JPMorgan Offers Capped Upside Notes Tied to Bitcoin ETF Performance

Quick breakdown:

- JPMorgan’s new structured notes link returns to BlackRock’s iShares Bitcoin Trust IBIT, offering at least 16% if the ETF clears preset levels in a year and up to 1.5x BTC upside by 2028.

- Gains are capped, principal is only protected to about a 30% drawdown, and investors take on JPMorgan credit and liquidity risk.

- Buyers are exposed to JPMorgan’s issuer credit risk since the instruments are unsecured obligations, and secondary liquidity is typically limited to over-the-counter dealing.

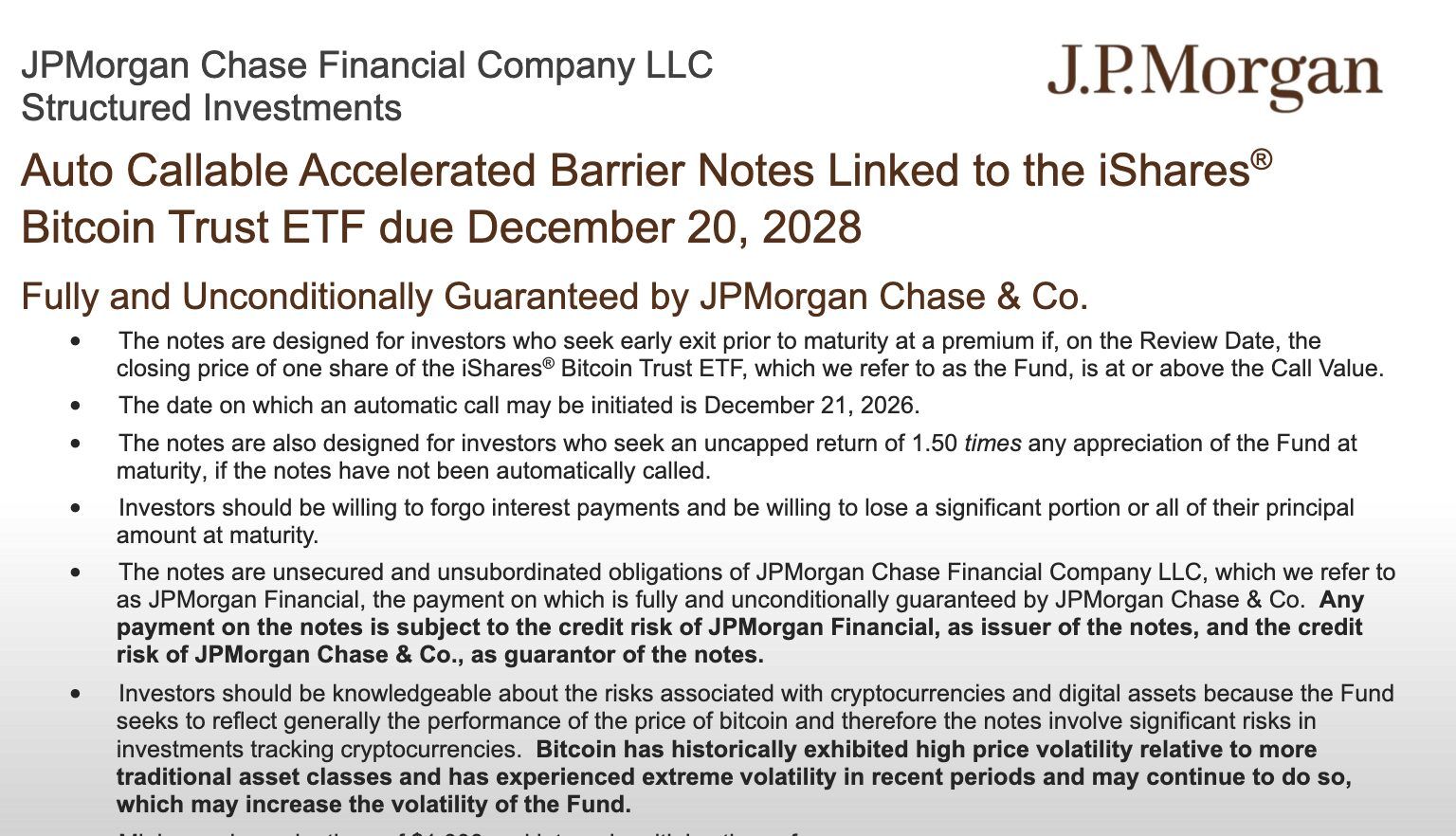

JPMorgan has structured a new batch of Bitcoin-linked notes that could deliver amplified returns if BTC and IBIT rally into 2028, while exposing investors to capped upside, conditional protection, and the bank’s own credit profile. The issuance underscores Wall Street’s push to package Bitcoin exposure into familiar securities instead of direct spot holdings.

