Pi Coin Price Triangle Breakout Is Backed by Multi-Sided Momentum

Pi Coin is demonstrating a notable shift in momentum after remaining constrained within a key technical pattern for several days. The altcoin is showing early signs of strength, but its ability to break out will depend heavily on market conditions and sustained investor support. With volatility building, Pi Coin is approaching a decisive moment. Pi

Pi Coin is demonstrating a notable shift in momentum after remaining constrained within a key technical pattern for several days.

The altcoin is showing early signs of strength, but its ability to break out will depend heavily on market conditions and sustained investor support. With volatility building, Pi Coin is approaching a decisive moment.

Pi Coin Has Support

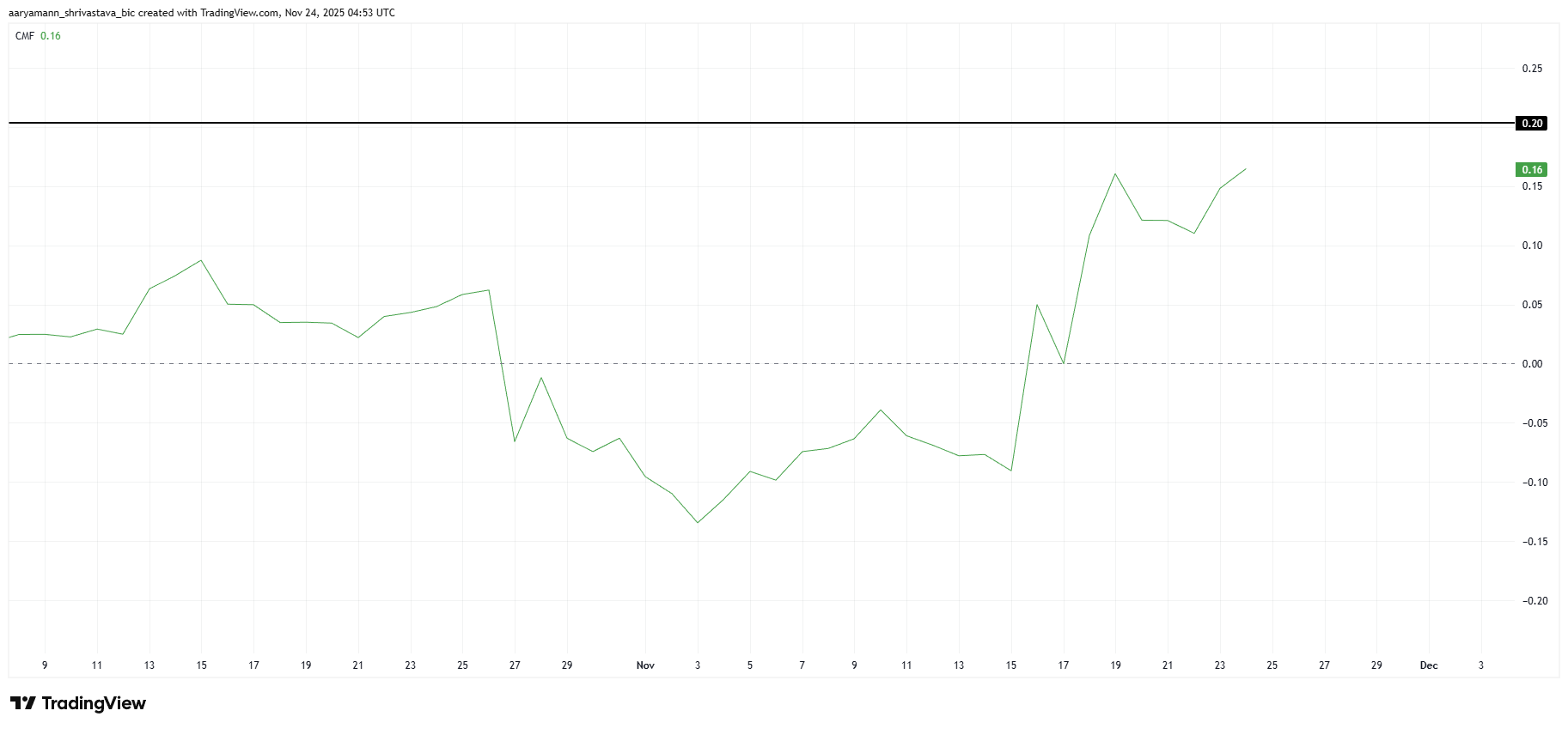

The Chaikin Money Flow offers an encouraging signal for Pi Coin. CMF has climbed to 0.16, indicating consistent inflows as investors continue to fund the altcoin’s rise. This indicator measures capital movement, and a rising trend reflects growing confidence among traders expecting a near-term price increase.

