3 Meme Coins To Watch In The Final Week Of November

Meme coins are finding their footing amid a volatile market, as Bitcoin attempts a recovery. This could help the speculative tokens bounce back even if the broader market recovery is slow. BeInCrypto has analysed three such meme coins that the investors should watch as November nears its end. Pippin (PIPPIN) PIPPIN has become the week’s

Meme coins are finding their footing amid a volatile market, as Bitcoin attempts a recovery. This could help the speculative tokens bounce back even if the broader market recovery is slow.

BeInCrypto has analysed three such meme coins that the investors should watch as November nears its end.

Pippin (PIPPIN)

PIPPIN has become the week’s strongest-performing meme coin after soaring 133% in seven days. The token now trades at $0.067 and has successfully flipped the $0.064 level into support, signaling strong buyer demand and renewed market attention.

If momentum holds, PIPPIN may rebound off this support and climb toward $0.080. The EMAs indicate that the token narrowly avoided a Death Cross, suggesting a resurgence in bullish sentiment. This shift could help propel PIPPIN toward the $0.100 mark as enthusiasm grows.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter.

PIPPIN Price Analysis. Source:

PIPPIN Price Analysis. Source: TradingView

PIPPIN Price Analysis. Source:

PIPPIN Price Analysis. Source: TradingView

If investors begin taking profits, PIPPIN may struggle to maintain its gains. A drop below $0.064 could send the price toward $0.052. Losing that support would invalidate the bullish thesis and increase the likelihood of a deeper retracement.

Dogecoin (DOGE)

Dogecoin remains in a downtrend that began nearly a month ago, but momentum could shift following the launch of the Grayscale Dogecoin spot ETF (GDOG).

The new product has sparked renewed interest, raising expectations for a potential rebound in the meme coin’s price this week.

If bullish sentiment strengthens, DOGE may push past the $0.151 resistance and climb toward $0.162. Dogecoin also exhibits a strong 0.95 correlation with Bitcoin, indicating that a BTC rally could potentially amplify its upward movement. This alignment gives DOGE an opportunity to mirror broader market gains.

DOGE Price Analysis. Source:

DOGE Price Analysis. Source: TradingView

DOGE Price Analysis. Source:

DOGE Price Analysis. Source: TradingView

If the ETF fails to generate sufficient enthusiasm, Dogecoin’s downtrend may continue. A drop below the $0.142 support could follow, potentially sending the price to $0.130. Such weakness would invalidate the bullish thesis and signal further bearish pressure ahead.

