Which Low-Cap Altcoins Benefit the Most From Growing Interest in the Neobank Narrative?

The crypto community has recently discussed the Neobank concept in Web3 more frequently. Investors are paying closer attention to projects with real-world applications, and this sector is drawing significant interest. Low-cap altcoins within the Neobank narrative may be undervalued. They create new opportunities for investors. What Potential Do Neobanks Have? A Neobank in Web3 refers

The crypto community has recently discussed the Neobank concept in Web3 more frequently. Investors are paying closer attention to projects with real-world applications, and this sector is drawing significant interest.

Low-cap altcoins within the Neobank narrative may be undervalued. They create new opportunities for investors.

What Potential Do Neobanks Have?

A Neobank in Web3 refers to a fully digital bank that operates entirely on blockchain. It requires no physical branches. It integrates DeFi features, including self-custody, yield-bearing accounts, and Visa/MasterCard crypto spending cards.

Unlike traditional neobanks, Web3 Neobanks emphasize transparency, the removal of intermediaries, and cross-chain connectivity.

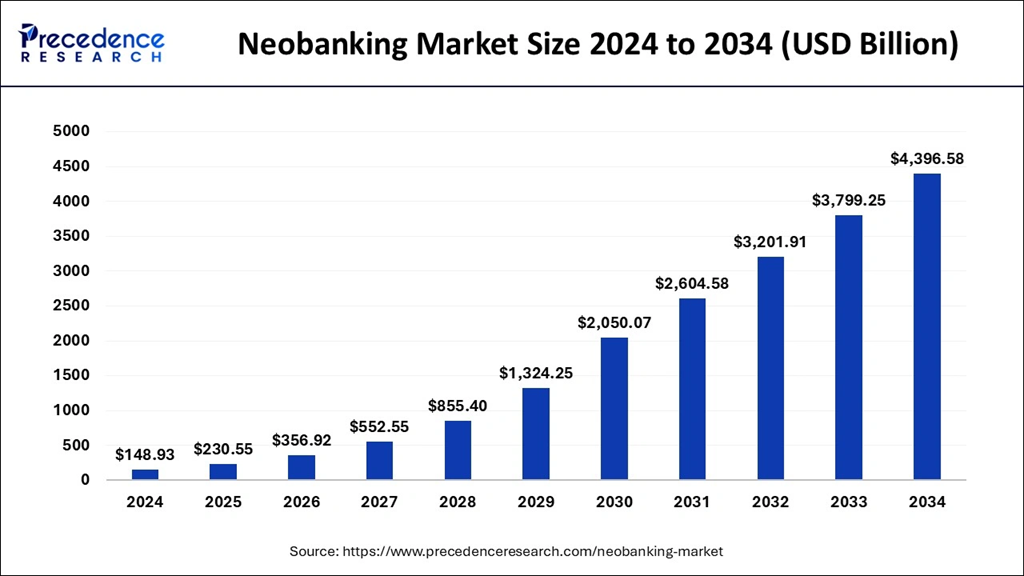

According to a report from Precedence Research, the global neobanking market reached $148.93 billion in 2024. It is projected to grow at a CAGR of 40.29% and hit $4,396.58 billion in 2034.

Neobanking Market Size. Source:

Neobanking Market Size. Source:

This massive growth potential can benefit Web3 Neobanks. The first reason is the increasing adoption of stablecoin use cases. The second is a shift in investor mindset toward crypto projects with real-world utility rather than hype-driven valuations.

“If stablecoin is to power Neobanks on-chain, then the current Web2 identity infra won’t be able to keep up,” investor Mike S predicted.

Coingecko indicates that the current Neobank category has a total market capitalization of $4.19 billion, comprising 13 major projects. Mantle leads with a market cap of $3.31 billion, followed by Ether.fi at $412 million.

