Shiba Inu's Transition From Fear to Gathering Depends on Surpassing $0.00000944

- Shiba Inu (SHIB) shows early recovery signs as buyers support key levels, contrasting November's sell-off. - Token burns and 15% derivatives growth boost optimism , with analysts projecting potential 3,000% gains if $0.00000944 breaks. - Strategic partnerships with Unity Nodes expand SHIB's utility beyond speculation, aligning with meme token trends. - Risks persist: major moving averages and outflows remain bearish, requiring sustained inflows to confirm turnaround.

Shiba Inu (SHIB), the popular meme cryptocurrency, is beginning to show signs of a rebound after an extended period of decline, leading to cautious hope among investors. Recent movements in its price suggest a possible transition from a bearish trend to a phase of stabilization, as buyers start to emerge around crucial support zones.

The ongoing rebound is being driven by several factors, such as token burns and heightened activity in SHIB’s derivatives market. More than 621 million tokens have recently been burned, reducing supply, while open interest in derivatives has jumped by 15%, reflecting growing speculative engagement. Some analysts believe these trends could pave the way for a major price surge, with projections that

Nevertheless, the recovery faces significant challenges. SHIB is still contending with resistance from key moving averages and a persistent downward trendline, and bears are likely to maintain control unless the price can surpass $0.00000944

Strategic collaborations are also shaping SHIB’s story. The token’s integration with Unity Nodes—a blockchain-powered mobile engine network—has broadened its functionality beyond mere speculation, allowing holders to engage in node management and decentralized activities. This move is in line with the larger trend of

Despite the positive developments, investors are still urged to be cautious.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Hash Ribbon Flashes Signal That Often Marks Cyclical Bottoms for Bitcoin Price

Bitcoin whale opens $56.7M Bitcoin long after 18 months on the sidelines

Analyst sees dogecoin breakout forming as falling wedge hints at explosive upside

Solana News Update: Institutional Investments Boost Solana Despite Security Concerns and Negative Market Trends

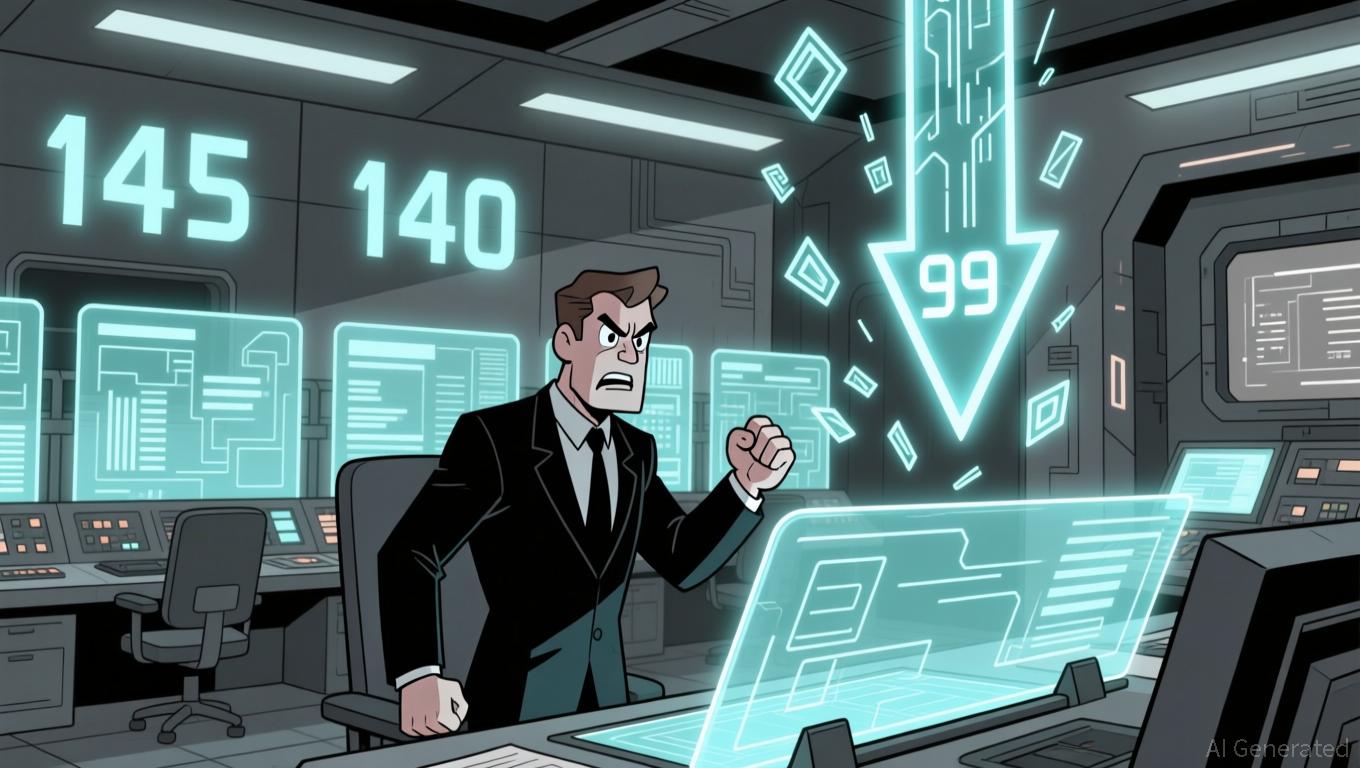

- Analysts predict Solana (SOL) will likely stay below $150 due to bear flag patterns and weak momentum, with key support at $140 potentially triggering a 30% drop to $99 if breached. - Despite technical headwinds, Solana's ETF inflows ($531M in first week) outpace Bitcoin and Ethereum , driven by 7% staking yields and lower fees compared to Bitcoin's $900M outflows. - Security risks persist after Upbit halted Solana withdrawals following a $37M hack, exposing vulnerabilities in hot wallet storage while CM