Solana shows early signs of bounce: $131 support holds line

Solana price is flashing a daily bullish divergence while holding key support at $131, suggesting early signs of strength and the possibility of a short-term reversal toward higher resistance levels.

- Momentum shift emerges as Solana steadies at a long-tested support zone

- Market behavior reflects early accumulation after extended sell pressure

- Divergence hints that downside exhaustion may be forming beneath recent lows

Solana’s ( SOL ) latest price action is showing encouraging signals after an extended period of downside pressure. A clear bullish divergence has formed on the daily chart, hinting that momentum may be shifting back toward buyers.

With price holding a major support level and several indicators showing alignment, and with Wormhole’s new Sunrise DeFi platform launching on Solana and debuting Monad’s MON as its first listing, the current structure suggests that Solana may be preparing for a relief move.

Solana price key technical points

- Daily bullish divergence forming between price and RSI

- Major support at $131 continues to act as a reaction zone

- Key resistance lies at the value area low and later at $167

SOLUSDT (1D) Chart, Source: TradingView

SOLUSDT (1D) Chart, Source: TradingView

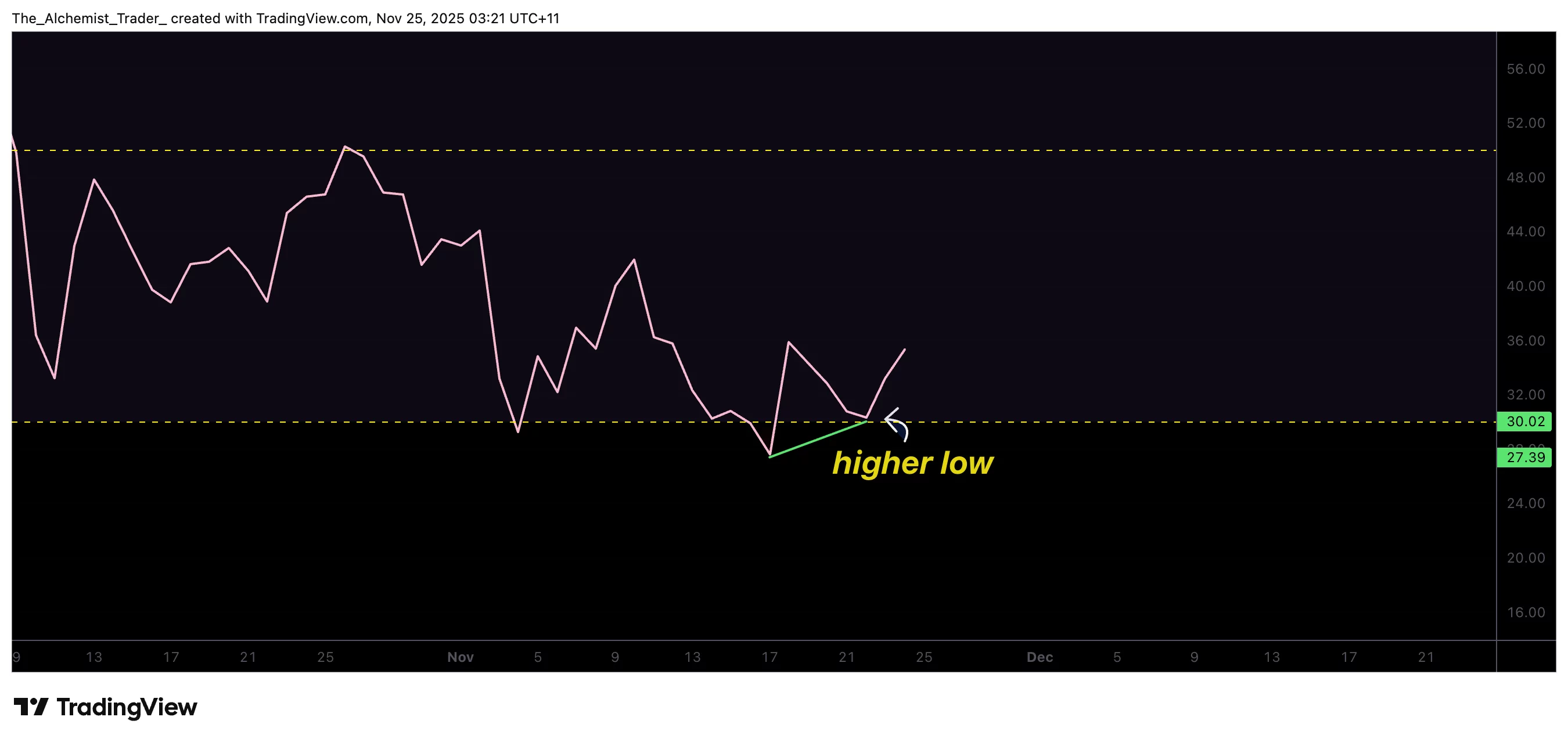

Solana is currently printing one of the most reliable early-reversal signals in technical analysis: a bullish divergence on the daily time frame. While price has recently formed a lower low, the RSI has created a higher low. This separation between momentum and price often suggests that sellers are losing strength even as price continues drifting downward.

Solana RSI, Source: TradingView

Solana RSI, Source: TradingView

The $131 region has become a focal point in recent sessions. This area has held as support multiple times, with price hovering above it for several days. Such behavior typically indicates the market is entering an accumulation phase where buyers absorb selling pressure before attempting a shift in direction.

If this support continues to hold, the next key level to watch is the value area low. Reclaiming this region would signal that buying pressure is returning, and that Solana may be preparing for a rotation toward the next significant resistance at $167. This level aligns with high-time-frame resistance and has historically acted as a significant decision point for trend continuation or rejection.

With new Solana ETFs from Grayscale and VanEck launching amid rising volatility, market flows may also help shape how the price reacts at this key level.

Price action and momentum indicators are now converging, suggesting a short-term reversal is becoming more likely. Bullish divergences often appear at the end of aggressive sell-offs, and Solana’s recent behavior fits this pattern. While confirmation is still pending, early signals suggest a potential shift in market sentiment.

