Tom Lee’s Prediction Lifts BMNR Price Hopes, but the Rebound Still Faces a Key Test

BMNR price dropped almost 22.7% this week, hitting fresh lows under $26. The fall looks sharp, but the stock is still up more than 160% over the past six months. Now, a small rebound looks likely on a daily chart. Traders would want to know whether this is only a bounce or the start of

BMNR price dropped almost 22.7% this week, hitting fresh lows under $26. The fall looks sharp, but the stock is still up more than 160% over the past six months. Now, a small rebound looks likely on a daily chart. Traders would want to know whether this is only a bounce or the start of a larger BitMine recovery.

Tom Lee’s latest call on Ethereum adds fuel to the discussion, but the chart shows a key test ahead.

Buying Pressure Returns, but Trend Signals Stay Weak

BMNR’s long slide continues to show stress across major moving averages. The 20-day EMA already crossed under the 100-day on November 14. That crossover lined up with a sharp sell-off, and the 50-day EMA is now closing in on the 100-day as well. If that second bearish crossover completes, it signals more downside risk.

Bearish Crossover Risks:

Bearish Crossover Risks:

But a few positives are surfacing beneath the price.

On-Balance Volume (OBV) tracks whether real volume is entering or leaving. Between August 4 and November 21, the price made a fresh lower low. OBV, however, made a higher low. This long-term bullish divergence means real buyers have been accumulating while the BitMine stock keeps falling. It creates room for a short-term rebound even when the broader trend stays weak.

Volume Keeps Rising:

Volume Keeps Rising:

The Chaikin Money Flow (CMF) tells the same story.

CMF also made a higher low over the same period and has now broken above its falling trend line. That break usually signals that larger wallets are stepping in again. Do note that between November 20 and November 21, the BMNR price made a lower low while the CMF flashed another higher low. Another bullish divergence.

BMNR CMF Rising:

BMNR CMF Rising:

A CMF trendline break often appears before price bottoms because it reflects large-wallet interest returning.

This CMF angle matters more for BMNR than for most stocks.

Tom Lee has pointed out that when institutions build large BMNR positions, the capital is often used to buy Ethereum. Rising CMF, therefore, hints at two things happening together: large buyers accumulating BMNR and potential ETH demand returning through BMNR exposure. That could also be good news for the standalone BMNR stock price.

Short term, this gives BMNR enough strength for a rebound attempt. But the trend flip isn’t confirmed yet.

BMNR Price Levels: The Test That Decides the Next Move

Short-term charts still support a rebound idea, but the move depends on what happens next with Ethereum. BMNR and ETH carry a 0.47 correlation, which means they move in the same direction at a moderate rate.

ETH-BMNR Correlation:

ETH-BMNR Correlation:

When ETH stabilizes or rises, BMNR usually follows. When ETH weakens, BMNR struggles to hold any bounce. This matters because Tom Lee has already predicted the ETH price rise to $7,000. If that prediction holds even marginally, the BMNR price could attempt a bounce.

