Thailand’s Bitkub Eyes $200 Million Initial Public Offering (IPO) In Hong Kong

Bitkub, Thailand’s top cryptocurrency exchange, is considering a $200 million initial public offering in Hong Kong as early as 2026. This strategic shift highlights both the challenges facing Thai capital markets and Hong Kong’s emergence as a digital asset hub. From Bangkok to Hong Kong: Bitkub‘s Strategic Pivot According to reports from Bloomberg, Bitkub had

Bitkub, Thailand’s top cryptocurrency exchange, is considering a $200 million initial public offering in Hong Kong as early as 2026.

This strategic shift highlights both the challenges facing Thai capital markets and Hong Kong’s emergence as a digital asset hub.

From Bangkok to Hong Kong: Bitkub‘s Strategic Pivot

According to reports from Bloomberg, Bitkub had originally planned a domestic listing, as mentioned in a 2023 shareholder letter. By April 2024, it was in the process of hiring financial advisers for a 2025 IPO on the Stock Exchange of Thailand.

“We are actively preparing for IPO filings, paving the way for further growth and access to capital. This exciting step will allow us to scale our impact, unlock even greater value for our shareholders, and further solidify our position as a global leader in fintech. We are considering listing our company first in Thailand, as we aim to become a pioneering Thai-nationality tech company. This strategic move aligns with our commitment to democratised Thailand’s value to everyone,” the exchange said in 2023.

