Today’s Outlook

1、Macroeconomist Lyn Alden: A major crash in Bitcoin and the overall crypto market is unlikely at this stage. “We have not yet reached a level of euphoria in this cycle, so there is no reason to expect large-scale sell-offs.”

2、U.S. Treasury Secretary Bessent: The government shutdown has caused a permanent $11 billion hit to U.S. GDP.

3、Alternative data: Crypto Fear & Greed Index rises to 19, compared to 13 yesterday and weekly average of 14; market sentiment remains in “extreme fear.”

Macro & Hot Topics

1、Crypto market recovers; Bitcoin briefly broke above $88,000; total crypto market cap rebounds above $3 trillion.

2、Michael Saylor posts “Won’t surrender,” hinting he will continue accumulating Bitcoin.

3、ProCap CIO: Large open interest in Bitcoin put options for late December; implied volatility has returned to pre-ETF-launch levels.

4、Bloomberg: Bitcoin’s decline signals weak year-end performance for risk assets, but 2026 may bring growth momentum.

Market Performance

1、BTC and ETH rebound, but the market remains in extreme fear. Liquidations in the past 24 hours total about $225 million, with $129 million from short positions.

2、U.S. stocks: Dow +1.08%, S&P 500 +0.98%, Nasdaq Composite +0.88%.

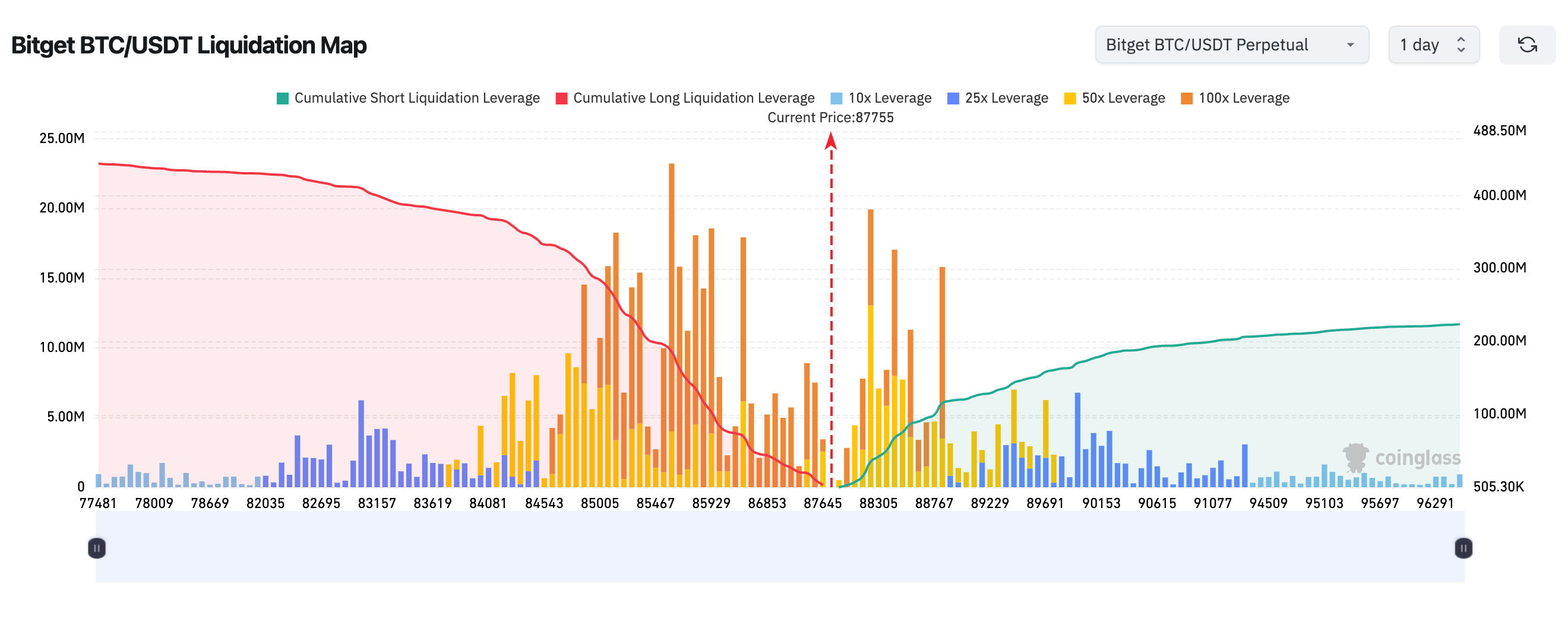

3、Bitget BTC/USDT liquidation map shows: BTC’s current price at $87,755 is just above a dense high-leverage long cluster (around $85,000–$88,000). Downward movement could easily trigger consecutive long liquidations. Upper short-side liquidation zones are more scattered with smaller cumulative size, meaning upward breakout faces less resistance than a downward chain reaction.

