Grayscale files with the SEC to launch first-ever Zcash ETF

Quick Take Grayscale filed a registration statement with the Securities and Exchange Commission on Wednesday to convert its Grayscale Zcash Trust into an ETF. Over the past month, Grayscale has converted several of its closed-end trusts into exchange-traded products, including one that tracks XRP, another focused on Dogecoin, and one that tracks SOL.

Investment manager Grayscale is looking to expand its lineup of cryptocurrency exchange-traded funds, this time with a product tracking Zcash — a move that would make it the first firm to offer a ZEC-focused ETF.

Grayscale filed a registration statement with the U.S. Securities and Exchange Commission on Wednesday to convert its Grayscale Zcash Trust into an ETF.

"The Trust’s investment objective is for the value of the Shares (based on ZEC per Share) to reflect the value of ZEC held by the Trust, as determined by reference to the Index Price (as defined herein), less the Trust’s expenses and other liabilities," the firm said in the filing.

The Grayscale Zcash Trust currently has over $196 million in assets under management as of Tuesday. Zcash (ZEC) is the 23rd largest cryptocurrency by market capitalization, according to The Block's price page. The token was introduced in 2016 by the Zerocoin Electric Coin Company as a means to offer enhanced privacy to users.

"As privacy becomes foundational across crypto, we view ZEC as a key contributor to a well-balanced digital asset portfolio," Grayscale said in a post on X.

Over the past month, Grayscale has converted several of its closed-end trusts to exchange-traded products, including one tracking XRP , another focused on Dogecoin , and one tracking SOL. The firm began converting crypto trusts with the debut of its Bitcoin ETF following a legal fight with the SEC , which opened the door to additional crypto-related ETFs. Crypto ETF issuers are also operating under a friendly regulatory environment at the SEC under the Trump administration, as the agency seeks to clarify its stance on digital assets.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Balancer DAO Starts Discussing $8M Recovery Plan After $110M Exploit Cut TVL by Two-Thirds

