6,202,753,441 Shiba Inu Longs Erased but Burn Rate Soars by 859%

As Shiba Inu loses some of its recent gains, more than 6.2 billion SHIB tied to long positions have been liquidated across the market.

Shiba Inu saw some relief yesterday after four straight days of losses between November 19 and 22. The meme coin broke its losing streak with a 4% rebound, climbing to $0.0000080 in the early hours of the day.

The recovery continued today, with SHIB briefly surging to around $0.000008133. However, the momentum was short-lived. As the broader crypto market turned bearish again, Shiba Inu erased its gains and slipped back below $0.000008.

Over 6 Billion SHIB in Long Positions Wiped Out

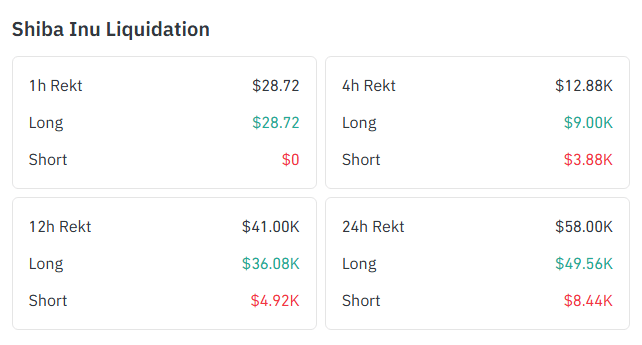

Long-position traders, those who bet on SHIB’s price rising, were hit the hardest by this sudden drop. Data from CoinGlass shows that approximately $41,000 worth of SHIB long positions were liquidated in the past 12 hours.

Meanwhile, liquidations have risen to about $58,000 over the past 24 hours. Long positions accounted for the vast majority of Shiba Inu liquidations, totaling $49,560, or 85.44%, of the total wipeout. Short positions, by contrast, amounted to $8,440.

At SHIB’s current price of $0.000007990, the long liquidations over the past day are equivalent to roughly 6,202,753,441 SHIB (6.2 billion), while the short liquidations translate to about 1.05 billion.

More Shiba Inu Liquidations Possible

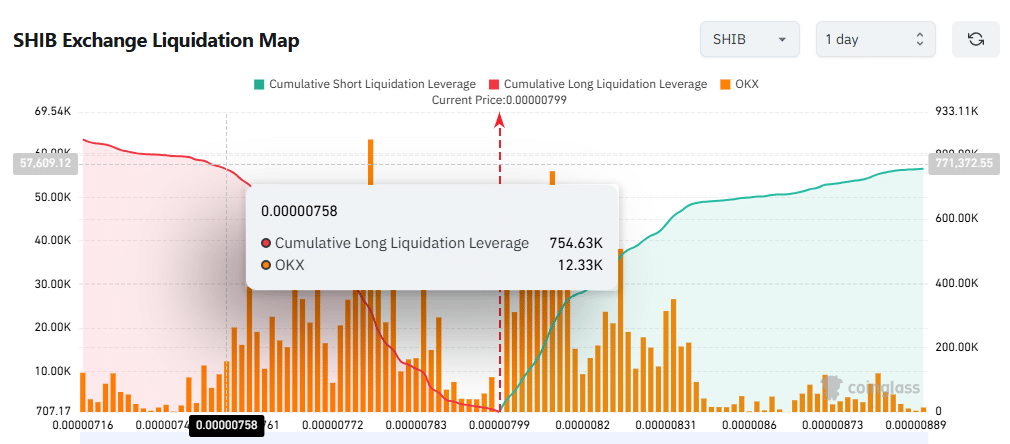

Despite Shiba Inu’s slight pullback earlier today, the asset still maintains a modest 24-hour gain of 0.97%. At its current price of $0.000007990, SHIB is up 5.39% from last week’s low of $0.000007581.

If it retests the $0.000007580 level, an estimated $754,630 worth of long positions would be liquidated, equivalent to roughly 99.55 billion at that price. Conversely, a potential upswing to $0.00000840 could trigger approximately $661,630 in short liquidations, representing around 78.76 billion SHIB at that price.

Daily Burn Rate Soars 859%

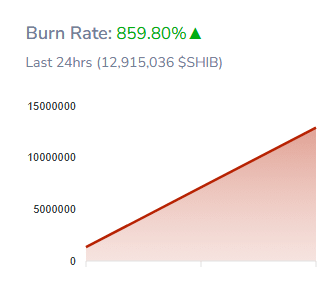

Meanwhile, Shiba Inu’s burn rate surged sharply over the past 24 hours, soaring by an impressive 859.60%. Despite this dramatic spike, the actual amount burned remained relatively modest, with just 12.91 million out of circulation.

The largest single burn during this period originated from the CEX.io crypto exchange, where a user transferred 9.5 million SHIB to the official burn address. Additional notable burns included transactions of 1.78 million, 1.52 million, and 1.27 million SHIB, contributing to the day’s overall total.

To date, approximately 410.753 trillion SHIB have been burned, leaving the total supply at around 589.24 trillion tokens.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin News Today: "Transforming Isolated Gas into Bitcoin: The Energy Innovation of KryptoByte and Archax"

- KryptoByte partners with Archax to custody Bitcoin mined using UK stranded gas, enhancing institutional credibility. - The model converts undervalued natural gas into Bitcoin via low-footprint infrastructure, targeting €2.5M annual cashflow. - Industry trends show sector-wide diversification, with firms like Cipher Mining and 100MW securing $333M-$200M in funding for energy-efficient operations. - Strategic alliances highlight Bitcoin's integration with traditional energy assets, aligning with AI/HPC-dri

Security Concerns Hinder Nigeria's 5G Aspirations

- Nigeria's 5G coverage remains at 3% three years post-launch, lagging behind regional peers and global trends like MENA's projected 48% adoption by 2030. - Security crises, including 300+ schoolkid kidnappings, have diverted government resources from infrastructure, delaying 5G rollout amid economic instability. - Despite 15.7% annual fintech growth, Nigeria's embedded finance sector faces innovation limits without widespread 5G to enable real-time data processing. - Contrasting South Africa's 20% online

TWT's Updated Tokenomics Framework: Key Changes and Market Impact for 2025

- TWT faces potential tokenomics shifts in 2025, inferred from industry trends toward buybacks and utility diversification. - Projects like Treehouse DAO and XRP Tundra highlight growing emphasis on deflationary mechanics and transactional utility. - TWT's long-term success depends on aligning with these trends through governance upgrades or cross-chain integration. - Investor sentiment remains cautious due to lack of official TWT announcements, despite broader market demand for sustainable token models.

Bitcoin Updates: Bitcoin ETF Withdrawals Underscore Rising Altcoin Momentum Amid Changing Crypto Focus

- BlackRock's IBIT Bitcoin ETF saw $3.79B in November outflows, marking its worst month since launch amid Bitcoin's 13% weekly price drop below $80,000. - Analysts link redemptions to profit-taking after October's $126,000 peak and macro concerns like delayed Fed rate cuts, creating a self-reinforcing price decline cycle. - Institutional buyers see Bitcoin's $90,000 level as a buying opportunity, while altcoin ETFs like Solana's BSOL attract $660M inflows with competitive staking yields. - Citigroup warns