Bitcoin News Update: Institutions Acquire Crypto Shares Amid Rising Bearish Bets on Bitcoin

- Bitcoin's $80,000 put options dominate trading with $2B open interest, signaling sharp bearish reversal after its worst monthly drop since 2022. - ETF outflows accelerated declines, with $3.8B November redemptions, while Ark Invest added $38.7M in crypto equities amid market fragmentation. - Analysts warn leveraged losses ($19B in October) and forced liquidations amplify downturn, with Citi noting critical support at $80,000. - Market remains divided: Binance calls pullback "healthy," while Peter Brandt

As

The recent decline has wiped out an estimated $1–1.2 trillion in total market capitalization since early October,

Options flows highlight the growing pessimism.

Despite the turbulence, new ventures are launching to take advantage of the changing landscape.

Opinions remain split regarding the future direction of the market.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

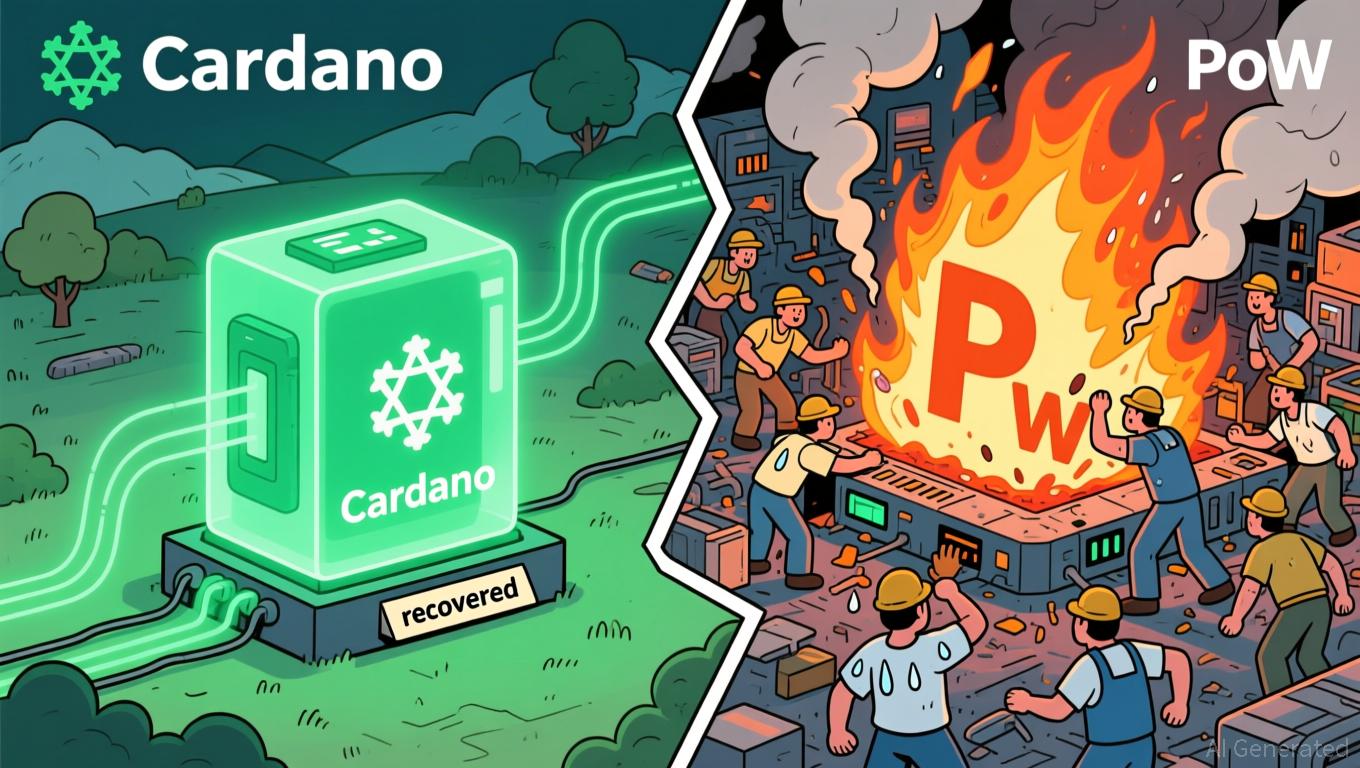

Cardano News Today: Blockchain Dispute: Should Those Responsible for Chain Splits Face Legal Action or Should Open-Source Creativity Be Safeguarded?

- Solana co-founder Anatoly Yakovenko praised Cardano's swift recovery from a November 2025 chain split, calling its resilience "pretty cool" despite a malicious transaction exploiting a deserialization bug. - Cardano's Ouroboros consensus model enabled rapid convergence without hard forks, preserving transaction throughput and avoiding fund losses through emergency node upgrades. - A public debate emerged between Yakovenko and Cardano founder Charles Hoskinson over legal accountability, with Hoskinson adv

Solana Founder Praises Cardano Consensus Mechanism, Boosting Community Respect

BNB Faces Critical Levels as BlackRock’s BUIDL Fund Joins the Action

Reputed Analyst Explains How a Bitcoin Price Relief Rally to $100,000 – $110,000 Is Likely