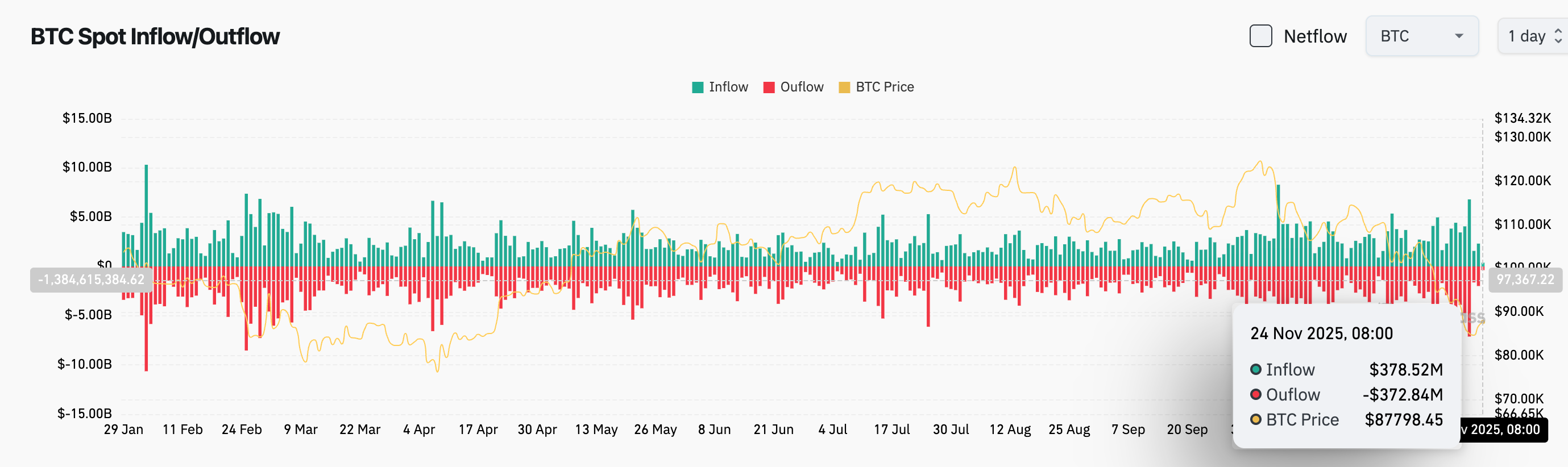

4、In the past 24 hours, BTC spot inflows were $378 million, outflows were $372 million, net inflow $6 million.

News

1、SEAL member: North Korean operatives have infiltrated 15%–20% of crypto companies; 30%–40% of job applications may come from North Korean agents attempting infiltration.

2、The U.S. Government Efficiency Department (DOGE), established under President Trump to reduce government size, has been dissolved.

3、Rumble, supported by Tether, launches crypto tipping and rolls out Rumble Wallet.

Project Updates

1、pump.fun team has transferred 405 million USDC to Kraken in the past week; funds are from PUMP tokens sold in a private placement to institutions in June at a price of $0.004.

2、Port3 launches token migration and burns more than 160 million tokens.

3、Monad co-founder clarifies that no meme coins or NFTs related to its pet Anago have been issued, reminding users to stay cautious.

4、Sui chain stablecoins saw $2.4 billion net inflows in the past 24 hours, ranking first; Aptos and Ethereum follow.

5、Aster: Due to a gold price feed error causing deviation in XAUUSDT prices, all affected users will be fully compensated.

6、Bitcoin community and Strategy supporters call to “boycott” JPMorgan due to MSCI’s proposed new rules.

7、Data: XPL, WCT, SAHARA and other tokens will have large unlocks this week, with XPL unlocking about $18.1 million in value.

8、Michael Saylor’s “Whether to HODL This Week” poll ends: 77.8% voted not to sell.

9、Uniswap community passes the temperature check proposal to activate the fee switch.

10、Bitwise CEO’s survey on responses to market crashes ends: “Buy” ranks first at over 43%, “Hold” ranks second at 37.6%; “Undecided” at 9.8%, and “Sell” at 9.5%.

Disclaimer: This report is generated by AI. Humans only perform information verification. This does not constitute investment advice.