What Altcoins are showing bullish momentum?

Most of the crypto market is stuck in a defensive crouch. The Fear and Greed Index is sitting at 12, which tells you sentiment is at rock-bottom. But this is where coin-specific catalysts matter more than the macro cycle. Supply shocks, major listings, and ecosystem upgrades can flip the script for individual tokens, even when the market mood is gloomy.

That’s exactly what is happening with altcoins TNSR , PARTI , and DYM . Their rallies aren’t random. They’re tied to real events that shift token economics, demand drivers, and long-term expectations.

Tensor (TNSR): A Supply Shock Meets Coinbase Muscle

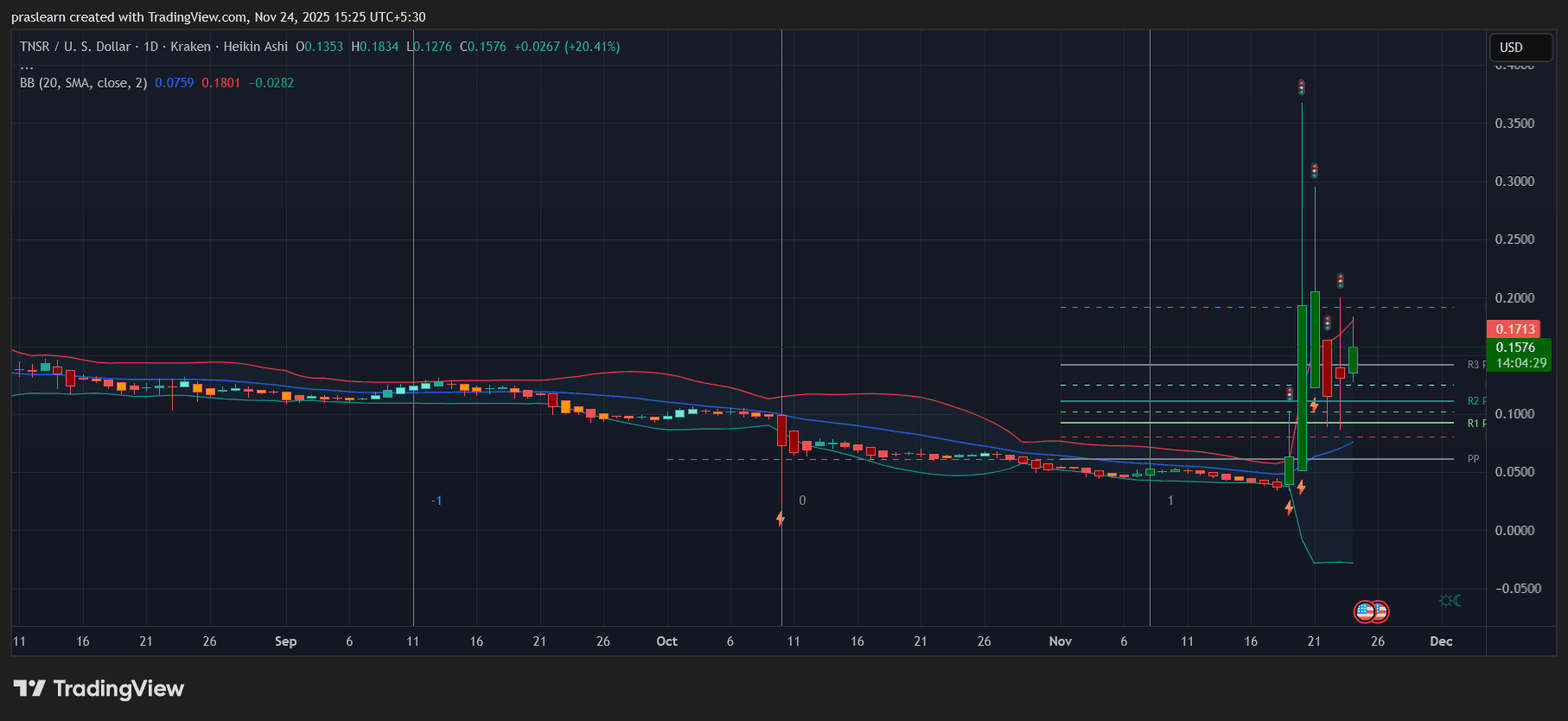

TNSR/USD Daily Chart- TradingView

TNSR/USD Daily Chart- TradingView

Tensor exploded more than 74 percent in a single day and over 300 percent across the week. The spark was Coinbase acquiring Vector, a Solana trading platform deeply linked to Tensor’s ecosystem. That acquisition triggered a 21.6 percent token supply burn and locked the founders’ tokens until 2028. This kind of supply reduction always catches traders’ attention, but pairing it with a top-tier exchange’s involvement amplified the effect.

