Bitcoin Updates: Senate Decision on Crypto Approaches While ETFs Lose $3.5B and Market Liquidity Declines

- A $101M crypto futures liquidation in October triggered a 30% Bitcoin price drop, marking the largest single-day selloff since 2022 amid ETF outflows and macroeconomic uncertainty. - $3.5B in November ETF redemptions and $4.6B stablecoin outflows highlight liquidity tightening, while leveraged traders face heightened volatility risks as retail investors retreat. - The U.S. Senate's upcoming crypto market structure bill could redefine regulatory clarity, potentially attracting institutional investment if

The cryptocurrency sector is currently experiencing significant turbulence, highlighted by a recent $101 million liquidation in futures contracts that has amplified market volatility and shifted investor outlooks. This event, combined with larger macroeconomic changes and evolving regulations, has prompted traders to adjust their approaches amid ongoing uncertainty. The October liquidation represented one of the most substantial single-day drops in crypto derivatives since mid-2022, signaling a broader market correction in

Since its October high above $126,000, Bitcoin’s value has fallen by more than 30%, now hovering near $87,000—

Wider economic conditions further complicate the picture.

At the same time, liquidity within the crypto market is tightening. The total value of stablecoins has dropped by $4.6 billion since November 1, with

Clearer regulations could help stabilize the market.

For now, crypto traders are approaching the market with caution. The combination of ETF outflows, reduced liquidity, and regulatory ambiguity points to a period of consolidation. Still, some analysts remain optimistic about the long-term, forecasting a potential resurgence in 2026 if economic conditions improve and regulatory clarity is achieved.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Hash Ribbon Flashes Signal That Often Marks Cyclical Bottoms for Bitcoin Price

Bitcoin whale opens $56.7M Bitcoin long after 18 months on the sidelines

Analyst sees dogecoin breakout forming as falling wedge hints at explosive upside

Solana News Update: Institutional Investments Boost Solana Despite Security Concerns and Negative Market Trends

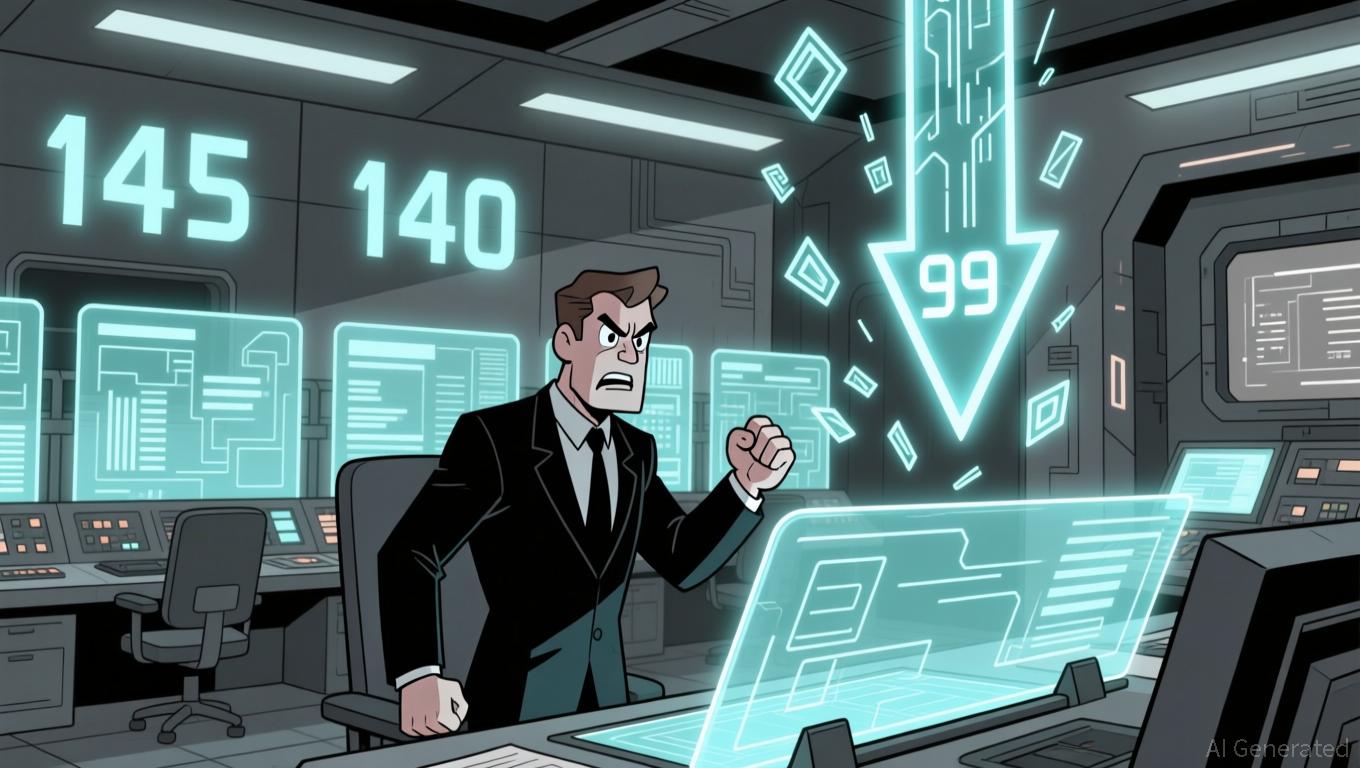

- Analysts predict Solana (SOL) will likely stay below $150 due to bear flag patterns and weak momentum, with key support at $140 potentially triggering a 30% drop to $99 if breached. - Despite technical headwinds, Solana's ETF inflows ($531M in first week) outpace Bitcoin and Ethereum , driven by 7% staking yields and lower fees compared to Bitcoin's $900M outflows. - Security risks persist after Upbit halted Solana withdrawals following a $37M hack, exposing vulnerabilities in hot wallet storage while CM