McKinsey: Artificial intelligence spending may limit the Fed's rate cuts in 2026

AI-driven growth may keep the U.S. economy strong, thereby limiting the expected rate cuts by the Federal Reserve next year. Although the market expects the Fed to cut rates up to three times, Dustin Read of McKinsey & Company stated that faster growth brought by AI may require tighter policies, causing U.S. Treasury yields to rise. He expects the 10-year U.S. Treasury yield to increase from the current 4% to 4.4% by mid-2026.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Hash Ribbon Flashes Signal That Often Marks Cyclical Bottoms for Bitcoin Price

Crypto for Advisors: Crypto’s Role in Portfolios

Bitcoin whale opens $56.7M Bitcoin long after 18 months on the sidelines

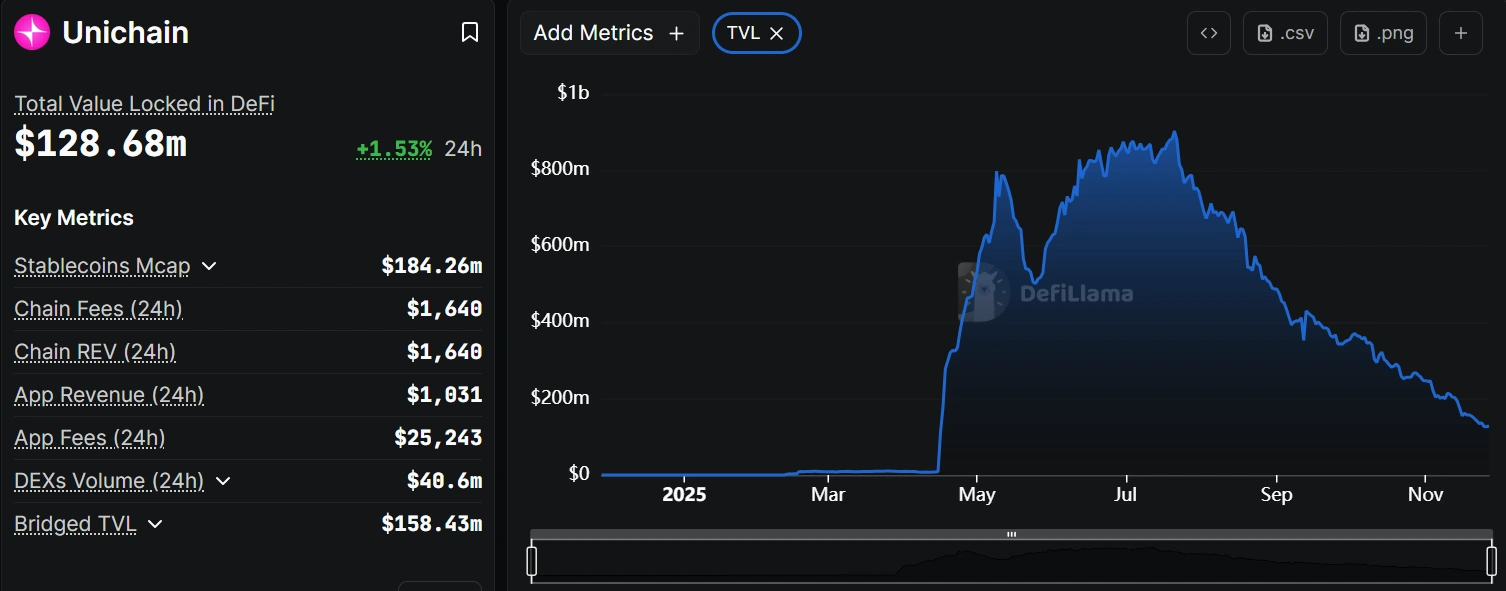

Unichain TVL collapses 86% as incentive program ends and liquidity exits