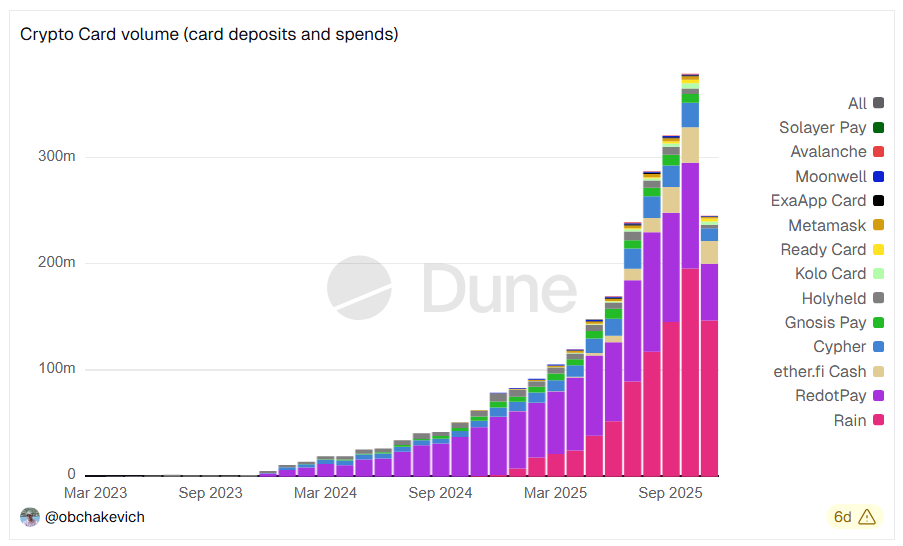

Additionally, Dune data indicate that physical card transaction volume from Web3 neobank projects reached a record high last month, surpassing $379 million.

Crypto Card Volume. Source:

Crypto Card Volume. Source:

Although the transaction volume remains small, analysts believe its growth potential is huge. Meanwhile, the link between Web3 projects and traditional payment companies is becoming stronger.

Crypto investors believe Neobanks will surge thanks to AI agents and blockchain privacy. Some experts go further and predict that Neobanks will become one of the key narratives shaping crypto trends in 2026.

Can Low-Cap Altcoins in the Neobank Sector Deliver Big Returns for Early Investors?

Despite optimistic predictions, Coingecko’s top three Neobank projects — Mantle (MNT), ether.fi (ETHFI) and Plasma (XPL) — all experienced prolonged price declines in November.

However, several low-cap altcoins with market caps below $100 million have recently attracted fresh capital and delivered strong performances.

1. Avici (AVICI)

Avici (AVICI) is a self-custodial crypto banking project built on Solana. It focuses on spending cards and on-chain swaps. Over the past two months, its market cap has increased tenfold to $77 million, and its price has exceeded $6.

Stalkchain reported a sharp rise in AVICI purchases in recent days. One wallet has actively accumulated about $35,000 worth of AVICI at a pace of $266 per minute.

A wallet is actively accumulating $35K worth of $AVICI buying $266 every 1 min.With $2.2M LP and a $68M mcap, those buys add 1.57% of the entire LP in buying pressure.Estimated impact:A 1.5%-2.8% pump, higher only if the buy continues beyond this session.On… pic.twitter.com/5c5QQfbd6x

— Stalkchain (@StalkHQ) November 23, 2025

The project announced that Avici Card reached 100,000 transactions in November. It described the card as becoming a daily habit and part of users’ everyday routines. Some investors expect AVICI to get $50–$100.

2. Cypher (CYPR)

Cypher is a protocol built on Base Chain. Users can receive CYPR tokens as rewards for card-based transactions.

Cypher aims to create an open economic model that drives growth among brands, service providers, online influencers, AI agents, and crypto card users.

The project’s market cap is currently under $10 million. Analysts believe it is undervalued.

@Cypher_HQ_ keeps going under the radar despite impressive metrics. Only behind EtherFi's Cash in cards volume and consistently processing ~2x its market cap in payments valueThis divergence between processed value and valuation has been ongoing for a while. Low liquidity and… pic.twitter.com/b6RY9zYB0s

— Alvaro_SR_23 (@Alvaro_SR_23) November 21, 2025

Alea Research recently highlighted several reasons for this view. Cypher processes payment value roughly twice its market cap. It also ranks second after EtherFi in card transaction volume. Low liquidity and limited listings on major CEXs have prevented significant price growth.