While the 0.20 level is historically viewed as a critical reversal threshold, Pi Coin has not reached that point yet. Until it does, the asset maintains strong backing from investors, giving it room to extend its upward momentum. Sustained inflows will be essential for any successful breakout.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

Pi Coin CMF. Source:

Pi Coin CMF. Source:

Pi Coin CMF. Source:

Pi Coin CMF. Source:

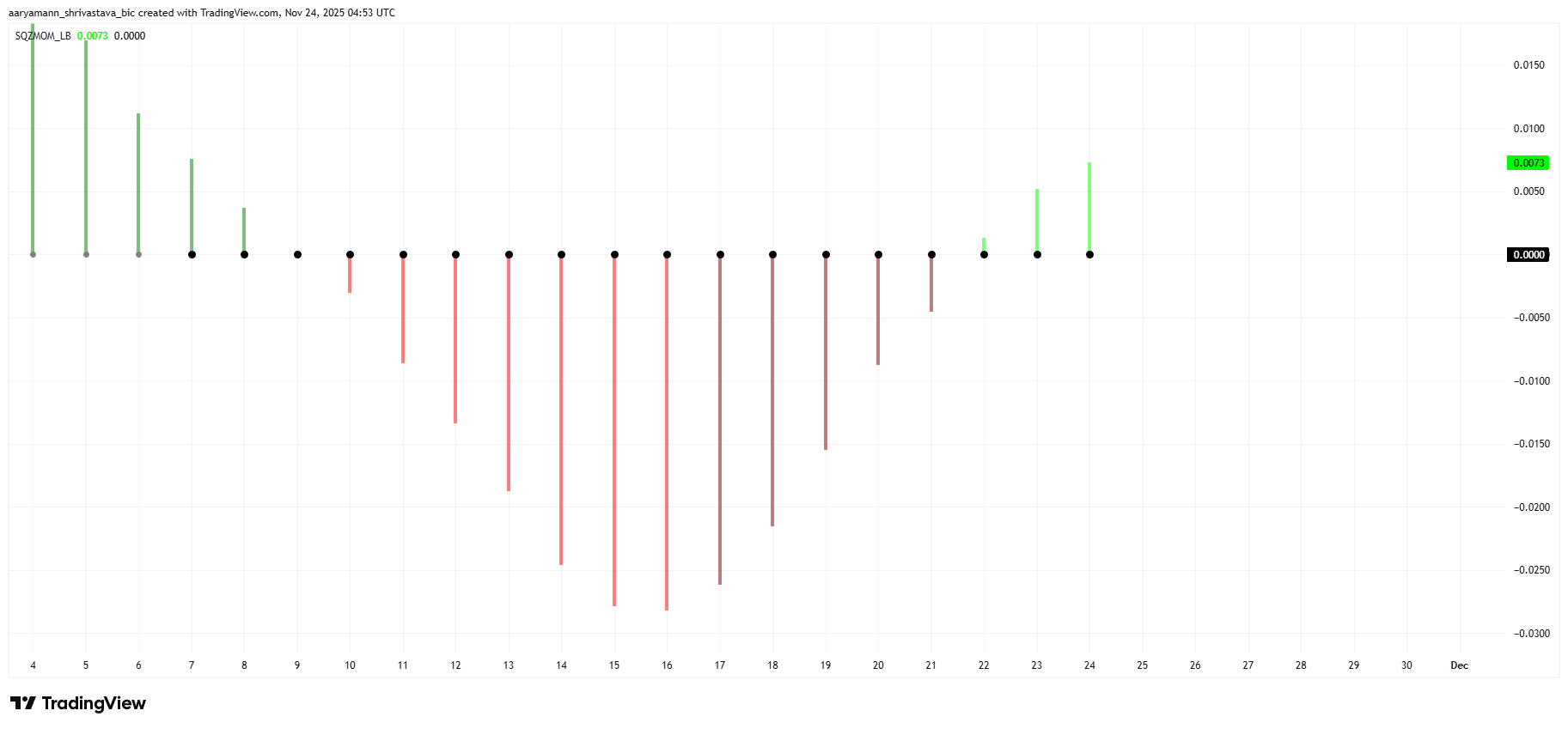

Macro momentum indicators reinforce Pi Coin’s strengthening position. The squeeze momentum indicator is currently showing a tightening squeeze as green bars rise, signaling growing bullish momentum. This pattern often precedes a sharp price move once the squeeze is released.