The notes tie their performance to BlackRock’s iShares Bitcoin Trust IBIT, a spot Bitcoin ETF that already holds tens of billions of dollars in assets under management. Investors buy the notes at a fixed price and receive payouts based on IBIT’s level at specific dates rather than traditional coupons.

Source

:

SEC

Source

:

SEC

How the Bitcoin-linked notes work

According to term sheets, the structure typically combines an auto-call feature after about one year with a final maturity in 2028, creating two key decision points for returns.

If IBIT trades at or above a set threshold on the early observation date, the notes get called, and investors receive a mid-teens return, usually around 16% on their principal. If IBIT finishes below that mark, the notes stay in place until 2028 and then track the ETF with an enhanced upside, typically about 1.5x, up to a maximum cap. On the downside, principal is generally protected only as long as IBIT doesn’t drop more than about 30% from its starting level. If it falls beyond that, investors begin taking losses and could see a substantial hit to their capital.

Because the instruments are unsecured obligations, buyers also rely on JPMorgan’s ability to honour payments at maturity, adding issuer credit risk to Bitcoin’s price volatility. Secondary liquidity is typically limited to over-the-counter dealing, which can make exiting the position before maturity difficult or costly.

Who these products target and why they matter

The notes are aimed at investors who expect Bitcoin to grind higher over the next few years but prefer a packaged security linked to a regulated ETF rather than direct crypto custody or derivatives trading. They can fit mandates that allow exposure to bank notes and listed ETFs while still providing a defined payoff profile tied to BTC performance.

At the same time, the design converts a simple asset into a complex payoff that blends options, barriers, and credit, requiring investors to understand scenarios across 2026 and 2028 before allocating capital. The launch adds to a broader shift in which banks use ETF-linked notes to intermediate Bitcoin exposure, signalling that BTC is being treated as a strategic reference asset inside traditional fixed-income and structured-product desks rather than a fringe speculation.

Meanwhile, JPMorgan’s Kinexys unit is piloting JPMD, a permissioned deposit token on the Base Layer 2 network, for institutional clients. This digital representation of commercial bank money offers a regulated, efficient 24/7 on-chain payment alternative to stablecoins. This move signals JPMorgan’s belief that regulated deposit products will be central to the future of digital finance.

Take control of your crypto portfolio with MARKETS PRO, DeFi Planet’s suite of analytics tools.”

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Fed's Leadership Ambiguity and Divergent Policy Views Fuel Market Fluctuations Ahead of December Meeting

- U.S. Federal Reserve faces speculation over Chair Powell's future amid mixed signals and internal divisions on rate cuts. - Market expectations for a December rate cut surged to 84.7% as officials like John Williams shifted toward easing, while dissenters like Stephen Miran face criticism. - Trump's reported plan to nominate Kevin Hassett as next Fed chair risks politicizing monetary policy, with Treasury yields dipping below 4% on speculation. - OPEC+ supply pauses and political pressures complicate the

XRP News Today: Clearer Regulations Propel XRP ETFs to $628M as the Asset Earns Greater Legitimacy

- Canary Capital's XRPC ETF dominates XRP ETF market with $250M inflows, outpacing all competitors combined. - Grayscale's GXRP and Franklin Templeton's XRPZ drove $164M debut inflows, boosting total XRP ETF AUM to $628M. - 2025 SEC ruling cleared XRP's secondary sales as non-securities, enabling institutional adoption and $2.19 price rebound. - XRPC's 0.2% fee waiver and institutional focus fueled $6B+ ETF trading volumes, reversing prior outflows. - Analysts project $6.7B XRP ETF growth within 12 months

Bitcoin Updates: Anxiety Sweeps Crypto Market, Yet ETFs Ignite Optimism for Recovery

- Crypto Fear & Greed Index hits 20, signaling extreme fear as BTC/altcoins face renewed volatility amid Tether's "weak" stablecoin downgrade. - Tether CEO defends USDt stability with $215B Q3 assets, while Bitcoin-focused firms adopt defensive stances against mNAV risks. - Altcoin Season Index at 25/100 shows modest rebound, with Zcash surging 1,000% and Grayscale filing first U.S. Zcash ETF. - Upcoming spot altcoin ETF launches and potential Fed rate cuts (80% priced) spark optimism despite fragile on-ch

The Impact of Artificial Intelligence on Transforming Business Efficiency and Entrepreneurial Expansion

- AI-driven tools are becoming essential for SMEs and startups to enhance productivity and operational efficiency amid competitive pressures. - McKinsey reports 71% of organizations now use generative AI in 2025, but SMEs lag behind large enterprises in scaling AI adoption. - AI adoption delivers measurable ROI, with case studies showing 15-140% productivity gains in sectors like legal, sales, and customer service. - Investors are prioritizing AI-enhanced SaaS platforms that address SME pain points, enabli