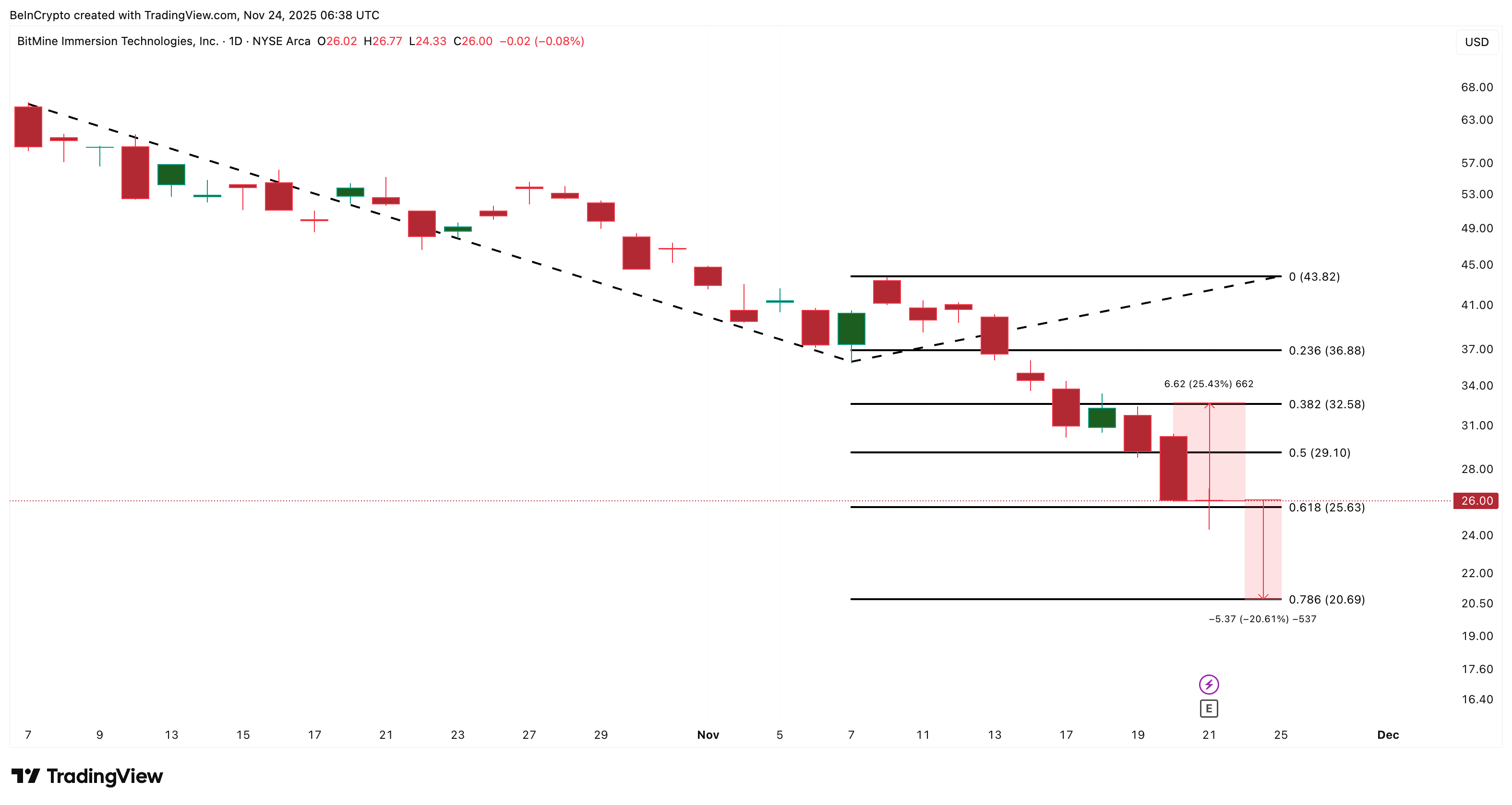

The first upside barrier sits at $32.58. Clearing this level with CMF still rising, possibly above the zero line, would confirm the rebound and open room toward $36.88. If ETH picks up momentum at the same time, the move can extend toward $43.82, which is the larger retracement zone tied to the last breakdown.

BMNR Price Analysis:

BMNR Price Analysis:

This is where the $7,000 ETH outlook becomes relevant — only an ETH recovery can turn BMNR from a rebound into a trend.

But the risk remains. If BitMine (BMNR) loses $25.63, the next support stands near $20.69, almost 20% lower. That drop lines up with previous corrections triggered by EMA crossovers, and the same risk sits in front of the stock now as the 50-day EMA closes in on the 100-day. If that crossover completes while ETH stays weak, the bounce fades and the downtrend continues.

This is the key test: the BMNR price must reclaim $32.58 with improving CMF and at least some ETH stability. Without that, the rebound remains temporary and the $20.69 stays in play.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Stablecoin Market Exceeds $280B as ECB Warns of Potential Systemic Risks

- Stablecoin market exceeds $280B, driven by regulatory clarity and institutional adoption, capturing 8% of crypto assets. - ECB warns of systemic risks from stablecoin concentration, de-pegging events, and mass redemption "runs" threatening global markets. - USDC overtakes USDT in onchain activity due to regulatory alignment, with Circle's market cap rising 72% YTD to $74B. - ECB calls for global regulatory coordination to address cross-border arbitrage gaps and prevent destabilizing retail deposit shifts

Bitcoin News Update: MicroStrategy Faces an Identity Dilemma—Is It a Technology Company or a Bitcoin Holding Entity?

- MicroStrategy faces potential MSCI index reclassification as a Bitcoin investment vehicle, risking $8.8B in passive fund outflows. - The debate centers on whether crypto-heavy firms should be classified as operating businesses or passive funds, impacting capital access and valuation. - CEO Michael Saylor defends MSTR as a "structured finance company," leveraging Bitcoin-backed securities to differentiate from passive vehicles. - Compressed stock-to-NAV multiples and Bitcoin's price slump threaten MSTR's

Japan Sets Out to Rebuild Investor Confidence in Crypto Following Significant Security Breaches

- Japan's FSA will mandate crypto exchanges to hold liability reserves proportional to trading volumes and security risks, modeled after traditional securities safeguards. - The reform responds to major breaches like the 2024 DMM Bitcoin hack ($312M stolen) and allows exchanges to offset reserve costs via insurance policies. - New rules require segregating user funds from corporate assets and reclassify crypto as securities under the Financial Instruments Act to enable investment products. - Experts view t

Bitcoin News Today: Bitcoin's Rebound Fails to Ease Crypto's Liquidity Crunch

- Bitcoin's $80,000 rebound failed to reverse crypto's liquidity crisis as structural risks deepen amid macroeconomic pressures and thinning market liquidity. - Total crypto market cap fell below $3 trillion with $950M+ liquidations, while Bitcoin's dominance dropped below 49% as capital rotated into altcoins like HBAR and HYPE. - Institutional divergence emerged: spot ETFs saw $1.38B redemptions while on-chain accumulators added 42,000 BTC, contrasting with long-term investors offloading ~42,000 BTC this