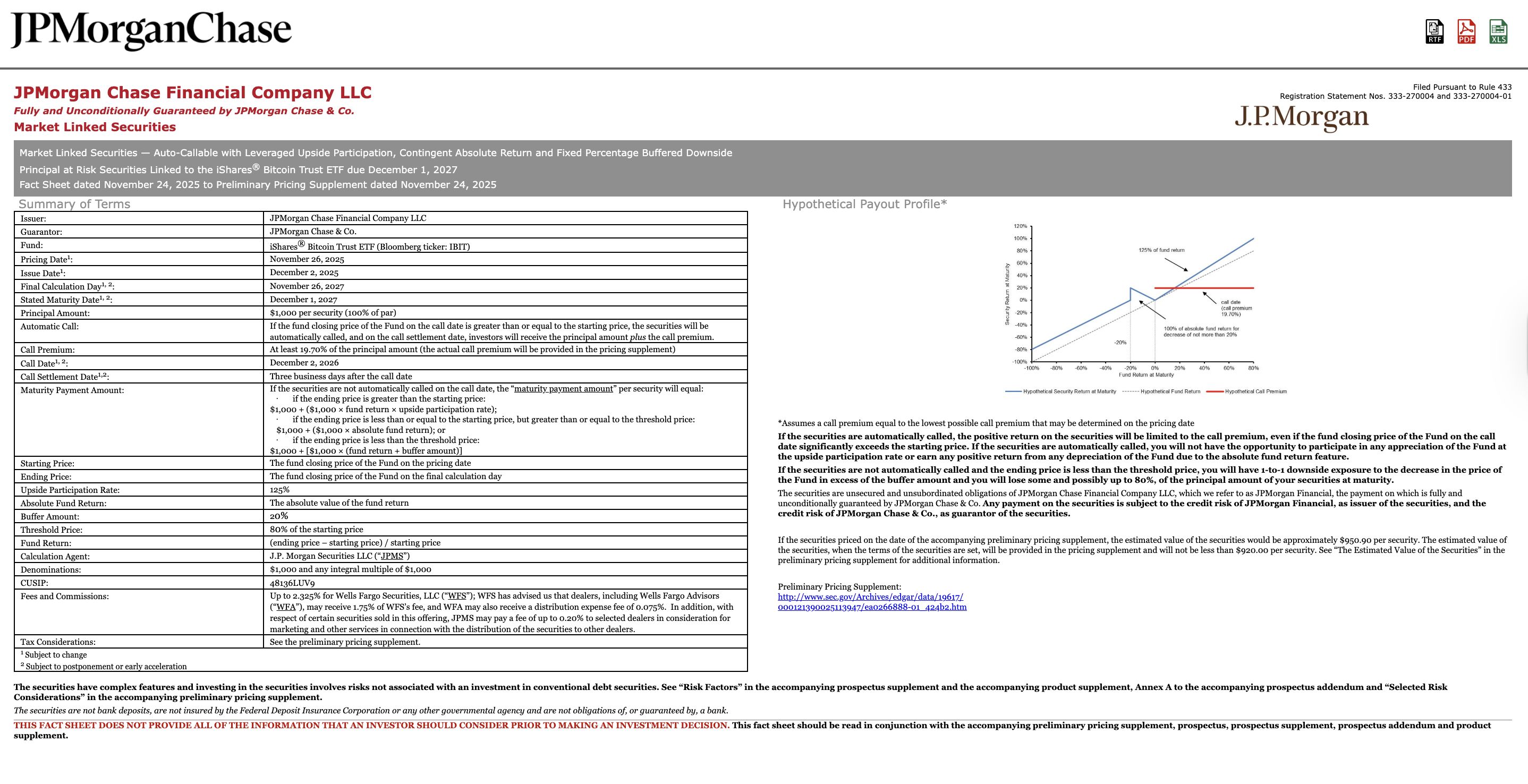

Bitcoiners accuse JPMorgan of rigging the game against Strategy, DATs

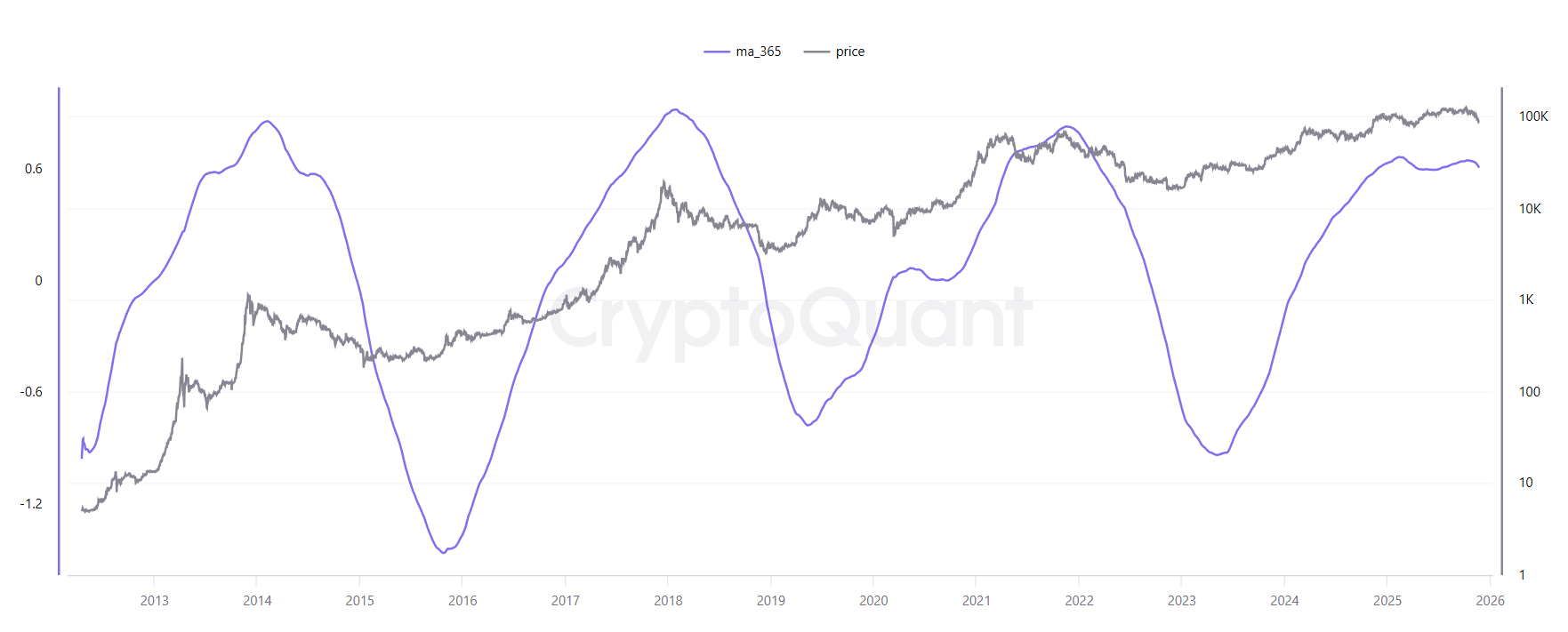

Bitcoin Downtrend Driven by Early Whale Selling, Says Ki Young Ju

Alchemy Pay Enables Fiat Purchases of Canton Coin, Opening $CC to 173 Countries