XRP Bucks the Trend as Crypto Funds See $1.94 Billion Weekly Outflows

Crypto investment funds experienced $1.94 billion in outflows last week, the third-largest streak since 2018. XRP stood out, attracting $89.3 million in inflows while Bitcoin and Ethereum faced withdrawals. Outflows over the past four weeks totaled $4.92 billion, equaling 2.9% of all assets under management. However, Friday saw $258 million in new inflows, offering a

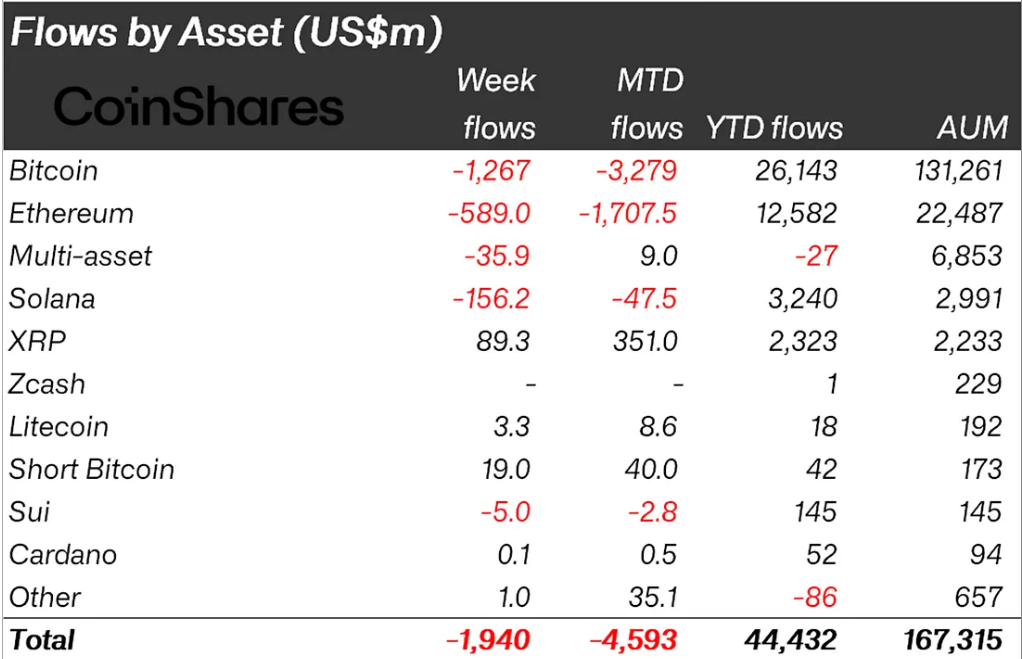

Crypto investment funds experienced $1.94 billion in outflows last week, the third-largest streak since 2018. XRP stood out, attracting $89.3 million in inflows while Bitcoin and Ethereum faced withdrawals.

Outflows over the past four weeks totaled $4.92 billion, equaling 2.9% of all assets under management. However, Friday saw $258 million in new inflows, offering a potential shift in market sentiment.

Crypto Outflows Mount Amid Policy Turmoil

Digital asset products experienced significant outflows, according to CoinShares’ weekly report. The $1.94 billion loss extended a challenging month, with capital withdrawals and price drops contributing to a 36% decrease in assets under management.

Funds based in the US accounted for 97% of the global outflows, reaching $1.97 billion. This reflects investor caution amid Federal Reserve policy uncertainty and hawkish commentary from Chair Jerome Powell.

In contrast, Germany and some European markets recorded modest inflows, highlighting a difference in regional market sentiment.

XRP Defies the Broader Crypto Selloff

Bitcoin saw $1.27 billion in outflows over the week. Yet, on Friday, the trend changed, as $225 million returned to Bitcoin products. Ethereum had $589 million in outflows, although a small rebound of $57.5 million occurred on Friday.

Crypto Fund Outflows Last Week. Source:

CoinShares

Crypto Fund Outflows Last Week. Source:

CoinShares

As other major cryptocurrencies lost capital, XRP distinguished itself by drawing $89.3 million in inflows. This shift reversed earlier reports of minor outflows, making XRP the only major digital asset to see real investment gains last week.

Solana, another altcoin, faced $156 million in outflows. The clear divergence between XRP and the rest of the market signals that investors may view its prospects differently for unique reasons.

Some analysts point to Ripple’s rapid infrastructure expansion as a possible factor. Social media discussions noted that Ripple spent $2.7 billion acquiring firms for custody, licensing, and stablecoin services. These moves are positioning XRP as a foundational layer in global finance rather than a simple speculative asset.

“Ripple spent $2.7B+ acquiring the future. This is not a usual crypto project anymore, it’s an infrastructure giant. Every piece locks in a future where $XRP is embedded in the financial system,” one user commented.

Meanwhile, data shows large investors are building their XRP holdings. Reports indicate that whales bought $7.7 billion worth of XRP in three months, a trend that often occurs before significant price moves.

Friday’s $258 million inflow suggests the possibility of a turning point, but it remains unclear if this is a true sentiment shift or just a pause.

Despite the recent volatility, year-to-date inflows remain at $44.4 billion, highlighting continued institutional interest.

The direction of fund flows in the coming weeks will likely depend on Federal Reserve updates and broader macroeconomic factors.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Stablecoin Market Exceeds $280B as ECB Warns of Potential Systemic Risks

- Stablecoin market exceeds $280B, driven by regulatory clarity and institutional adoption, capturing 8% of crypto assets. - ECB warns of systemic risks from stablecoin concentration, de-pegging events, and mass redemption "runs" threatening global markets. - USDC overtakes USDT in onchain activity due to regulatory alignment, with Circle's market cap rising 72% YTD to $74B. - ECB calls for global regulatory coordination to address cross-border arbitrage gaps and prevent destabilizing retail deposit shifts

Bitcoin News Update: MicroStrategy Faces an Identity Dilemma—Is It a Technology Company or a Bitcoin Holding Entity?

- MicroStrategy faces potential MSCI index reclassification as a Bitcoin investment vehicle, risking $8.8B in passive fund outflows. - The debate centers on whether crypto-heavy firms should be classified as operating businesses or passive funds, impacting capital access and valuation. - CEO Michael Saylor defends MSTR as a "structured finance company," leveraging Bitcoin-backed securities to differentiate from passive vehicles. - Compressed stock-to-NAV multiples and Bitcoin's price slump threaten MSTR's

Japan Sets Out to Rebuild Investor Confidence in Crypto Following Significant Security Breaches

- Japan's FSA will mandate crypto exchanges to hold liability reserves proportional to trading volumes and security risks, modeled after traditional securities safeguards. - The reform responds to major breaches like the 2024 DMM Bitcoin hack ($312M stolen) and allows exchanges to offset reserve costs via insurance policies. - New rules require segregating user funds from corporate assets and reclassify crypto as securities under the Financial Instruments Act to enable investment products. - Experts view t

Bitcoin News Today: Bitcoin's Rebound Fails to Ease Crypto's Liquidity Crunch

- Bitcoin's $80,000 rebound failed to reverse crypto's liquidity crisis as structural risks deepen amid macroeconomic pressures and thinning market liquidity. - Total crypto market cap fell below $3 trillion with $950M+ liquidations, while Bitcoin's dominance dropped below 49% as capital rotated into altcoins like HBAR and HYPE. - Institutional divergence emerged: spot ETFs saw $1.38B redemptions while on-chain accumulators added 42,000 BTC, contrasting with long-term investors offloading ~42,000 BTC this