Fed Rate-Cut Odds Reach 71%, but Bitcoin Could Drop Further — Here’s Why

Bitcoin (BTC) has increased nearly 8% since last Friday, bouncing back from recent lows near $80,500. This rally comes as market odds for a Fed rate cut in December jumped. The recovery aligns with capitulation among short-term holders and one of Bitcoin’s largest-ever exchange outflow spikes, raising the market’s hope of a continued recovery. Despite

Bitcoin (BTC) has increased nearly 8% since last Friday, bouncing back from recent lows near $80,500. This rally comes as market odds for a Fed rate cut in December jumped.

The recovery aligns with capitulation among short-term holders and one of Bitcoin’s largest-ever exchange outflow spikes, raising the market’s hope of a continued recovery. Despite this, some analysts warn of an impending correction.

Market Confidence Builds Around Monetary Policy Shift

Bitcoin’s predominant downtrend since early October has continued to pull it to multi-month lows. On November 21, the coin dropped as low as $80,522. This price level was last seen in late April.

However, BTC appears to show a modest recovery. According to BeInCrypto Markets data, BTC traded at $86,947 at the time of writing, up 1.07% over the past day.

Bitcoin (BTC) Price Performance. Source:

BeInCrypto Markets

Bitcoin (BTC) Price Performance. Source:

BeInCrypto Markets

Capriole Fund founder Charles Edwards noted that much of the volatility in tech stocks, and thereby Bitcoin, stems from the market’s constant shift in expectations for a rate cut.

At the start of November, markets priced in a 90% chance of a December rate cut. Those odds later fell to 30%, but have since rebounded to over 70%. Edwards said that,

“As the market reverts, expect it will carry Bitcoin somewhat higher.”

