Strategy Says Even a Bitcoin Crash to $25,000 Wouldn’t Break Its Balance Sheet

Strategy (formerly MicroStrategy) has confirmed that its assets-to-debt collateral ratio would remain at 2.0x, even if Bitcoin (BTC) fell to $25,000, far below its $74,000 average purchase price. This comes as the company’s stock has declined by 49% and faces the possibility of exclusion from MSCI indices, with a decision expected by January 2026. (Micro)

Strategy (formerly MicroStrategy) has confirmed that its assets-to-debt collateral ratio would remain at 2.0x, even if Bitcoin (BTC) fell to $25,000, far below its $74,000 average purchase price.

This comes as the company’s stock has declined by 49% and faces the possibility of exclusion from MSCI indices, with a decision expected by January 2026.

(Micro) Strategy’s $16 Billion Liability Stack Backed 3.6x by Bitcoin

In a recent X (formerly Twitter) post, the company emphasized the strength of its balance sheet by highlighting what it calls the “BTC Rating” of its convertible debt.

“If BTC drops to our $74,000 average cost basis, we still have 5.9x assets to convertible debt, which we refer to as the BTC Rating of our debt. At $25,000 BTC, it would be 2.0x,” the post read.

According to the firm, even if Bitcoin were to fall to $74,000, its average cost basis, the value of its BTC reserves, would still be 5.9 times greater than its convertible debt. In a deeper downturn, with Bitcoin at $25,000, the assets-to-debt ratio would remain at 2.0x.

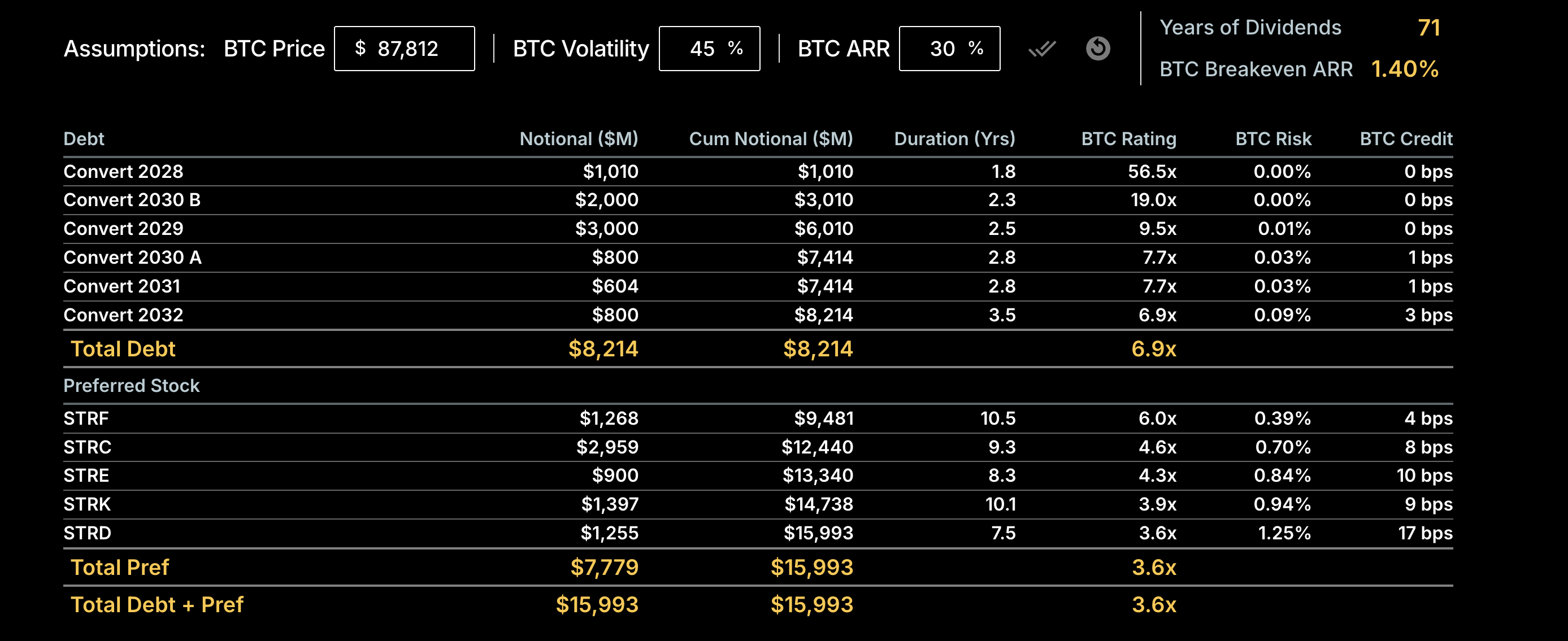

Based on the current Bitcoin price of $87,812, the company shows a notably strong asset-to-liability profile. According to the credit dashboard, Strategy carries $8.214 billion in total convertible debt with maturities spanning 2028 to 2032.

