Institutions Turn to Purpose-Built Blockchains as Privacy Concerns Drive Shift Away from Ethereum

Financial institutions are shifting away from Ethereum (ETH) and opting for purpose-built blockchains tailored to meet their institutional needs. Recent developments, such as Klarna’s launch of its stablecoin on an alternative network and the rise of privacy-focused chains like Canton, raise questions about the network’s dominance. Corporate Blockchain Adoption Signals New Threat to Ethereum: Here’s

Financial institutions are shifting away from Ethereum (ETH) and opting for purpose-built blockchains tailored to meet their institutional needs.

Recent developments, such as Klarna’s launch of its stablecoin on an alternative network and the rise of privacy-focused chains like Canton, raise questions about the network’s dominance.

Corporate Blockchain Adoption Signals New Threat to Ethereum: Here’s Why

Klarna announced KlarnaUSD, becoming the first bank to issue a stablecoin on Tempo, a payments blockchain from Stripe and Paradigm. This decision has sparked debate in the crypto community. Some view it as a bearish signal for Ethereum.

“Someone tell me why this isn’t bearish for Ethereum? A major fintech with a big move into stablecoins is not launching it on Ethereum. If Tempo didn’t exist then this would have likely launched on Ethereum or an ETH L2…Tempo taking marketshare in what is the main thesis for Ethereum: stablecoins,” an analyst stated.

Ethereum hosts major stablecoins, including Tether (USDT) and USDC (USDC), which together command over $100 billion in market capitalization. They drive significant network activity and fees. By opting for Tempo, Klarna bypasses Ethereum’s ecosystem, potentially diverting liquidity and innovation.

Another analyst, Zach Rynes, emphasized that Klarna’s decision demonstrates that corporate blockchains are gaining adoption, while public chains continue to be overshadowed by large fintech companies.

“Another confirmation that corpo L1 chains are here to stay and that your favorite commoditized ‘neutral’ public chain #375936 is getting steamrolled by Fintech yet again,” he said.

The rise of the Canton Network further exemplifies this. It is a Layer 1 network built with privacy controls at its core. Institutions can choose how visible or restricted their activity is, enabling setups that range from fully permissionless to completely private systems.

Despite these differences, applications on Canton can still connect and interact across the network. Goldman Sachs’ Digital Asset Platform (GS DAP) uses the Canton network natively.

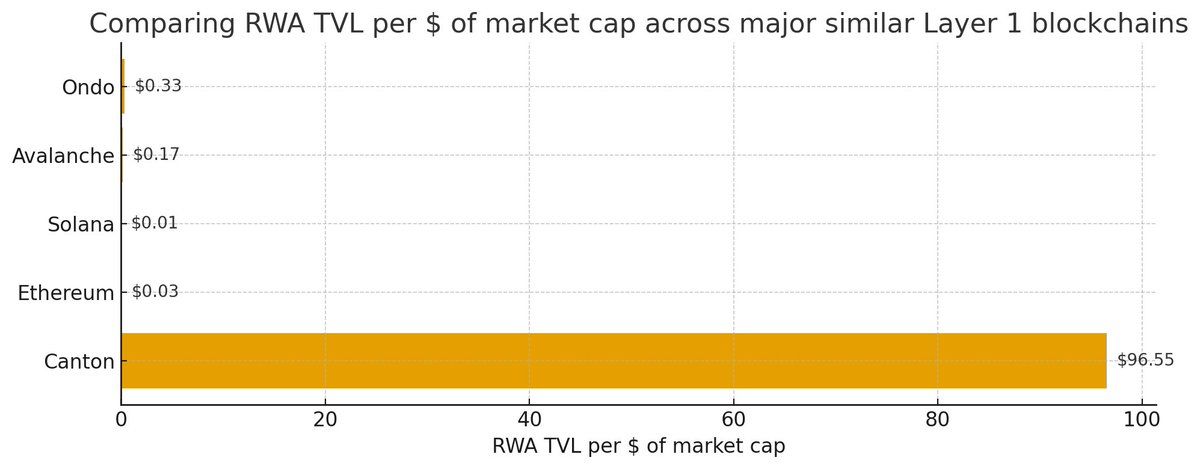

Notably, Canton exhibits a significant level of capital efficiency, producing around $96 of RWA Total Value Locked (TVL) for every $1 of market capitalization. In contrast, Ethereum generates approximately $0.03 of RWA TVL for every $1 of market cap.

