Metaplanet borrows $130m to buy Bitcoin as risks loom

Despite ongoing crypto market volatility, Metaplanet opted for a leveraged strategy for its latest Bitcoin acquisition.

- Metaplanet is leveraging to acquire more Bitcoin, despite volatility

- The firm tapped an additional $130 million from its $500 million loan facility

- The Tokyo-listed firm recently announced a $135 million share offering

Due to ongoing volatility in the crypto markets, markets expect digital treasury firms to slow down their acquisitions. However, Tokyo-listed Metaplanet is not one of them. On Tuesday, November 25, the firm announced that it drew a new $130 million loan from its Bitcoin-backed credit line.

The latest loan brings Metaplanet’s total borrowings from its $500 million facility to $230 million. The firm will use to buy more Bitcoin, expand its BTC income business, and potentially repurchase shares. This makes the loan a leveraged bet, while the firm still sits on nearly 20% of unrealized loss on its current BTC holdings.

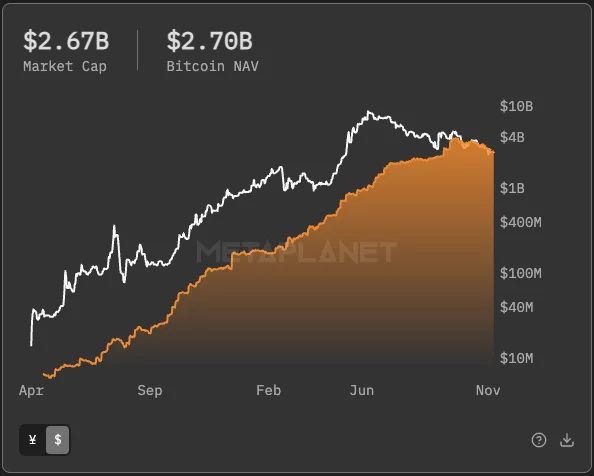

Metaplanet’s market cap and the net asset value of its Bitcoin holdings | Source: Metaplanet

Metaplanet’s market cap and the net asset value of its Bitcoin holdings | Source: Metaplanet

The firm will calculate loan interest in U.S. dollars, along with the spread. The term renews daily, and the firm can repay the loan at its discretion. What is more, its income strategy includes using Bitcoin as collateral to sell options.

Metaplanet makes a leveraged, risky bet

Borrowing money to buy Bitcoin is a potentially lucrative yet risky strategy. If Bitcoin goes down enough, leveraged buyers can find themselves wiped out. Firms that use it, including Michael Saylor’s Strategy, are typically more volatile than the underlying asset.

Metaplanet is using its leveraged strategy in combination with share sales. On November 20, the firm announced plans to issue $135 million worth of Class B perpetual shares. These shares mirror Strategy’s approach to BTC acquisitions, combining equity sales with borrowing.

Currently, Metaplanet’s average Bitcoin purchase price is $108,036, more than 20% higher than its current price of $87.505.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin Updates Today: Bitcoin Faces Challenges Amid Stablecoin Uncertainty and Changing Regulations

- Bitcoin's structural resilience persists amid monthly volatility, driven by evolving regulations, institutional adoption, and shifting market sentiment. - SEC's 2025 regulatory framework aims to streamline crypto oversight, potentially reducing uncertainty and aligning with global standardization efforts. - Tether's USDT stability downgrade raises concerns over Bitcoin's role in reserves, while Arthur Hayes predicts $80k-$250k price swings tied to liquidity and Fed policy. - Infrastructure projects like

Bitcoin News Update: Cryptocurrency Markets Confront Threefold Challenges: Increased Regulatory Oversight, Shifting Corporate Strategies, and Technical Hurdles Hamper BTC Rebound

- Asian markets and crypto assets fell as Japan's BOJ policy shifts drove capital out of equities and digital currencies, with Bitcoin dropping below $82,000. - Tether defended its USDt stablecoin amid S&P's "weak" rating, citing $215B in Q3 2025 assets, but ongoing stability concerns persist in the crypto sector. - Binance faces legal challenges including a Hamas attack-related lawsuit, compounding regulatory risks for crypto exchanges amid compliance scrutiny. - Grayscale's Zcash ETF filing highlights ni

Ethereum News Update: Apeing’s 10x Presale Advantage Depends on Prompt Community Participation

- Apeing ($APEING) presale offers 10x potential gains via early whitelist access, contrasting its $0.0001 presale price with a projected $0.001 listing. - Community-driven projects like FARTCOIN and PEPE demonstrate how cultural relevance and engagement drive meme coin growth, mirroring Apeing's strategy. - Ethereum's gas improvements and XRP's institutional adoption create a favorable market backdrop, supporting speculative meme coin opportunities. - Investors are urged to assess risks despite projected 1

Deciphering the ZKsync Boom: The Impact of Vitalik's Support on Layer 2 Adoption

- Vitalik Buterin's endorsement boosted ZKsync's $ZK token by 143%, signaling growing institutional and retail confidence in ZK rollups. - The Atlas upgrade achieved 43,000 TPS with 70% lower gas fees, attracting Deutsche Bank and UBS for asset tokenization and compliance solutions. - ZKsync trails Arbitrum ($16.63B TVL) but aims to close gaps via privacy-centric design and the upcoming Fusaka upgrade targeting 30,000 TPS. - Institutional partnerships and Ethereum's ZK roadmap position ZKsync as a key play