"Five simultaneous shocks" hit! The logic behind this round of bitcoin's plunge is completely different from the past

The investment logic of bitcoin is changing, and the importance of risk management has been brought to an unprecedented level.

The investment logic of bitcoin has shifted, and the importance of risk management has been elevated to an unprecedented level.

Written by: Bao Yilong

Source: Wallstreetcn

Deutsche Bank believes that the logic behind bitcoin's recent plunge has fundamentally changed.

According to Chasing Wind Trading Desk, on November 24, Deutsche Bank released a research report stating that, unlike previous crashes mainly driven by retail speculation, this round of bitcoin's correction and decline is the result of a "fivefold shock"—macroeconomic headwinds, hawkish signals from the Federal Reserve, stalled regulatory progress, institutional capital outflows, and long-term holders taking profits.

Data shows that bitcoin has plummeted nearly 35% from its early October peak of about $125,000 to around $80,000, causing the total crypto market capitalization to evaporate by about $1 trillion. This round of correction is no longer a single event within the crypto space, but rather a concentrated manifestation of bitcoin's risk asset attributes as it becomes increasingly integrated into the global macro-financial system.

The research report emphasizes that the correlation between bitcoin and tech stocks has increased significantly, and its "digital gold" safe-haven narrative is facing a severe test in the current environment. This suggests that the investment logic of bitcoin is undergoing a fundamental transformation, and the importance of risk management has reached an unprecedented height.

Shock One: High Correlation Between Bitcoin and Tech Stocks

This bitcoin decline occurred in sync with the drop in US stocks and other risk assets, indicating that its function as a defensive hedging tool has not yet been established.

(Bitcoin market cap was the first to decline among various risk assets)

Deutsche Bank points out that as the US government faces shutdown, global trade tensions reignite, and concerns about AI-related valuations grow, bitcoin's price movement during the US stock market downturn has resembled that of a high-growth tech stock, rather than an independent store of value.

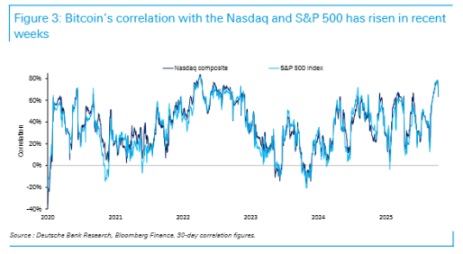

Data shows that so far in 2025, bitcoin's daily correlation with the Nasdaq 100 index has reached 46%, and its correlation with the S&P 500 index has risen to 42%.

(In recent weeks, the correlation between bitcoin and the Nasdaq and S&P 500 indices has increased)

These two correlations have surged in recent weeks, reaching levels similar to those during the market stress of the 2022 COVID-19 pandemic. As bitcoin trades around the clock and has a higher beta coefficient, it often leads the S&P 500 index in its movements.

In contrast, traditional safe-haven assets such as gold and US Treasuries have performed well recently.

For example, on October 10, after the Trump administration issued tariff threats, bitcoin fell 5.6%, while gold rose 1.03%, and the yield on 10-year US Treasuries increased by 10.6 basis points.

Although gold has fallen more than 3% from its mid-October peak and the 10-year US Treasury yield has risen about 11 basis points since October 22 (from 3.95%), both have still outperformed bitcoin.

Shock Two: Monetary Policy Uncertainty Intensifies Sell-off

Market uncertainty over the Federal Reserve's monetary policy path is another key driver of bitcoin's decline.

The report highlights the strong negative correlation between bitcoin prices and Federal Reserve interest rates.

For example, during the Fed's rate hike cycle in 2022, the correlation reached as high as -90%; during the rate cut cycle in 2020, the correlation was -27%, with rate cuts boosting bitcoin prices.

Previously, in October, although the Fed cut rates by 25 basis points, when Chairman Powell stated that "a further rate cut in December is not a foregone conclusion, far from it," bitcoin prices plunged.

Soon after, on November 4, Fed Governor Cook again said there was no guarantee of a rate cut in December, and bitcoin immediately fell by more than 6%.

So far this year, the correlation between bitcoin returns and Fed interest rates is -13%. This clearly shows that any signal of tightening monetary policy or pausing easing will directly hit the liquidity-dependent bitcoin market.

Shock Three: Key Regulatory Legislation Stalled

In July, the US House of Representatives approved the bipartisan Digital Asset Market CLARITY Act, which set a framework for digital asset classification and established the Commodity Futures Trading Commission (CFTC) as the main industry regulator, sparking a broad crypto rally.