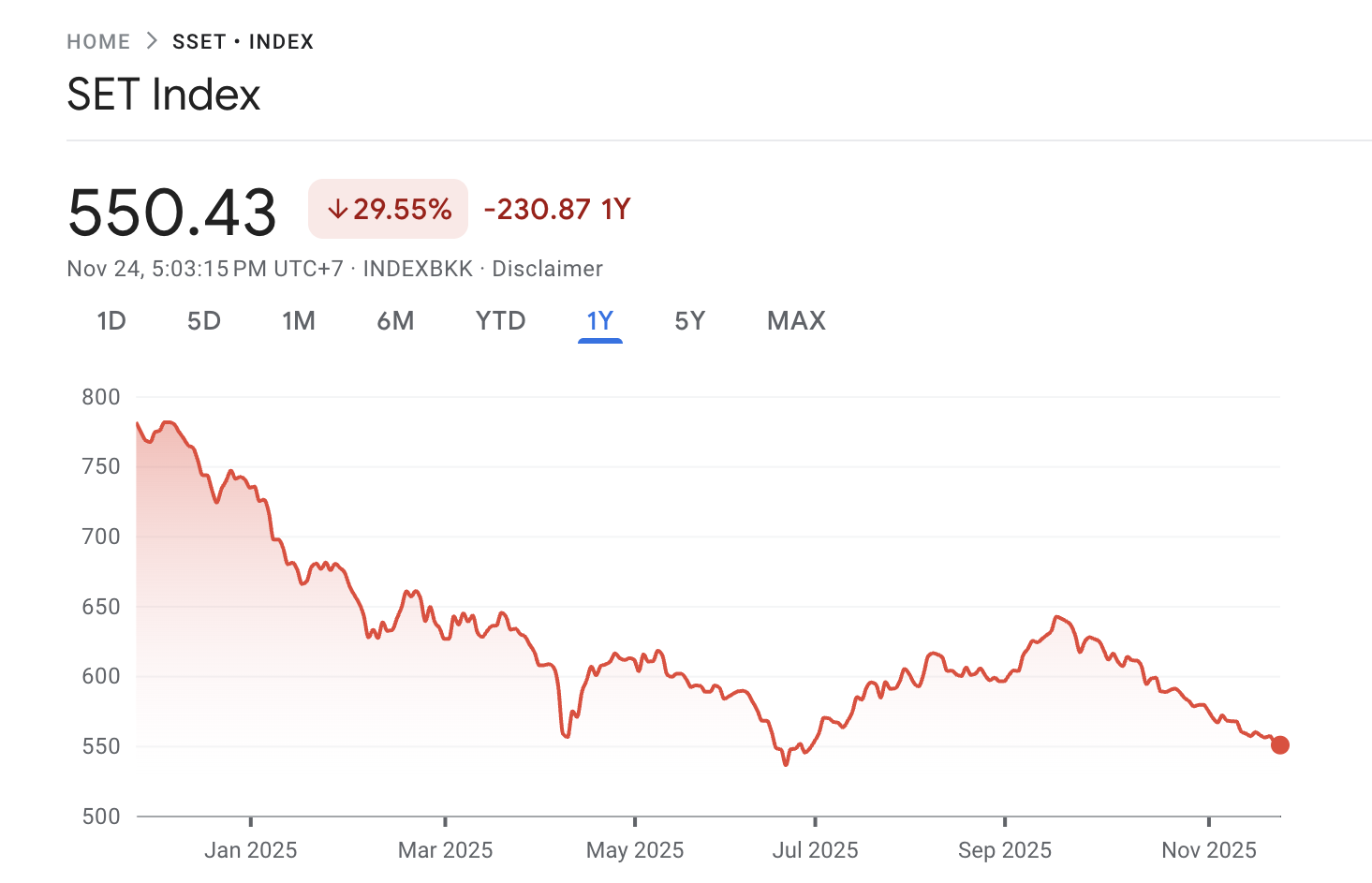

However, these plans were disrupted as Thailand’s stock market slumped. The SET Index, the country’s main equity gauge, has dropped nearly 30% this year to 550.43 points, making it one of the worst-performing markets in 2025. Thai listings have also faced a weighted average decline of more than 12%.

SET Index Performance. Source:

Google Finance

SET Index Performance. Source:

Google Finance

Amid this volatility, Bitkub has started considering international options instead. Bloomberg noted that discussions are still underway and the final direction may shift, according to people familiar with the matter.

Founded in 2018, Bitkub remains Thailand’s leading centralized crypto exchange. It offers 237 coins and 240 trading pairs. The exchange’s 24-hour trading volume is $66.3 million, with USDT/THB as its most active pair. Bitkub’s total assets stand at over $800 million, and the platform has a Trust Score of 7 out of 10 on CoinGecko.

With this latest move, Bitkub would join HashKey Group in pursuing a public listing in Hong Kong. Bloomberg noted that in October, the firm, which operates the city’s leading licensed cryptocurrency exchange, reportedly submitted paperwork for its own listing. The firm aims to raise around $500 million, with plans for an IPO as soon as this year.

Hong Kong is a booming crypto market. In the first half of 2025, total bank transactions in digital asset-related products and tokenized assets reached $26.1 billion Hong Kong dollars. This marked a 233% increase over the same period last year and already exceeded the full-year total of last year.

Thailand is not behind when it comes to crypto adoption. Despite challenges in equity markets, Thailand is moving towards establishing a favorable regulatory space for digital assets.

The Ministry of Finance suspended capital gains tax on cryptocurrency sales from January 1, 2025, through December 31, 2029. This five-year exemption only applies to trades conducted via Thai SEC-licensed platforms.

“This is a key step in boosting Thailand’s economic potential and a major opportunity for Thai entrepreneurs to thrive on the global stage,” Deputy Finance Minister Julapun Amornvivat stated.

The ministry added that this measure could generate approximately $1 billion in annual revenue by increasing activity and consumption.

Read the article at BeInCryptoDisclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Stablecoin Market Exceeds $280B as ECB Warns of Potential Systemic Risks

- Stablecoin market exceeds $280B, driven by regulatory clarity and institutional adoption, capturing 8% of crypto assets. - ECB warns of systemic risks from stablecoin concentration, de-pegging events, and mass redemption "runs" threatening global markets. - USDC overtakes USDT in onchain activity due to regulatory alignment, with Circle's market cap rising 72% YTD to $74B. - ECB calls for global regulatory coordination to address cross-border arbitrage gaps and prevent destabilizing retail deposit shifts

Bitcoin News Update: MicroStrategy Faces an Identity Dilemma—Is It a Technology Company or a Bitcoin Holding Entity?

- MicroStrategy faces potential MSCI index reclassification as a Bitcoin investment vehicle, risking $8.8B in passive fund outflows. - The debate centers on whether crypto-heavy firms should be classified as operating businesses or passive funds, impacting capital access and valuation. - CEO Michael Saylor defends MSTR as a "structured finance company," leveraging Bitcoin-backed securities to differentiate from passive vehicles. - Compressed stock-to-NAV multiples and Bitcoin's price slump threaten MSTR's

Japan Sets Out to Rebuild Investor Confidence in Crypto Following Significant Security Breaches

- Japan's FSA will mandate crypto exchanges to hold liability reserves proportional to trading volumes and security risks, modeled after traditional securities safeguards. - The reform responds to major breaches like the 2024 DMM Bitcoin hack ($312M stolen) and allows exchanges to offset reserve costs via insurance policies. - New rules require segregating user funds from corporate assets and reclassify crypto as securities under the Financial Instruments Act to enable investment products. - Experts view t

Bitcoin News Today: Bitcoin's Rebound Fails to Ease Crypto's Liquidity Crunch

- Bitcoin's $80,000 rebound failed to reverse crypto's liquidity crisis as structural risks deepen amid macroeconomic pressures and thinning market liquidity. - Total crypto market cap fell below $3 trillion with $950M+ liquidations, while Bitcoin's dominance dropped below 49% as capital rotated into altcoins like HBAR and HYPE. - Institutional divergence emerged: spot ETFs saw $1.38B redemptions while on-chain accumulators added 42,000 BTC, contrasting with long-term investors offloading ~42,000 BTC this