57, the bearish scenario stays active.

Key downside levels now sit at:

- $26.99 (23.6% Fib)

- $24.15 (38.2% Fib, stronger support)

If both these levels break, the BitMine price might even head towards $16.29.

BitMine Price Analysis:

TradingView

BitMine Price Analysis:

TradingView

These supports show why the recovery remains uncertain. Without a CMF breakout and a close above $31.57, BitMine’s bounce will continue to face resistance, and the charts leave room for a deeper pullback.

However, a clean close above $31.57 can invalidate the bearish case for now and can even push the BitMine price towards $43.83. But that would require Ethereum to show strength as well.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Law Firms Take Action Against Corporations Amid Rising Investor Lawsuits

- U.S. law firms like Schall and Gross are leading class-action lawsuits against corporations for alleged investor misrepresentations across sectors. - Cases involve DexCom , MoonLake , Beyond Meat , and Stride , accusing them of concealing risks, overstating drug efficacy, and inflating enrollment figures. - Legal actions highlight SEC's intensified focus on biotech disclosures and edtech compliance, with deadlines set for investor claims by late 2025-2026. - These lawsuits emphasize corporate accountabil

Solana News Update: Solana ETFs Attract $476M While Death Cross and $120 Support Level Approach

- Solana ETFs attract $476M in 19 days, driven by Bitwise's 0.20% fee BSOL ETF with $424M inflows. - Technical indicators show a death cross and $120-$123 support test, with RSI at oversold 33 amid stagnant price action. - Institutional confidence grows via Franklin Templeton's fee-waiver strategy, contrasting Bitcoin/Ethereum ETF outflows of $5.34B. - Whale accumulation and on-chain growth hint at long-term buying, but $140 resistance remains unbroken despite ETF inflows.

XRP News Today: ADGM's Authorization of RLUSD Establishes International Standard for Institutional Stablecoin Compliance

- Ripple's RLUSD stablecoin gains FSRA approval for institutional use in Abu Dhabi's ADGM, effective November 27, 2025. - The $1.2B market-cap stablecoin features 1:1 USD reserves, third-party audits, and compliance with ADGM's transparency standards. - ADGM's approval aligns with its strategy to position Abu Dhabi as a global digital asset hub through regulated fiat-referenced tokens. - Ripple's Middle East expansion includes partnerships with UAE banks and regulatory licenses in Dubai, Bahrain, and Afric

Pi Network Boosts Web3 Gaming Innovation Through New Strategic Partnership