Most of these convertible notes exhibit exceptionally high BTC Rating, ranging from 7x to more than 50x. The BTC Rating for total convertible debt stands at 6.9x.

Strategy BTC Rating. Source:

Strategy Credit Dashboard

Strategy BTC Rating. Source:

Strategy Credit Dashboard

Below the debt layer, the company holds $7.779 billion in preferred stock across five series (STRF, STRC, STRE, STRK, STRD). These have longer average durations, many running 8 to 10 years or more. Moreover, they carry slightly higher risk profiles than the senior debt stack.

The preferred equity carries a BTC Rating of 3.6x, indicating a solid, though thinner, collateral cushion relative to the company’s convertible debt. Combined, the company’s total obligations, debt plus preferred stock, amount to $15.993 billion.

At the current Bitcoin price, these liabilities are supported by a consolidated BTC Rating of 3.6x, meaning the company holds more than three and a half times the value of its outstanding obligations in Bitcoin-denominated assets.

This indicates that the company is exceptionally well-capitalized, overcollateralized by a substantial BTC buffer, and highly resilient to Bitcoin price declines. This provides it with significant financial stability and strategic flexibility.

According to the data from SaylorTracker, Strategy holds 649,870 BTC valued at $56.99 billion, making it the largest corporate holder globally.