Price action

If Solana maintains support at $131 and activates the bullish divergence, a move toward $167 may follow. A loss of support would delay the reversal and return the asset to a bearish continuation phase.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Stablecoin Market Exceeds $280B as ECB Warns of Potential Systemic Risks

- Stablecoin market exceeds $280B, driven by regulatory clarity and institutional adoption, capturing 8% of crypto assets. - ECB warns of systemic risks from stablecoin concentration, de-pegging events, and mass redemption "runs" threatening global markets. - USDC overtakes USDT in onchain activity due to regulatory alignment, with Circle's market cap rising 72% YTD to $74B. - ECB calls for global regulatory coordination to address cross-border arbitrage gaps and prevent destabilizing retail deposit shifts

Bitcoin News Update: MicroStrategy Faces an Identity Dilemma—Is It a Technology Company or a Bitcoin Holding Entity?

- MicroStrategy faces potential MSCI index reclassification as a Bitcoin investment vehicle, risking $8.8B in passive fund outflows. - The debate centers on whether crypto-heavy firms should be classified as operating businesses or passive funds, impacting capital access and valuation. - CEO Michael Saylor defends MSTR as a "structured finance company," leveraging Bitcoin-backed securities to differentiate from passive vehicles. - Compressed stock-to-NAV multiples and Bitcoin's price slump threaten MSTR's

Japan Sets Out to Rebuild Investor Confidence in Crypto Following Significant Security Breaches

- Japan's FSA will mandate crypto exchanges to hold liability reserves proportional to trading volumes and security risks, modeled after traditional securities safeguards. - The reform responds to major breaches like the 2024 DMM Bitcoin hack ($312M stolen) and allows exchanges to offset reserve costs via insurance policies. - New rules require segregating user funds from corporate assets and reclassify crypto as securities under the Financial Instruments Act to enable investment products. - Experts view t

Bitcoin News Today: Bitcoin's Rebound Fails to Ease Crypto's Liquidity Crunch

- Bitcoin's $80,000 rebound failed to reverse crypto's liquidity crisis as structural risks deepen amid macroeconomic pressures and thinning market liquidity. - Total crypto market cap fell below $3 trillion with $950M+ liquidations, while Bitcoin's dominance dropped below 49% as capital rotated into altcoins like HBAR and HYPE. - Institutional divergence emerged: spot ETFs saw $1.38B redemptions while on-chain accumulators added 42,000 BTC, contrasting with long-term investors offloading ~42,000 BTC this