However, the momentum since summer has stalled.

The report notes that Republican Senator Tim Scott recently stated that, due to the previous prolonged US government shutdown and bipartisan disagreements over decentralized finance (DeFi) identity verification and anti-money laundering controls, the bill will not be signed by the Senate before 2026.

The stagnation of regulatory momentum has directly hindered the integration of bitcoin into investment portfolios and the deepening of liquidity.

Report data shows that as regulatory expectations cool, bitcoin's volatility has rebounded from a low of 20% in August to 39%.

At the same time, Deutsche Bank data shows that market adoption has stalled, with the usage rate of US retail crypto users dropping from 17% in July to 15% in October. Google Trends data also shows that global interest in bitcoin is waning.

(Trends in global search popularity for bitcoin)

Shock Four: Institutional Capital Outflows and Liquidity Drought

In this round of decline, liquidity exhaustion and institutional capital outflows have formed a vicious cycle.

The sell-off on October 10 is a typical example. According to Kaiko Research, the order book depth on major crypto exchanges dropped sharply that day, and sell-side liquidity even disappeared for several minutes.

This liquidity gap amplified the impact of the price drop and weakened market makers' willingness to provide liquidity.

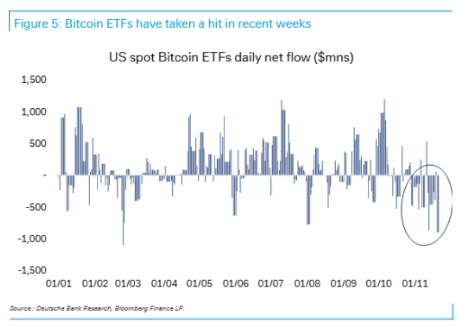

In contrast to earlier this year, when spot bitcoin ETFs attracted billions of dollars in inflows and supported market liquidity, the recent sell-off has triggered massive institutional capital outflows.

Bloomberg data shows that US spot bitcoin ETFs have recently seen large single-day net outflows. This institutional withdrawal has further intensified market selling pressure and liquidity stress, causing the total crypto market capitalization to shrink by about 24% since the October high, more than $1 trillion.

(Bitcoin ETFs have performed poorly in recent weeks)

Shock Five: Long-term Holders Take Profits

Unlike previous crypto crashes mainly driven by newcomers or leveraged traders, this correction saw long-term bitcoin holders taking profits.

The research report cites blockchain data showing that long-term holders sold more than 800,000 bitcoins in the past month, the highest level since January 2024.

Earlier this year, many long-term investors had been accumulating or holding bitcoin to weather volatility, supporting supply-demand dynamics. Glassnode data shows that as prices fell, multi-year holders reduced their positions, increasing circulating supply.

Meanwhile, rising bitcoin volatility and a broader crypto market downturn have kept many traders in a defensive stance.

The Crypto Fear & Greed Index fell to 11 on November 21, the lowest level this year. Although bitcoin is becoming more mature, the recent pullback has been enough to prompt even long-term holders to reduce risk, reinforcing the recent bearish momentum.

Bitcoin's 30-day volatility has climbed again, now reaching 39%, though it is still far from 2020 levels. The forced liquidation of leveraged trades discussed by market participants during the sell-off has also exacerbated bearish sentiment.

(Bitcoin's 30-day volatility is rising again, but still far from 2020 levels)

Conclusion: A New Type of Correction With Institutional Participation

Deutsche Bank believes it is still uncertain whether bitcoin can stabilize after this correction. Looking ahead, the inclusion of bitcoin in mainstream investment portfolios may continue in stages.

Recent regulatory reforms targeting crypto market structure are expected to bring a clearer policy framework, thereby boosting institutional investor confidence. At the same time, the adoption of stablecoins by large financial institutions is also expected to enhance overall market liquidity.

In addition, governments and central banks around the world are showing increasing interest in digital currencies. For example, recent initiatives launched by Luxembourg and the Czech Republic demonstrate that official participation in the crypto market is on the rise.

However, the research report emphasizes that uncertainty and leverage effects may intensify bitcoin price volatility, so as the crypto market develops, it is crucial to implement strict risk management measures.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

HIP-3 projects are transforming the Hyperliquid ecosystem

U.S. stocks, Pokémon cards, CS skins, pre-IPO companies—a diversified, all-weather liquidity capital market.

Crypto Market at a Crossroads: Top KOLs Debate Rebound vs. Reversal

The rise of paid communities: Information barriers are reshaping investment class disparities

How Zcash went from low-profile token to the most-searched asset in November 2025