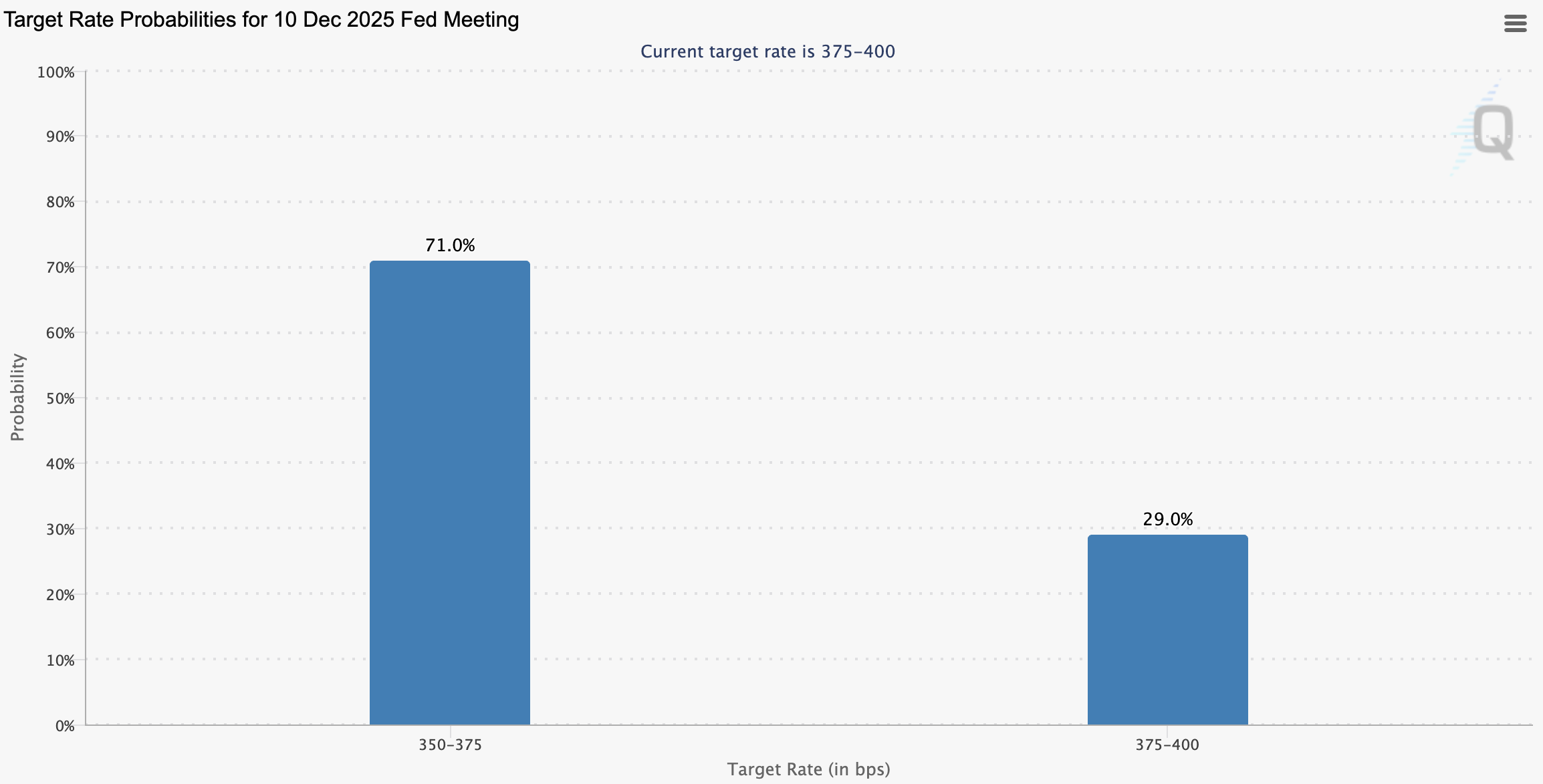

According to the CME FedWatch Tool, market participants are now pricing in a 71% chance of another 25-basis-point cut at the Fed’s December 10 meeting. This comes after the Fed lowered rates by 25 basis points in October to a range of 3.75% to 4.00%, marking its second reduction of 2025.

Odds of a Fed Rate Cut in December. Source:

CME FedWatch Tool

Odds of a Fed Rate Cut in December. Source:

CME FedWatch Tool

Importantly, the central bank also announced that it will end quantitative tightening on December 1, 2025. Together, these signals indicate rising liquidity and lower borrowing costs, a combination that strengthens demand for risk assets, particularly Bitcoin.

Bitcoin Shows Signs of Approaching a Market Turning Point

Beyond macroeconomic forces, on-chain data also suggests that Bitcoin may be nearing a potential bottom. Analyst Quinten François noted a surge in BTC being moved off exchanges, typically seen as a positive sign for market sentiment.

“Exchange outflows just printed one of the largest spikes in history. Every major outflow event on this chart marked the start of a huge leg up,” François wrote.

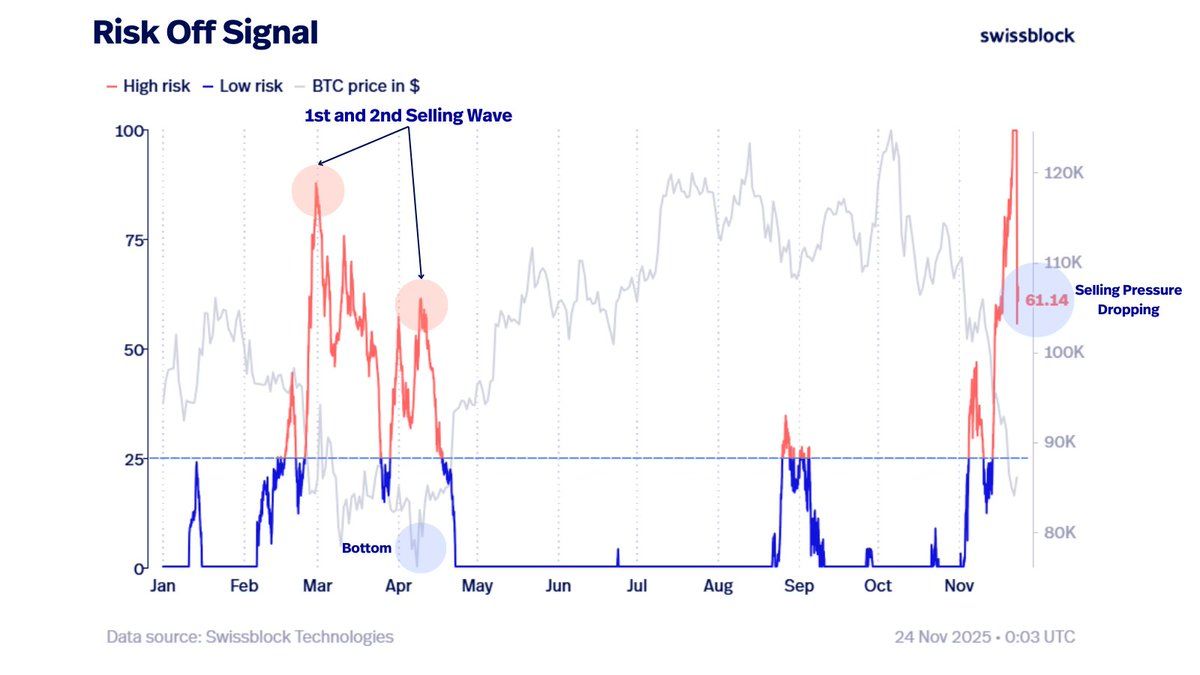

Swissblock Technologies has also identified a shift in its Risk-Off Signal. The indicator has fallen noticeably, suggesting the worst of the capitulation is ending. This supports the argument that Bitcoin is in the early stages of forming a new bottom.

