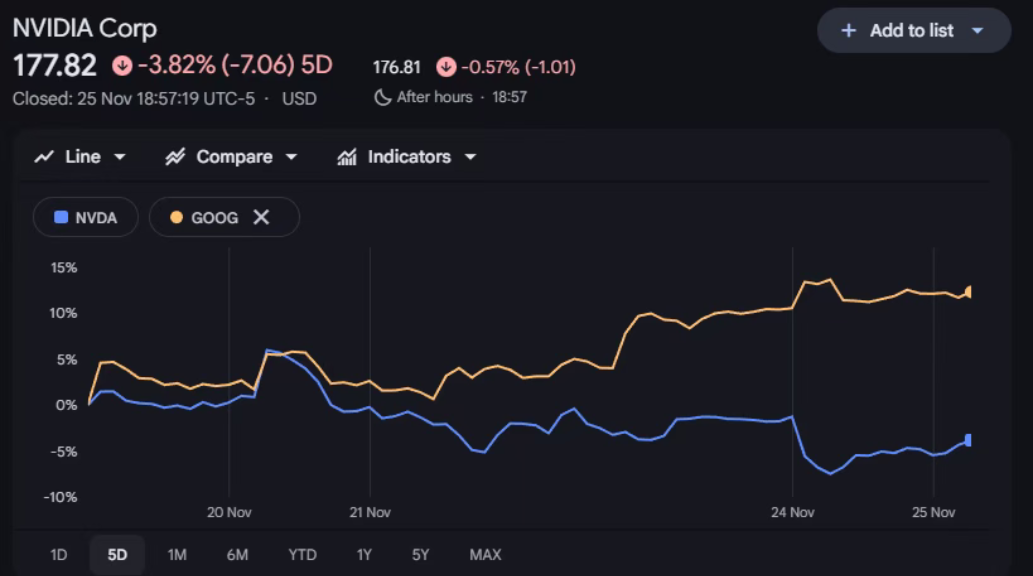

A sudden shift in market sentiment and a rare counterattack from a giant. Nvidia’s stock price experienced a thrilling roller coaster on Tuesday, plunging more than 7% at one point in early trading, wiping out nearly 350 billion USD in market value, and finally closing down 2.6%, hitting a two-month low.

Meanwhile, Google’s parent company Alphabet bucked the trend, rising 1.6% and setting a record closing high for the third consecutive trading day, with its market value approaching the 4 trillion USD mark.

This dramatic volatility in the capital markets stems from an AI chip hegemony battle that is brewing. Facing market doubts, Nvidia took the rare step of speaking out, declaring that its GPU technology is “a generation ahead of the industry.”

1. The Polarization of Tech Giants

Tuesday’s US stock market presented a rare picture of polarization among tech stocks. Nvidia experienced a dramatic trading day, plunging more than 7% intraday, marking its largest single-day drop in recent times.

This plunge was not an isolated event, as several companies related to Nvidia were also swept into the vortex.

● Server manufacturer Super Micro Computer (SMCI) fell 2.5%, data center operator CoreWeave—partly owned by Nvidia—dropped 3.1%, and its main competitor AMD also fell 4.15%.

● In stark contrast, Google’s parent company Alphabet closed up 1.6%, setting a record high for the third consecutive trading day.

● This divergence shows that investors are repositioning in the AI sector, shifting their focus from traditional hardware suppliers to tech giants demonstrating full-stack capabilities.

● Nvidia’s market value has shrunk by more than 700 billion USD from its peak of nearly 5 trillion USD less than a month ago, a figure that exceeds the total market value of most tech companies.

2. The Challenge of Google’s TPU

The direct trigger for this shift in market sentiment is the competitive threat posed by Google’s AI chip TPU.

● Last week, Google released its Gemini 3 model, which is considered to surpass OpenAI’s ChatGPT, and this model was trained using Google’s own TPU rather than Nvidia chips.

● What shook the market even more was media reports that Google is pitching its TPU to potential customers, including Meta, and is considering using its self-developed chips in future data centers.

● Meta, like OpenAI, has always been one of Nvidia’s important customers.

● Mike O’Rourke, an analyst at Jones Trading, said that the release of Gemini 3 “may prove to be a more subtle but more important version than DeepSeek’s disruption.” This view represents a market consensus: Google is transforming from a laggard to a leader in the AI race.

● Charlie McElligott, a strategist at Nomura Securities, pointed out that Alphabet’s latest model has “reshuffled the AI landscape,” pushing the market into a “new DeepSeek moment.”

3. Nvidia Responds: A Rare Move to Reassure the Market

Facing the market’s intense reaction, Nvidia adopted the rare strategy of making a public response.

● Nvidia spoke out on social media platform X, declaring that its GPU technology is “a generation ahead of the industry,” and stating that its chips are “the only platform that can run all AI models and is universal across various computing scenarios.”

“We are happy for Google’s success—they have made great progress in artificial intelligence, and we will continue to provide products and services to Google.” Nvidia said in its statement.

