Polish Crypto Influencer Says the Supercycle Is Dead, Bitcoin Is Back in a Classic Bear Market

Bitcoin is once again at the center of discussions about market cyclicality, and Polish crypto influencer Phil Konieczny argues that the current declines fit perfectly into his previous forecasts. He emphasizes that Bitcoin is behaving according to a historical pattern, and the market realized too late that the bull market was over. According to him,

Bitcoin is once again at the center of discussions about market cyclicality, and Polish crypto influencer Phil Konieczny argues that the current declines fit perfectly into his previous forecasts.

He emphasizes that Bitcoin is behaving according to a historical pattern, and the market realized too late that the bull market was over. According to him, the current bear market is a natural part of the cycle and should not be ignored.

The cryptocurrency market is going through a difficult phase, but in Phil’s opinion everything is going exactly as it should.

Bitcoin in a Bear Market

Phil Konieczny starts his video from the statement that the current market behaves in a textbook way when it comes to 4-year cycles. He claims that Bitcoin, which trades for around $85,000 today, follows a pattern already seen several times.

In the next part, he emphasizes that historical peaks have occurred earlier each time. Phil explains that in 2017 the peak came in December, in 2021 it arrived in November, and the current peak appeared in October. In his view, these data points confirm the market’s cyclicality.

He also notes that Bitcoin is now entering a natural downward phase. He adds that many people ignored the signals, although they were visible.