3. Machines-cash (MACHINES)

Machines-cash (MACHINES) is a newly launched crypto payment platform focused on privacy on Base. Its current market cap is under $5 million.

Analysts believe the project could attract capital inflows similar to those of AVICI, potentially achieving a 10-fold increase. Several reasons support this view. The development team includes talent with experience from MetaMask, Trust Wallet, DARPA, Flipside Crypto, Paxful, and Polygon. An advisor from AVICI also participates in the project.

If you missed my $AVICI call that printed a 10x for us, then don't miss $MACHINES.Many KOLs are just now starting to push AVICI which we had very very early, and the same will happen with this one.@machines_cash is a privacy-focused crypto payment platform on Base. The… pic.twitter.com/lJB7QcxSep

— 0xHades (@OnlyHades_) November 19, 2025

Machines-cash allows anonymous and secure Visa card payments. Users can transact using alias accounts that hide wallet addresses, transaction histories, and personal identities. This feature is especially attractive as interest in privacy continues to rise.

Market sentiment remains gloomy, which will significantly affect the potential of low-cap projects. Moreover, as more crypto neobanks emerge, selecting truly high-quality projects becomes increasingly challenging.

Jay Yu, a researcher at Pantera Capital, believes that retention, card transaction volume, and user count will determine the winners in this emerging market.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Ethereum News Update: BitMine Targets '5% Alchemy' While Ethereum Treasury Exceeds $11.2 Billion

- BitMine (BMNR) holds 3.63M ETH (3.0% supply), becoming the world's largest Ethereum treasury with $11.2B in crypto/cash assets. - Recent 69,822 ETH purchase and institutional backing from ARK, Kraken, and Galaxy support its "Alchemy of 5%" goal to acquire 5% ETH supply. - Despite 40% ETH price drop causing $4B unrealized losses, BitMine plans 2026 staking infrastructure launch amid evolving crypto regulations. - As second-largest crypto treasury after MicroStrategy, BitMine's rapid ETH accumulation and l

COAI Token Fraud Aftermath and Safeguarding Investors in Cryptocurrency: Addressing Compliance Preparedness and Strategies for Reducing Risks

- COAI token's 2025 collapse erased $116.8M for C3.ai, exposing DeFi's systemic risks from algorithmic stablecoin failures and centralized control. - U.S. regulators modernized crypto oversight via SEC no-action letters and CFTC policy shifts, but fragmented frameworks persist between agencies. - Retail investors now rely on blockchain analytics tools and real-time fraud detection platforms to combat scams, as EU's MiCA regulation sets global benchmarks. - Post-COAI reforms emphasize balancing innovation w

XRP News Today: Institutional ETFs Drive XRP Closer to Widespread Acceptance

- XRP surged to $3.66 in July 2025 after years below $1, driven by ETF launches and regulatory optimism. - Eight U.S. XRP ETFs, including Grayscale’s fee-waived GXRP , attracted $423M in assets, signaling institutional validation. - Analysts project $5.05 by 2025 and $26.50 by 2030, but warn of risks like whale concentration and market manipulation. - Emerging projects like $APEING Whitelist highlight crypto’s cyclical nature, with ETFs creating new entry points for risk-tolerant investors.

Ethereum News Update: Miners Invest $200 Million in Ethereum DeFi, Anticipating a Supercycle

- Bitcoin miner BitMine adds $200M in Ethereum to reserves, citing confidence in its DeFi and smart contract potential. - L2 Capital's Tom Lee predicts a crypto "supercycle" by mid-2024, driven by ETF approvals and stablecoin regulations. - Institutional Ethereum holdings rise as firms like Argo and Hut 8 diversify portfolios, with crypto fund assets hitting $18B. - Analysts debate Ethereum's $10K 2025 target, noting Dencun upgrades' scalability benefits but cautioning regulatory risks from China/EU.