Bitkub Eyes Hong Kong IPO as Thai Market Downturn Stalls Local Listing Plans

Quick Breakdown

- Thailand’s largest crypto exchange is weighing a $200M IPO in Hong Kong.

- Volatile Thai markets and a five-year SET Index low stall the local debut.

- Hong Kong’s booming IPO scene and crypto-friendly stance attract Bitkub.

Bitkub considers overseas listing amid Thai market turmoil

Bitkub, Thailand’s largest cryptocurrency exchange, is exploring an initial public offering (IPO) abroad amid weak market conditions that continue to weigh on local investor sentiment. According to a Bloomberg report citing people familiar with the matter, the company is targeting about $200 million in a potential Hong Kong listing.

The move comes after Bitkub’s earlier plan to go public in Thailand in 2025 was put on hold due to heightened volatility and uncertainty in the domestic equities market.

Thai stock market hits five-year low in 2025

Thailand’s stock market has struggled to find stability throughout 2025 amid escalating political tensions with Cambodia and concerns over trade disruptions.

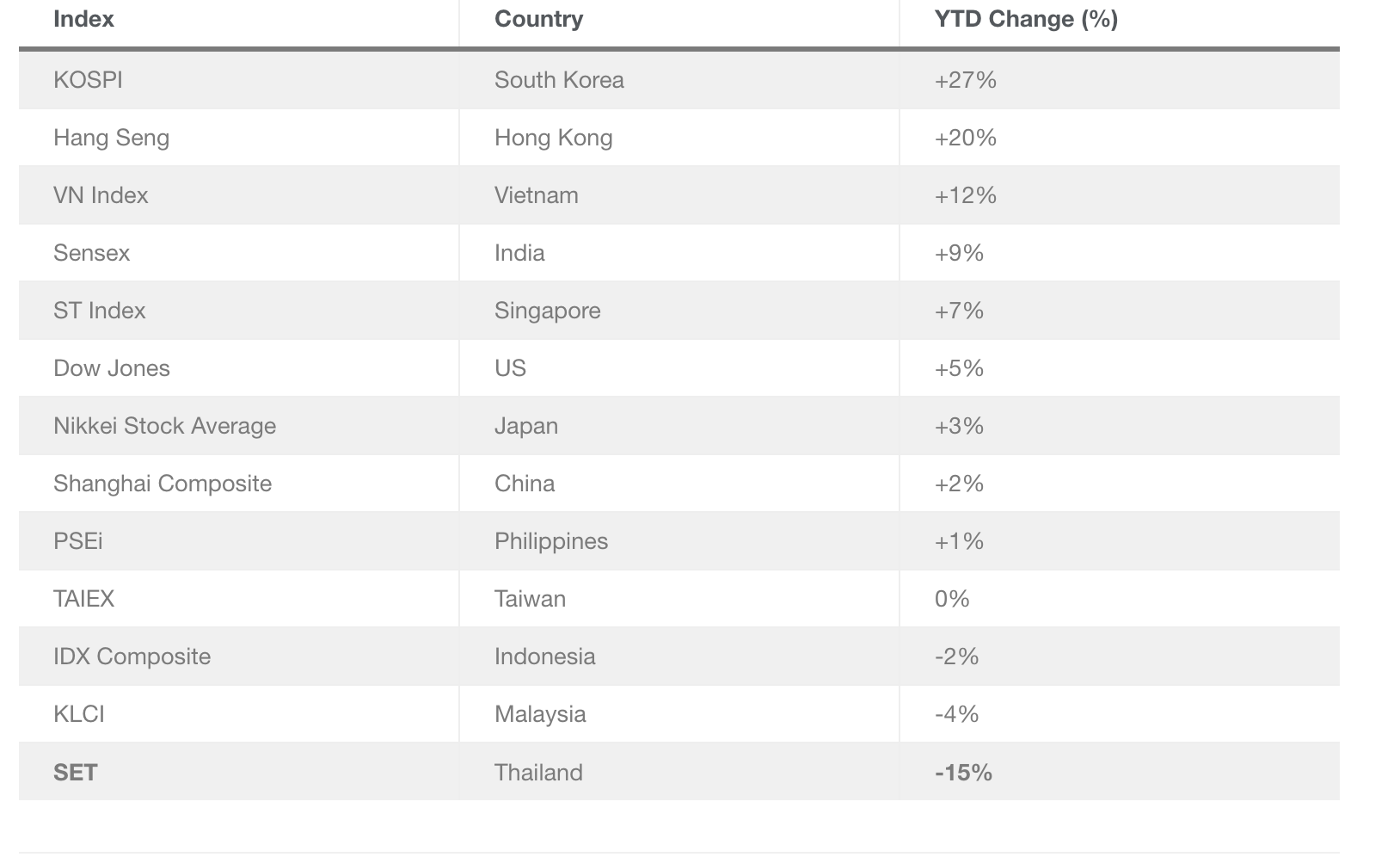

The Stock Exchange of Thailand (SET) has dropped roughly 10% this year, sliding to a five-year low in the first half of 2025, one of the weakest performances in Asia.

Source

:

Thailand Business News

Source

:

Thailand Business News

Even after two months of modest recovery, foreign investors remained net sellers, offloading more than 100 billion baht (about $3 billion) in equities during the first 10 months of the year.

This contrasts sharply with broader regional performance: major Asian markets, including South Korea and Hong Kong, saw gains of 27% and 20%, respectively, over the same period.

Hong Kong’s IPO boom draws global crypto firms

For Bitkub, Hong Kong’s surging IPO ecosystem presents a more attractive path. The Hong Kong Stock Exchange reported raising HK$216 billion (around $27.8 billion) from IPOs between January and October 2025, a massive 209% jump from the previous year.

The city has quickly become a hotbed for digital asset companies. Bitcoin Depot, the world’s largest Bitcoin ATM operator, is among the notable crypto firms expanding into the region.

In October, local crypto heavyweight HashKey Group also filed for a public listing, aiming to raise $500 million ahead of a planned 2026 debut, potentially one of the first local crypto IPOs.

Take control of your crypto portfolio with MARKETS PRO, DeFi Planet’s suite of analytics tools.”

