Crypto’s Dilemma: Openness Exposes £25 Million Russian Money Laundering Operation

- UK's NCA dismantled a £25M crypto money laundering network linked to Russian entities, enabling sanctions evasion and war funding through drug trafficking proceeds. - 128 arrests and digital asset seizures were made using blockchain analytics, as the network operated a shadow bank across 28 UK locations. - Global regulators tighten crypto oversight, with Japan requiring exchange reserves post-hacks and privacy wallets balancing confidentiality with AML compliance. - Public blockchain transparency proved

The National Crime Agency (NCA) has revealed that a UK-based criminal syndicate, valued in the billions, has utilized cryptocurrency to launder money from drug trafficking and channel funds to Russian organizations, thereby aiding sanctions evasion and supporting Russia’s military activities. This investigation, named "Operation Destabilise," has led to 128 individuals being detained and the confiscation of more than £25 million in both cash and digital currencies, with authorities

Although cryptocurrencies are often seen as anonymous, the openness of public blockchains has played a vital role in exposing these criminal operations. Blockchain analytics company Chainalysis

Regulatory bodies worldwide are tightening controls. Japan’s Financial Services Agency (FSA)

The UK’s intensified enforcement highlights the ongoing conflict between crypto’s use in illegal finance and the push for regulatory oversight. As both blockchain analysis firms and government agencies enhance their monitoring abilities, criminal organizations are under greater observation. Nevertheless, the resourcefulness of offenders—such as the UK group’s creation of a covert banking system—shows the persistent game of cat and mouse between law enforcement and those seeking to evade it

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

XRP News Today: XRP Drops to $2.20 as ETF Investments Face Off Against Major Whale Sell-Offs and Derivatives Market Liquidations

- XRP fell below $2.20 despite $164M ETF inflows, showing institutional demand-price disconnection amid whale selling and derivatives liquidations. - Whale activity sold 200M XRP post-ETF launch, while RLUSD's 30-day volume surged to $3.5B, contrasting with broader crypto outflows. - Technical analysis highlights $2.20 support and $2.26 resistance, with JPMorgan forecasting $14B in XRP ETF inflows due to cross-border payment adoption. - XRP's 0.50% ETF exposure lags Bitcoin/Ethereum's 6.54%/5.5%, but deriv

Bitcoin News Update: Medium-Sized Investors Help Steady Bitcoin During ETF Outflows and Broader Economic Challenges

- Bitcoin (BTC-USD) rose above $90,000 for the first time in nearly a week, but remains down 19% month-to-date amid macroeconomic headwinds and ETF outflows. - Mid-sized holders (10–1,000 BTC) accumulated 365,000 BTC, stabilizing prices as institutional liquidity re-entered via a rare $238M ETF inflow. - Technical indicators suggest a fragile rebound, with BTC below its 365-day moving average and CryptoQuant's Bull Score Index at 20/100, signaling prolonged bearish sentiment. - Analysts highlight conflicti

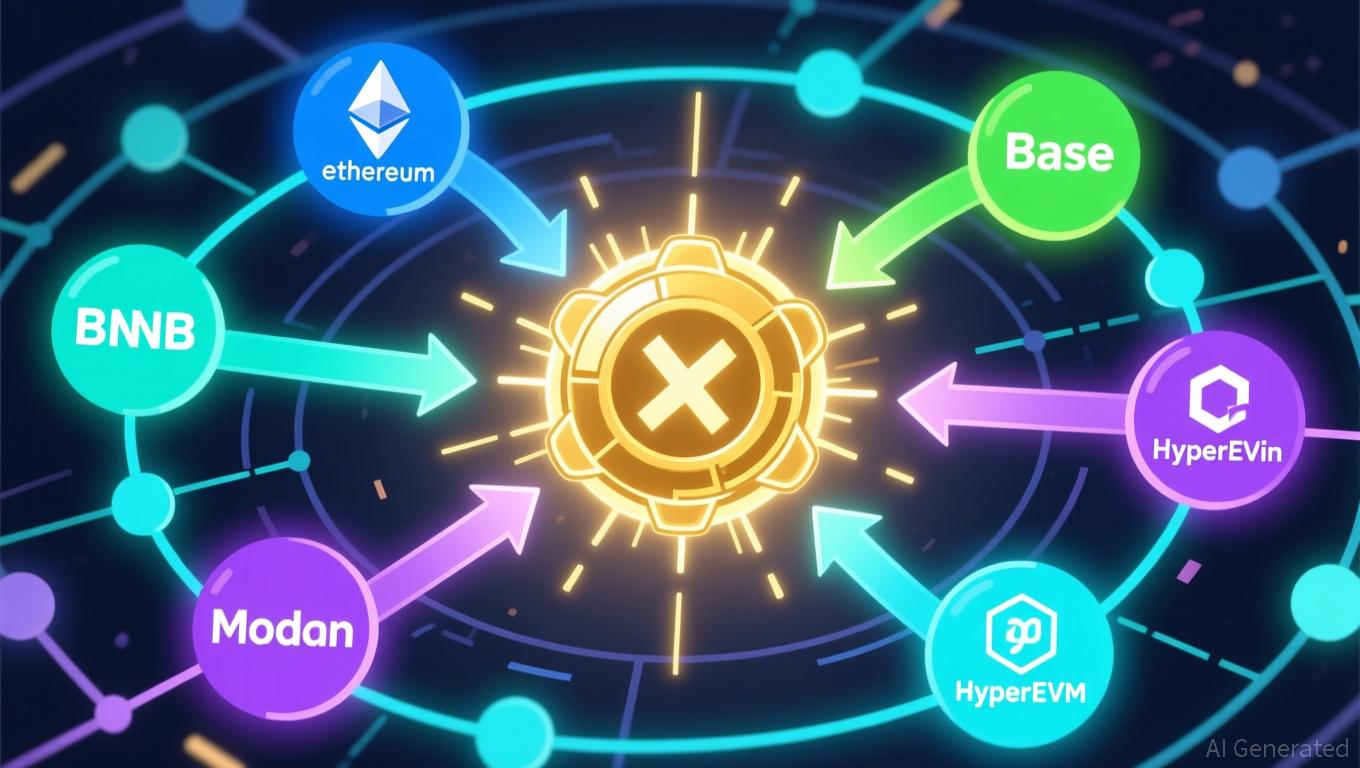

Avail’s Nexus Mainnet Brings Liquidity Together to Address Blockchain Fragmentation

- Avail launches Nexus Mainnet, a cross-chain execution layer unifying liquidity across Ethereum , BNB Chain, and other major blockchains. - The platform uses intent-based routing and multi-source liquidity aggregation to address blockchain fragmentation and inefficiencies. - Developers gain SDKs/APIs for cross-chain integration, while users benefit from simplified transactions and reduced reliance on traditional bridges. - AVAIL token coordinates the network, with future Infinity Blocks roadmap aiming to

Bitcoin News Update: Bitcoin's Plunge Signals Trump's Diminishing Influence, as Crypto Connections Weaken Amid MAGA's Downturn

- Nobel laureate Paul Krugman links Bitcoin's $1 trillion crash to Trump's waning political influence and crypto-linked wealth decline. - Trump family's crypto assets lost $1 billion in value, with Eric Trump's ABTC shares down 50% and memecoins losing 90% of peak value. - Despite losses, complex financial structures like Alt5 Sigma holdings buffer the family, while Krugman ties crypto turmoil to fractured MAGA support. - Trump's pro-crypto policies face scrutiny as Bitcoin's $40k drop undermines his econo