Strategy Confronts Market Slide and Index Uncertainty

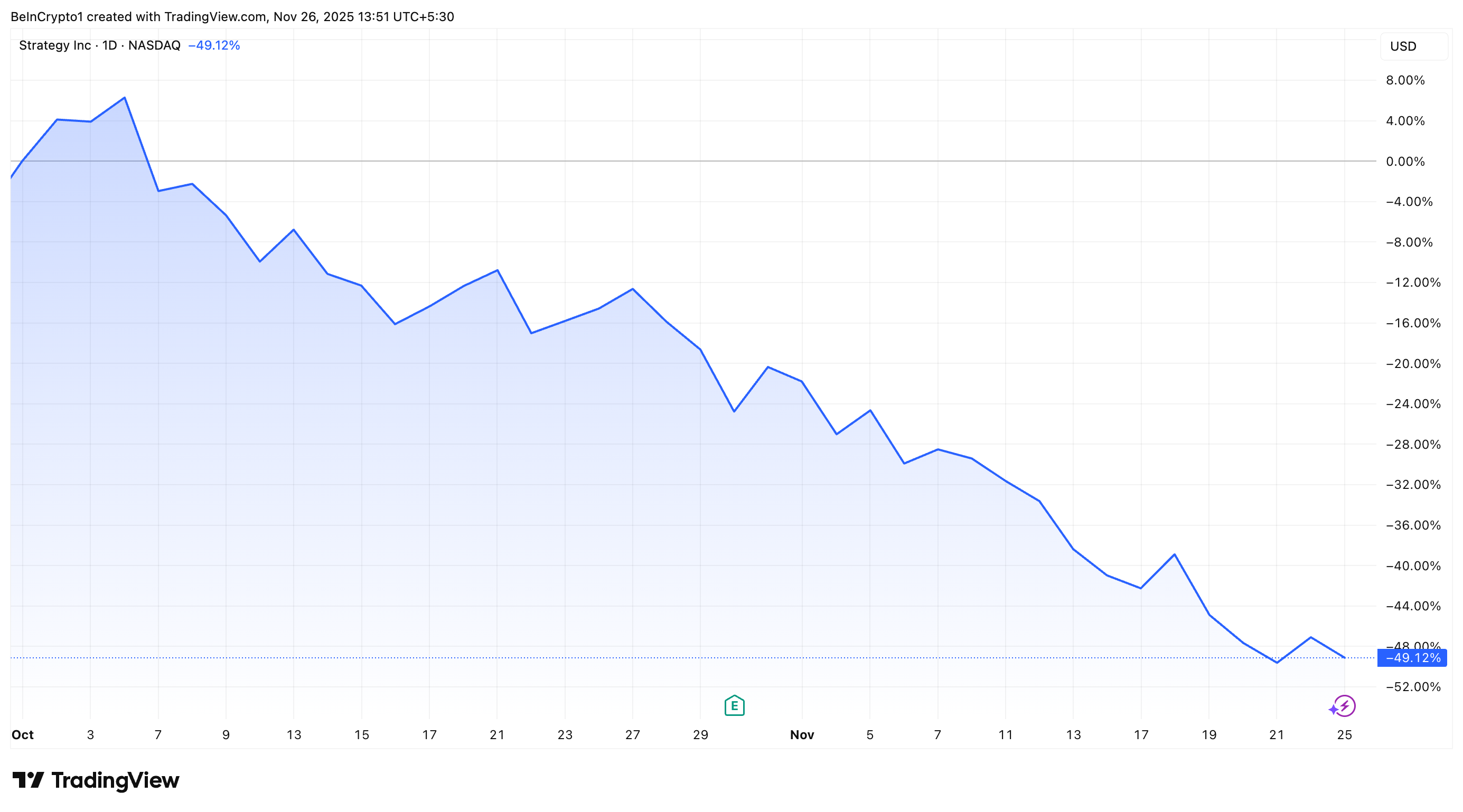

Notably, this revelation comes at a time when the firm has been under considerable pressure. MSTR shares have fallen by more than 49% since early October, trading at levels last seen in late 2024.

MicroStrategy (MSTR) Stock Performance. Source:

TradingView

MicroStrategy (MSTR) Stock Performance. Source:

TradingView

Strategy also faces heightened scrutiny from MSCI. It is considering a criterion that would exclude companies where digital assets make up 50% or more of total assets.

A decision is expected by January 15, 2026. JPMorgan research estimates potential outflows could surge as high as $8.8 billion if additional index providers adopt similar rules. According to the bank,

“With MSCI now considering removing MicroStrategy and other digital asset treasury companies from its equity indices…outflows could amount to $2.8bn if MicroStrategy gets excluded from MSCI indices and $8.8bn from all other equity indices if other index providers choose to follow MSCI.”

The company was also left out of the S&P 500, missing another key opportunity. Adding to the challenges, after six consecutive weeks of Bitcoin purchases, the firm has broken its buying streak. This comes as the mNAV premium has collapsed toward near parity.

Nonetheless, the firm is making other strategic moves. Blockchain intelligence firm Arkham reported that Strategy transferred some of its assets from Coinbase to Fidelity Custody. This reflects a plan to split custodial risk between several regulated providers.

“Strategy (MSTR) has been diversifying custodians away from Coinbase, and has moved 58,390 Bitcoin (currently: $5.1 Billion) to Fidelity Custody over the past 2 months….with a total of 165,709 BTC ($14.50 billion) sent to Fidelity Custody,” Arkham stated.

Thus, despite mounting market pressure, index uncertainty, and a sharp decline in its stock price, Strategy remains heavily overcollateralized and structurally resilient. Its Bitcoin-backed balance sheet continues to provide a substantial buffer against volatility. At the same time, ongoing efforts to diversify custodial risk signal a company’s positioning for long-term stability, even in a challenging environment.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Switzerland Postpones Crypto Tax Data Exchange to Meet Technological and International Requirements

- Switzerland delays crypto tax data sharing until 2027, aligning with global regulatory reevaluations amid evolving tech and market dynamics. - SGS acquires Australia's Information Quality to boost digital revenue, reflecting Swiss firms' expansion into tech-driven compliance solutions. - Canada's Alberta oil sands policy shift highlights governments prioritizing economic growth over strict climate regulations, mirroring Switzerland's approach. - BridgeBio's precision medicine and Aires' EMF solutions dem

Switzerland's Focus on Privacy Conflicts with International Efforts for Crypto Taxation

- Switzerland delays crypto tax data sharing with international partners until 2027, contrasting with global regulatory efforts to close offshore loopholes. - The U.S. advances implementation of the OECD's CARF framework, aiming to automate reporting on foreign crypto accounts by 2029. - CARF requires foreign exchanges to report U.S. account details, mirroring traditional tax standards and targeting crypto tax evasion. - Switzerland's privacy-focused stance highlights tensions between financial confidentia

Zcash News Update: Reliance Shifts Entirely to Zcash, Citing Privacy and Regulatory Alignment

- Reliance Global Group, a Nasdaq-listed fintech firm, shifted its entire crypto portfolio to Zcash (ZEC), divesting Bitcoin , Ethereum , and other major coins. - The strategic pivot, announced November 25, prioritizes Zcash's privacy-focused zk-SNARKs technology for institutional compliance and selective data disclosure. - Zcash's 1,200% 90-day price surge and Grayscale's ETF filing highlight growing institutional interest in privacy-centric assets. - The move reflects broader crypto industry trends towar

Bitcoin News Update: Bitcoin Fear Index Drops to 22 While Investors Look for Signs of Market Rebound

- Bitcoin Fear & Greed Index rose to 22 from 20, indicating slight easing of extreme fear but persistent bearish sentiment. - Bitcoin stabilized near $87,000 after hitting $80,553, yet remains below key resistance levels amid $3.5B ETF outflows. - Structural factors like leverage and liquidations drive selloffs, with ETF redemptions correlating to 3.4% price drops per $1B outflow. - Analysts note oversold technical indicators and waning retail capitulation as potential inflection points for near-term rebou