- PEPE trades near $0.054056 after a 7-day decline of 18.2%, keeping the price close to its short-term support at $0.053979.

- The token moves within a tight 24-hour range between $0.053979 and $0.054295, showing reduced volatility in recent sessions.

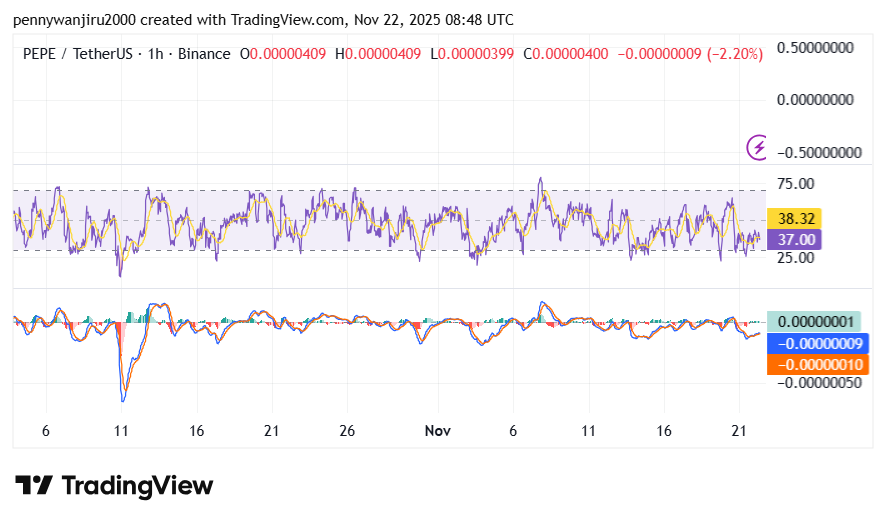

- Hourly indicators remain stable, with RSI near 38, while the asset’s BTC and ETH values show similar weekly declines.

PEPE was still trading inside a small intraday range as the market stood close to its short maintenance zone. The token moved at approximately $0.054056 with a loss of 18.2 percent in the last seven days and this kept the asset near the lower end of its recent price range. The chart has shown that there is constant movement within a lengthy span of horizontal movement and the hourly indicators are moving within a narrow range.

This placed more focus on the token’s next movements, especially as the market hovered near the $0.053979 support. The current position also aligned with a limited 24-hour range, creating a compact structure for traders tracking short-term levels.

Price Holds Tight Range as Indicators Stay Neutral

The hourly chart revealed PEPE fluctuating between $0.053979 and $0.054295 which revealed a decreased volatility in the last few sessions. It is worth noting that the RSI remained close to 38, indicating that there were no sudden fluctuations.

This consistent range appeared throughout most of November, as the chart showed repeated oscillations inside the same band. However, the price remained slightly above the key support, keeping focus on the lower threshold. The next section expands on how the asset’s broader structure aligns with these patterns.

Consistent Fluctuations Mark Recent Market Behavior

The chart reflected repeated moves inside the same horizontal channel, with short bursts of momentum followed by quick reversals. Such movements maintained the price stable but narrow and the MACD showed short dips and then got back to the neutral ground.

Source: TradingView

Source: TradingView

Moreover, the RSI was trading at 38.32 showing the market is in oversold territory. These measures were directly related to the shrinkage of the range of the market, which was preserved over several sessions. The last part discusses the role of these levels in informing the subsequent possible actions of the asset.

Support Zone Draws Market Attention Ahead of Next Move

PEPE continued to hold just above $0.053979, which acted as the main support in the current range. This level guided short-term monitoring as price action maintained its narrow structure. The asset remained close to the upper boundary at $0.054295, although the market did not break through it during the latest movements. This kept all attention on the balance between resistance and support as the chart held steady near these defined thresholds.