Expectations for a Federal Reserve rate cut rise, with an 80% probability of a rate cut in December

According to ChainCatcher, citing Golden Ten Data, investors are increasing their bets, expecting the Federal Reserve to cut interest rates again at next month's rate decision, eliminating last week's doubts and paving the way for a rise in U.S. Treasury bonds. Open interest in futures contracts linked to the Fed's benchmark rate has surged over the past three trading days, and market pricing shows there is about an 80% probability of a 25 basis point rate cut at the Fed's December meeting. This shift in expectations began with last week's delayed release of September employment data, and New York Fed President Williams stated that there is "near-term" room for rate cuts against the backdrop of a weakening labor market.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Multicoin Capital purchases another 60,000 AAVE worth $10.68 million

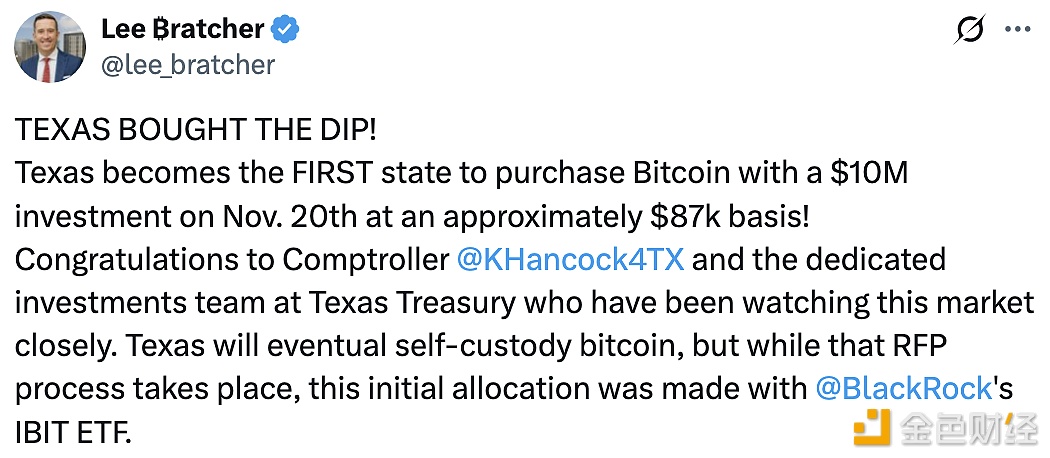

Texas invests $10 million in bitcoin at a price of around $87,000

SKALE has built an AI-oriented Layer 3 blockchain based on Base

Dell's revenue outlook far exceeds expectations, shares rise over 5% after hours