A Comparison of RWA TVL Per Dollar of Market Cap. Source:

X/MattMena__

A Comparison of RWA TVL Per Dollar of Market Cap. Source:

X/MattMena__

But why are institutions moving away from Ethereum? Privacy could be the primary driver of this exodus. Public blockchains like Ethereum make all transactions permanently visible, a core challenge for institutions.

When banks or corporations transfer large sums, this transparency poses a significant risk. Competitors can analyze patterns, front-run trades, and uncover strategic business ties.

According to COTI Network’s analysis, enterprises adopting Web3 often overlook blockchain transparency as a liability. The article notes that public blockchains expose all transactions and metadata, which can reveal sensitive data or undermine negotiation leverage. This creates regulatory concerns with laws such as GDPR and exposes trade secrets.

This disconnect explains why institutions are building private blockchains or seeking public networks with enhanced privacy. Transparency, a celebrated virtue in crypto, creates vulnerabilities when handling billion-dollar trades and confidential relationships.

This trend signals a split: public networks like Ethereum for decentralized or retail use, while institutions move to private or specialized chains with confidentiality. Whether Ethereum can win back institutional trust or specialized networks take over remains uncertain as finance undergoes a digital transformation.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Switzerland Postpones Crypto Tax Data Exchange to Meet Technological and International Requirements

- Switzerland delays crypto tax data sharing until 2027, aligning with global regulatory reevaluations amid evolving tech and market dynamics. - SGS acquires Australia's Information Quality to boost digital revenue, reflecting Swiss firms' expansion into tech-driven compliance solutions. - Canada's Alberta oil sands policy shift highlights governments prioritizing economic growth over strict climate regulations, mirroring Switzerland's approach. - BridgeBio's precision medicine and Aires' EMF solutions dem

Switzerland's Focus on Privacy Conflicts with International Efforts for Crypto Taxation

- Switzerland delays crypto tax data sharing with international partners until 2027, contrasting with global regulatory efforts to close offshore loopholes. - The U.S. advances implementation of the OECD's CARF framework, aiming to automate reporting on foreign crypto accounts by 2029. - CARF requires foreign exchanges to report U.S. account details, mirroring traditional tax standards and targeting crypto tax evasion. - Switzerland's privacy-focused stance highlights tensions between financial confidentia

Zcash News Update: Reliance Shifts Entirely to Zcash, Citing Privacy and Regulatory Alignment

- Reliance Global Group, a Nasdaq-listed fintech firm, shifted its entire crypto portfolio to Zcash (ZEC), divesting Bitcoin , Ethereum , and other major coins. - The strategic pivot, announced November 25, prioritizes Zcash's privacy-focused zk-SNARKs technology for institutional compliance and selective data disclosure. - Zcash's 1,200% 90-day price surge and Grayscale's ETF filing highlight growing institutional interest in privacy-centric assets. - The move reflects broader crypto industry trends towar

Bitcoin News Update: Bitcoin Fear Index Drops to 22 While Investors Look for Signs of Market Rebound

- Bitcoin Fear & Greed Index rose to 22 from 20, indicating slight easing of extreme fear but persistent bearish sentiment. - Bitcoin stabilized near $87,000 after hitting $80,553, yet remains below key resistance levels amid $3.5B ETF outflows. - Structural factors like leverage and liquidations drive selloffs, with ETF redemptions correlating to 3.4% price drops per $1B outflow. - Analysts note oversold technical indicators and waning retail capitulation as potential inflection points for near-term rebou