Dogecoin Rally Hopes Rise After ETF Push — But the Real Fight Lies At $0.18

The Dogecoin price is trying to recover again. Its price trades near $0.14 after a small pullback, but the mood around the token has shifted over the past 24 hours. The new Dogecoin ETF listing has improved sentiment, the chart has flashed a clean reversal signal, and whales have begun to add again. Still, the

The Dogecoin price is trying to recover again. Its price trades near $0.14 after a small pullback, but the mood around the token has shifted over the past 24 hours.

The new Dogecoin ETF listing has improved sentiment, the chart has flashed a clean reversal signal, and whales have begun to add again. Still, the strongest resistance sits above a key price level, and breaking it remains the real test.

Reversal Setup Forms as Big Holders Add Again

Dogecoin triggered a classical reversal structure on the daily chart post the Grayscale ETF launch.

Between 4 November and 21 November, the price made a lower low while the Relative Strength Index (RSI), a momentum indicator, made a higher low. This bullish divergence pattern usually appears towards the end of a downtrend.

Right after this signal, Dogecoin climbed more than 15%.

Reversal Setup:

TradingView

Reversal Setup:

TradingView

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter .

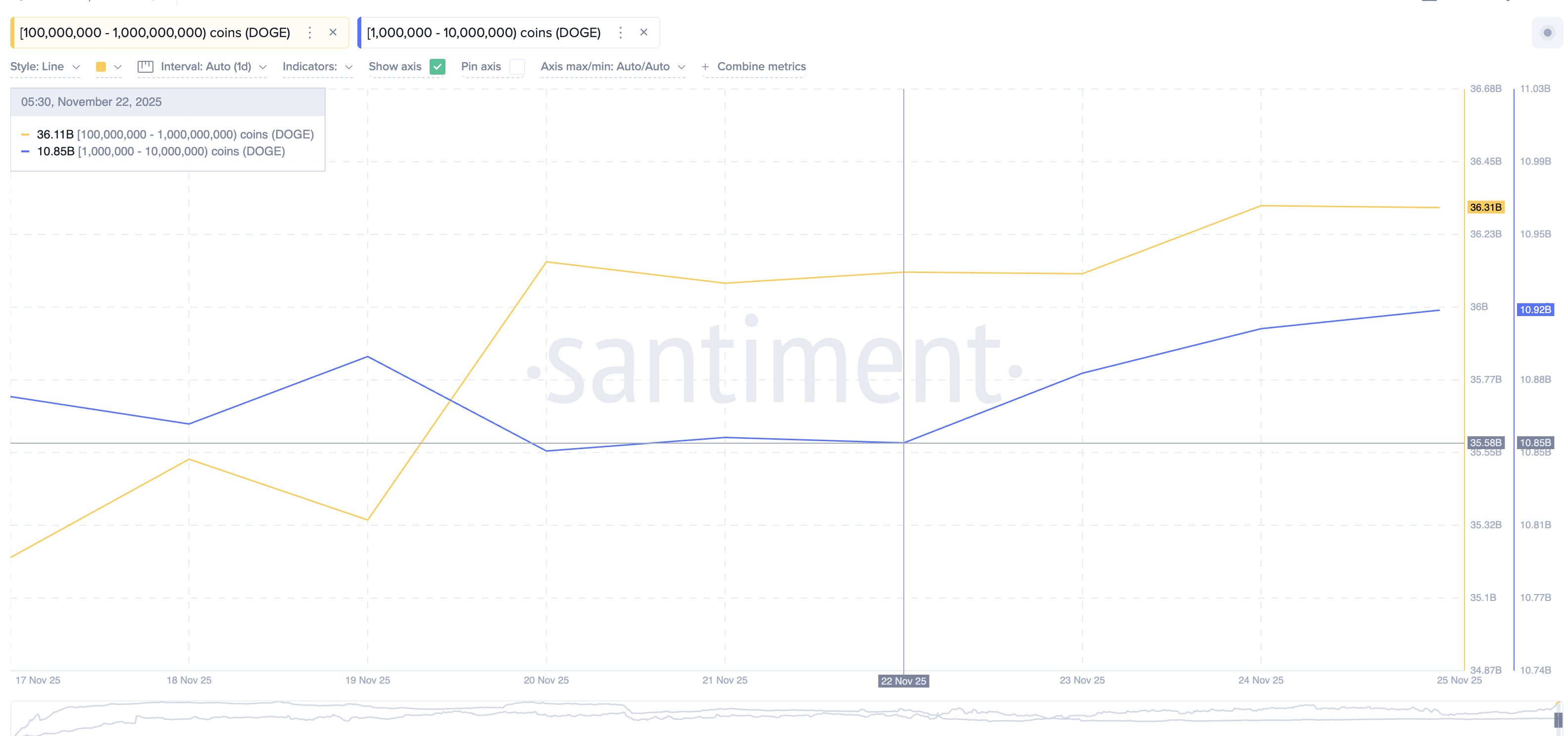

The move also aligns with fresh buying from two whale cohorts. The group holding 100 million to 1 billion DOGE increased its balance from 35.34 billion DOGE to 36.31 billion DOGE starting 19 November. A second group holding 1 million to 10 million DOGE began adding on 22 November, raising its balance from 10.85 billion DOGE to 10.92 billion DOGE.

