Crypto: A Surge of New Buyers Is Complicating Ethereum’s Path to $3,000

Ethereum struggles to regain height after its recent correction, oscillating below major technical levels despite the loyalty of its long-term holders. The second largest crypto market capitalization tries to revive its upward momentum, but the demand engine runs at low speed. Without new capital inflows, the recovery remains fragile, dependent on the patience of long-term investors.

In brief

- Long-term holders consolidate their positions and stabilize Ethereum after the recent correction.

- But the stagnation of new addresses and the absence of fresh capital limit the potential for upward recovery.

- As long as demand remains contained, $3,000 remains a major resistance for an already fragile market.

Ethereum: long-term holders hold the line

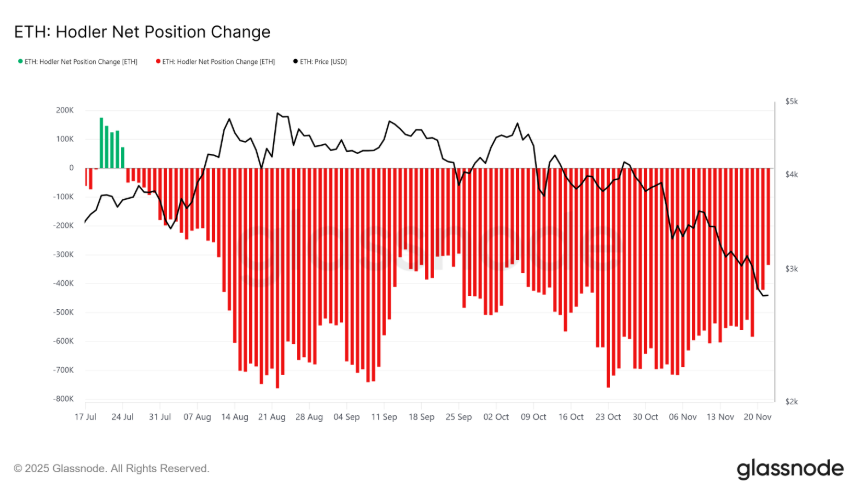

On-chain data confirms it: the HODLer Net Position Change, an indicator that measures ETH movements in long-term wallets, returns to positive territory. This signals market stabilization and a slowdown in asset outflows.

Historically, this kind of reversal often precedes an accumulation phase, a sign that confidence is returning among seasoned investors. By reducing selling pressure, these holders lay the foundation for a stronger base for the next bullish cycle.

However, this internal strength is not enough to restart the engine. The crypto market needs oxygen: that of new investors. Yet, the creation of new Ethereum addresses is stagnant, illustrating the still cautious confidence of newcomers. This inertia slows the network’s growth, preventing demand from expanding beyond the circle of the convinced.

By maintaining their positions, historical investors stabilize prices, but they alone cannot create new momentum. To turn this consolidation into a sustained recovery, the market must reconnect with a shared accumulation dynamic, where fresh capital supports existing holders.

A recovery still lacking fuel

Currently, Ethereum trades around $2,814, just below a key resistance. The symbolic $3,000 threshold is only a few percent away, but remains difficult to break without a clear rebound in demand. The market structure remains healthy, but the momentum is lacking; the trend relies more on the conviction of the old hands than on the appetite of newcomers.

In this context, the slightest weakness in inbound flows can extend the consolidation phase. If buyers are slow to return, Ethereum risks getting stuck in a neutral zone where rebound attempts quickly fade. Conversely, an improvement in volumes and a return of confidence could be enough to turn $3,000 into support, opening the way to a test towards $3,131 and beyond.

For now, the market’s message is clear: the structure holds, but the recovery lacks fuel. As long as the engine of new buyers remains slow, the road to $3,000 promises to be winding, marked by hesitations and false breakouts. Recently, the crypto treasury turned red with Ethereum falling below $3,000, increasing pressure on a market already weakened by the lack of fresh capital.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

The rise of paid communities: Information barriers are reshaping investment class disparities

How Zcash went from low-profile token to the most-searched asset in November 2025

Powell’s allies make a major statement! Is a Federal Reserve rate cut in December now highly likely again?

Economists point out that three of the most influential officials have formed a strong coalition supporting interest rate cuts, which will be difficult to shake.

The latest SOL proposal aims to reduce the inflation rate, but what are the opponents thinking?

The Solana community has proposed SIMD-0411, which would increase the inflation deceleration rate from 15% to 30%. It is expected to reduce SOL issuance by 22.3 million over the next six years and accelerate the reduction of the inflation rate to 1.5% before 2029.