The volume tells the story: $1.07B traded in 24 hours, with RSI flying above 90. That’s aggressive buying, but also a warning sign. When momentum gets this overheated, you usually see a pullback. The real test is whether TNSR can defend the $0.17 support zone once the dust settles. If it holds, the supply burn narrative can sustain another leg up. If it breaks, the post-acquisition euphoria may deflate quickly.

Particle Network (PARTI): Real Utility Starts Showing

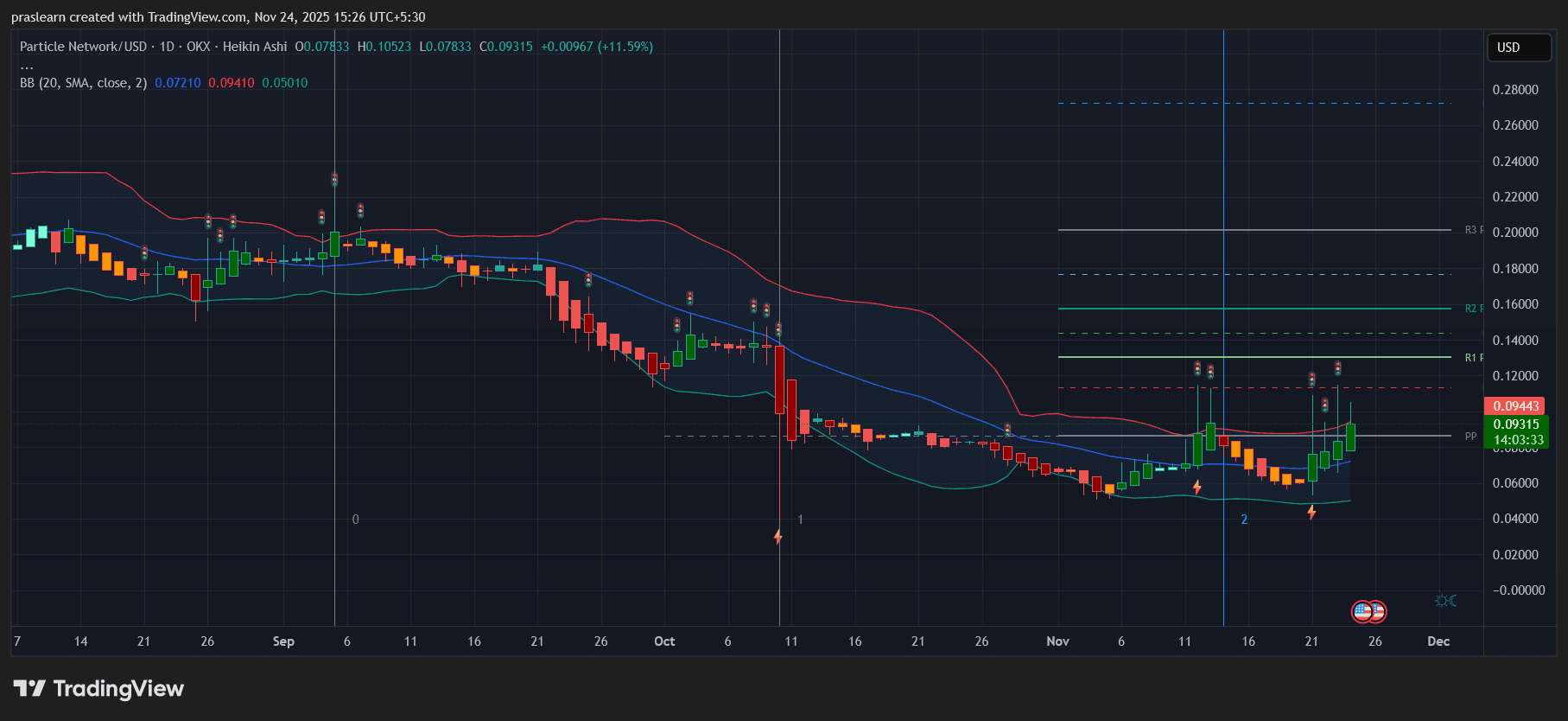

PARTI/USD Daily Chart- TradingView

PARTI/USD Daily Chart- TradingView

Particle Network isn’t moving because of hype. Its breakout—over 50 percent in 24 hours—tracks directly to two tangible drivers: a KRW listing on Bithumb and the Universal SDK launch. KRW listings almost always bring fresh liquidity from Korea, and we saw that immediately with volume jumping more than 300 percent.

