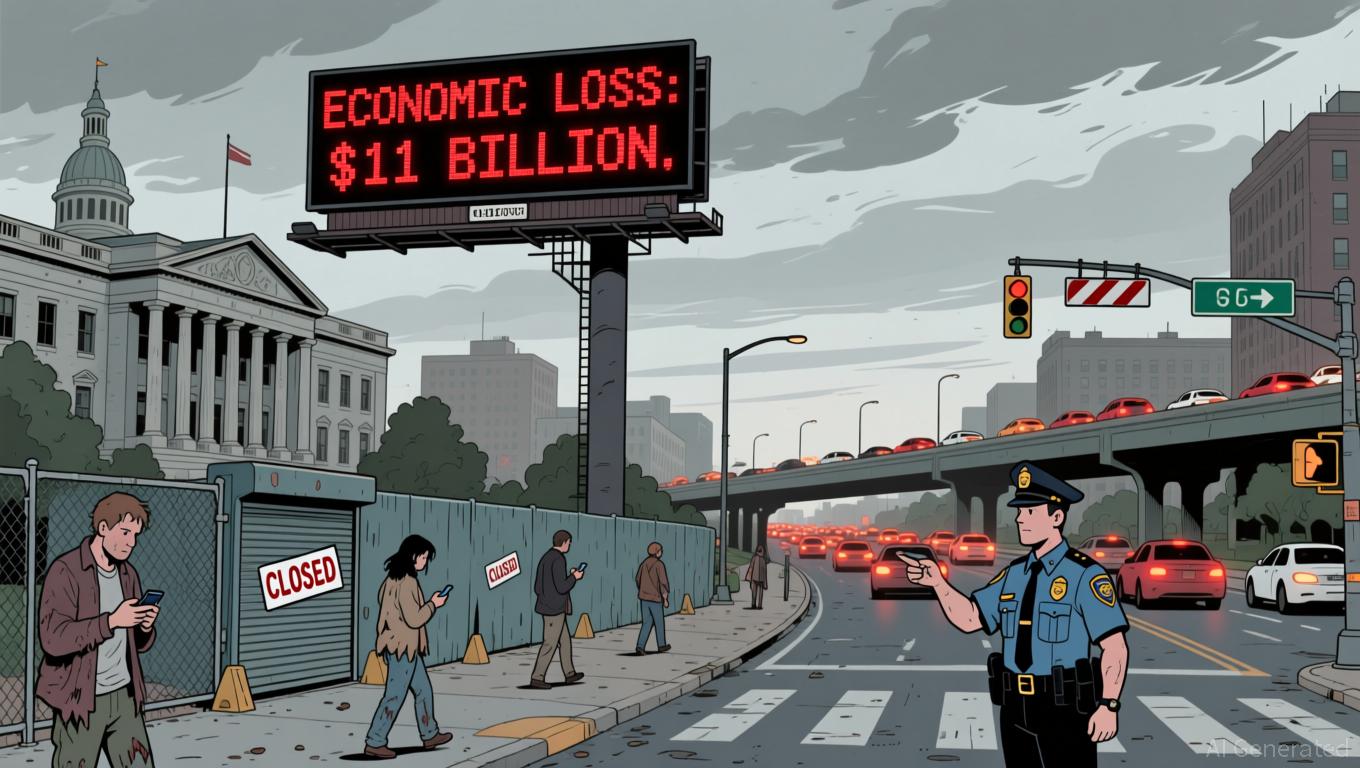

Political Stalemate Results in $11 Billion Loss, Highlighting Deep-Rooted Flaws in the System

- U.S. government shutdown in late 2025 caused $11B economic loss, disrupted critical data collection for CPI and employment reports. - Treasury Secretary Bessent highlighted recession risks in rate-sensitive sectors but emphasized services-driven inflation, not Trump trade policies. - "One Big, Beautiful Bill" tax cuts aim to boost incomes, with analysts projecting 0.4pp growth boost despite Fed rate constraints. - Shutdown intensified calls for congressional reform to end gridlock, as prediction markets

The United States experienced a government shutdown spanning 43 days at the end of 2025

The BLS

Despite these obstacles, the administration remains optimistic about the nation’s economic direction.

The economic consequences of the shutdown have strengthened demands for legislative change.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

XRP News Update: XRP ETFs See Inflows Soar While Prices Drop: The $628 Million Inflow Mystery

- XRP ETF inflows hit $164M daily as Bitwise, Grayscale, and Franklin Templeton drive institutional adoption, surpassing $628M total assets. - Ripple's 2025 SEC settlement and RLUSD stablecoin boosted confidence, but XRP's price fell below $2 amid whale sales of 200M tokens. - CME's XRP futures and NYSE Arca's ETF approvals signal growing institutional infrastructure, though 41.5% of XRP supply remains in loss positions. - XRP outperformed Bitcoin (+89% vs 3.6%) due to DeFi upgrades and cross-border utilit

India’s legal framework poses significant obstacles to the enforcement of U.S. court judgments.

- U.S. courts face enforcement challenges in India as Byju Raveendran's $1.07B default judgment clashes with India's strict foreign judgment recognition rules under Section 13. - TCS must appeal a $194M trade secrets ruling from the U.S. Fifth Circuit, highlighting cross-border IP disputes' complexity in the global IT sector . - Binance refunds Alpha Points after a technical error in a token airdrop, emphasizing operational risks in blockchain-based reward systems. - Amber International reports 69.8% YoY a

Bitcoin News Update: Bitcoin's Divergence from MAG7 Highlights a Shift Toward Scarcity-Focused Identity

- Bitcoin’s recent price drop and volatility warnings highlight market fragility amid diverging MAG7 correlations. - A historic $19B liquidation on October 10 marked Bitcoin’s decoupling from MAG7 tech stocks, reclassifying it as a scarcity-based hedge. - Low institutional adoption and 5% odds for MAG7 firms to hold Bitcoin in 2025 underscore limited macro support. - Trump’s growth forecasts lack Bitcoin tailwinds; CleanSpark’s AI pivot highlights crypto diversification. - Bitcoin’s future hinges on macroe

Bitcoin News Today: JPMorgan's Bold Bitcoin Gamble: Potential for 1.5x Profit or 40% Decline by 2028

- JPMorgan Chase launched a Bitcoin-linked structured note tied to BlackRock's IBIT ETF, offering 16% minimum returns by 2026 or 1.5x uncapped gains by 2028. - The product reflects institutional acceptance of Bitcoin as a tradable macro asset, aligning with ETF inflows despite recent market declines. - Investors face significant risks: potential 40% losses if Bitcoin collapses, though partial downside protection is offered for declines under 30% by 2028. - JPMorgan's approach mirrors Morgan Stanley's $104M