Whales Buying Dogecoin:

Whales Buying Dogecoin:

Together, these cohorts added 1.04 billion DOGE, worth roughly $153 million, at current prices. This is the strongest accumulation in quite a while and supports the reversal structure.

Heatmap Shows the Real Battle Ahead

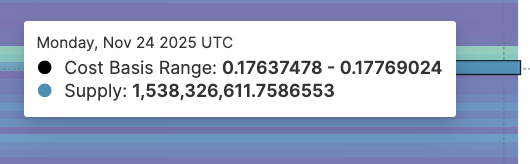

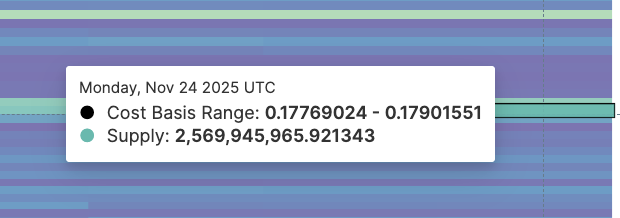

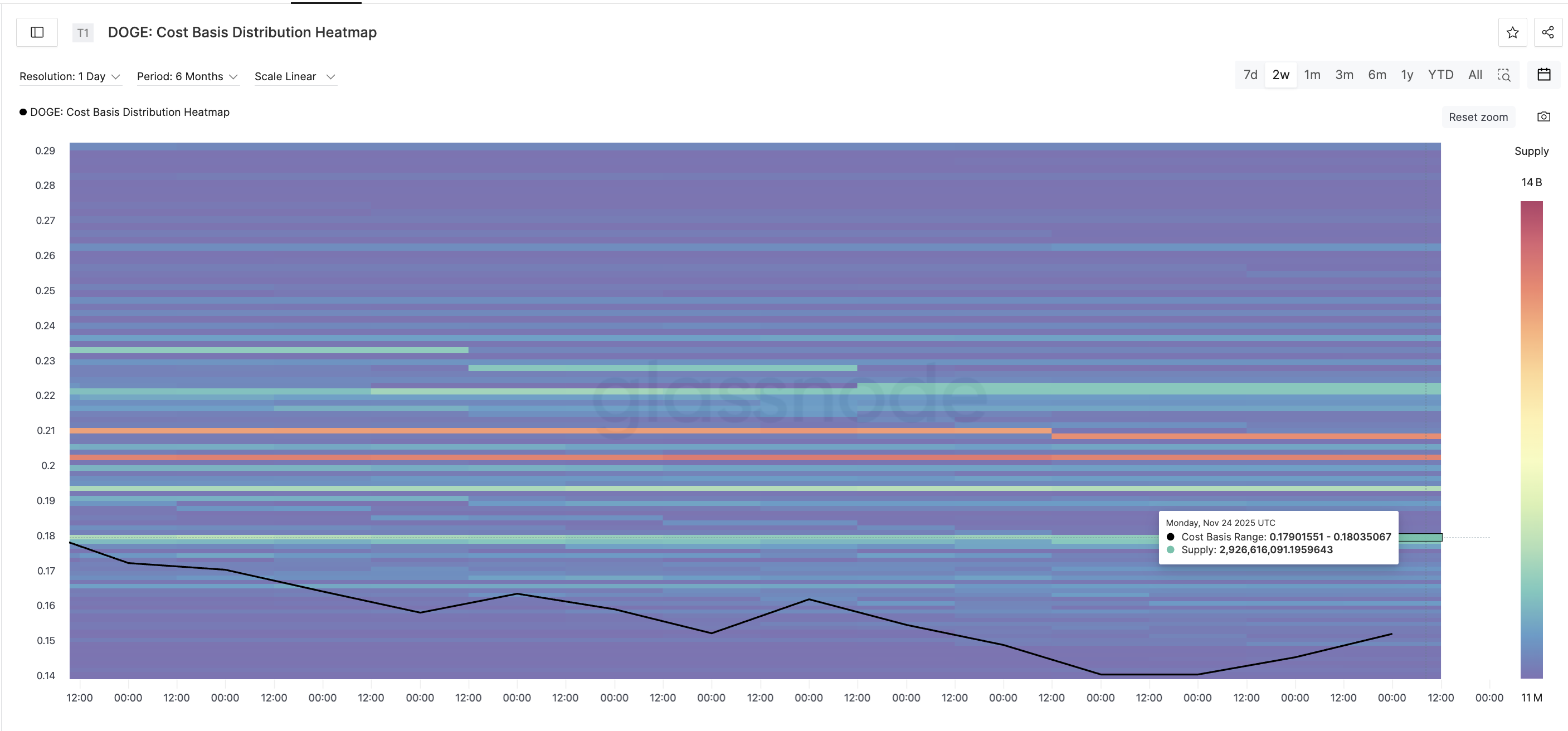

Even with the DOGE ETF boost and whale accumulation, Dogecoin now faces its largest supply block in weeks. The cost-basis heatmap shows a dense cluster of 7.03 billion DOGE between $0.17 and $0.18.

Key DOGE Cluster 1:

Key DOGE Cluster 1:

At that price, this barrier represents more than $1.20 billion worth of coins held by traders who may sell into strength.

Key DOGE Cluster 2:

Key DOGE Cluster 2:

Until Dogecoin closes above $0.18, the reversal setup and whale support cannot fully play out. And every bounce might fail if market conditions weaken.

Key DOGE Cluster 3:

Key DOGE Cluster 3:

The chart shows the real fight sits here, not in the earlier bounce.

Dogecoin Price Levels: What Confirms and What Breaks the Move

Dogecoin must reclaim $0.17 on the price chart to begin the build-up toward the $0.17–$0.18 wall. This zone is the last checkpoint before a momentum expansion.

This is the key level that has rejected every rally attempt since early November. A clean break above $0.18 opens the path toward $0.21, which aligns with the Fibonacci structure and the next major supply zone.

On the downside, the invalidation sits at $0.13. A daily close below this level breaks the reversal setup and signals that the ETP-led optimism and whale accumulation were not enough to sustain strength.

Dogecoin Price Analysis:

TradingView

Dogecoin Price Analysis:

TradingView

The Dogecoin price has a stronger setup now than it did earlier this month, but the chart is clear: the real fight, and the real confirmation of bullishness, still lies ahead.

Read the article at BeInCryptoDisclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Trump’s ACA Subsidy Proposal Weighs Financial Relief Against Concerns Over Fraud in a Delicate Political Balance