The bigger story though is chain abstraction. Developers finally have a clearer path to building cross-chain apps without dealing with the usual connectivity headaches. The RSI at 77 shows momentum is strong but not wild. The key question is whether PARTI can keep the $0.20 to $0.22 support band intact. If it does, the token decouples further from broader market trends and turns into a pure utility play rather than a speculative pump.

Dymension (DYM): Tech Upgrades That Actually Matter

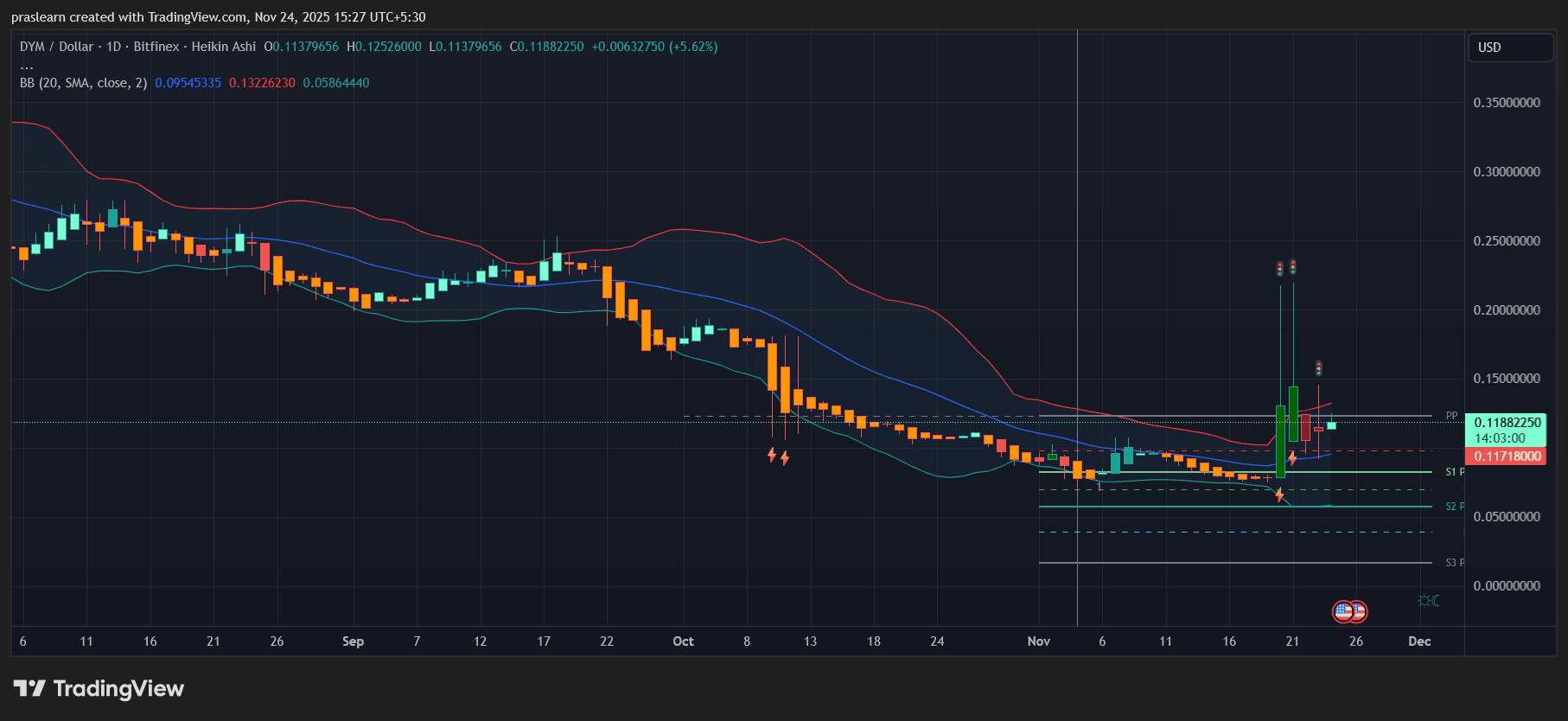

DYM/USD Daily Chart- TradingView

DYM/USD Daily Chart- TradingView

Dymension’s move is tied to fundamentals rather than hype cycles. The Beyond upgrade is a genuine architecture shift, cutting block times to a single second. Pair that with a steady weekly burn of 115,000 tokens and you get a mix of speed, scarcity, and growing use cases.

The market rewarded that. DYM is up more than 34 percent in 24 hours and nearly 54 percent across the week. The bullish MACD crossover reinforces the momentum, but the bigger picture sits in the RollApps ecosystem and the eye-catching 50 percent APY staking rewards. Traders will want to watch how fast new RollApps come online and how quickly the upgrade drives real adoption. That will decide whether DYM breaks into a sustained growth cycle.

So What Happens Next?

When the crypto market is fearful, altcoins usually fall into two categories: hype-driven spikes that fade quickly or structurally strong moves backed by catalysts. TNSR, PARTI, and DYM land in the second group. Each has a driver that isn’t tied to general market sentiment: a supply shock, a major listing with real utility, and a core protocol upgrade.

The predictive angle comes down to two checkpoints:

- Do they sustain their volumes above key moving averages? If volume collapses, momentum breaks.

- Do roadmap events deliver what traders are pricing in? Token burns, SDK launches, and L1 upgrades only matter if adoption follows.

Right now, $TNSR is the most vulnerable to a sharp correction because RSI overheating rarely ends gently. $PARTI looks the most stable if it protects its new support zone. $DYM sits in the middle but has the strongest long-term story tied to its ecosystem expansion.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Accelerated Pathways Help Close the Gap Between ACS Guidelines and Actual Clinical Practice