● Nvidia also emphasized that its chips offer “higher performance, versatility, and interchangeability” compared to Google’s TPU and other application-specific integrated circuit (ASIC) chips, which are usually designed for a single company or function.

This kind of public reassurance is uncommon in Nvidia’s history.

● Gil Luria, an analyst at D.A. Davidson, commented: “This memo itself makes Nvidia look passive, and not sharing it publicly would make things look even worse. We agree with many of their answers, but a company of this size does not need to respond to every question raised outside of earnings season.”

4. Deep Crisis: The Divergence Between Fundamentals and Market Expectations

The real dilemma Nvidia faces is the huge gap between its performance and market expectations.

● From a fundamental perspective, Nvidia’s business performance remains strong. In the third quarter of fiscal year 2026, the company’s revenue reached 57 billion USD, up 62% year-on-year; adjusted net profit reached 31.9 billion USD, up 65% year-on-year.

● More importantly, the company’s guidance for the next quarter reached 65 billion USD, far exceeding analysts’ expectations of 61.66 billion USD. CEO Jensen Huang revealed at the earnings call that Nvidia’s total AI chip orders for 2025 and 2026 have reached 500 billion USD.

● However, the better-than-expected performance did not lead to a rise in the stock price. After Nvidia released its earnings report, the stock price rose nearly 6% in after-hours trading, but fell 3.15% the next trading day. The evaporation of market value stems from doubts about Nvidia’s long-term growth logic.

● On the one hand, major tech companies are developing their own chips to reduce dependence on Nvidia. Google’s TPU is just one example; Amazon, Microsoft, and others are also developing their own AI chips.

● On the other hand, investors are beginning to focus on the return cycle of AI investments. Enterprises, cloud service providers, and startups continue to expand computing infrastructure, but real returns at the application layer have yet to be fully realized.

5. Jensen Huang’s Dilemma: The Anxiety of a “No-Win Situation”

Behind the stock price fluctuations, a series of recent remarks by Nvidia CEO Jensen Huang have revealed an unusual sense of anxiety. In an internal all-hands meeting, Huang admitted that the company is now in a “no-win situation”:

● “If we deliver a bad quarter, the market will say this proves the AI bubble; but even if we deliver an excellent quarter, some will say we’re just fueling the bubble.”

● Huang even joked: “You should see some of the memes online, saying we’re basically holding up the Earth. It sounds exaggerated, but it’s not entirely wrong.”

● When talking about the company’s dramatic market value fluctuations, he spoke with humor but also revealed helplessness about market sentiment: “No one has ever lost 500 billion USD in a few weeks, right?”

These remarks reflect the multiple pressures Nvidia faces as a bellwether of the AI industry—maintaining market confidence in the AI sector, coping with changes in the competitive landscape, and dealing with the disconnect between valuation and fundamentals.

6. The Intensifying Bubble Debate

Concerns about Nvidia also include doubts about whether the AI industry is experiencing “circular financing.” Some analysts have pointed out that the recent 100 billion USD deal between Nvidia and OpenAI has a special structure:

Nvidia will inject capital into OpenAI to build data centers, and OpenAI will equip these data centers with Nvidia’s chips.

● One analyst bluntly said: “Simply put, I’m Nvidia, I want OpenAI to buy more of my chips, so I give them money to buy them. This is common in small-scale deals, but it’s very unusual at the scale of tens of billions of dollars.”

● Similar deal structures have also appeared in collaborations with companies like CoreWeave. OpenAI reached a multi-billion dollar deal with CoreWeave—CoreWeave rents out the chip computing power of its data centers to OpenAI in exchange for shares in CoreWeave.

● At the same time, Nvidia, which also holds a stake in CoreWeave, has promised to absorb all of CoreWeave’s unused data center computing power by 2032.

These complex deal structures have raised doubts in the market about the authenticity of AI demand, with some investors worrying that the current AI boom has structural problems similar to those during the internet bubble era.

7. A New Stage in the AI Race

Despite short-term challenges, Nvidia’s dominance in the AI infrastructure sector remains solid. Jensen Huang has publicly stated that Nvidia will transform into a global AI infrastructure company over the next decade, predicting that by the end of this century, investment in AI infrastructure will reach 3 to 4 trillion USD.

● Nvidia CFO Colette Kress also emphasized: “We believe that in the annual 3 to 4 trillion USD AI infrastructure buildout, Nvidia will be the optimal choice.”

● A Google spokesperson’s statement highlighted the diversified strategies of large tech companies in AI infrastructure: “Demand for our custom TPU and Nvidia GPU is accelerating. We will continue to support both as always.”

Currently, the AI chip market is not a “zero-sum game”; it is more likely that multiple solutions will coexist. Google’s TPU may perform excellently in specific fields, but Nvidia’s GPU still has broad advantages in generality and flexibility.

Nvidia’s pullback seems more like the result of multiple factors converging at the same time: valuation pressure, changing industry outlook, real challenges in AI investment returns, and repeated macro liquidity shifts.

Jensen Huang recently admitted that the company is caught in a “no-win situation”: excellent performance is accused of fueling the AI bubble, while poor performance is seen as evidence of the bubble bursting.