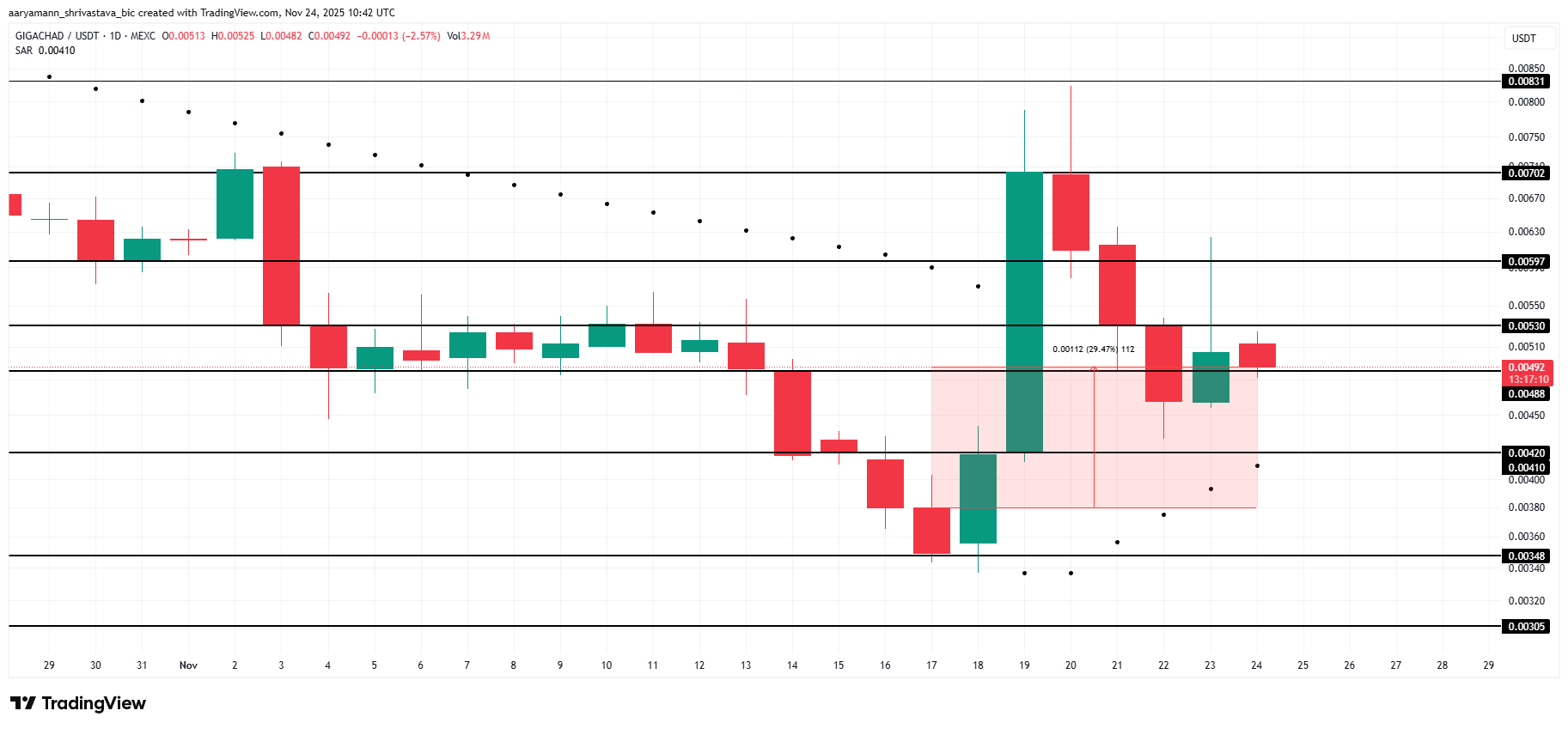

Gigachad (GIGA)

GIGA has surged 27% over the past week, as momentum has shifted decisively from bearish to bullish. The Parabolic SAR confirms an active uptrend, signaling strengthening buyer interest and improving technical conditions that support continued upward movement in the near term.

If this momentum holds, GIGA could break above the $0.0053 resistance and advance toward $0.0059. A successful breach of that level may open the path to $0.0070, extending the rally and attracting additional investor attention as confidence builds.

GIGA Price Analysis. Source:

GIGA Price Analysis. Source: TradingView

GIGA Price Analysis. Source:

GIGA Price Analysis. Source: TradingView

If selling pressure emerges, GIGA could lose its upward traction. A drop below the $0.0048 support level may push the price toward $0.0042 or even $0.0034. Such a decline would invalidate the bullish thesis and increase the risk of a deeper correction.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Stablecoin Market Exceeds $280B as ECB Warns of Potential Systemic Risks

- Stablecoin market exceeds $280B, driven by regulatory clarity and institutional adoption, capturing 8% of crypto assets. - ECB warns of systemic risks from stablecoin concentration, de-pegging events, and mass redemption "runs" threatening global markets. - USDC overtakes USDT in onchain activity due to regulatory alignment, with Circle's market cap rising 72% YTD to $74B. - ECB calls for global regulatory coordination to address cross-border arbitrage gaps and prevent destabilizing retail deposit shifts

Bitcoin News Update: MicroStrategy Faces an Identity Dilemma—Is It a Technology Company or a Bitcoin Holding Entity?

- MicroStrategy faces potential MSCI index reclassification as a Bitcoin investment vehicle, risking $8.8B in passive fund outflows. - The debate centers on whether crypto-heavy firms should be classified as operating businesses or passive funds, impacting capital access and valuation. - CEO Michael Saylor defends MSTR as a "structured finance company," leveraging Bitcoin-backed securities to differentiate from passive vehicles. - Compressed stock-to-NAV multiples and Bitcoin's price slump threaten MSTR's

Japan Sets Out to Rebuild Investor Confidence in Crypto Following Significant Security Breaches

- Japan's FSA will mandate crypto exchanges to hold liability reserves proportional to trading volumes and security risks, modeled after traditional securities safeguards. - The reform responds to major breaches like the 2024 DMM Bitcoin hack ($312M stolen) and allows exchanges to offset reserve costs via insurance policies. - New rules require segregating user funds from corporate assets and reclassify crypto as securities under the Financial Instruments Act to enable investment products. - Experts view t

Bitcoin News Today: Bitcoin's Rebound Fails to Ease Crypto's Liquidity Crunch

- Bitcoin's $80,000 rebound failed to reverse crypto's liquidity crisis as structural risks deepen amid macroeconomic pressures and thinning market liquidity. - Total crypto market cap fell below $3 trillion with $950M+ liquidations, while Bitcoin's dominance dropped below 49% as capital rotated into altcoins like HBAR and HYPE. - Institutional divergence emerged: spot ETFs saw $1.38B redemptions while on-chain accumulators added 42,000 BTC, contrasting with long-term investors offloading ~42,000 BTC this