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Ethereum News Update: Ethereum Faces $2,500 Threshold—Beginning of a Supercycle or Start of a Major Sell-Off?

- Tom Lee predicts Ethereum's $2,500 support level could trigger a buying frenzy, framing it as a structural inflection point after systematic liquidation. - BitMine's 3.63M ETH holdings and recent $20M WorldCoin investment signal institutional confidence in Ethereum's long-term tokenization potential. - While Dencun upgrades and staking yields bolster fundamentals, macro risks and $1,500 downside remain concerns amid volatile $2,900-$3,115 near-term price action.

Bitcoin Updates: Blockrise's Bitcoin Lending Reflects Growing Institutional Confidence in Regulated Digital Asset Finance

- Blockrise, a Dutch Bitcoin-only firm, launched €20,000 crypto-backed loans after securing EU MiCA regulatory approval, enabling cross-border EU operations. - The service targets corporate clients, allowing Bitcoin collateralization while retaining asset ownership, with 8% interest rates adjusted monthly. - Its semi-custodial model uses hardware-secured vaults and joint transaction authorization, managing €100M in client assets under this structure. - The move aligns with rising institutional demand for B

XRP News Today: XRP's Role in International Transactions Strengthens as ETFs Spark Institutional Movement

- XRP's price nears $2.30 threshold amid ETF-driven institutional interest, with Canary Capital's XRPC ETF attracting $13M net inflows despite broader crypto outflows. - Technical analysis highlights fragile support at $2.03 and critical resistance at $2.45, with breakdowns risking a slide to $1.50 while breakouts could trigger bullish momentum. - XRP's real-world utility gains traction via SWIFT GPI integration, demonstrating cross-border payment efficiency that differentiates it from speculative altcoins

Bitcoin Updates: Tether Faces Scrutiny Over Stability—S&P Issues Caution While Crypto Community Responds

- S&P Global Ratings downgraded Tether's USDT to "weak," citing high-risk Bitcoin exposure and reserve transparency concerns. - Tether criticized the rating as "misleading," defending its 1:1 dollar peg and $135B Treasury holdings as evidence of stability. - The downgrade highlights regulatory tensions as USDT faces scrutiny under new laws requiring stablecoins to be fully backed by low-risk assets. - Despite risks, USDT maintains $184B market cap and $76B daily volume, underscoring its critical role in cr