- Trump proposes extending ACA subsidies for two years, raising eligibility to 700% FPL and ending zero-premium plans to combat fraud. - The plan faces bipartisan challenges, with Senate voting in mid-December and House Republicans favoring alternative cost-cutting measures. - Analysts warn premium hikes could destabilize ACA markets, risking coverage for 22 million Americans amid partisan gridlock.

Thiel Turns to Major Defensive Tech Firms Amid Growing Concerns Over AI Bubble

- Peter Thiel's Q3 2025 portfolio reshuffling saw full exit from Nvidia and reduced Tesla holdings , shifting funds to Apple and Microsoft amid AI valuation concerns. - The $166M from sales was partially reinvested into Apple and Microsoft, leaving over $120M in cash reserves, signaling a defensive strategy shift. - Nvidia's 0.33% premarket dip and mixed market reactions highlight institutional sentiment shifts, with analysts debating Thiel's caution versus potential miscalculation. - Thiel's track record

Burnout Epidemic Pushes Companies to Address Wave of 'Revenge Resignations'

- 55% of U.S. workers report burnout, driving "revenge quitting" surge as 72% see reduced efficiency and 71% lower job performance. - Burnout disproportionately impacts Gen Z (66%) and remote workers (61%), linked to workload (50%) and poor team dynamics (50%). - Only 42% of burnt-out employees discuss struggles with managers, with half receiving no meaningful support, risking talent exodus. - Eagle Hill Consulting warns burnout threatens organizational stability, urging leaders to address root causes befo

Solana News Update: In 2025, Investors Focus on Diversifying Rather Than Speculating in Their Crypto Approaches

- Sygnum Bank's 2025 report reveals 57% of investors prioritize crypto for portfolio diversification, surpassing speculative gains as the top motive. - Crypto's low correlation with traditional assets drives its adoption as a strategic hedge against macroeconomic risks, with 70% seeking staking yield inclusion in ETFs. - High-net-worth investors allocate 10%-20% to crypto for wealth preservation, while 150+ U.S. crypto ETF applications highlight growing institutional demand. - Regulatory uncertainty (40% c