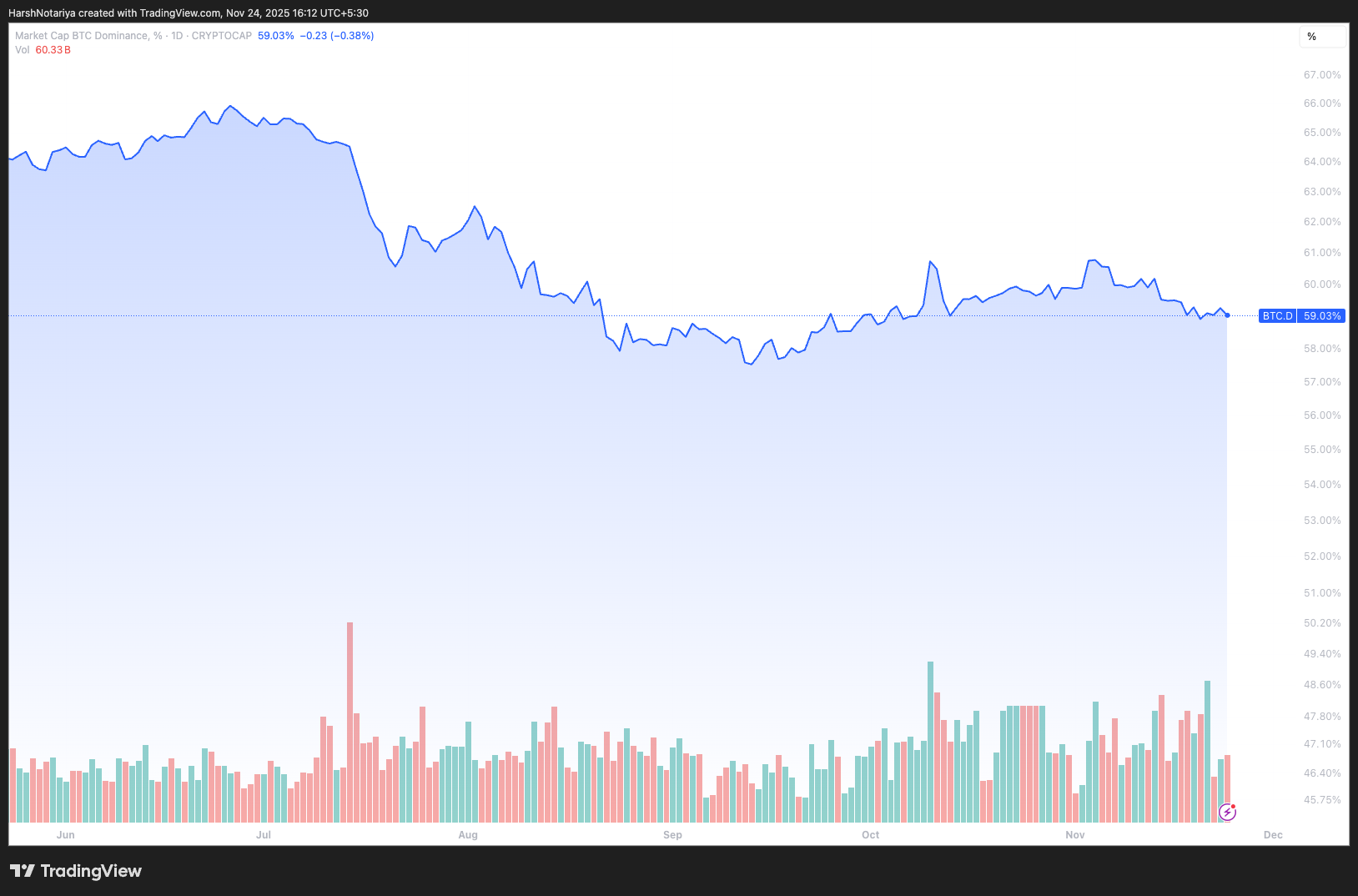

Phil also comments on Bitcoin’s dominance, which in his opinion is not growing as strongly as it should. At the same time, smaller altcoins record huge losses, often at 60–80% per year. This shows the real weakness of the market.

Bitcoin dominance. Source:

TradingView

Bitcoin dominance. Source:

TradingView

Phil’s Key Warnings

Phil Konieczny openly says that the supercycle narrative was wrong. In his opinion, the market gave clear signals that cyclicality continued. He emphasizes that it was unwise to ignore this data.

Meanwhile, Bitcoin is below its 50-week moving average. In Phil’s opinion, this is a classic bear market signal. However, the investors should not ignore the possibilities of a dead-cat bounce.

Bitcoin Trades Below 50-Week EMA For the First Time Since 2023. Source:

TradingView

Bitcoin Trades Below 50-Week EMA For the First Time Since 2023. Source:

TradingView

The Polish influencer warns investors to stay away from altcoins. This is because, the risk of investing on altcoins is too high. Not to mention, many altcoins never recovered from previous bear markets.

Macroeconomics, ETFs and key investor questions about Bitcoin

Phil discusses the macroeconomic situation extensively, which he believes is very worrying. It points to an inverted yield curve that has historically always heralded a recession.

He mentions Americans’ debt and the growing number of company bankruptcies. It also highlights the risks arising from the US–China trade war. In his opinion, these factors significantly limit the growth potential of markets.

Then he discusses the topic of ETFs. He explains that their purchases were one of the main drivers of the beginning of the bull market.

However, he notes that their activity alone is not enough if the macro situation does not improve. Phil ndicates that the correlation between S&P 500 and Bitcoin has become one-sided. This means that stock market declines drag down cryptocurrencies, but increases do not give them the same support.

The Polish influencer sums it up:

- Bitcoin responds to macro and macro looks bad,

- Altcoins have an extremely low chance of making a lasting rebound, the

- The cycle looks the same as the previous ones.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Stablecoin Market Exceeds $280B as ECB Warns of Potential Systemic Risks

- Stablecoin market exceeds $280B, driven by regulatory clarity and institutional adoption, capturing 8% of crypto assets. - ECB warns of systemic risks from stablecoin concentration, de-pegging events, and mass redemption "runs" threatening global markets. - USDC overtakes USDT in onchain activity due to regulatory alignment, with Circle's market cap rising 72% YTD to $74B. - ECB calls for global regulatory coordination to address cross-border arbitrage gaps and prevent destabilizing retail deposit shifts

Bitcoin News Update: MicroStrategy Faces an Identity Dilemma—Is It a Technology Company or a Bitcoin Holding Entity?

- MicroStrategy faces potential MSCI index reclassification as a Bitcoin investment vehicle, risking $8.8B in passive fund outflows. - The debate centers on whether crypto-heavy firms should be classified as operating businesses or passive funds, impacting capital access and valuation. - CEO Michael Saylor defends MSTR as a "structured finance company," leveraging Bitcoin-backed securities to differentiate from passive vehicles. - Compressed stock-to-NAV multiples and Bitcoin's price slump threaten MSTR's

Japan Sets Out to Rebuild Investor Confidence in Crypto Following Significant Security Breaches

- Japan's FSA will mandate crypto exchanges to hold liability reserves proportional to trading volumes and security risks, modeled after traditional securities safeguards. - The reform responds to major breaches like the 2024 DMM Bitcoin hack ($312M stolen) and allows exchanges to offset reserve costs via insurance policies. - New rules require segregating user funds from corporate assets and reclassify crypto as securities under the Financial Instruments Act to enable investment products. - Experts view t

Bitcoin News Today: Bitcoin's Rebound Fails to Ease Crypto's Liquidity Crunch

- Bitcoin's $80,000 rebound failed to reverse crypto's liquidity crisis as structural risks deepen amid macroeconomic pressures and thinning market liquidity. - Total crypto market cap fell below $3 trillion with $950M+ liquidations, while Bitcoin's dominance dropped below 49% as capital rotated into altcoins like HBAR and HYPE. - Institutional divergence emerged: spot ETFs saw $1.38B redemptions while on-chain accumulators added 42,000 BTC, contrasting with long-term investors offloading ~42,000 BTC this