“If we use Risk-Off as a bottoming guide, this next week becomes critical. We need to see selling pressure continue to fade. Often, a second selling wave (weaker than the first and with price holding the previous lows) becomes one of the most reliable bottom signals. That second wave usually marks seller exhaustion and a shift in control back toward the bulls,” the post read.

Bitcoin Risk-Off Signal. Source:

X/Swissblock

Bitcoin Risk-Off Signal. Source:

X/Swissblock

Another analyst highlighted a clear divergence between long-term and short-term Bitcoin holders. According to Binary CDD, long-term holders quietly distributed coins during periods of market strength, with activity spikes aligning with local or macro cycle tops. This suggests profit-taking began well before the market correction.

Meanwhile, short-term holders have entered a phase of deep capitulation. SOPR readings indicate that these investors have been selling at sustained losses, forming a pronounced capitulation band below 1.0.

“Although this does not imply an immediate reversal, the cleansing of weak hands and the absorption seen around the lower accumulation zone suggest that the market is transitioning into a potential accumulation phase,” he stated.

This combination of smart-money distribution at the top and retail capitulation at the bottom typically signals the later stages of a correction. Nonetheless, analyst CryptoDan pointed out that,

“When looking at the broader picture through the combined long- and short-term SOPR, the current movement can be interpreted in exactly two ways: ‘If the current zone is a correction phase → this is the bottom.’ ‘If the current zone is a bear cycle → the end of the decline is still far away.’ For now, we need to keep both possibilities open and respond accordingly.”

Why Bitcoin Could See Another Correction

Amid these cautiously optimistic on-chain signals, analysts warn that Bitcoin may still face heightened volatility in the short term. Crypto Rover emphasized that the open CME gap created over the weekend remains unfilled. He added that nearly all CME gaps over the past five months have been closed, with 95% filled within seven days.

$BTC has a CME gap around the $85,300 level.Most of the CME gaps are filled within a week, so be prepared for a correction.

— Ash Crypto (@AshCrypto) November 24, 2025

Meanwhile, analyst Ted Pillows cautioned that if Bitcoin fails to reclaim the $88,000–$90,000 range soon, the price could slide toward a new monthly low.

Thus, while Bitcoin shows early signs of stabilization supported by improving macro conditions and encouraging on-chain trends, the market is not out of the woods yet. A recovery remains possible, but key resistance levels and the unfilled CME gap leave room for another short-term correction.

Read the article at BeInCryptoDisclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Stablecoin Market Exceeds $280B as ECB Warns of Potential Systemic Risks

- Stablecoin market exceeds $280B, driven by regulatory clarity and institutional adoption, capturing 8% of crypto assets. - ECB warns of systemic risks from stablecoin concentration, de-pegging events, and mass redemption "runs" threatening global markets. - USDC overtakes USDT in onchain activity due to regulatory alignment, with Circle's market cap rising 72% YTD to $74B. - ECB calls for global regulatory coordination to address cross-border arbitrage gaps and prevent destabilizing retail deposit shifts

Bitcoin News Update: MicroStrategy Faces an Identity Dilemma—Is It a Technology Company or a Bitcoin Holding Entity?

- MicroStrategy faces potential MSCI index reclassification as a Bitcoin investment vehicle, risking $8.8B in passive fund outflows. - The debate centers on whether crypto-heavy firms should be classified as operating businesses or passive funds, impacting capital access and valuation. - CEO Michael Saylor defends MSTR as a "structured finance company," leveraging Bitcoin-backed securities to differentiate from passive vehicles. - Compressed stock-to-NAV multiples and Bitcoin's price slump threaten MSTR's

Japan Sets Out to Rebuild Investor Confidence in Crypto Following Significant Security Breaches

- Japan's FSA will mandate crypto exchanges to hold liability reserves proportional to trading volumes and security risks, modeled after traditional securities safeguards. - The reform responds to major breaches like the 2024 DMM Bitcoin hack ($312M stolen) and allows exchanges to offset reserve costs via insurance policies. - New rules require segregating user funds from corporate assets and reclassify crypto as securities under the Financial Instruments Act to enable investment products. - Experts view t

Bitcoin News Today: Bitcoin's Rebound Fails to Ease Crypto's Liquidity Crunch

- Bitcoin's $80,000 rebound failed to reverse crypto's liquidity crisis as structural risks deepen amid macroeconomic pressures and thinning market liquidity. - Total crypto market cap fell below $3 trillion with $950M+ liquidations, while Bitcoin's dominance dropped below 49% as capital rotated into altcoins like HBAR and HYPE. - Institutional divergence emerged: spot ETFs saw $1.38B redemptions while on-chain accumulators added 42,000 BTC, contrasting with long-term investors offloading ~42,000 BTC this