If the bullish momentum remains intact during the release, Pi Coin may experience a volatility surge that supports a substantial price rise. This setup indicates that broader market forces are aligning in favor of PI, strengthening the case for an imminent breakout.

Pi Coin Squeeze Momentum Indicator. Source:

Pi Coin Squeeze Momentum Indicator. Source:

Pi Coin Squeeze Momentum Indicator. Source:

Pi Coin Squeeze Momentum Indicator. Source:

PI Price Can Break Out

Pi Coin trades at $0.241 while moving within a symmetrical triangle pattern, a formation known for producing sharp breakouts. The technical structure suggests that PI is approaching the end of its consolidation phase and is likely to break through the pattern soon.

Given the strong inflows and building momentum, a successful breakout could push Pi Coin above the $0.250 level. From there, the price may extend toward $0.260 or even $0.272 if bullish conditions persist. These targets align with the current upward pressure reflected in momentum indicators.

Pi Coin Price Analysis. Source:

Pi Coin Price Analysis. Source:

Pi Coin Price Analysis. Source:

Pi Coin Price Analysis. Source:

However, investors should remain cautious. If either inflows weaken or bullish momentum softens, Pi Coin may shift into sideways movement. A breakdown from the symmetrical triangle could send the price falling to $0.224 or even $0.217. Such a move would invalidate the bullish thesis and signal a reversal in sentiment.

Read the article at BeInCryptoDisclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

DOGE drops by 0.22% as Government Efficiency Agency Faces Dissolution

- The Trump-era DOGE agency, dissolved 8 months early in Nov 2025, aimed to cut $2 trillion in federal spending but struggled with coordination and lacked legislative framework. - Despite Elon Musk's involvement and $335M in reported savings, DOGE's erratic operations and internal disputes led to its absorption into the Office of Personnel Management. - Legal challenges persist as former USAID staff seek transparency, while supporters argue its efficiency principles remain active despite the abrupt shutdow

LUNA Drops 0.27% as Stablecoin Market Cap Continues to Fall

- LUNA fell 0.27% in 24 hours to $0.0733, showing a 82.3% annual decline amid broader bearish trends. - Stablecoin market cap dropped to $3028.37B (-0.33% weekly), marking its largest monthly decline since 2022's LUNA collapse. - Analysts link LUNA's struggles to waning investor trust in algorithmic stablecoins and heightened regulatory scrutiny. - Market shifts favor fully collateralized stablecoins, pressuring complex mechanisms like LUNA's hybrid model.

ZEC rose by 0.18% on November 25 as a result of short-selling fluctuations and portfolio rebalancing

- ZEC rose 0.18% on Nov 25 despite a 20.61% weekly decline, surging 825.18% annually amid volatile short-position liquidations. - A top short trader lost $2.78M after 31 liquidations as BTC/SOL prices spiked, reducing their BTC short exposure by 47%. - The "Top ZEC Short" opened a $3.48M MON short at $0.032, while the largest MON long faces liquidation at $0.0248. - Market dynamics highlight ZEC's role as a short-term confidence barometer, with institutional short-covering rallies under bearish pressure.

Bitcoin Updates: Senate Deadlock Over CLARITY Act Triggers Volatility in Crypto Markets

- Bitcoin fell below $82,000, losing $1 trillion in value due to macroeconomic risks and stalled U.S. crypto regulation (CLARITY Act). - Federal Reserve's delayed rate cuts and political gridlock over CLARITY Act deepened uncertainty, eroding market confidence. - Firms introduced leveraged tools and AI staking to navigate volatility, highlighting sector resilience amid leverage risks. - Deutsche Bank warned Bitcoin's 46% Nasdaq correlation weakens its value proposition, while political crypto advocacy grow