- A Hunan hospital study found fast-track pathways for ACS patients reduced treatment delays and MACE without increased bleeding risk. - The protocol cut median door-to-ECG time by 50% and door-to-balloon time for STEMI patients to 68 minutes, improving guideline adherence. - In-hospital MACE rates dropped from 11.6% to 6.6%, with 30-day composite outcomes improving from 13.9% to 8.7% under fast-track care. - Researchers emphasized the pathway's applicability across all ACS subtypes and potential system ef

Crypto Supporters Rally Ahead of 2026 Midterm Elections to Influence a Congress Favoring Innovation

- Stand With Crypto, backed by Coinbase , launched a 2026 midterm campaign to evaluate candidates' digital asset policies, focusing on innovation, de-banking, and regulation. - The group aims to influence Congress to prioritize pro-crypto policies, leveraging prior success in mobilizing voters and tracking 274 "pro-crypto" elected officials in 2024. - SEC's 2026 regulatory shift to information security and delayed digital asset legislation create uncertainty, while Trump's political strategies intersect wi

Ethereum News Update: While Ethereum Declines, DeFi's Mutuum Rises Amid Presale Boom

- Ethereum (ETH) fell below $2,800 on Nov 24, 2025, amid crypto market turmoil driven by rising Japanese bond yields and algorithmic sell-offs. - DeFi project Mutuum Finance (MUTM) raised $18.9M in its presale, with Phase 6 nearing 90% sales at $0.035 per token before a 20% price increase. - Mutuum's dual-lending model and automated interest systems differentiate it, while Ethereum ETFs saw $465M outflows despite institutional Bitcoin/Ethereum deposits. - The project's presale growth remains resilient amid

XRP News Update: Franklin XRP ETF: $1.69 Trillion Titan Signals Crypto Market Evolution

- Franklin Templeton launches XRPZ ETF, first regulated XRP fund on NYSE Arca, reflecting institutional crypto adoption. - SEC's 2025 Ripple settlement cleared XRP's regulatory status, enabling $125M-payout-driven investment products like XRPZ. - XRPZ joins competitive ETF landscape (Bitwise, Grayscale) amid mixed market signals: $2.11 price rebound vs. 200M XRP whale sales. - Franklin's $1.69T AUM entry underscores crypto market maturation, with XRP positioned as foundational asset for cross-border paymen